Comscore:2016年美国网络、移动、社交媒体报告

- 1. For info about the proprietary technology used in comScore products, refer to http://comscore.com/About_comScore/Patents

- 2. © comScore, Inc. Proprietary. 2 About this report The 2016 U.S. Cross-Platform Future in Focus leverages several data sources unique to comScore: The report is based primarily on behavioral measurement from comScore Media Metrix® Multi-Platform, which provides deduplicated reporting of digital audiences across desktop computers, smartphones and tablets, and comScore Mobile Metrix®, which provides deduplicated reporting of mobile web and app audiences across both smartphones and tablets. The report also includes survey-based mobile data from comScore MobiLens®, as well as TV/Cross-Platform behavioral data from the comScore Xmedia™, comScore OnDemand Everywhere® and comScore TV Everywhere™ product lines. Important Definitions: o Electronic Sell-Through (EST): The consumer pays a fee to purchase or perpetually licenses a digital reproduction (i.e., movie or TV show). This licensed reproduction could be in the form of a file downloaded to the consumer’s internet-connected device or local hard drive, or via access to the content in a virtual storage locker or cloud-based service for streaming on demand to the end-user. The major digital retailers here are Amazon, Google Play, iTunes, PlayStation, Xbox, Vudu and others. o Free on Demand (FOD): Operator-based free on demand content, usually offered via broadcast and cable networks for free or with advertising. o Internet Video on Demand (iVOD): The temporary license (i.e., a rental) of a program for a limited and pre-determined viewing period (such as 24 or 48 hours) for on-demand viewing by an end- user. The program may be downloaded and stored locally on the end-user’s device, or accessed online via streaming from digital retailers like Amazon Instant Video, Google Play, iTunes, PlayStation Store, Xbox Video and Vudu. o Over-the-Top Subscription Video on Demand (OTT SVOD): Refers to the delivery of audiovisual content streamed over the internet without the involvement of an internet service provider (ISP) in the control or distribution of the content. The ISP is neither responsible for, nor is able to control, the viewing abilities, copyrights, and/or other redistribution of the content, which arrives from a third party and is delivered to an end-user’s device from online subscription services like Amazon Prime, Hulu Plus and Netflix. o Mobile: The combination of smartphone and tablet. When data is referring specifically smartphones or tablets, it will be labeled accordingly. o Subscription Video on Demand (SVOD): For a fixed, recurring fee, subscribers may have unlimited streaming to a licensed catalog of content for the duration of their active subscription term. Subscription terms may be as short as one month (e.g., Hulu Plus, Netflix) or as long as one year (e.g., Amazon Prime). In addition to SVOD via over-the top (OTT), SVOD can also be delivered via Cable Video on Demand (cVOD), which is on demand content streamed or downloaded via a cable, telecommunications or satellite provider (e.g., HBO, Showtime, Starz). o Transactional on Demand (TOD): A temporary license (rental) of a movie or special event from an operator for a fee for a limited and pre-determined viewing period (such as 24 or 48 hours) for on- demand viewing. o Unique visitor: A person who visits an app or digital media property at least once over the course of a month. For more information about subscribing to comScore services, please contact us at www.comscore.com/learnmore.

- 3. © comScore, Inc. Proprietary. 3 Table of Contents Multi-Platform 4 Digital Media 8 Mobile 21 Social Media 28 TV & Cross Platform 37 Advertising 48 E-Commerce 55 Box Office 64 Ten Trends of 2016 67

- 4. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 4 Multi-Platform

- 5. © comScore, Inc. Proprietary. 5 Digital media usage time is exploding right now, and it’s being driven entirely by mobile – particularly on smartphone. Total digital media usage has nearly tripled since 2010, and since 2013 it’s up 35%, with smartphone having grown 78% and contributing to 92% of the total increase in time spent. Tablet is also seeing very strong growth over that 2-year period at 30%, while desktop is down slightly. Growth in Digital Media Time Spent in Minutes (MM) Source: comScore Media Metrix Multi-Platform & Mobile Metrix, U.S., Dec 2015 vs. Dec 2014 vs. Dec 2013 505,591 551,184 500,173 441,693 646,324 787,541 123,661 197,446 160,767 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 Dec-2013 Dec-2014 Dec-2015 Desktop Smartphone Tablet +30% vs. 2013 +78% vs. 2013 -1% vs. 2013

- 6. © comScore, Inc. Proprietary. 6 Mobile now represents almost 2 out of 3 digital media minutes, and smartphone apps alone are approaching half of all digital time spent. Although desktop is relatively flat in total engagement, it is losing share to mobile – which now accounts for 65% of digital media time spent. Mobile apps now drive the majority of digital time spent at 56%, and smartphone apps alone look to account for a majority of digital media consumption in 2016. Share of Digital Media Time Spent by Platform Source: comScore Media Metrix Multi-Platform & Mobile Metrix, U.S., Total Audience 30% 35% 40% 45% 50% 55% 60% 65% 70% Dec-2013 Jun-2014 Dec-2014 Jun-2015 Dec-2015 Share of Digital Time Spent on MOBILE APP Share of Digital Time Spent on MOBILE 35% 56% 65% Share of Digital Time Spent on DESKTOP +12pts +12pts -12pts 44% 53% 47% Share of Digital Time Spent on SMARTPHONE APP+12pts 35% 47%

- 7. © comScore, Inc. Proprietary. 7 Multi-platform internet usage is the norm across age segments today, while mobile-only usage is also becoming more prominent. Virtually all 18-34 year-old Millennials (97%) are mobile users, while 20% don’t use desktop at all. The Age 35-54 demographic has the highest percentage of multi- platform users (82%), while the oldest segment still has a sizeable, but shrinking, portion of its audience that only uses desktop. Share of Demographic Audiences by Platform Usage Source: comScore Media Metrix Multi-Platform, U.S., Age 18+, Dec 2015 / Dec 2014 / Dec 2013 22% 12% 11% 15% 5% 3% 18% 10% 8% 40% 26% 26% 68% 76% 76% 67% 74% 77% 77% 84% 82% 57% 68% 67% 9% 12% 13% 18% 21% 20% 5% 6% 10% 3% 6% 7% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Mobile Only Multi-Platform Desktop Only Age 55+Age 35-54Age 18-34Age 18+

- 8. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 8 Digital Media

- 9. © comScore, Inc. Proprietary. 9 Google Chrome is widening its market share lead for desktop browser activity, accounting for 45% of all page visits. Google Chrome gained 4 percentage points of the desktop browser market in the 2nd half of last year, as it looks to host the majority of desktop activity in 2016. Safari also saw slight gains, while Microsoft and Firefox browsers experienced declines. Share of Desktop Browser Activity Source: comScore Custom Analytics, U.S., Total Audience 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Jun-2015 Dec-2015 ShareofDesktopPageVisits Internet Explorer/Microsoft Edge Google Chrome 2% 28% 45% Other +4pts -3pts +0pts 31% 41% 2% Firefox-3pts17% 14% 10% 11% Safari+1pts

- 10. © comScore, Inc. Proprietary. 10 Google remains the strong leader in the U.S. search market with nearly 2/3rds of all search queries conducted. However, 2nd and 3rd players Bing and Yahoo both increased their market shares about one percentage point from the previous year. Share of Desktop Searches for Explicit Core Search Market Source: comScore qSearch, U.S., Q4 2015 Google also retains the lead in the U.S. desktop search market. Bing and Yahoo both increased their respective market shares in 2015. 64% 21% 12% 2%1% Google Bing Yahoo Ask AOL

- 11. © comScore, Inc. Proprietary. 11 Digital is delivering audiences at scale, as the number of properties reaching at least 20 million monthly visitors is up 20% vs. year ago. There are a growing number of digital media properties reaching large audiences in the tens of millions, with 206 above 20 million. In addition to 34 additional properties reaching 20 MM UVs in 2015, there were seven new properties achieving the 100 million milestone vs. the same period in 2014. Number of Digital Media Properties Reaching Unique Visitor Thresholds Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 / Dec 2014 119 142 39 4314 21 0 50 100 150 200 250 Dec-2014 Dec-2015 NumberofDigitalMediaProperties 20-50 MM 50-100 MM 100+ MM +50% +10% +19%

- 12. © comScore, Inc. Proprietary. 12 Digital media audiences continue to climb, being driven by mobile audiences, which have now far surpassed those of desktop. Over the past two years, digital media audiences of the Top 1000 properties have surged to an average 16.8 million visitors per month. This has been driven by a more than doubling of mobile audiences while desktop audiences have seen a gradual slide. Growth in Top 1000 Digital Media Property Audiences Source: comScore Media Metrix Multi-Platform, U.S., Dec 2013 – Dec 2015 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 Dec-2013 Mar-2014 Jun-2014 Sep-2014 Dec-2014 Mar-2015 Jun-2015 Sep-2015 Dec-2015 Average#ofUniqueVisitorsbyPlatform(MM) TOTAL DIGITAL MOBILE DESKTOP 8.1 12.3 5.6 7.0 16.8 11.3

- 13. © comScore, Inc. Proprietary. 13 Within the Top 100 digital media properties, incremental audience from mobile is now more than double that of desktop alone. Mobile audiences continue to represent an increasingly important contribution to total digital audience. Two years ago, mobile helped boost the audiences of the Top 100 digital media properties by 59% and more recently that number has exploded to 120%. Median Audience Sizes for the Top 100 Digital Media Properties Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 / Dec 2014 / Dec 2013 45,180 50,462 56,780 28,382 29,214 25,762 0 10,000 20,000 30,000 40,000 50,000 60,000 Dec-2013 Dec-2014 Dec-2015 UniqueVisitors(000) Total Digital Desktop +120% vs. desktop alone +59% vs. desktop alone +73% vs. desktop alone

- 14. © comScore, Inc. Proprietary. 14 Google Sites remains the #1 web property, Facebook jumped one spot to #2, and Yahoo is the only other property with 200MM visitors. The average Top 10 digital media property has 37% of its audience visiting only on mobile and 31% visiting on both mobile and desktop. 6 of the Top 10 have larger mobile-only audiences than desktop-only audiences. Clearly, mobile is no longer a secondary digital touchpoint for many publishers. Top Digital Properties: Unique Visitors (MM) by Platform Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 0 50 100 150 200 250 300 Google Sites Facebook Yahoo Sites Amazon Sites Microsoft Sites AOL, Inc. Comcast NBCUniversal CBS Interactive Mode Media Apple Inc. Desktop Only Multi-Platform Mobile Only 219 MM 205 MM 199 MM 192 MM 181 MM 155 MM 151 MM 144 MM 142 MM 248 MM

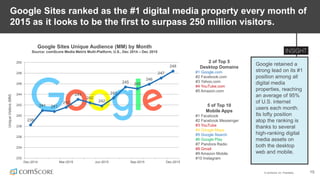

- 15. © comScore, Inc. Proprietary. 15 Google Sites ranked as the #1 digital media property every month of 2015 as it looks to be the first to surpass 250 million visitors. Google retained a strong lead on its #1 position among all digital media properties, reaching an average of 95% of U.S. internet users each month. Its lofty position atop the ranking is thanks to several high-ranking digital media assets on both the desktop web and mobile. Google Sites Unique Audience (MM) by Month Source: comScore Media Metrix Multi-Platform, U.S., Dec 2014 – Dec 2015 2 of Top 5 Desktop Domains #1 Google.com #2 Facebook.com #3 Yahoo.com #4 YouTube.com #5 Amazon.com 5 of Top 10 Mobile Apps #1 Facebook #2 Facebook Messenger #3 YouTube #4 Google Maps #5 Google Search #6 Google Play #7 Pandora Radio #8 Gmail #9 Amazon Mobile #10 Instagram 238 241 241 242 243 242 242 243 245 245 246 247 248 232 234 236 238 240 242 244 246 248 250 Dec-2014 Mar-2015 Jun-2015 Sep-2015 Dec-2015 UniqueVisitors(MM)

- 16. © comScore, Inc. Proprietary. 16 This past year saw leading social platforms, traditional publishers and a multinational retailer surpass 100 MM visitors for the first time. Linkedin reached the 100 MM visitor milestone in the first month of 2015, followed in March by another social network Twitter and Time Inc.’s group of publisher sites. Time Inc., which was founded before the digital age, was joined by fellow print publisher Hearst and traditional brick- and-mortar retailer Walmart. Digital Media Properties Reaching 100 Million Unique Visitor Milestone in 2015 Source: comScore Media Metrix Multi-Platform, U.S., Dec 2014 – Dec 2015 60,000 70,000 80,000 90,000 100,000 110,000 120,000 130,000 UniqueVisitors(000) Twitter Time Inc. Network (U.S) Wal-Mart Linkedin Hearst

- 17. © comScore, Inc. Proprietary. 17 A number of traditional print publishers leveraged mobile to capture new, often younger audiences on digital. Several major traditional print publishers experienced greater than 20% visitor gains in 2015, led by the Washington Post with 78% year- over-year audience growth and Dow Jones & Company (home of The Wall Street Journal) with 58% growth. * Based on selection of ‘traditional print publishers’ with 20 percent year-over-year unique visitor growth. 0 20 40 60 80 100 120 UniqueVisitors(MM) Dec-2014 Dec-2015 Y/Y Digital Audience Growth of Selected Traditional Print Publishers* Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 / Dec 2014 +78% +58% +46% +40% +37% +29% +29% +27% +26% +22% +21%

- 18. © comScore, Inc. Proprietary. 18 At the content category level, most now get a majority of their traffic from mobile and are continuing to shift toward that platform. Nearly every category has become more mobile over the past year, but Personals and Retail are among those seeing the most dramatic shifts in time spent. The number of categories getting the majority of its engagement from desktop is rapidly dwindling. Share of Content Category Time Spent by Platform Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 69% 58% 51% 46% 44% 39% 38% 36% 23% 21% 12% 8% 6% 31% 42% 49% 54% 56% 61% 62% 64% 77% 79% 88% 92% 94% Portals Business/Finance Entertainment - News Health - Information News/Information Sports Retail Lifestyles Personals Social Networking Online Gaming Photos Maps Desktop Mobile + 4 pts Mobile Point Change vs. 2014 + 10 pts + 12 pts + 2 pts + 6 pts + 11 pts + 13 pts + 5 pts + 15 pts + 5 pts + 1 pts - 1 pts + 4 pts

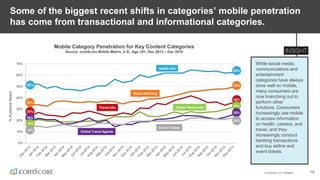

- 19. © comScore, Inc. Proprietary. 19 Some of the biggest recent shifts in categories’ mobile penetration has come from transactional and informational categories. While social media, communications and entertainment categories have always done well on mobile, many consumers are now branching out to perform other functions. Consumers increasingly use mobile to access information on health, careers, and travel, and they increasingly conduct banking transactions and buy airline and event tickets. Mobile Category Penetration for Key Content Categories Source: comScore Mobile Metrix, U.S., Age 18+, Dec 2013 – Dec 2015 0% 10% 20% 30% 40% 50% 60% 70% %AudienceReach Health Info Online Banking Travel Info Online Travel Agents Event Tickets Career Resources 36% 62% 49% 32% 25% 22% 23% 52% 34% 20% 18% 14%

- 20. © comScore, Inc. Proprietary. 20 A number of high-profile brands saw app audiences jump several multiples in the past year. Two leading retail home improvement brands ranked among the fastest rising mobile apps in 2015, as Lowe’s and The Home Depot ramped up their mobile presences. Airbnb also saw major growth as the company continues to shake up the lodging and travel industry. Y/Y Unique Visitor Growth of Selected Fast Rising Mobile Apps* Source: comScore Mobile Metrix, U.S., Age 18+, Dec 2015 / Dec 2014 931% 920% 823% 717% 717% 607% 551% 541% 514% 421% GIF Keyboard Lowe's SiriusXM Nextdoor Airbnb OfferUp OneDrive The Home Depot The Washington Post Imgur * Based on selection of apps with at least 1 million unique visitors and growing 400 percent year-over-year.

- 21. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 21 Mobile

- 22. © comScore, Inc. Proprietary. 22 U.S. smartphone penetration is now approaching 80% and finally showing signs of slowing growth as the market nears saturation. Since the end of 2005, smartphone penetration of the mobile phone market has grown from next to nothing to 79%. In the past 3 years, a quarter of the mobile phone market made the switch from feature phone to smartphone, a trend that continues but is slowing. Smartphone Penetration of Mobile Phone Market Source: comScore MobiLens, U.S., Age 13+, 3 Mo. Avg. Ending Dec 2005 - 3 Mo. Avg. Ending Dec 2015 2% 3% 6% 11% 17% 27% 42% 54% 65% 75% 79% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Dec 2005 Dec 2006 Dec 2007 Dec 2008 Dec 2009 Dec 2010 Dec 2011 Dec 2012 Dec 2013 Dec 2014 Dec 2015

- 23. © comScore, Inc. Proprietary. 23 Smartphone penetration increased among every age demographic, with Millennials now well over the 90% mark. Millennials saw the most significant gains in smartphone penetration in 2015, with both 18-24 and 25-34 year-olds solidly above 90%. Despite the Age 55+ segment having the most room for growth, its 1-point annual gain may indicate a slow climb to attaining those higher levels of penetration. Smartphone Penetration by Demo Source: comScore MobiLens, U.S., Age 13+, 3 Mo. Avg. Ending Dec 2015 / Dec 2014 76% 90% 89% 81% 57% 79% 94% 93% 84% 58% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total: Age 18+ Age 18-24 Age 25-34 Age 35-54 Age 55+ Dec-2014 Dec-2015

- 24. © comScore, Inc. Proprietary. 24 The U.S. market share for smartphone operating systems has stabilized in recent years with Android #1 and iOS a strong #2. Smartphone OS market share has shifted immensely from its early years, but has remained relatively stable since 2013. It now appears that the most popular device for accessing the internet will be dominated by two major players’ software platforms for the foreseeable future. Smartphone Platform Market Share: 10-Year Trend Source: comScore MobiLens, U.S., Age 13+, 3 Mo. Avg. Ending Dec 2005 - 3 Mo. Avg. Ending Dec 2015 1% 5% 29% 47% 53% 51% 53% 53% 9% 17% 25% 25% 30% 36% 42% 42% 43% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% HP/Palm Symbian BlackBerry Microsoft iOS Android

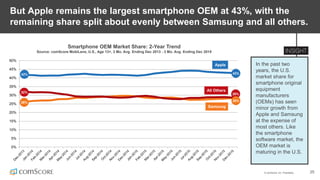

- 25. © comScore, Inc. Proprietary. 25 But Apple remains the largest smartphone OEM at 43%, with the remaining share split about evenly between Samsung and all others. In the past two years, the U.S. market share for smartphone original equipment manufacturers (OEMs) has seen minor growth from Apple and Samsung at the expense of most others. Like the smartphone software market, the OEM market is maturing in the U.S. Smartphone OEM Market Share: 2-Year Trend Source: comScore MobiLens, U.S., Age 13+, 3 Mo. Avg. Ending Dec 2013 - 3 Mo. Avg. Ending Dec 2015 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 29% 43% 28% 32% 42% 26% Apple All Others Samsung

- 26. © comScore, Inc. Proprietary. 26 iPhone owners have been rapidly upgrading to the latest “6” models, which now constitute a majority of iPhone’s U.S. installed base. Apple’s iPhone 3, 4, and 5 models collectively lost 23 million users in 2015, but more than made that up by gaining nearly 31 million new iPhone 6 and 6 Plus users. The iPhone 6/6S models look to surpass the iPhone 5/5S/5C models in early 2016 for total number of owners in the U.S. Trend of Apple iPhone Users (MM) by Device Family Source: comScore MobiLens, U.S., Age 13+, 3 Mo. Avg. Ending Dec 2014 - 3 Mo. Avg. Ending Dec 2015 24.2 21.7 20.3 19.2 16.1 15.2 15.4 14.6 13.3 12.1 11.3 10.5 9.7 39.3 39.0 38.7 39.0 39.0 37.0 38.7 38.5 38.3 37.0 34.9 32.6 30.8 7.9 10.3 12.7 14.9 18.3 20.8 20.6 22.1 23.1 24.0 26.1 28.5 30.5 3.7 4.7 5.6 6.4 6.8 7.0 7.1 7.5 8.0 9.1 9.8 10.7 11.6 0 10 20 30 40 50 60 70 80 90 Dec-2014 Jan-2015 Feb-2015 Mar-2015 Apr-2015* May-2015* Jun-2015 Jul-2015 Aug-2015 Sep-2015 Oct-2015 Nov-2015 Dec-2015 AppleiPhoneUsers(MM) Apple iPhone 3G/4/4S Apple iPhone 5/5S/5C Apple iPhone 6/6S Apple iPhone 6/6S Plus * The months of April and May 2015 were calculated using their single month of data vs. the 3-month average, due to an improved sample weighting methodology introduced in April.

- 27. © comScore, Inc. Proprietary. 27 Large screen smartphones have been quickly gaining in popularity and overtook small screen smartphone ownership in April 2015. More consumers are adopting smartphones with a 4.5” display or greater, while tablet ownership has plateaued in the past year. This correlation could be due to tablets and larger screen smartphones sharing many of the same use cases. Device Ownership by Smartphone Screen Size and Tablet Source: comScore MobiLens, U.S., Age 13+, 3 Mo. Avg. Ending Sep 2014 - 3 Mo. Avg. Ending Dec 2015 0 20 40 60 80 100 120 140 DeviceOwners(MM) Tablet Smartphone <4.5” Smartphone 4.5”+ * The months of April and May 2015 were calculated using their single month of data vs. the 3-month average, due to an improved sample weighting methodology introduced in April.

- 28. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 28 Social Media

- 29. © comScore, Inc. Proprietary. 29 Social Networking leads all categories in engagement, accounting for 1 out of 5 minutes spent online. The strength of this category, along with Email and IM, highlights that one of digital’s primary functions is for communication – now more so than ever with the rise of mobile. Share of Total Digital Time Spent by Content Category Source: comScore Media Metrix Multi-Platform, U.S., Total Audience, December 2015 Social networking accounts for one in every five minutes spent on the internet. Social Networking 19% Multimedia 12% Radio 8% Portals 6%Online Gaming 5% Retail 5% Instant Messengers 4% E-mail 4% News/Information 4% Other 34%

- 30. © comScore, Inc. Proprietary. 30 The smartphone app has taken over as by far the most popular access point for social media usage, with desktop on the decline. The vast majority of social media consumption occurs on mobile apps, driven largely by smartphones. The smartphone app is the dominant social platform in the U.S., now accounting for 61% of all social media time spent, up 8 percentage points from last year. Share of Time Spent on Social Media Across Different Platforms Source: comScore Media Metrix Multi-Platform & Mobile Metrix, US, Dec 2015 / Dec 2014 / Dec 2013 33% 26% 21% 53% 53% 61% 3% 4% 6% 10% 13% 9% 3% 3% Dec-2013 Dec-2014 Dec-2015 Desktop Smartphone App Smartphone Web Tablet App Tablet Web

- 31. © comScore, Inc. Proprietary. 31 Millennials use several social networks regularly, but Facebook continues to lead in both audience size and engagement. After Facebook, relative newcomer Snapchat has the highest engagement per visitor among Millennials, just ahead of Instagram. The latter network has the largest audience penetration after Facebook, followed by Twitter and LinkedIn. Age 18-34 Digital Audience Penetration vs. Engagement of Leading Social Networks Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 0 200 400 600 800 1,000 1,200 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% AverageMonthlyMinutesperVisitor % Reach Among Age 18-34

- 32. © comScore, Inc. Proprietary. 32 The 35+ population are also heavy Facebook users, but don’t spread their attention quite as heavily across other networks as Millennials. Age 35+ users have lower audience penetration and lower engagement than Millennials for just about every social network – the one exception being slightly higher engagement on the business-oriented LinkedIn. Age 35+ Digital Audience Penetration vs. Engagement of Leading Social Networks Source: comScore Media Metrix Multi-Platform, U.S., Dec 2015 0 200 400 600 800 1,000 1,200 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% AverageMonthlyMinutesperVisitor % Reach Among Age 35+

- 33. © comScore, Inc. Proprietary. 33 13.8% 9.9% 15.8% 16.2% 13.9% 1.9% 3.0% 3.1% 2.5% 1.3% 2.0% 2.1% 1.6% 0.3% 0.4% Total Digital Desktop Mobile Smartphone Tablet Facebook Messenger Instagram WhatsApp 17.2% 10.0% 21.2% 21.8% 18.0% Facebook usage overall accounts for 1 in every 6 minutes spent online, and more than 1 in 5 minutes spent on mobile. Facebook is the #1 digital media property by time spent. While it maintains an impressive double- digit market share of desktop time spent, it really shines on mobile platforms, where its four core apps each contribute a meaningful share of engagement. Facebook Q4 2015 Share of Total Digital Media Time Spent by Platform Source: comScore Media Metrix Multi-Platform & Mobile Metrix, U.S., Q4 2015

- 34. © comScore, Inc. Proprietary. 34 While Facebook’s users mirror the internet as a whole, Instagram, Tumblr, Vine and especially Snapchat skew significantly younger. Snapchat is the youngest skewing social network with almost half of its users between 18- 24 years old and 2/3rds of them between the ages of 18-34. The most popular networks among Millennials tend to be those with visually- focused content that can be consumed easiest on mobile. Demographic Composition % of Major Social Networks Source: comScore Media Metrix Multi-Platform, U.S., Age 18+, Dec 2015 16.5 15.5 18.2 22.9 16.8 16.5 46.8 26.9 28.1 20.3 22.4 22.2 25.6 23.6 23.9 29.2 21.7 22.1 18.8 20.8 20.0 19.4 20.5 20.9 11.7 16.8 17.1 18.1 18.3 16.7 15.5 16.6 17.4 7.7 15.5 14.4 15.7 14.1 14.5 11.1 15.2 13.7 3.5 11.1 9.5 10.6 8.9 8.4 5.5 7.4 7.5 1.0 8.0 8.7 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Age 65+ Age 55-64 Age 45-54 Age 35-44 Age 25-34 Age 18-24

- 35. © comScore, Inc. Proprietary. 35 A majority of college-age adults use Snapchat every month, and the popular app is picking up traction among older Millennials, too. More than three in every five 18-24 year-olds now use Snapchat on their smartphones each month. Older Millennials are gaining ground fast at 31% penetration, while those age 35+ are still below 10% penetration. Is popularity among Millennials a predictor of eventual mainstream adoption? Snapchat Smartphone App Penetration by Age Source: comScore Mobile Metrix, U.S., Age 18+, April 2013 – Dec 2015 0% 10% 20% 30% 40% 50% 60% 70% Apr-2013 Dec-2013 Aug-2014 Apr-2015 Dec-2015 %Reach Age 25-34 8% 31% 5% 24% 2% Age 35+ Age 18-24 64%

- 36. © comScore, Inc. Proprietary. 36 0% 10% 20% 30% 40% 50% 60% 70% Dec-2013 Mar-2014 Jun-2014 Sep-2014 Dec-2014 Mar-2015 Jun-2015 Sep-2015 Dec-2015 %Reach Age 25-34 Age 35-54 Total Age 18+ Age 18-24 Age 55+ Linkedin also experienced a recent surge in growth driven by Millennials, as younger adults get more serious about their careers. Linkedin has seen a dramatic growth trajectory in the past two years, and while the gains cut across demographic segments, the biggest strides have been made among Millennials. 18-24 year-olds have seen penetration surge from 14% to 48% while 25-34 year-olds have overtaken 35-54 year-olds as the highest penetration demo group. Linkedin.com Penetration by Age Demographic Source: comScore Media Metrix Multi-Platform, U.S., Dec 2013 – Dec 2015 57% 40% 29% 28% 25% 14% 53% 49% 48% 25%

- 37. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 37 TV & Cross-Platform

- 38. © comScore, Inc. Proprietary. 38 The total amount of time watching TV is down 2% year-over-year for both Live TV and DVR (excluding Video On Demand). While viewing is down on Live TV and DVR, this does not mean that consumers are watching less content overall. There is now a greater availability of viewing options appealing to a wider array of tastes than ever before, but many of these options are offered via OTT, on demand and digital video. Total Hours of TV Viewing: Live & DVR Period Source: comScore TV Essentials, U.S., Q1 2016 vs. Q1 2015, Live +15 Day DVR Playback Period 95.0 92.9 18.9 18.5 0.0 20.0 40.0 60.0 80.0 100.0 120.0 Q1 2015 Q1 2016 TotalHoursofTVViewing(Billions) +15 Day DVR Period Live 113.9 -2% Y/Y -2% -2% 111.4

- 39. © comScore, Inc. Proprietary. 39 Within the cVOD market, subscription content has an impressive share of engagement despite being driven by only a few channels. The majority of cVOD viewing is Free On Demand, but most of the growth is happening via subscription services such as HBO and Showtime. TOD, which includes fee- based rentals or special events, lost share in 2015 – perhaps due to subscription VOD increasingly filling the consumer need for great storytelling and high production value. Cable Video On Demand (cVOD) Share of Time Spent Source: comScore OnDemand Essentials, U.S., Q1-Q3 2015* 61.4% 61.7% 30.0% 31.2% 8.6% 7.1% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q1-Q3 2014 Q1-Q3 2015 Transactional On Demand (TOD) Subscription Video On Demand (SVOD) Free On Demand (FOD) * Data originally appears in the State of VOD: Trend Report: http://www.rentrak.com/section/our_services/analytics/svod/

- 40. © comScore, Inc. Proprietary. 40 Among Free On Demand content, the TV Entertainment and Kids categories increased their total share of transactions by 4% in 2015. The TV Entertainment category accounts for the majority of FOD viewing while also being one of the faster growing categories. Along with Kids content, which is also growing its share of viewing transactions, the two make up three of every four Free On Demand views. Free On Demand (FOD) Share of Transactions* by Category Source: comScore OnDemand Essentials, U.S., 2015 / 2014** 47.8% 49.4% 23.3% 25.6% 13.9% 10.2% 5.1% 5.5% 10.0% 9.3% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2015 Other Movies Music Kids TV Entertainment * A VOD transaction is defined as any On Demand streaming order or view. ** Data originally appears in the State of VOD: Trend Report: http://www.rentrak.com/section/our_services/analytics/svod/

- 41. © comScore, Inc. Proprietary. 41 Moreover, the TV Entertainment category’s share of all VOD time spent has tripled in 6 years. TV Entertainment content has been rapidly gaining share of total VOD transactions and time spent over the past several years before stabilizing in 2015. Other content categories such as Movies, Music, Kids, News and Sports account for the remaining share of transactions and time spent. Video On Demand (VOD) Share of Transactions* and Time Spent in TV Entertainment Category Source: comScore OnDemand Essentials, U.S., Video On Demand 16% 19% 23% 29% 32% 37% 37% 16% 21% 25% 32% 36% 40% 40% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2009 2010 2011 2012 2013 2014 2015 Share of Transactions Share of Time Spent * A VOD transaction is defined as any On Demand streaming order or view.

- 42. © comScore, Inc. Proprietary. 42 Most of the $8.7 billion in On Demand revenue came from recurring subscription fees. Purchases and rentals via digital retailers such as Amazon, Google Play and iTunes contributed to another 1/3rd share, while On Demand rentals from a cable operator only accounted for 10%. 2015 Share of Marketplace Revenue for On Demand Content* Source: comScore OnDemand Essentials, Digital Download Essentials and Internet TV Essentials, U.S., FY 2015 The majority of On Demand revenue comes from OTT subscription services, such as Netflix, Amazon Prime and Hulu Plus. 57% 21% 12% 10% Over the Top Subscription Video on Demand (OTT SVOD) Electronic Sell-Through (EST) Internet Video on Demand (iVOD) Transactional on Demand (TOD) * Please refer to page 2 of this report for the full definitions of these On Demand industry terms.

- 43. © comScore, Inc. Proprietary. 43 There are more media platforms competing for consumers’ attention than ever, as shown by digital eclipsing Live TV among Millennials. There’s a clear trend showing that as demographic segments get younger, those consumers are more likely to spend time on their mobile device and less likely to spend time watching Live TV. It’s possible that digital share of time spent among 35-54 year-olds might also soon surpass Live TV. Share of Platform Time Spent by Demographics Source: comScore Xmedia and Media Metrix Multi-Platform, U.S., Q4 2015, Live TV 47% 57% 70% 14% 21% 14% 40% 22% 15% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Age 18-34 Age 35-54 Age 55+ TV Desktop Mobile

- 44. © comScore, Inc. Proprietary. 44 When accounting for a selection of cable networks’ digital properties, nearly 1/3rd of their total audience is uncovered. This analysis of 10 cable networks showed that their digital properties achieved massive incremental audience reach on desktop and mobile. On average, these networks attracted 24 million additional eyeballs on digital, extending their audience footprints by 29%. Cable Network Analysis: TV + Digital Cross-Platform Audience Reach Analysis Source: comScore Xmedia, U.S., November 2015 – Live TV 85.0 85.0 5.1 11.6 11.614.6 12.7 12.7 0 20 40 60 80 100 120 TV Desktop Mobile Total Reach(Millions) 109.3 MM Incremental Desktop Reach Incremental Mobile Reach Desktop Audience Overlap Mobile Audience Overlap TV Reach

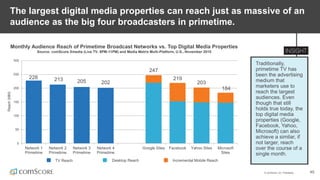

- 45. © comScore, Inc. Proprietary. 45 The largest digital media properties can reach just as massive of an audience as the big four broadcasters in primetime. Traditionally, primetime TV has been the advertising medium that marketers use to reach the largest audiences. Even though that still holds true today, the top digital media properties (Google, Facebook, Yahoo, Microsoft) can also achieve a similar, if not larger, reach over the course of a single month. Monthly Audience Reach of Primetime Broadcast Networks vs. Top Digital Media Properties Source: comScore Xmedia (Live TV, 8PM-11PM) and Media Metrix Multi-Platform, U.S., November 2015 228 213 205 202 247 219 203 184 0 50 100 150 200 250 300 Network 1 Primetime Network 2 Primetime Network 3 Primetime Network 4 Primetime Google Sites Facebook Yahoo Sites Microsoft Sites Reach(MM) TV Reach Desktop Reach Incremental Mobile Reach

- 46. © comScore, Inc. Proprietary. 46 YouTube remains a leader in video, growing its total time spent on all platforms the past 2 years – most dramatically on mobile. The total time consumers spend on YouTube is up for both desktop and mobile, but its mobile engagement has nearly doubled over the past two years. It’s easier than ever to consume video anytime and anywhere, and mobile is the best medium for immediate, on-the- go viewing. YouTube: Trend in Total Minutes (MM) Source: comScore Media Metrix Multi-Platform, U.S., Dec 2013 – Dec 2015 0 20,000 40,000 60,000 80,000 100,000 120,000 Dec-2013 Mar-2014 Jun-2014 Sep-2014 Dec-2014 Mar-2015 Jun-2015 Sep-2015 Dec-2015 TotalMinutes(MM) Mobile Desktop +95% +8%

- 47. © comScore, Inc. Proprietary. 47 Cross-platform measurement drives media planning efficiencies; for example by showing how digital video can be layered onto a TV buy. Cross-platform media planning can break down silos and allow brands to more efficiently reach audience targets. Over the course of a month, a YouTube ad buy across desktop and mobile has the potential to deliver 90%+ target reach when coupled with network primetime TV. Audience Reach Analysis by Demographic: Major Broadcast TV Network in Primetime + YouTube Source: comScore Xmedia, U.S., November 2015 – Live TV (8PM-11PM) 54% 58% 67% 43% 38% 24% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% Age 18-34 Age 35-54 Age 55+ %Reach YouTube (Incremental) Major Primetime Network 91% 97% 96%

- 48. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 48 Advertising

- 49. © comScore, Inc. Proprietary. 49 The top online display advertisers deliver hundreds of billions of impressions every year, but the market is highly fragmented. Verizon led all advertisers by delivering roughly 1 out of every 80 desktop display ad impressions in 2015. Close competitor AT&T ranked 3rd, while the rest of the Top 10 included leading consumer packaged goods, retail and technology companies. Top Advertisers by Share of Total Desktop Display Ad Impressions Source: comScore Ad Metrix, U.S., FY 2015 1.27% 1.17% 0.99% 0.88% 0.73% 0.73% 0.61% 0.60% 0.58% 0.58% Verizon Communications Intertainment Media AT&T Microsoft eBay Procter & Gamble Nissan Motor Amazon Kellogg American Express

- 50. © comScore, Inc. Proprietary. 50 Both desktop and mobile ads deliver branding effectiveness, but mobile performs better – particularly at the bottom of the funnel. Mobile ads caused point lifts up to 2.5x greater than ads on desktop across four key brand metrics and performed strongest in bottom- funnel metrics, such as intent to buy and likelihood to recommend. Less ad clutter and proximity to point of purchase may be driving better effectiveness for mobile ads. Percentage Point Lift in Brand Metrics for Desktop and Mobile Ads Source: comScore BSL and mBSL Benchmarks, U.S., Full Year 2015 Aided awareness Favorability Likelihood to recommend Purchase Intent 1.4 2.3 1.3 2.7 1.5 3.3 1.4 3.7 Desktop Mobile

- 51. © comScore, Inc. Proprietary. 51 But ad blockers, now used by 10% of U.S. desktop internet users, prevent some online ad impressions from ever reaching people. Ad blocker usage is a concern for publishers but has remained around 10% on desktop over the past six months. Publishers reaching a young male audience are most likely to be affected. Fortunately industry bodies and publishers are now taking action to address the issue by improving user experience and enhancing communication with their readership around value exchange. Incidence of Ad Blocker Usage Among U.S. Desktop Internet Users Source: comScore Custom Analytics, U.S., December 2015 11% 19% 15% 9% 8% 8% 8% 9% 14% 10% 7% 8% 7% 7% 0% 5% 10% 15% 20% 25% Total 18-24 25-34 35-44 45-54 55-64 65+ Male Female

- 52. © comScore, Inc. Proprietary. 52 Of the ad impressions that do get served, more than half can’t have an impact because they’re not viewable or not delivered to a human. A full 52% of all desktop ad impressions are unable to deliver an advertising impact. While most of these non-viewable ads are simply delivered to parts of the web page that are out of view, a meaningful percentage is being delivered to bots and by definition not viewable to a human. Percentage of Viewable Ad Impressions in U.S. Source: comScore vCE Norms, U.S., Q4 2015 48% 45% 7% Viewable Non-viewable Invalid Traffic (IVT)

- 53. © comScore, Inc. Proprietary. 53 Sophisticated IVT is a significant contributor to the overall issue of invalid traffic, necessitating advanced detection methods. Sophisticated IVT, which according to the Media Rating Council (MRC) includes “traffic originating from hijacked devices, malware or misappropriated content,” accounts for the vast majority of invalid traffic. Sophisticated detection techniques are therefore required for advertisers to mitigate the potential for waste. Invalid Traffic (IVT) by Type Source: comScore Custom Analytics, U.S., Q4 2015 75% 25% % Sophisticated IVT % General IVT

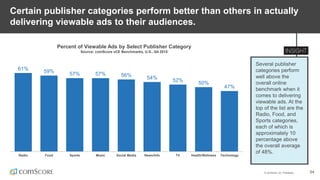

- 54. © comScore, Inc. Proprietary. 54 Certain publisher categories perform better than others in actually delivering viewable ads to their audiences. Several publisher categories perform well above the overall online benchmark when it comes to delivering viewable ads. At the top of the list are the Radio, Food, and Sports categories, each of which is approximately 10 percentage above the overall average of 48%. Percent of Viewable Ads by Select Publisher Category Source: comScore vCE Benchmarks, U.S., Q4 2015 61% 59% 57% 57% 56% 54% 52% 50% 47% Radio Food Sports Music Social Media News/Info TV Health/Wellness Technology

- 55. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 55 E-Commerce

- 56. © comScore, Inc. Proprietary. 56 By Q4 2015, total digital commerce had grown to account for 15% of discretionary dollars spent by consumers – an all-time record mark. Digital’s share of consumer discretionary spending, which peaks in seasonally colder months, reached an all-time high in Q4 2015 at 15%. Digital commerce share appears to be accelerating in recent years due to the impact of mobile. Desktop & Mobile Digital Commerce Share of Corresponding Consumer Spending* Source: U.S. Dept. of Commerce, comScore e-Commerce & m-Commerce Measurement, U.S., 2004 - 2015 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% Digital Commerce Share (desktop + mobile) e-Commerce Share (desktop) *Note: e-Commerce share is shown as a percent of DOC’s Total Retail Sales excluding Food Service & Drinking, Food & Bev. Stores, Motor Vehicles & Parts, Gasoline Stations and Health & Personal Care Stores. 13.5% (Q4 ‘14) 12.5% Q4 ‘15 15.0% Q4 ‘15 11.8% (Q4 ‘14)

- 57. © comScore, Inc. Proprietary. 57 Boosted by a growing share of mobile, total digital commerce surpassed $90 billion in Q4 2015 to mark its highest total ever. Digital commerce growth rates have remained relatively stable in the past two years, hovering between 12-16%. Despite strong growth rates through much of 2015, however, Q4 saw a material slow- down in the y/y growth rate driven in part by a tougher comparison to a strong Q4 2014. Total U.S. Retail Digital Commerce Growth Source: comScore e-Commerce & m-Commerce Measurement, U.S., 2012 - 2015 $50.2 $49.8 $47.5 $63.1 $56.1 $54.8 $53.9 $72.1 $61.1 $59.8 $58.3 $76.9 $5.9 $4.7 $5.8 $8.3 $7.3 $6.9 $6.7 $10.7 $11.1 $11.1 $11.4 $15.6 15% 16% 14% 12% 13% 13% 14% 16% 14% 15% 15% 12% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Y/Y%Growth Billions($) Desktop Mobile Y/Y % Growth

- 58. © comScore, Inc. Proprietary. 58 In terms of discretionary retail spending, m-commerce growth is far outpacing desktop e-commerce and bricks-and-mortar. 2015 was a huge year for mobile commerce, seeing annual growth of 56% and gaining a larger share of retail dollars. Desktop e- commerce is still experiencing moderate growth at 8%, but it has dipped into single digits as mobile continues to emerge as a buying platform. Full Year 2015 Y/Y Retail Spending Growth by Channel Source: U.S. Dept. of Commerce, comScore M-Commerce and E-Commerce Measurement, U.S., FY 2015 / FY 2014 +1% +8% +56% +0% +10% +20% +30% +40% +50% +60% Total Discretionary Retail e-Commerce m-Commerce

- 59. © comScore, Inc. Proprietary. 59 Mobile commerce appears to have hit an inflection point in its growth and has seen a big uptick in its digital commerce share. M-commerce has come a long way in the past 5 years and now contributes about 1 in every 6 dollars spent via digital commerce. 2015 saw an especially strong jump in its percent share of the total market as consumers became more comfortable transacting on their smartphones and tablets. Quarterly Trend in Mobile Commerce as a Share of Total Digital Commerce Source: comScore M-Commerce and E-Commerce Measurement, U.S., Q2 2010 – Q4 2015 1.8% 2.4% 3.6% 5.8% 6.6% 8.8% 9.0% 9.3% 8.1% 9.8% 11.3% 10.5% 8.6% 10.8% 11.7%11.5% 11.1%11.1% 13.0% 15.4%15.6% 16.4% 16.9% Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015

- 60. © comScore, Inc. Proprietary. 60 However, dollars are significantly lagging digital media time spent on mobile, highlighting the mobile conversion challenge. Mobile accounts for 60% of time spent shopping online, but only 16% of all retail dollars spent, due to factors such as security concerns and smaller screen size. This m- commerce monetization gap will continue to narrow over time, but the shares of time spent and dollars spent likely won’t ever reach equilibrium. 2015 Share of Retail Time Spent vs. Spending by Platform Source: comScore M-Commerce and E-Commerce Measurement, U.S., FY 2015 60% 16% 40% 84% Time Spent Dollars Spent Desktop Mobile 44% Gap

- 61. © comScore, Inc. Proprietary. 61 Categories that did have high m-commerce conversion, such as Video Games & Accessories, saw the biggest annual gains. Online retail grew 14% year-over-year in 2015, with the fastest growing categories seeing most of their gains on mobile. The top 3 product categories in terms of growth contain inexpensive, less complicated purchases that consumers are increasingly willing to make on their smartphones and tablets. Y/Y % Change in Total Retail Digital Commerce Dollars by Category Source: comScore E-Commerce Measurement, U.S., FY 2015 vs. FY 2014 44% 42% 32% 30% 29% 25% 23% 19% 16% 15% 14% 12% 11% 9% 8% 6% 5% 5% Video Games, Consoles & Accessories Toys & Hobbies Sport & Fitness Jewelry & Watches Event Tickets Music, Movies & Videos Flowers, Greetings & Misc Gifts Apparel & Accessories Home & Garden Furniture, Appliances & Equipment Total Digital Commerce Computer Software Books & Magazines Consumer Electronics Consumer Packaged Goods Office Supplies Computers / Peripherals / PDAs Digital Content & Subscriptions

- 62. © comScore, Inc. Proprietary. 62 Apparel & Accessories overtook Computer Hardware in Q1 and Q2 as the #1 category for digital commerce for the first time ever. Computer Hardware has long been the #1 category in digital commerce, but recent strength in the Apparel & Accessories category – due in large part to mobile commerce – vaulted it ahead in the first two quarters of 2015 before briefly losing the lead in Q3, only to regain it in the final quarter. Digital Commerce Sales by Category: Apparel & Accessories vs. Computer Hardware Source: comScore E-Commerce & M-Commerce Measurement, U.S., Q1 2013 – Q4 2015 $8.4 $8.4 $7.1 $12.3 $9.9 $10.0 $8.4 $15.0 $12.4 $11.8 $10.1 $17.2 $9.2 $9.1 $9.9 $13.5 $10.2 $10.0 $11.3 $15.9 $11.1 $11.0 $11.8 $16.0 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Billions($) APPAREL & ACCESSORIES COMPUTER HARDWARE

- 63. © comScore, Inc. Proprietary. 63 This holiday season retail traffic peaked on Black Friday and Cyber Monday, with mobile outpacing desktop every day this season. Mobile accounted for 63% of all online retail visits this holiday season and outpaced desktop every single day of the season. Mobile visits peaked on Black Friday, while desktop visits peaked on Cyber Monday, which saw more overall retail traffic than any other day in 2015. 2015 Holiday Season: Digital Retail Visits (MM) by Platform Source: comScore Custom Analytics, U.S., Nov 1 – Dec 31, 2015 - 100 200 300 400 500 600 700 800 11/1/2015 11/8/2015 11/15/2015 11/22/2015 11/29/2015 12/6/2015 12/13/2015 12/20/2015 12/27/2015 Visits(MM) MOBILE DESKTOP TOTAL DIGITAL Black Friday Cyber Monday

- 64. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 64 Box Office

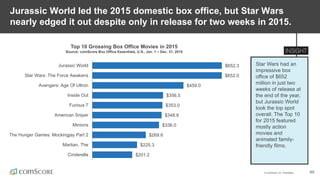

- 65. © comScore, Inc. Proprietary. 65 $652.3 $652.0 $459.0 $356.5 $353.0 $348.8 $336.0 $269.6 $225.3 $201.2 Jurassic World Star Wars: The Force Awakens Avengers: Age Of Ultron Inside Out Furious 7 American Sniper Minions The Hunger Games: Mockingjay Part 2 Martian, The Cinderella Star Wars had an impressive box office of $652 million in just two weeks of release at the end of the year, but Jurassic World took the top spot overall. The Top 10 for 2015 featured mostly action movies and animated family- friendly films. Jurassic World led the 2015 domestic box office, but Star Wars nearly edged it out despite only in release for two weeks in 2015. Top 10 Grossing Box Office Movies in 2015 Source: comScore Box Office Essentials, U.S., Jan. 1 – Dec. 31, 2015

- 66. © comScore, Inc. Proprietary. 66 20th Century Fox was home to two of the biggest movies in 2015 in terms of total digital purchases and rentals. As with the top grossing box office movies, action films tended to be most popular among audiences, even on the “small screen.” Gone Girl was the top U.S. digital movie purchase/rental in 2015, topping Kingsman: The Secret Service and American Sniper. RANK TITLE STUDIO 1 Gone Girl Fox 2 Kingsman: The Secret Service (2015) Fox 3 American Sniper (2014) Warner 4 Interstellar (2014) Paramount 5 The Hunger Games: Mockingjay - Part 1 (2014) Lionsgate 6 Interview, The (2014) Sony 7 Big Hero 6 (2014) Disney 8 John Wick (2014) Lionsgate 9 Fury Sony 10 Mad Max 4: Fury Road (2015) Warner 11 Inside Out (2015) Disney 12 Get Hard (2015) Warner 13 Home (2015) Fox 14 Hobbit, The: The Battle Of The Five Armies (2014) Warner 15 Avengers: Age Of Ultron (2015) Disney 16 Equalizer, The Sony 17 Birdman (2014) Fox 18 Spy (2015) Fox 19 Insurgent (2015) Lionsgate 20 San Andreas (2015) Warner * Excludes NBC Universal and non-participating Independent distributors. EST revenue source: DEG Top 20 Digital Movie Purchases & Rentals in 2015 Source: comScore Digital Download Essentials, U.S., Jan. 1 – Dec. 31, 2015

- 67. © comScore, Inc. Proprietary.© comScore, Inc. Proprietary. 67 Ten Trends for 2016

- 68. © comScore, Inc. Proprietary. 68 Top Trends for 2016 1. 2016 will be the year of cross-platform ̵ Over the past few years we’ve seen the convergence of desktop and mobile into a unified multi-platform digital environment. The next phase in media convergence is the collision of TV and Digital as a higher percentage of viewing happens via the internet and as consumers’ viewing patterns become more fluid across platforms. As measurement systems are developed to quantify this behavior, the media and marketing industries will be transformed by the power of cross-platform data. 2. Digital audience growth will subside, leading to a renewed focus on engagement and attention metrics ̵ Digital audiences have undergone a sustained period of growth from the emergence of the mobile internet, but signs that this growth trend is beginning to taper off point to a growing demand for metrics that go beyond demonstrating scale. Engagement metrics, such as time spent and meaningful visits, are likely to play an increasing role in articulating the value of a digital media property’s audience. 3. The smartphone app will account for the majority of all digital media consumption ̵ Time spent on smartphone apps has been consistently trending upward in the past few years, ending 2015 with a 47% share of total digital media engagement. It’s growth trajectory will continue in 2016 – particularly as mobile video viewing gains steam – on its way to representing the majority of all digital consumption time. 4. Mobile ad spend will get unlocked as measurement standards come into place ̵ Mobile advertising growth has been on a tear the past two years, which is little surprise given the shift in media consumption to smartphones and tablets. At the same time, measurement standards for mobile have lagged that of desktop, which has likely inhibited further ad spending on mobile. As those standards finally come into clearer view in 2016, advertisers will benefit from more comparable metrics and more scalable means of reaching the right consumers. 5. Social media will increasingly revolve around video content ̵ With Snapchat having now emerged as the next great social media company, there is a growing realization of the power of video to drive social resonance. Facebook and Instagram have already ramped up their video efforts, and more recently we’ve seen Twitter-owned Periscope capture the attention of users with its livestreaming capability.

- 69. © comScore, Inc. Proprietary. 69 Top Trends for 2016 6. Platform publishing optimization will emerge as digital’s newest cottage industry ̵ With publishers putting their content directly on 3rd party publishing platforms such as Facebook Instant Articles, Snapchat Discover and Apple News, a host of technological, analytic and revenue optimization challenges will arise that may exceed what publishers are equipped to efficiently handle in-house. Just as search engine optimization boomed during the first half of the 2000s, and social marketing optimization exploded in the late 2000s, the next big digital cottage industry will be built around publisher platform optimization. 7. Just as small screen viewing is shifting to the tiny screen, the big screen will be increasingly fought on the small screen ̵ TV – aka “small screen” – content viewing has increasingly shifted to even smaller screens such as smartphones and tablets in the past few years. A parallel shift we can expect to see accelerate in 2016 is from the movie theater screen to TV screen. As Netflix, Amazon, Hulu and others enter bidding wars for the rights to major motion pictures that would traditionally have a theatrical release, more first-run viewing of these films is likely to happen from the comfort of streaming video subscribers’ homes. 8. Wider availability of over-the-top (OTT) content will grow the Total Video pie, not cannibalize it ̵ The conversation around shifts toward OTT viewing on Netflix, Amazon and the like has traditionally been coupled with discussion of cord-cutting. But with more broadcast and cable networks – such as HBO, CBS, Disney and others – making their content available over-the-top via apps, there is a renewed opportunity to reach those non-Pay TV audiences who couldn’t otherwise be reached while not increasing the rate of cord-cutting. 9. Mobile commerce will surpass 20% share of total retail dollars spent on digital ̵ While m-commerce conversion will remain a relative friction point, a confluence of factors are improving to help mobile’s share of spending continue to accelerate. Faster connections, decreasing concerns over transaction security, larger phone screen sizes, and more frictionless navigation of e-commerce mobile sites and apps will all help push m- commerce share from under 17% in 2015 to more than 20% in 2016. 10. Content curation will emerge as a key area of tech and startup innovation ̵ The expansiveness and highly fragmented nature of media content today has created a huge problem for consumers who want to easily access and keep track of the TV shows, digital videos, podcasts, books, music, and articles they want to consume. At the same time, there remains untapped opportunity for more relevant content recommendation – leveraging social and other algorithms – that can help significantly improve the content discovery experience. That such large consumer friction points still exist suggest that the technology/media sector may be ripe for its next wave of innovation (ironically, just as talk of the tech bubble bursting reaches a fever pitch).

- 70. © comScore, Inc. Proprietary. 70© 2016 comScore, Inc.For info about the proprietary technology used in comScore products, refer to http://www.comscore.com/About-comScore/Patents www.comscore.com @comScore www.linkedin.com/company/comscore www.facebook.com/comscoreinc For more information about comScore and its measurement products, please visit: www.comscore.com/learnmore For more information about the report, please contact: ANDREW LIPSMAN, VP Marketing & Insights alipsman@comscore.com ADAM LELLA, Senior Marketing Insights Analyst alella@comscore.com