el paso 092805Hopper_Deutsche

- 1. John Hopper Vice President, Treasurer Deutsche Bank High Yield Conference September 28, 2005 the place to work the neighbor to have the company to own

- 2. Cautionary Statement Regarding Forward-looking Statements This presentation includes forward-looking statements and projections, made in reliance on the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The company has made every reasonable effort to ensure that the information and assumptions on which these statements and projections are based are current, reasonable, and complete. However, a variety of factors could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this presentation, including, without limitation, our ability to implement and achieve our objectives in the long- range plan, including achieving our debt-reduction targets; our ability to obtain necessary governmental approvals for proposed pipeline projects and our ability to successfully construct and operate such projects; our ability to meet production volume targets in our Production segment; uncertainties associated with exploration and production activities; our ability to successfully execute, manage, and integrate acquisitions; our ability to close our announced asset sales on a timely basis; changes in commodity prices for oil, natural gas, and power; general economic and weather conditions in geographic regions or markets served by the company and its affiliates, or where operations of the company and its affiliates are located; the uncertainties associated with governmental regulation; political and currency risks associated with international operations of the company and its affiliates; competition; and other factors described in the company’s (and its affiliates’) Securities and Exchange Commission filings. While the company makes these statements and projections in good faith, neither the company nor its management can guarantee that anticipated future results will be achieved. Reference must be made to those filings for additional important factors that may affect actual results. The company assumes no obligation to publicly update or revise any forward-looking statements made herein or any other forward-looking statements made by the company, whether as a result of new information, future events, or otherwise. 2

- 3. Our Purpose El Paso Corporation provides natural gas and related energy products in a safe, efficient, and dependable manner 3

- 4. El Paso Overview Premier natural gas pipeline franchise ► One of largest independent producers ► – Turnaround almost complete Significant leverage to favorable commodity ► fundamentals Excellent progress on asset sales/debt ► reduction 4

- 5. Significant Progress in Turnaround December 2003 Current Liquidity Stressed Strong ► ► ► Net debt $20.5 billion $15.9 billion* ► ► ► Asset sales Long-Range Plan (LRP) goal: $4.3 billion sold under LRP ► ► ► $3.3 billion–$3.9 billion Incremental goal: $1.4 billion announced or ► ► $1.2 billion–$1.6 billion closed Pipes, E&P, marketing & Pipes, E&P, marketing (out of ► ► Range of businesses ► trading, petroleum, chemical, or exiting all other) domestic & international power, midstream, others Large corporate center Small corporate center—push ► ► Corporate structure ► functions to businesses 5 divisions ► 2 divisions ► *As of June 30, 2005 5

- 6. U.S. Natural Gas Market Macro Overview Consumption & Supply in Tcf Demand Growth Domestic ► Gas consumption in the 2004–2014 35 supply power sector will grow 30 substantially +5.0 Tcf 25 – 200 GWs of gas-fired Power Generation generating capacity built 20 since 2000 +1.0 Tcf Industrial ► Domestic supply grows 15 slowly +0.4 Tcf Commercial 10 ► More than $20 billion in +0.7 Tcf Residential 5 infrastructure required Other +0.3 Tcf over next 5 Years 0 2002 2004 2006 2008 2010 2012 2014 Source: CERA and FERC 6

- 8. Leading Natural Gas Infrastructure Key Statistics ► 58,000 miles ► 1/3 of daily U.S. throughput ► 40% of U.S. growth capital in 2005* Distinguishing Features ► Unmatched connectivity Elba ► Superior market presence Island ► Favorable recontracting position ► Outstanding growth potential *Source: Energy Information Association 8

- 9. Connectivity Strength: Market Catoosa Co. Ringgold 75 SNG delivery 75 SNG delivery 49 SNG delivery points to 49 SNG delivery Calhoun points to points to Chatsworth Alagasco points to Alagasco AGL Rome AGL Gadsden Cedartown/ Marietta Lincoln Rockmart Dallas Jasper Ben Hill Oakman Pell City Augusta Carrolton Anniston Warrenton Birmingham South Atlanta Yates Talladega Blythe Newnan Oak Grove Reform Bass Junction Intensive Tuscaloosa Sandersville Thomaston Greene Co. Centerville Macon Opelika Danville S. Thomaston Phenix City Eclectic Dexter Connections Springfield/ Demopolis Laurens County Guyton (South) Tuskegee Savannah Selma Uniontown Montgomery Citygates ► Plants ► SNG SNG Delivery Points/Areas 9

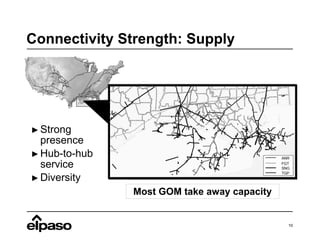

- 10. Connectivity Strength: Supply ► Strong presence ► Hub-to-hub ANR service FGT SNG TGP ► Diversity Most GOM take away capacity 10

- 11. El Paso’s Pipelines Unmatched for Growth Projects Why is this good? Superior presence ► – Market – Supply basins Growth Capital Commitment* $586 MM 2004 ► + $450 MM 2005 ► ± $450 MM 2006–2008 ► *In addition to ± $450 MM/year maintenance capex 11

- 13. Early Culture Shifts/Focus Items Old New Basin dominance Best in basin ► ► Inadequate pre-investment Consistent and disciplined risk ► ► analysis and reserve determination Poor portfolio management Comprehensive mapping with ► ► life-of-property exploitation plans Deep exploration emphasis Capital allocation to full risk ► ► spectrum Production growth through Short-term focus on existing ► ► capex properties and base production. Long-term emphasis on value creation 13

- 14. El Paso Production Well Positioned in Key U.S. Natural Gas Basins 14

- 15. Production Company Overview Average Daily Production1 (MMcfe/d) Production stabilized ► 860–9002 901 810+2 814 Creating value at ► 70 Equity 24 Equity $4.75/MMBtu GOM, Onshore, and ► Brazil performing well Texas Gulf Coast ► developing low-risk inventory 1Q 2004 2004 2005E 2005 Exit 1Includes volumes attributable to Four Star equity 2Assumes no effects from Hurricane Katrina 15

- 16. Dramatic Shift Towards Onshore Production Key takeaways ► Onshore production almost doubles as percentage of total International ► Business more predictable 8% ► R/P goes from 6.2 to 7.4 Onshore 25% GOM GOM Onshore How was this accomplished? 25% 41% 47% TX Gulf ► Shifted capital towards Onshore TX Gulf Coast mid-2004 Coast 34% 20% ► Successful drilling program ► Medicine Bow accelerates 1Q 2004 2005E Exit process – 80% proved reserves in core Onshore areas 16

- 17. Texas Gulf Coast Turnaround Well Underway Problems Response Focused on deep, New management ► ► expensive wells Changed risk profile ► Generally 100% working ► Success measured by ► interest PVR Success defined by high ► Building inventory of ► flow rates low-risk prospects Wheels came off in 2003 ► Leveraging large ► acreage position Situation analogous to successful GOM turnaround 17

- 18. Creating More Value in Shallower Objectives Historical focus was ► Frio lower Vicksburg ► Well cost: $1.3 MM ► Reserves: 1.1 Bcfe ► F&D costs: ≈ $1.18 Mcfe Multi-pay ► environment offers 8,500' Upper Vicksburg attractive, shallower ► Well cost: $1.7 MM ► Reserves: 2.0 Bcfe options ► F&D costs: ≈ $0.85 Mcfe 12,000' PVR increases from ► Lower Vicksburg 1.2 to 2.1 ► Well cost: $7.6 MM ► Reserves: 5.3 Bcfe ► F&D costs: ≈ $1.43 Mcfe 19,000' Note: Estimates based on per Sand Resistivity (HC Indicator) well data for a South Texas well 18

- 19. Good Progress in Texas Gulf Coast Monte Christo Field Hidalgo Early returns very good ► El Paso has ≈ 200,000 net acre ► position to evaluate/leverage Expect solid inventory for ► Operated wells 2006 capital program 2005 wells Jeffress/Samano Field 2006 wells EP leases Initial Capex Production ($ MM) (MMcf/d) Field Formation Hamman Ranch 361 Monte Christo U. Vicksburg $1.0 6.1 Hamman Ranch 471 Monte Christo U. Vicksburg $0.9 9.5 Hamman Ranch 601 Monte Christo L. Vicksburg $2.3 11.0 Salinas M 03 Jeffress L. Vicksburg $2.1 3.4 1.22 Hamman Ranch 71 Monte Christo U. Vicksburg $1.8 Renger 2 Speaks L. Wilcox $5.3 15.0 Saga 1 La Copita U. Vicksburg $3.0 Completing; sets up 3 offsets 1Recompletions 2Testing continuing 19

- 20. Production Company Summary Very confident in completing E&P turnaround ► Program creating value at plan prices ► Business becoming more predictable ► – More onshore production – Longer R/P Strong outlook for 2006 ► 20

- 21. Outlook for 2006

- 22. Substantial Leverage to Natural Gas & Oil Prices Potential 2006 Impact Assumed Gas $5 $6 $7 $8 $9 $10 Price $/MMBtu $2,891 $2,649 $2,377 $10 gas price $2,105 $1,803 $1,953 implies $670 MM incremental cash $ MM Revenue vs. $5 Current Cash Loss from Strip ($90) ($173) Legacy Hedges ($257) ($341) ($424) ($508) Assumptions: 330 Bcfe*; 10% basis differential and oil priced at 6x gas *For illustrative purposes: Will provide 2006 guidance in January; assumes high end of 2005 exit rate 22

- 23. Cost Reductions Continue Greenway lease’s approximately $50 MM annual costs ► ending in 2007 Political risk insurance cost which peaked at more than ► $25 MM per year essentially eliminated with sale of foreign assets D&O insurance annual expense of $29 MM reduced by ► nearly one-half after 2005 Outside legal costs of approximately $55 MM per year ► expected to come down in 2006 and down sharply in 2007 Accounting and audit annual costs of $45 MM to be trimmed ► by one-third after 2005 Trading costs reduce as book continues to shrink ► 23

- 24. Summary El Paso has made rapid progress ► Pipelines performing great; outlook great ► Production turnaround complete by year end ► Shaping up for a great 2006 ► 24

- 25. Appendix

- 26. Production Related Derivative Schedule 2005 2006 2007 2008 2009-2012 Average Average Average Average Average Notional Hedge Average Notional Hedge Average Notional Hedge Notional Hedge Notional Hedge Natural Gas Volume Price Cash Price Volume Price Cash Price Volume Price Volume Price Volume Price (Bcf) ($/MMBtu) ($/MMBtu) (Bcf) ($/MMBtu) ($/MMBtu) (Bcf) ($/MMBtu) (Bcf) ($/MMBtu) (Bcf) ($/MMBtu) Designated Fixed Price - Legacy 1 32.60 $6.79 $3.64 83.7 $6.36 $3.93 4.6 $3.28 4.6 $3.42 16.0 $3.74 Fixed Price 0.50 $5.78 $5.78 1.8 $5.28 $5.28 0.8 $5.23 Economic Fixed Price 6.10 $8.05 $8.05 24.7 $8.11 $8.11 Ceiling 60.0 $9.50 $9.50 21.0 $9.00 18.0 $10.00 16.8 $8.75 Floor 18.00 $6.00 $6.00 120.0 $7.00 $7.00 21.0 $7.00 18.0 $6.00 16.8 $6.00 30.0 $6.00 2005 2006 2007 2008 Average Average Average Average Notional Hedge Average Notional Hedge Average Notional Hedge Notional Hedge Oil Volume Price Cash Price Volume Price Cash Price Volume Price Volume Price (MMBbl) ($/MMBtu) ($/MMBtu) (MMBbl) ($/MMBtu) ($/MMBtu) (MMBbl) ($/MMBtu) (MMBbl) ($/MMBtu) Designated Fixed Price 0.1 $35.15 $35.15 0.4 $35.15 $35.15 0.2 $35.15 Economic Fixed Price 0.2 $59.20 $59.20 1.0 $58.81 $58.81 Ceiling 1.0 $60.38 0.9 $57.03 Floor 1.0 $55.00 0.9 $55.00 See El Paso’s form 10-Q filed 8/5/05 and form 10-K/A filed 6/15/05 for additional information on the company’s derivative activity 1Hedge price and cash price are identical for 2007–2012 Note: As of August 30, 2005 26

- 27. John Hopper Vice President, Treasurer Deutsche Bank High Yield Conference September 28, 2005 the place to work the neighbor to have the company to own