2018 DRR Financing 5.1 Rhodri Lane

- 1. Aon Benfield UNDP DRR Financing Workshop Rhodri J. Lane, Managing Director Head of International Capital Markets October 5, 2018

- 2. Aon Securities Inc. 2 Contents 1. Review of Government Sponsored Catastrophe Bonds 2. Cat Bond Market Update 3. Considerations for Generali 4. Appendix

- 3. Aon Securities Inc. 3 1. Review of Government Sponsored Catastrophe Bonds

- 4. Aon Securities Inc. 4 Select Government Sponsored Catastrophe Bonds Issuance Year Sponsoring Country Beneficiary Entity Notional Amount (millions) Recovery Mechanism Perils Covered 2006 Mexico FONDEN / AGROASEMEX, Munich Re $160 Parametric Mexico HU / EQ 2009 Mexico FONDEN / AGROASEMEX, Munich Re $290 Parametric Mexico HU / EQ 2012 Mexico FONDEN / AGROASEMEX, Munich Re $315 Parametric MX HU / EQ 2012 Turkey Turkish Catastrophe Insurance Pool (TCIP) $100 Parametric Mexico HU / EQ 2014 World Bank: CCRIF Member Countries CCRIF Member Countries $30 Parametric Caribbean HU 2015 Turkey Turkish Catastrophe Insurance Pool (TCIP) $100 Parametric Turkey EQ 2017 World Bank: Mexico FONDEN / AGROASEMEX, $360 Parametric MX HU / EQ 2018 World Bank: Chile, Colombia, Mexico, Peru FONDEN / AGROASEMEX1, Swiss Re1 $1,360 Parametric Chile, Colombia, Mexico and Peru EQ 2018 FEMA / NFIP Hannover Re (Ireland) DAC $500 Indemnity Flood ▪ Further examples exist of quasi-governmental, municipal and US State mandated catastrophe bond issuances have been prolific and well established (e.g. the California Earthquake Authority) ▪ Government entities have been sponsoring Catastrophe Bonds since 2006 and have accessed over $3.1 billion of the below listed issuances ▪ Mexico has been the most consistent governmental sponsor having accessed Catastrophe Bond Capacity since 2006 ▪ Issuances are almost exclusively Parametrically triggered structures Government Catastrophe Bonds

- 5. Aon Securities Inc. 5 View Government Sponsored Catastrophe Bonds ▪ Geographic scope has been largely limited to North America leaving significant room for expansion into new regions ▪ In 2018, the landmark Pacific Alliance transaction took the market into Latin America by introducing Chile, Colombia, and Peru to the Catastrophe Bond coverage ▪ Significant interest exists in the Insurance-Linked Securities market to offer protection to an increasingly geographically diverse set of risks Geographic Scope

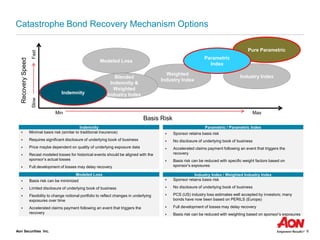

- 6. Aon Securities Inc. 6 Min Max SlowFast RecoverySpeed Basis Risk ▪ Minimal basis risk (similar to traditional insurance) ▪ Requires significant disclosure of underlying book of business ▪ Price maybe dependent on quality of underlying exposure data ▪ Recast modeled losses for historical events should be aligned with the sponsor’s actual losses ▪ Full development of losses may delay recovery Industry Index Modeled Loss Weighted Industry Index Blended Indemnity & Weighted Industry Index Indemnity Catastrophe Bond Recovery Mechanism Options ▪ Sponsor retains basis risk ▪ No disclosure of underlying book of business ▪ Accelerated claims payment following an event that triggers the recovery ▪ Basis risk can be reduced with specific weight factors based on sponsor’s exposures Parametric / Parametric Index ▪ Sponsor retains basis risk ▪ No disclosure of underlying book of business ▪ PCS (US) industry loss estimates well accepted by investors; many bonds have now been based on PERILS (Europe) ▪ Full development of losses may delay recovery ▪ Basis risk can be reduced with weighting based on sponsor’s exposures Industry Index / Weighted Industry Index ▪ Basis risk can be minimized ▪ Limited disclosure of underlying book of business ▪ Flexibility to change notional portfolio to reflect changes in underlying exposures over time ▪ Accelerated claims payment following an event that triggers the recovery Modeled Loss Indemnity Pure Parametric Parametric Index

- 7. Aon Securities Inc. 7 Overview of Parametric Index Recovery Mechanisms Recoveries from a parametric structure are automatic, relatively straightforward, and doesn’t require insurance claims adjustment which allows for an ideal approach to government sponsors looking to transfer risk ▪ In a parametric index transaction the payout is based on reported physical parameters of a covered event − Wind Storm parameters could include among others • Wind speed • Central pressure • Forward speed • Storm radius • Storm surge height − Earthquake parameters could include • Ground acceleration • Richter Scale − Other parameters may include Precipitation, Temperature, Mortality Rates ▪ Parameters must be reported by a reputable government agency or third party reporting mechanism ▪ These parameters may be measured and reported at different levels of granularity (the Resolution) − While designing the index formula, varying weights may be assigned to various resolution locations, in order to match the cedants exposures at these locations and to minimise basis risk (the difference between payout from the structure and losses incurred by the cedant post-event)

- 8. Aon Securities Inc. 8 ILS Losses Due to Natural Disasters (in millions) Year Event Transaction Trigger Issuance Size ($ millions) Paid and Estimated ($ millions) Notes 1999 Europe Windstorm Lothar Georgetown Re Indemnity; Aggregate $44.5 $43.2 Final Loss 2005 Hurricane Katrina KAMP Re Indemnity; Occurrence $190.0 $142.5 Final Loss 2011 Japan earthquake Muteki Parametric; Occurrence $300.0 $300.0 Full loss of principal 2011 Japan earthquake Vega Capital 2010 Class D Index and Parametric; Occurrence $42.6 $16.0 ~$16mn loss to reserve account 2011 Severe Thunderstorm Mariah Re 2010-1 and 2 Index; Aggregate $200.0 $200.0 Full loss of principal 2015 Hurricane Patricia MultiCat 2012-I C Parametric; Occurrence $100.0 $50.0 Final Loss 2016 Aggregated storm losses Gator Re Ltd. Indemnity; Aggregate and occurrence $200.0 $35.0 Final Loss 2017 Mexico EQ IBRD CAR 113 A Parametric; Occurrence $150.0 $150.0 Final Loss 2017 HU Irma Manatee Re 2016-1 C Indemnity; Occurrence $20.0 $15.0 2017 HU Harvey, Irma & Maria Loma Re 2013-1 C Indemnity and Industry Index; Aggregate $65.0 $0.0 2017 HU Harvey, Irma & Maria Atlas IX Capital 2015 Index, Annual Aggregate $150.0 $1.5 PCS expects to adjust further 2017 HU Harvey & Irma, thunderstorms, CA wildfires, winter storms Caelus Re V 2017-1 B, C, D Indemnity; Aggregate $300.0 $0.0 2017 HU Irma Citrus Re 2015-1 B,C Citrus Re 2016-1 D-501 , E-50 Citrus Re 2017-1 A and 2 B Indemnity; Occurrence $387.5 $252.0 2017/18 HU Harvey, Irma, CA wildfires, winter storms Residential Re 2014-1 10 Residential Re 2015-1 10 Residential Re 2016-1 10 Residential Re 2017-1 10 Residential Re 2013-II 1 Indemnity; Occurrence and Aggregate $325.0 $60.0 Extension until Dec 6, 2018 2018 HU Matthew, Harvey, Irma Blue Halo Re 2016-1 B Index; Term Aggregate $55.0 $0.82 Total $2.53B $1.27B 1 Loss estimates limited to this tranche, all other Citrus bonds have paid out Source: Artemis, Intralinks Indicates Estimate $20.0 $1.74B $294.2 $239.0 $204.4 $46.7 As of September 21, 2018

- 9. Aon Securities Inc. 9 3. Case Study: FONDEN 2017 Notes Recovery

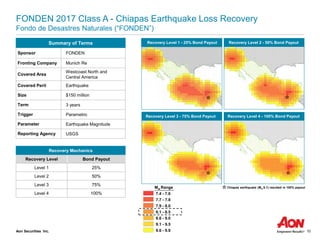

- 10. Aon Securities Inc. 10 Recovery Mechanics Recovery Level Bond Payout Level 1 25% Level 2 50% Level 3 75% Level 4 100% Summary of Terms Sponsor FONDEN Fronting Company Munich Re Covered Area Westcoast North and Central America Covered Peril Earthquake Size $150 million Term 3 years Trigger Parametric Parameter Earthquake Magnitude Reporting Agency USGS FONDEN 2017 Class A - Chiapas Earthquake Loss Recovery Fondo de Desastres Naturales (“FONDEN”) Recovery Level 1 - 25% Bond Payout Recovery Level 2 - 50% Bond Payout Recovery Level 3 - 75% Bond Payout Recovery Level 4 - 100% Bond Payout 7.4 - 7.6 7.7 - 7.8 7.9 - 8.0 8.1 - 8.5 8.6 - 9.0 9.1 - 9.5 9.6 - 9.9 Mw Range Chiapas earthquake (Mw 8.1) resulted in 100% payout

- 11. Aon Securities Inc. 11 7.4 - 7.6 7.7 - 7.8 7.9 - 8.0 8.1 - 8.5 8.6 - 9.0 9.1 - 9.5 9.6 - 9.9 Recovery Level 4 - 100% Bond Payout FONDEN 2017 Class A - Chiapas Earthquake Loss Recovery Fondo de Desastres Naturales (“FONDEN”) Chiapas 0km 200km100km Mw Range Event Description Event Chiapas Earthquake Occurrence Date September 8, 2017 Event Magnitude 8.1Mw Reporting Agency USGS Economic Losses ~ Over $2 billion Insured Losses $1 billion See details of selected area to the right Detailed Earthquake Box - Recovery Level 4 (100% Bond Payout) Chiapas

- 12. Aon Securities Inc. 12 4. Case Study: Pacific Alliance Earthquake Catastrophe Bond

- 13. Aon Securities Inc. 13 Pacific Alliance Earthquake Catastrophe Bond Joint Multi-Country Floating Rate Earthquake-Linked CAR Notes Summary of Terms Issuer International Bank for Reconstruction and Development (“IBRD”) The Insureds Republic of Chile, Republic of Colombia, FONDEN (Mexico) and the Republic of Peru Trigger Parametric, per occurrence Covered Events Earthquake Events Earthquake Event Condition Earthquake Location Condition, Depth Condition and Minimum Magnitude Condition Primary Earthquake Reporting Agency United States Geological Survey (“USGS”) Event Calculation Agent AIR Worldwide Corporation (“AIR”) Earthquake Payout Steps Chile 30%, 70%, 100%; with linear interpolation between the steps (starting from 30%) Colombia 25%, 50%, 100%; with linear interpolation between the steps (starting from 25%) Mexico 50%, 100%; with linear interpolation between the steps (starting from 50%) Peru 30%, 70%, 100%; with linear interpolation between the steps (starting from 30%) Entire Risk Period Chile, Colombia, Peru February 8, 2018 to and including February 7, 2021 Mexico February 8, 2018 to and including February 7, 2020 1 Probabilities are Year 1 risk statistics as modeled by AIR Chile Earthquake Notes Colombia Earthquake Notes Class A Mexico Earthquake Notes Class B Mexico Earthquake Notes Peru Earthquake Notes Issuance Size $500M $400M $160M $100M $200M Attachment Probability1 1.35% 2.78% 1.09% 8.25% 7.14% Expected Loss1 0.86% 1.56% 0.79% 6.54% 5.00% Exhaustion Probability1 0.44% 0.79% 0.49% 4.53% 2.86% Interest Spread 2.50% 3.00% 2.50% 8.25% 6.00% Sharpe Ratio 20% 13% 21% 8% 5% Multiple of Expected Loss 2.9x 1.9x 3.2x 1.3x 1.2x The $1.36 billion Joint Multi-Country Floating Rate Earthquake-Linked Capital at Risk (“CAR”) Notes provide parametric coverage for each member country of the Pacific Alliance The issuance marks the second largest catastrophe bond on record, and represents the largest sovereign risk transfer in the history of the insurance-linked securities sector

- 14. Aon Securities Inc. 14 30% Earthquake Payout Rate – Depth Range (>0km to ≤200km) or Depth Range (>0km to ≤25km) 70% Earthquake Payout Rate – Depth Range (>0km to ≤200km) or Depth Range (>0km to ≤25km) 100% Earthquake Payout Rate – Depth Range (>0km to ≤200km) or Depth Range (>0km to ≤25km) Recovery Mechanics Earthquake Payout Amount Earthquake Payout Rate Mw: ≥ Min Mw 1, < Mw 2 Mw: ≥ Min Mw 2, < Mw 3 Mw: ≥ Mw 3 Earthquake Payout Amount Earthquake Payout Rate Aggregate Nominal Amount═ × 30% 40% ×+ (Mw – Min Mw1) ÷ (Min Mw2 – Min Mw1) 100% 70% 30% ×+ (Mw – Min Mw2) ÷ (Min Mw3 – Min Mw2) Pacific Alliance Earthquake Catastrophe Bond Covered Area and Payout Steps - Chile Earthquake Notes Example The bond’s parametric trigger is based on the US Geological Survey data Each individual box captured by the Chile Earthquake Notes’ Covered Area contains unique parameters, dictating potential recovery Minimum magnitude thresholds and depth conditions correspond with a range of payout amounts, set at 30%, 70% or 100% 2 Depth Range (>25km to ≤200km) Depth Range (>25km to ≤200km) Depth Range (>25km to ≤200km)

- 15. Aon Securities Inc. 15 6. Case Study: US FEMA, NFIP Catastrophe Bond FloodSmart Re Ltd Series 2018-1 Notes

- 16. Aon Securities Inc. 16 1 Based on KatRisk’s long term rates analysis 2 Parenthetical figures represent KatRisk’s utilization of Sea Surface Temperature (“SST”) conditioning for tropical cyclone tracks FloodSmart Re Ltd. Series 2018-1 Notes Transaction Summary Summary of Terms Issuer FloodSmart Re Ltd. Reinsured Federal Emergency Management Agency (“FEMA”), a component of the U.S. Department of Homeland Security (“DHS”), and the program it administers, the National Flood Insurance Program (“NFIP”) Ceding Reinsurer Hannover Re (Ireland) DAC Modeling Firm KatRisk LLC (“KatRisk”) Trigger Indemnity; per occurrence Covered Event Any Flood Event that has resulted in an Ultimate Net Loss to the Subject Business in the Covered Area as determined by the Reinsured Flood Event Any Flood resulting, directly or indirectly, from a Named Storm whose Named Storm Duration commences during the Risk Period that causes flood losses to the Subject Business during the period of 504 consecutive hours following the Date of Loss of the relevant Flood Covered Area The fifty (50) states of the United States of America, the District of Columbia, Puerto Rico and the U.S. Virgin Islands Risk Period August 1, 2018 Atlantic Standard Time – July 31, 2021 Hawaii-Aleutian Time Permitted Investments U.S. Treasury Money Market Funds Aon Securities Inc. (including its affiliates, “Aon”) is providing this document for general informational purposes only and Aon makes no representation or warranty of any kind. This document is strictly confidential. The recipient not shall disclose any portion hereof without the express written consent of Aon, and in no event shall this document be disclosed without the full cover letter or email with which it was originally delivered. Class A B Issuance Size (millions) $325 $175 Attachment Level (millions) $7,500 $5,000 Exhaustion Level (millions) $10,000 $10,000 Attachment Probability1 6.04% 9.68% Expected Loss1,2 4.94% (5.29%) 6.32% (6.80%) Exhaustion Probability1 4.03% 4.08% Interest Spread 11.25% 13.50% Sharpe Ratio 31% 32% Multiple of Expected Loss 2.3x 2.2x

- 17. Aon Securities Inc. 17 FloodSmart Re Ltd. 2018-1 Transaction Structure Investment Yield + Risk Interest Spread InvestorsNote Proceeds U.S.Transformer Reinsurer FEMA & NFIP (Reinsured) Reinsurance Agreements Reinsurance Premium FloodSmart Re Ltd. (Issuer) Outstanding Principal Amount at Redemption Note Proceeds Investment Yield Loss Payment Hannover Re (Ireland) DAC (Ceding Reinsurer) Retrocession Agreements Retrocession Premium Note Payment Accounts Ceding Reinsurer Reinsurance Trust Accounts U. S. Based Reinsured Reinsurance Trust Accounts 2018 ILS Transaction Process ▪ Hannover Re (Ireland) DAC was engaged to act as the Ceding Reinsurer (i.e. Transformer Reinsurer) for FloodSmart Re Ltd. 2018-1 ▪ A Bermuda-based special purpose insurer named FloodSmart Re Ltd. (i.e. the Issuer) was created to issue Notes to investors ▪ Proceeds from the sale of the Notes were initially deposited into separate Ceding Reinsurer Reinsurance Trust Accounts, and then immediately transferred to separate U.S.-based Reinsured Reinsurance Trust Accounts and invested in Permitted Investments (i.e. US MMF) ▪ Funds held in the Reinsured Reinsurance Trust Accounts are available to satisfy any obligations of the Ceding Reinsurer to the Reinsured under the related Reinsurance Agreements ▪ The Issuer’s obligations to the Ceding Reinsurer under the Retrocession Agreements are deemed satisfied upon satisfaction of such obligation of the Ceding Reinsurer to the Reinsured under the relevant Reinsurance Agreements Transformer Reinsurer

- 18. Aon Securities Inc. 18 Appendix: Aon Securities Overview

- 19. Aon Securities Inc. 19 Aon Securities: Global overview Helping clients manage complex commercial issues by providing strategic advice, raising capital and managing risk Aon Benfield Inc. (“Aon Benfield"), Aon Securities, Inc. ("ASI") and Aon Securities Limited ("ASL" and, together with ASI, "Aon Securities") are all wholly-owned subsidiaries of Aon plc. Aon Benfield, including its Aon Benfield Analytics division, provides reinsurance brokerage and consulting services. Securities advice, products and services are offered solely through ASI and ASL. Investment Banking Group Strategic advice Raising capital Managing risk ▪ M&A Buy / sell side / MBO ▪ JV structuring ▪ Divestitures ▪ Restructuring ▪ Debt Advisory ▪ Start-ups ▪ Private Equity Advisory ▪ Private placements ▪ Fund structuring ▪ ILS Funds ▪ Start-ups ▪ Sidecars ▪ JVs Cat bond ▪ Structuring ▪ Distribution Sidecars ▪ Structuring ▪ Distribution ▪ ILS secondary trading ▪ INCR ▪ Collateralised reinsurance ▪ Cat swaps An integrated securities and corporate finance platform, with access to an unparalleled network of global reinsurance brokers, modellers, actuaries and technical specialists Chicago London New York Tokyo Hong Kong Aon Benfield Offices Aon Securities Offices A leading capital and strategic advisor with global coverage bringing together 100 years of specialist experience

- 20. Aon Securities Inc. 20 ▪ Leading ILS bank, with over $33.84 billion in cumulative new issuances since 2007 ▪ Consistently ranked in top 3 investment banks in ILS issuance in last 5 years, number 1 in 2011, 2013, 2014, 2016, 2017 and 2018YTD ▪ Team has over 115 years combined ILS experience ▪ Brought 53 different sponsors to market, representing almost half of all sponsors ▪ Specialize in bringing new sponsors to market, including 31 to date ▪ Bank of choice for many repeat sponsors, with 78 such transactions since 2009 ▪ Dedicated resources to support sponsor throughout life of cat bond ▪ Innovator in structuring, collateral solutions and placement of bonds Rank Investment Bank Notional Amount ($ millions) Deal Count % of Total Notional % of Total Deals 2007–2018YTD 1. Aon Securities 33,840.7 107 43% 34% 2. Goldman, Sachs & Co 21,476.5 82 27% 26% 3. Swiss Re Capital Markets 20,235.0 74 26% 24% 4. GC Securities 19,504.6 77 25% 25% 5. Deutsche Bank 9,813.9 37 12% 12% 2018 1. Aon Securities 5,535.0 11 60% 42% 2. Swiss Re Capital Markets 2,960.0 6 32% 23% 3. GC Securities 2,924.0 11 32% 42% 4. Goldman, Sachs & Co. 1,950.0 5 21% 19% 5. Citibank N.A. 1,610.0 2 18% 8% 2017 1. Aon Securities 6,076.0 16 57% 46% 2. GC Securities 3,287.0 11 31% 31% 3. Swiss Re Capital Markets 2,865.0 7 27% 23% 4. Goldman, Sachs & Co. 1,985.0 7 19% 20% 5. Munich Re 1,626.0 6 15% 17% 2016 1. Aon Securities 2,760.0 7 48% 33% 2. GC Securities 2,430.0 9 42% 43% 3. Swiss Re Capital Markets 1,325.0 5 23% 24% 4. Goldman, Sachs & Co. 1,150.0 4 20% 19% 5. BNP Paribas 1,000.0 4 17% 19% 2015 1. GC Securities 2,425.0 9 35% 33% 2. Aon Securities 2,278.9 7 33% 26% 3. Swiss Re Capital Markets 1,234.9 6 18% 22% 4. Deutsche Bank Securities 1,025.0 6 15% 22% 5. Goldman, Sachs & Co. 1,000.0 5 15% 19% As of September 21, 2018 Aon Securities is the Market Leading ILS Bank

- 21. Aon Securities Inc. 21 May 2014 Placement Agent Surplus Notes $70,000,000 $125,000,000 Joint-Structuring Agent July 2013 Joint-Bookrunner $300,000,000 Long Point Re III Ltd. Series 2015-1 Variable Rate Notes Co-Manager May 2015 $375,000,000 Sanders Re Ltd. Series 2017-1 Variable Rate Notes Joint-Bookrunner Sole-Structuring Agent March 2017 West Bend Mutual Insurance Company Tradewynd Re Ltd. Series 2013-1 Variable Rate Notes As of September 21, 2018 Aon Securities’ Selected Transactions Sole Placement Agent Sole-Structuring Agent July 2015 $150,000,000 December 2014 December 2014 December 2014 November 2014 May 2014 May 2014 May 2014 $375,000,000 Nakama Re Ltd. Series 2014-2 Variable Rate Notes Sole-Bookrunner Sole-Structuring Agent December 2014 Joint-Structuring Agent Sole-Bookrunner Sole Placement Agent Sole-Bookrunner Joint-Bookrunner Sole-Bookrunner Joint-Bookrunner Sole-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent Joint-Structuring Agent Sole-Structuring Agent Joint-Structuring Agent Sanders Re Ltd. Nakama Re Ltd. Series 2014-2 Series 2014-1 Tradewynd Re Ltd. Tramline Re II Ltd. Silverton Re Ltd. Series 2014-1 Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes $500,000,000 $200,000,000 $85,000,000 $500,000,000 $200,000,000 $300,000,000 $750,000,000$300,000,000 ¥35,000,000,000 Merna Re Ltd. Kizuna Re II Ltd. Series 2015-1 Series 2015-1 Variable Rate Notes Variable Rate Notes Variable Rate Notes Sole-Bookrunner Sole-Structuring Agent Joint-Bookrunner Sole-Structuring Agent Sole-Placement Agent July 2015 March 2015 March 2015 €285,000,000 Benu Capital Limited ZENKYOREN Atlas IX Capital Limited ZENKYOREN Kilimanjaro Re Limited Sanders Re Ltd. Series 2014-1 $300,000,000 $125,000,000 $300,000,000 $625,000,000 Blue Halo Re Ltd. Merna Re Ltd. Nakama Re Ltd. Kilimanjaro Re Limited Series 2016-1 Series 2016-1 Series 2015-1 Series 2015-1 Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes Sole-Bookrunner Sole-Bookrunner Joint-Bookrunner Sole Placement Agent Sole-Bookrunner Sole-Bookrunner Sole-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent June 2016 March 2016 January 2016 December 2015 December 2015 December 2015 $225,000,000 Blue Halo Re Ltd. Series 2016-2 Variable Rate Notes Sole-Bookrunner Sole-Structuring Agent July 2016 Nakama Re Ltd. $700,000,000 September 2016 Sole-Structuring Agent Sole-Bookrunner Variable Rate Notes Series 2016-1 $185,000,000 Sole-Structuring Agent Sole-Structuring Agent $300,000,000$125,000,000 Citrus Re Ltd. $525,000,000 $750,000,000 Series 2017-1 Galilei Re Ltd. Galilei Re Ltd. Variable Rate Notes Series 2017-1 Series 2016-1 Sole-Bookrunner Variable Rate Notes Variable Rate Notes Sole-Structuring Agent Joint-Bookrunner Joint-Bookrunner March 2017 January 2017 December 2016 ZENKYOREN ZENKYOREN Atlas IX Capital DAC Silverton Re Ltd.Series 2016-1Series 2016-1 $300,000,000 Caelus Re IV Limited Variable Rate Notes Joint-Bookrunner Joint-Structuring Agent April 2016 Caelus Re 2013 Limited New Point V Limited Eurus III Ltd.Series 2013-1 $320,000,000 $75,000,000 $400,000,000 $247,000,000 $228,000,000 Common Shares Sole-Bookrunner Sole Bookrunner Sole-Structuring Agent July 2013 March 2013 March 2013 December 2012 June & December 2012 November 2012 September 2012 Advisor $350,000,000 $300,000,000 €100,000,000 Lead Structurer Variable Rate Notes Variable Rate Notes Common Shares Variable Rate Notes Variable Rate Notes Variable Rate Notes Joint-Bookrunner Joint-Bookrunner Joint-Bookrunner Joint-Bookrunner May 2013 July 2013 Variable Rate Notes Variable Rate Notes Ibis Re II Ltd. Pelican Re Ltd. $185,000,000 $140,000,000 Joint-Bookrunner Sole-Bookrunner Lead-Structuring Agent Sole-Structuring Agent June 2013 May 2013 Series 2013-1 Series 2013-1 $270,000,000 Atlas Re VII Limited Sanders Re Ltd. Caelus Re 2013 Limited Merna Re IV Ltd. Lorenz Re Ltd. Series 2013-1 Series 2013-2 Compass Re Ltd. Series 2012-1 Advisor Joint-Structuring Agent Joint-Structuring Agent Joint-Structuring Agent Sole Structuring Agent Sole-Structuring Agent Joint Bookrunner Variable Rate Notes Variable Rate Notes Mona Lisa Re Ltd. $150,000,000 Joint-Structuring Agent July 2013 Series 2013-2 Joint-Bookrunner Variable Rate Notes Kizuna Re II Ltd. VenTerra Re Ltd. Series 2014-1 Series 2013-1 July 2014 March 2014 March 2014 Sole-Bookrunner Sole-Bookrunner Joint-Bookrunner Sole-Structuring Agent Sole-Structuring Agent Joint-Structuring Agent Merna Re V Ltd. Riverfront Re Ltd. Variable Rate Notes Variable Rate Notes Variable Rate Notes $450,000,000 $300,000,000 $95,000,000 $180,000,000 Sole Structuring Agent Sole Bookrunner Sole Placement Agent Sole Placement Agent Sole-Bookrunner Sole-Bookrunner Atlas IX Capital Limited Northshore Re Limited Series 2013-1 $245,000,000 $250,000,000 $55,500,000 $65,000,000 €350,000,000 $300,000,000 $200,000,000 Sole Placement Agent Joint-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent Joint-Bookrunner Sole-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent March 2014 December 2013 December 2013 December 2013 December 2913 September 2013 September 2013 August 2013 Variable Rate NotesVariable Rate Notes Joint-Bookrunner Kilimanjaro Re Limited Atlas X Capital Limited ZENKYOREN Silverton Re Ltd. Calypso Capital II Limited Nakama Re Ltd. Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes €40,000,000 December 2013 Windmill Re I Ltd. Series 2013-1 Variable Rate Notes Sole Placement Agent Sole-Structuring Agent Variable Rate Notes Variable Rate Notes $400,000,000 Tailwind Re Ltd. Series 2017-1 November 2017 Variable Rate Notes Sole-Bookrunner Sole-Structuring Agent Variable Rate Notes Joint- Structuring Agent Joint-Bookrunner February 2018 $1,360,000,000 CAR 116,117,118,119,120 $700,000,000 Nakama Re Ltd. Series 2018-1 Sole-Bookrunner Sole-Structuring Agent March 2018 ZENKYOREN Kizuna Re Ltd. $200,000,000 Variable Rate Notes Sole Structuring Agent Sole Placement Agent March 2018 Sole-Bookrunner Sole-Structuring Agent Variable Rate Notes $500,000,000 Sanders Re Limited March 2018March 2018 Sole-Bookrunner Sole-Structuring Agent Merna Re V Ltd. $300,000,000 Variable Rate Notes $500,000,000 Series 2018-1 July 2018 Joint Bookrunner FloodSmart Re Ltd. $500,000,000 Series 2018-1 Joint-Bookrunner May 2018 Long Point Re III Ltd. Variable Rate Notes Series 2018-1 $450,000,000 Caelus Re IV Limited Variable Rate Notes Joint-Bookrunner Joint-Structuring Agent May 2018 $262,500,000 Kilimanjaro Re Limited Series 2018-1 Sole-Bookrunner Sole-Structuring Agent April 2018 Variable Rate Notes $262,500,000 Kilimanjaro Re Limited Series 2018-2 Sole-Bookrunner Sole-Structuring Agent April 2018 Variable Rate Notes $250,000,000 Series 2018-1 May 2018 Sole-Bookrunner Sole-Structuring Agent Bowline Re Ltd. Variable Rate Notes €40,000,000 June 2017 Joint-Bookrunner Sole-Bookrunner May 2017 May 2017 $189,000,000 $35,000,000 $375,000,000 $950,000,000 $300,000,000 $300,000,000 Riverfront Re Ltd. Citrus Re Ltd. Caelus Re V Limited Kilimanjaro II Re Limited Kilimanjaro II Re Limited Merna Re Ltd. Series 2017-1 Series 2017-2 Series 2017-1 Series 2017-1 Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes Variable Rate Notes Joint-Bookrunner Sole-Bookrunner Sole-Bookrunner Sole-Bookrunner Joint-Structuring Agent Sole-Structuring Agent Joint-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent Sole-Structuring Agent May 2017 July 2017 July 2017 March 2017 $430,000,000 $200,000,000 Spectrum Capital Ltd. Sanders Re Ltd. Series 2017-1 Series 2017-2 Variable Rate Notes Variable Rate Notes Sole-Bookrunner Joint-Bookrunner Sole-Structuring Agent Sole-Structuring Agent June 2017 May 2017 Windmill Re I Ltd. Series 2017-1 Variable Rate Notes Sole Placement Agent Sole-Structuring Agent Sole-Bookrunner Northshore Re Limited Series 2017-1 $350,000,000 Sole-Structuring Agent July 2017 Variable Rate Notes $150,000,000 Galileo Re Ltd. Series 2017-1 Variable Rate Notes Joint-Bookrunner November 2017 $925,000,000 Ursa Re Ltd. Series 2017-1 Variable Rate Notes Joint-Bookrunner May 2017 $400,000,000 Ursa Re Ltd. Series 2017-1 Variable Rate Notes Joint-Bookrunner November 2017 $250,000,000 Ursa Re Ltd. Series 2018-1 Joint-Bookrunner November 2017 Variable Rate Notes

- 22. Aon Securities Inc. 22 Disclaimer This document or presentation and all of its contents (collectively, the “Document”) were intended for general informational purposes only. This Document is intended only for the designated recipient to whom it was originally delivered by Aon Securities Inc., Aon Securities Limited or its affiliates (collectively, “Aon”) and any other recipient to whose delivery Aon consents in writing (each, a “Recipient”). This Document is strictly confidential and no Recipient shall reproduce this Document (in whole or part) or disclose, provide or make available this Document, or any portion or summary hereof, to any third party without the express written consent of Aon. This Document is made available on an “as is” basis, and Aon makes no representation or warranty of any kind (whether express or implied), including without limitation in respect of the accuracy, completeness, timeliness, or sufficiency of the Document. This Document is not intended, nor shall it be considered, construed or deemed, as (1) an offer to sell or a solicitation of an offer to buy any security or any other financial product or asset, (2) an offer, solicitation, confirmation or any other basis to engage or effect in any transaction or contract (in respect of a security, financial product or otherwise), or (3) a statement of fact, advice or opinion by Aon or its directors, officers, employees, or representatives (collectively, the “Representatives”). Any potential transaction will be made or entered into only through definitive agreements and such other documentation as may be necessary, including, as applicable, any disclosure or offering materials provided by Aon Securities Inc. or its appropriately licensed affiliate(s). No representation, warranty or guarantee is made that any transaction can be effected at the values provided or assumed in this Document (or any values similar thereto) or that any transaction would result in the structures or outcomes provided or assumed in this Document (or any structures or outcomes similar thereto). Actual results may differ substantially from those indicated or assumed in this Document. Aon and its Representatives shall have no liability to any party for any claim, loss, damage or liability in any way arising from or relating to the use or review of this Document (including without limitation any actions or inactions, reliance or decisions based upon this Document), any errors in or omissions from this Document, or otherwise in connection with this Document. Aon does not provide and this Document does not constitute any form of legal, accounting, taxation, regulatory, or actuarial advice.