Verizon Overview Broadband during DigiWorld Summit 2011

- 1. DigiWorld Summit 2011 November 16, 2011

- 2. Verizon Overview Verizon Communications Wireline Wireless FiOS Presence Revenue (2010): $41B Voice subs (3Q11): 24.5M Broadband subs (3Q11): 8.6M FiOS TV subs (3Q11): 4.0M Revenue (2010): $63B Retail Customers (3Q11): 90.7M Smartphone penetration (3Q11): 39% LTE markets (3Q11): 165 markets (covering population of >186M)

- 3. IPTV Is The Link To Multiplatform Consumption DEMAND DISTRIBUTION DEVICES Device shifting Time shifting Place shifting Higher broadband speeds Cloud storage Content security Picture quality IPTV

- 4. Current Content Distribution Linear, VOD Authenticated, VOD, Live Events Linear, VOD, Apps Multichannel Providers (MVPDs) 300+ Linear Digital Networks 30K VOD Titles MVPDs (Auth) Online only (e.g., Hulu – 18K Titles) Content providers (Ad-supported, Auth) Library content (e.g., Netflix – 30K Titles) Content Availability Nascent Distribution Platforms Content distribution still limited by device In-home streaming MVDP authenticated apps Hulu Plus, Netflix Watch ESPN, HBO Go apps Mobile only MVPDs (Auth Trial) Hulu Plus, Netflix Content providers Authenticated, VOD, Live Events

- 5. Deployed Innovation Authentication OTT Interactivity Content ubiquitous across devices Reach consumers at every point of access Drive engagement Multiplatform Consumer aspiration: Favorite content anywhere, anytime IPTV Expands Content Reach

- 6. Authentication Overview In-Home (Live and VOD) Out-of-Home Authenticated Content Access MVPD Programmer Site 3 rd Party Authenticator iPad App Sling Adapter Xbox Limited Availability Players Devices Players Devices Authentication reinforces value of underlying video subscription

- 7. 90% of HHs will connect TVs to internet by 2015 Est 1.4 OTT subscriptions per OTT HH by 2015, many households with have 2-3 subscriptions Most OTT subs will be Complementors – users supplementing current multichannel subscription with OTT Widely available broadband speeds for streaming… More than 75% of Households can stream SD video (2+ Mbps) More than 25% of Households can stream HD video (7+Mbps) … and growing fast Large installed base of networked devices… Broad range of content offered… … about to triple by 2014 2010 128M 2014 368M … and more to come … and a growing Video OTT Market Movies TV Shows Sports more than 40% of HHs paying for video OTT Million OTT Paying HHs US market is primed for OTT Growth: from $6B in 2011 to $19B in 2015 US OTT Market Overview Game Consoles 89M Internet TVs 107M Blu-Ray Players 89M STB / DVR 82M

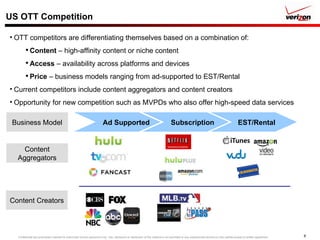

- 8. US OTT Competition Subscription EST/Rental Ad Supported Business Model Content Aggregators Content Creators OTT competitors are differentiating themselves based on a combination of: Content – high-affinity content or niche content Access – availability across platforms and devices Price – business models ranging from ad-supported to EST/Rental Current competitors include content aggregators and content creators Opportunity for new competition such as MVPDs who also offer high-speed data services

- 9. Key Factors Consumer Behavior Device Proliferation Platform Content Availability Consumer Expectation Opportunity Time shifting, place shifting, device shifting High-affinity content New revenue OTT subscription revenue Additional advertising revenue Rental/EST revenue Expand subscription market beyond multichannel Increase from 100M HHs to 150+M subs (US) Drive device sales Expand number of devices per customer IPTV Opportunity Summary