Disruptive capital

- 1. IN REGIONAL INNOVATION FOR LOCAL DEVELOPMENT

- 2. DISRUPTIVE VENTURES 1. Definition 2. Market 3. Strategy 4. Criteria 5. One-Stop 6. Investor 7. Portfolio 8. Team 9. Network 10. Deployment 11. Investment Process 12. Terms

- 3. DISRUPTIVE VENTURES Disruptive Ventures is a seed and growth stage investor in leading innovation-driven companies in Vietnam and South East Asia. We invest in ambitious business-minded entrepreneurs with the heart of sustainable development. We possess a unique approach to maximize the ventures in both business and development aspects. We use Disruptive Innovation as the key theory. The focusing sectors are Information Communication Technology, Fintech, SaaS, IOT, We aim for a 15 - 20 companies in a portfolio.

- 5. STRATEGY Our objective is accelerating a startup by leveraging its exceptional founders in business for a profitable outcome and development for a sustainable brand. The main reason of failure in entrepreneurship is there are too many things to handle for inexperienced and lack-of-resource founders. Therefore, our startups shared a system of value-added activities which become smarter and more suitable along the life of the fund. So that the founders have more time to focus what they are good at and their own development. Our strategy is based on both scientific theory and business experience.

- 6. CRITERIA - Exceptional Team of Entrepreneurs - Seed or Growth Stage - Nationally or Regionally Scalable - Potential Plan of Social Impacts and Sustainable Solutions - Innovation-Based Products - Proven Business Model - Sound Proof of Concepts - Execution Know How - Capital Efficient - Growing Markets

- 7. KPI - Business Gowth Targets - Professionally-functioned Targets - Social and Development Targets. May include how many vulnerable ones working in the startups, the products are accessible for disadvantages,…

- 8. ONE-STOP Entrepreneurs focus mainly on product and team development. Until the startups are ready to operate fully as a professional company, we provide access to extra value supports including: Workspace, Law Counseling, Sale & Business Development, Marketing Strategy Advisory, Talent Acquisition, Finance in the means of daily interaction, training courses, mentorship and collaborative ecosystem. Investors and Partners find it easier and more effective to capture the whole picture.

- 9. INVESTOR Disruptive Ventures provides less ROI compared to other VCs. Our target ROI is 20x - 50x. We, however, guarantee significant brands with social impacts and sustainable development. With Disruptive Ventures, investors do both things at the same time: earn capital from investing and steering the future companies to sustainable development.

- 10. PORTFOLIO Company Description Sector Market Size Equity Social Aspect 1 Cantin.vn With the vision of applying technology to improve the quality of food court in Vietnam, Cantin has worked with universities and industrial zones in HCMC to discuss making a change for those canteens. 2 Vuon Sang Tao Known as one of the leaders in the STEM field in HCMC, Vuon Sang Tao is an educational center that uses robots and coding to help children to get to know technologies as soon as possible and improve their soft skills such as problem-solving, team-work, critical thinking,... 3 Smart Insoles The project wants to change the Vietnamese shoe industry with the help of technologies by creating a smart chip and smart insoles which can track users' daily activity and alert when needed 4 Co-working Coffee Co-working Coffee can be separated into 2 parts: co-working space and coffee house. As our connection is the field of the start-up is large and always scalable, a co-working coffee will be an ideal place to meet up and work.

- 11. PORTFOLIO Company Description Sector Market Size Equity Social Aspect 5 Smart Sale 6 City VR 7 Start Legal & Accounting 8

- 12. TARGET PORTFOLIO 1 MARKETING & SALE STARTUP 1 LEGAL & ACCOUNTING STARTUP 1 CO-WORKING SPACE 12 - 17 INNOVATION- DRIVEN STARTUPS

- 13. DR. LIEM NGO Chairman Ph.D. from Albert-Ludwigs-University Freiburg. 45-year experienced in Rural Development, NGO and Information Technology in Germany, Switzerland, SEA and Africa TEAM TIEN NGUYEN CEO Strategy in University College Dublin with full Scholarship from the Irish Government. 10-year Serial Entrepreneur, Investor and Strategy Researcher in Europe, SEA and China TIEN PHAN Chief Investment Officer 12-year experienced in Business Development and Training. Significant achievement with a 10- million- revenue business and 200-member staff CHUNG NGUYEN Chief Operation Officer Dedicate Operation Manager with Entrepreneur Spirit. Specialized in Real Estate, Office Management and Business Development SEN HUYNH Head of Finance Salutatorian in Finance in Foreign Trade University with many scholarships. 5-year experienced in banking, anti-money laundering at Sumitomo Bank and HSBC. UYEN NGUYEN Assistant Full Provincial Scholarship to study in Australia. Former VNG content specialist. DUY DANG Head of Deal Execution Vice-President of Lixitech & UniGroup 8-year Serial Entrepreneur and Investor and successfully exited to VNG.

- 14. ADVISORY BOARD TRUNG HA MBA from Harvard Business School. 40-year experienced in Strategy and Business Coaching CLAYTON CHRISTENSEN Professor at Harvard Business School Father of Disruptive Innovation Theory DANIEL MAHER Professor at University College Dublin Former Head of Innovation at ACT Venture Capture H.E. JOHN MCCULLAGH Irish Ambassador in Vietnam

- 15. STRUCTURE BOD 6 Deal Execution (1 head), 1 Principal, 1 Associate Growth Capital (1 head), 1 Principal, 1 Associate

- 16. NETWORK One of the key point that DISRUPTIVE focuses on is creating a dynamic and lively network, both online and offline, of our former and current founders, advisors, mentors and partners in order to gain the maximum knowledge of our startups. The activities within the Network include: Founder workshops, Networking & Introductions, Shared Resources, Investor and Partner Events, Best Practice Sharing, Significant Innovation Discussion and International Expansion.

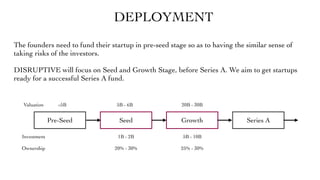

- 17. The founders need to fund their startup in pre-seed stage so as to having the similar sense of taking risks of the investors. DISRUPTIVE will focus on Seed and Growth Stage, before Series A. We aim to get startups ready for a successful Series A fund. DEPLOYMENT Pre-Seed Seed Growth Series A Valuation <5B 5B - 6B Investment Ownership 1B - 2B 20% - 30% 20B - 30B 5B - 10B 25% - 30%

- 18. TERM SHEET (Fact Checking, Market Analysis, Deal Negotiation) INVESTMENT PROCESS DEAL SOURCING (Accelerator, Incubator, Events, References, Social Media) SCREENING (Information Checking, Initial DD, Meetings, Criteria Filtering) DUE DILIGENCE (In-depth interview, Financial, Operation, Corporate Governance) ADVISORY (Investors, Entrepreneurs, Industry Experts) REVIEW (Risk Analysis, Comparison and Static Process) 2000 Startups/Year 150 Startups 15 - 20 Startups

- 19. FUND TERMS - Management Fees: 5% - Performance Fees: 15% per exits - Deployment Period: 12 - 18 months - Expected Hold: 3 - 7 years - Fund Size: 200B - Portfolio: Approximately 20 startups