Crowdfunding good causes

- 1. CROWDFUNDING GOOD CAUSES Opportunities and challenges for charities, community groups and social entrepreneurs Crowdfunding Good Causes June 6th, Nesta #Crowd4Good Jonathan Bone jonathan.bone@nesta.org.uk @JonoBone Peter Baeck Peter.baeck@nesta.org.uk @PeterBaeck Download the report: www.nesta.org.uk/crowdfunding-good-causes

- 3. CROWDFUNDING GOOD CAUSES Opportunities and challenges for charities, community groups and social entrepreneurs BACKGROUND • Little research looking at crowdfunding good causes to date • Market studies show growing but small market • Evidence of opportunities for non financial and financial benefits

- 4. AIMS OF THE REPORT Characteristics of crowdfunding for good causes, opportunities and challenges What is keeping community and voluntary organisations from using crowdfunding How can we make the most out of crowdfunding for good causes What we did • Review of existing literature (not much) • Interviews with some of the leading platforms focusing on good causes • Survey of 450+ CVS organisations

- 5. WHAT IS IT Crowdfunding is a way of financing projects, businesses and loans through small contributions from a large number of sources, rather than large amounts from a few. Contributions are made directly or through a light–touch platform rather than through banks, charities or stock exchanges

- 6. DIFFERENT MODELS Donation-based: People donate money towards a project. Except for seeing the feeling of seeing the project go ahead, receive no financial return or product. Average campaign size - £714. Equity based: Enables the crowd to invest for equity, or profit/revenue sharing in businesses or projects, with the hope of a financial return if the business exits. Average campaign size - £523,978 Community Shares: Similar to standard equity except they can only be sold by cooperatives and community benefit societies and although investors may sometimes earn interest , they cannot go up in value. Average campaign size - £309,342 Lending based: People seeking a loan apply through the platform, with members of the crowd taking small chunks of the overall loan. Profit is made when loan is repaid with interest. Average campaign size - £76,280 Reward-based: People contribute to projects and receive a non–financial reward or product in return. Average campaign size - £6,326. £%

- 7. DIFFERENT MODELS Donation-based: People donate money towards a project. Except for seeing the feeling of seeing the project go ahead, receive no financial return or product. Average campaign size - £714. Community Shares: Similar to standard equity except they can only be sold by cooperatives and community benefit societies and although investors may sometimes earn interest , they cannot go up in value. Average campaign size - £309,342 Reward-based: People contribute to projects and receive a non–financial reward or product in return. Average campaign size - £6,326.

- 8. EVENTS AND ACTIVITES NewVIc Ability Counts Football Squad - £630 to get to the nationals CAMPAIGNS AND MOVEMENTS Keep streets live raised £3,285 from 133 backers to go towards paying legal and campaigning costs GARDENS PLAYGROUNDS AND GREENSPACES Global Garden, Global Kitchen raised £10,894, from 110 Backers to set up a community garden and kitchen BUILDINGS, RESTORATIONS AND INFRASTRUCTURE PortPatrick community Benefit Society - £103,000 from 363 backers to save harbour EQUIPMENT AND TOOLS Help a Heart campaign raised £1,808 and £1,107 in 2 campaigns to buy defibrillators for a local community.

- 9. OPPORTUNITIES Mobilising volunteers and other non financial contributions Helping fund projects that would otherwise not get funded Transparency on who and what gets funded Increased experimentation Marketing and awareness raising 64% of donation fundraisers unlikely to have received finance elsewhere 90% of those donating subsequently promoted it to their social network 25% offered to volunteer with the project they supported Around 75% stated the money they donated would otherwise be given to charity

- 10. CHALLLENGES Crowdfunding is hard and there are limits on the size of what can be funded Negative impact on diversity, equality and participation Balancing one off support through crowdfunding against need for long term finance Replacing government funding Potential conflict between the crowd’s and the organisation’s priorities Risks favouring those who are digitally savvy with money to fund projects Community Shares requires a change of legal status Average donation and rewards campaign =< £10K Equivalent to small grants Often requires months of work for relatively small amounts of money

- 11. What are the main barriers keeping charities, community groups and social entrepreneurs from using crowdfunding? How can these be addressed? Survey of 452 charities, community groups and social entrepreneurs to understand their perception awareness and usage of crowdfunding ?

- 12. High awareness but little use of crowdfunding 74% aware of but hadn’t used it 11% Have never heard off it 15% had used it

- 13. Why aren’t organisations using crowdfunding?

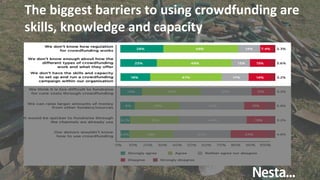

- 14. The biggest barriers to using crowdfunding are skills, knowledge and capacity

- 15. Why aren’t organisations using crowdfunding?

- 16. What factors would make organisations use crowdfunding?

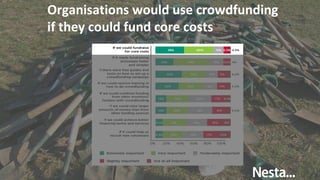

- 17. Organisations would use crowdfunding if they could fund core costs

- 18. Factors that would make organisations use crowdfunding

- 19. Perceived Suitability of the different crowdfunding models to fundraising needs Community shares was least well known model but seen as 3rd most suitable Equal awareness of donation and rewards, but rewards is seen as less suitable

- 20. Perceived Suitability of the different crowdfunding models to fundraising needs Community shares was least well known model but seen as 3rd most suitable Equal awareness of donation and rewards, but rewards is seen as less suitable

- 21. Perceived Suitability of the different crowdfunding models to fundraising needs Community shares was least well known model but seen as 3rd most suitable Equal awareness of donation and rewards, but rewards is seen as less suitable

- 22. How does crowdfunding compare to other forms of funding

- 23. How does crowdfunding compare to other forms of funding

- 24. How does crowdfunding compare to other forms of funding

- 25. Recommendations • Try and set up at least one crowdfunding campaign • Join up fundraising and campaign teams to run their crowdfunding campaigns • Curate a group of projects on a pre-existing platform or develop a customised crowdfunding platform For charities, community groups and social entrepreneurs…

- 26. Recommendations Funders, investors and other supporters of community and voluntary sector organisations should… • Invest in building crowdfunding knowledge, skills and capacity building. • Integrate crowdfunding into existing funding schemes through match funding • Support transition from crowdfunding projects to developing sustainable organisations • Set up referral schemes from grant funders and social investors • Test and measure effect of crowdfunding

- 27. CROWDFUNDING GOOD CAUSES Opportunities and challenges for charities, community groups and social entrepreneurs Panel Discussion Karl Wilding, Director of Public Policy and Volunteering, NCVO Julia Groves, Partner and Head of Crowdfunding, Downing LLP and Director, UK Crowdfunding Association Ben Warren, Investment Associate, Big Society Capital Chair: Peter Baeck, Head of Collaborative Economy Research, Nesta #Crowd4Good Download the report: www.nesta.org.uk/crowdfunding-good-causes

Editor's Notes

- &lt;number&gt;

- Video &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;

- &lt;number&gt;