Earnings Presentation - 4Q15 and 2015

- 1. 4Q15 Results Conference Call February 26th, 2016 – 11:00 am (BrT) 9:00 am (NY)/ 2:00 pm (London)

- 2. 4Q15 and 2015 Results DISCLAIMER This presentation contains forward-looking statements regarding the prospects of the business, estimates for operating and financial results, and those regarding Cia. Hering'sgrowth prospects. These are merely projections and, as such, are based exclusively on the expectations of Cia. Hering management concerning the future of the business and its continued access to capital to fund the Company’s business Plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors and risks disclosed in Cia. Hering’sfiled disclosure documents and are, therefore, subject to change without prior notice. • Financial Performance • SAP Implementation • Outlook • Q&A

- 3. FINANCIAL PERFORMANCE GROSS REVENUES AND BREAKDOWN BY BRAND R$ MILLION 4Q15 4Q14 Change 2015 2014 Change 595.4 603.9 -1.4% 1,857.3 1,976.0 -6.0% 475.4 475.0 0.1% 1,415.0 1,482.6 -4.6% 58.4 57.1 2.3% 204.8 213.3 -4.0% 35.9 40.9 -12.4% 130.2 155.8 -16.5% 17.4 25.6 -31.8% 82.4 99.5 -17.2% 12.5 8.1 53.0% 42.8 35.1 22.2% International Markets GROSS REVENUES BREAKDOWN PER CHANNEL DOMESTIC MARKET EX -OTHER REVENUES 2015, R$ MILLION – CHANGE 2015 X 2014 Gross revenues of R$ 1.9 billion, influenced by the negative effects of macroeconomic scenario and greater conservatism of distribution channels.

- 4. HERING STORE NETWORK GROSS SALES SELL-OUT, R$ MILLION Gross revenues of R$ 1,577.5 million (- 0.3%), affected by challenging consumer environment, partially offset by the opening of 13 stores in the year ¹ Stores opened in the last twelve months net from closings.

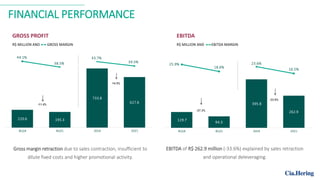

- 5. FINANCIAL PERFORMANCE EBITDA of R$ 262.9 million (-33.6%) explained by sales retraction and operational deleveraging. Gross margin retraction due to sales contraction, insufficient to dilute fixed costs and higher promotional activity. GROSS PROFIT R$ MILLION AND GROSS MARGIN EBITDA R$ MILLION AND EBITDA MARGIN

- 6. FINANCIAL PERFORMANCE NET INCOME R$ MILLION AND NET MARGIN CAPEX R$ MILLION Operating income decline was partially offset by higher financial income and lower income tax. Inauguration of São Luis de Montes Belos plant (Goiás State), and implementation of SAP system. In stores, investments were mainly to the opening of 2 DZARM. stores, after its business plan reformulation.

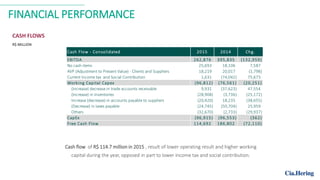

- 7. FINANCIAL PERFORMANCE Cash flow of R$ 114.7 million in 2015 , result of lower operating result and higher working capital during the year, opposed in part to lower income tax and social contribution. CASH FLOWS R$ MILLION Cash Flow - Consolidated 2015 2014 Chg. EBITDA 262,876 395,835 (132,959) No cash items 25,693 18,106 7,587 AVP (Adjustment to Present Value) - Clients and Suppliers 18,219 20,017 (1,798) Current Income tax and Social Contribution 1,631 (74,042) 75,673 Working Capital Capex (96,812) (76,561) (20,251) (Increase) decrease in trade accounts receivable 9,931 (37,623) 47,554 (Increase) in inventories (28,908) (3,736) (25,172) Increase (decrease) in accounts payable to suppliers (20,420) 18,235 (38,655) (Decrease) in taxes payable (24,745) (50,704) 25,959 Others (32,670) (2,733) (29,937) CapEx (96,915) (96,553) (362) Free Cash Flow 114,692 186,802 (72,110)

- 8. FINANCIAL PERFORMANCE Cash generation converted into shareholder’s return. Payout of 47% in 2015. SHAREHOLDER’S RETURN R$ MILLION

- 9. SAP IMPLEMENTATION Implementation schedule foresees project closure in March/16 ‘Go-Live’ with assisted operation during the month Operation normalization, but still monitored by the project team Project closure, with operations conducted by the company normally Jan Mar Feb 53

- 10. PERSPECTIVAS Economic environment remains challenging in 2016 Priorities for 2016: actions to revamp sales growth by improving Products supply and Shop experience (P&S) Aggressive refurbishment plan at Hering Store Network Balance Sheet and Earnings protection - CapEx reduction, expenses control and reduction in collection leftovers.

- 11. Fabio Hering – CEO Frederico Oldani – CFO and IRO Bruno Salem Brasil – IR Manager Caroline Luccarini – IR Analyst www.ciahering.com.br/ir +55 (11) 3371 – 4867/4805 ri@hering.com.br INVESTOR RELATIONS TEAM