el paso C0A209DE-4313-4A81-8B00-54550DEAC9E8_Barclays_Fixed_Income_032509

- 1. El Paso Corporation Mark Leland Executive Vice President & Chief Financial Officer Barclays 2009 Fixed Income Energy & Pipeline Conference March 25, 2009

- 2. Cautionary Statement Regarding Forward-looking Statements This presentation includes certain forward-looking statements and projections. The company has made every reasonable effort to ensure that the information and assumptions on which these statements and projections are based are current, reasonable, and complete. However, a variety of factors could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this release, including, without limitation, changes in unaudited and/or unreviewed financial information; our ability to meet our 2009 debt maturities; volatility in, and access to, the capital markets; our ability to implement and achieve our objectives in our 2009 plan, including achieving our earnings and cash flow targets; the effects of any changes in accounting rules and guidance; our ability to meet production volume targets in our Exploration and Production segment; our ability to comply with the covenants in our various financing documents; our ability to obtain necessary governmental approvals for proposed pipeline and E&P projects and our ability to successfully construct and operate such projects; the risks associated with recontracting of transportation commitments by our pipelines; regulatory uncertainties associated with pipeline rate cases; actions by the credit rating agencies; the successful close of our financing transactions; our ability to close asset sales, as well as transactions with partners on one or more of our expansion projects that are included in the plan on a timely basis; credit and performance risk of our lenders, trading counterparties, customers, vendors and suppliers ;changes in commodity prices and basis differentials for oil, natural gas, and power; our ability to obtain targeted cost savings in our businesses; inability to realize anticipated synergies and cost savings on a timely basis or at all; general economic and weather conditions in geographic regions or markets served by the company and its affiliates, or where operations of the company and its affiliates are located, including the risk of a global recession and negative impact on natural gas demand; the uncertainties associated with governmental regulation; political and currency risks associated with international operations of the company and its affiliates; competition; and other factors described in the company's (and its affiliates') Securities and Exchange Commission filings. While the company makes these statements and projections in good faith, neither the company nor its management can guarantee that anticipated future results will be achieved. Reference must be made to those filings for additional important factors that may affect actual results. The company assumes no obligation to publicly update or revise any forward-looking statements made herein or any other forward-looking statements made by the company, whether as a result of new information, future events, or otherwise. Certain of the production information in this presentation include the production attributable to El Paso’s 49 percent interest in Four Star Oil & Gas Company (“Four Star”). El Paso’s Supplemental Oil and Gas disclosures, which are included in its Annual Report on Form 10-K, reflect its proportionate share of the proved reserves of Four Star separate from its consolidated proved reserves. In addition, the proved reserves attributable to its proportionate share of Four Star represent estimates prepared by El Paso and not those of Four Star. Cautionary Note to U.S. Investors—The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation that the SEC's guidelines strictly prohibit us from including in filings with the SEC. U.S. Investors are urged to consider closely the disclosures regarding proved reserves in this presentation and the disclosures contained in our Form 10-K for the year ended December 31, 2007, File No. 001-14365, available by writing; Investor Relations, El Paso Corporation, 1001 Louisiana St., Houston, TX 77002. You can also obtain this form from the SEC by calling 1-800-SEC-0330. Non-GAAP Financial Measures This presentation includes certain Non-GAAP financial measures as defined in the SEC’s Regulation G. More information on these Non-GAAP financial measures, including EBIT, EBITDA, and the required reconciliations under Regulation G, are set forth in this presentation or in the appendix hereto. El Paso defines Resource Potential or Resource Inventory as subsurface volumes of oil and natural gas the company believes may be present and eventually recoverable. The company utilizes a net, geologic risk mean to represent this estimated ultimate recoverable amount. 2

- 3. Our Purpose El Paso Corporation provides natural gas and related energy products in a safe, efficient, and dependable manner 3

- 4. Our Vision & Values the place to work the neighbor to have the company to own 4

- 5. Meeting Challenges, Preserving Opportunities Today Longer-Term Raised liquidity to Delivering pipeline $3.3 billion backlog On-time, on-budget Reduced capital thoughtfully Preserving E&P inventory Reviewing capital and financing options Improving credit metrics continuously Manage to commodity price environment Attractive hedges 5

- 6. 2009 Financial Targets $ Billions, Except EPS EPS*: $0.85–$1.05 EBIT* total: $2.0–$2.3 Pipelines: $1.4; E&P: $0.8–$0.9 EBITDA*: $3.1–$3.3 Pipelines: $1.8; E&P: $1.4–$1.6 Cash flow from operations: $1.7–$2.0 Capex: $2.7–$3.1 Pipelines: $1.7; E&P: $0.9–$1.3 Note: 2009 Plan assumes natural gas price of $5.00 per MMBtu (NYMEX) and oil prices of $40.00 per Bbl (WTI) 6 *Excludes MTM changes on hedge derivatives and includes cash proceeds on settlements based on Plan prices

- 7. Recent Significant Financing Activities El Paso Corp. 5-year, $500 MM 12% Notes (15.25% yield) Ended high-yield offering drought El Paso Exploration & Production $300 MM Revolver Secured borrowing base facility (LIBOR + 350 bps) TGP 7-year, $250 MM 8% Notes (9% yield) Investment-grade unsecured notes El Paso Corp. 7-year, $500 MM 8.25% Notes Significant reduction in yield—9.125% After financings, weighted average cost of debt at 7.1% 7

- 8. Substantial Increase in Liquidity $ Billions $3.3 $2.5 $2.2 $1.9 $1.9 $1.2 $1.0 $1.2 $1.4 $1.3 $1.2 $0.7 Sep. 30, Dec. 31, Jan. 31, Feb. 28, 2008 2008 2009 2009 Bank Lines Cash 8

- 9. Liquidity Outlook $ Billions $0.2 $0.9 $1.9 $0.2 $2.7– $1.1 $3.1 $2.2 $1.2– $1.6 E&P Capex 12/31/08 YTD Net OCF Remaining May Dividends Capex YE Financings Asset Maturity & Minority Liquidity & Asset Sales Interest Sales Ample liquidity for 2009 Note: Forecast assumes most of $500 MM LC facility replaced and EPEP $300 MM facility renewed 9

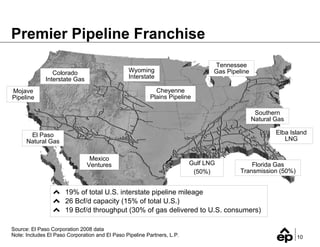

- 10. Premier Pipeline Franchise Tennessee Wyoming Gas Pipeline Colorado Interstate Interstate Gas Cheyenne Mojave Plains Pipeline Pipeline Southern Natural Gas Elba Island El Paso LNG Natural Gas Mexico Gulf LNG Florida Gas Ventures Transmission (50%) (50%) 19% of total U.S. interstate pipeline mileage 26 Bcf/d capacity (15% of total U.S.) 19 Bcf/d throughput (30% of gas delivered to U.S. consumers) Source: El Paso Corporation 2008 data Note: Includes El Paso Corporation and El Paso Pipeline Partners, L.P. 10

- 11. Committed Growth Backlog: Large & Profitable ~$8 billion capex; construct at 7x run rate EBITDA Ruby Pipeline $3 Billion TGP Concord TGP 300 Line Project 2011 $21 MM $750 MM 1.3–1.5 Bcf/d Nov 2009 2011 30 MMcf/d 290 MMcf/d WIC System Expansion $71 MM 2010–2011 Elba Expansion III & Elba 320 MMcf/d Express CIG Totem Storage $1.1 Billion $154 MM (100%) 2010–2014 WIC Piceance Lateral July 2009 8.4 Bcf / 0.9 Bcf/d & 1.2 Bcf/d $62 MM 200 MMcf/d 4Q 2009 220 MMcf/d SNG Cypress Phase III $86 MM 2011 CIG Raton 2010 160 MMcf/d Expansion $146 MM 2Q 2010 SNG South System III/ TGP Carthage 130 MMcf/d SESH Phase II Expansion $352 MM / $69 MM $39 MM 2011–2012 May 2009 Gulf LNG 370 MMcf/d / 350 MMcf/d 100 MMcf/d $1+ Billion (100%) 2011 El Paso Pipeline Partners, LP FGT Phase VIII 6.6 Bcf / 1.3 Bcf/d Expansion $2.4 Billion (100%) El Paso Pipeline 2011 800 MMcf/d Note: As of February 26, 2009; El Paso Pipeline Partners owns 25% of SNG & 40% of CIG 11

- 12. Financing the Pipeline Backlog $ Billions $1.3 $7.8 $1.0 $1.3 $2.4 $1.8 Gulf LNG/ Backlog Spent to Date 2009 Funded Remaining 2010-2013 Expected FGT Capital Ruby Remaining Financing Backlog Backlog expected to generate $1.2 billion of incremental EBITDA* * EBITDA run-rate on proportional basis 12

- 13. Construction Risk Management El Paso Capital ($ Billions) Steel Construction Elba Expansion Fixed-Price EPC Contract $ 1.1 Elba Express Fixed Unit-Priced Gulf LNG (50%) Fixed-Price EPC Contract $ 0.5 Ruby Fixed Incentive-Based $ 3.0 FGT Phase VIII (50%) Fixed Unit-Priced $ 1.2 TGP 300 Line Fixed Negotiating $ 0.8 Backlog has been significantly de-risked 13

- 14. Pipeline Outlook Stability from demand-based revenues Highly focused on execution of project backlog Significant risk mitigation in place Committed to grow El Paso Pipeline Partners $3.0 B NOL offsets potential gains on drop downs Selectively review future opportunities Mitigate potential financing and steel costs 14

- 15. Top 10 Domestic Independent Nile Delta Brazil Egypt Rio de Janeiro Brazil Egypt 2 significant development Onshore conventional projects exploration Additional exploration 1.05 MM net acres potential First drilling January 09 Domestic Low to medium-risk repeatable plays 98% drilling success rate Growing unconventional inventory Note: Based on 2008 data except Egypt acres include January 2009 transaction with RWE 15

- 16. Exploration & Production Significant progress in 2008 595 Bcfe of reserves adds in 20081 195% domestic reserve replacement ratio2 27% inventory growth in 2008 $0.9 B–$1.3 B capital for 2009 Focused on: value creation, inventory preservation, low-risk programs Highly flexible capital plan 725–815 MMcfe/d production3 1Prior to revisions; does not include Four Star 2Prior to price-related revisions; does not include Four Star 3 Includes Four Star 16

- 17. Improving Domestic Reserve Metrics Reserve Replacement Costs Reserve Replacement Ratio (RRC, $/Mcfe) (RRR) 255% $3.26 $3.92 195% $3.22 $2.87 129% 109% 2006 2007 2008 2006 2007 2008 Reflects acquisitions Note: 2008 RRC and RRR do not include price revisions. Prior years RRC and RRR include proved reserves additions, acquisitions, price, and performance revisions. Results do not include Four Star 17

- 18. 2009 Capital Program Focused on Lower-Risk Programs $0.9 billion–$1.3 billion Capital Spending ($ MM) capital program Flexible capital program $1,742 focusing on value creation $1,300 Increased focus on low-risk programs with significant inventory and repeatability Haynesville Cotton Valley Horizontal Altamont Oil 2008 2009 Black Warrior CBM International completing Central Western TGC development of Camarupim GOM Intl Acq. 18

- 19. Preserving Significant Resource Inventory* Additional shale gas potential (Raton, Haynesville) Upside International exploration success Potential 3.5 Tcfe 6.6 Tcfe unrisked non-proved resources Risked 2.8 Tcfe risked unconventional and low risk Unproved Infill drilling (Raton CBM, Altamont oil) Inventory Heavily weighted to U.S. Onshore (75%) 2.5 Tcfe Proved 645 Bcfe Proved Undeveloped Reserves Reserves R/P of 8.6 19 *As of 12/31/08 and includes interest in Four Star

- 20. Improving Results in Arklatex Program Haynesville Shale (currently producing 27 MMcfe/d as of February 21, 2009) 120 4,000 4 Wells Producing IP (MMcfe/d) 3,500 Spud to First Sales (Days) 100 Miller Land Co 10H #1 4.5 3,000 80 Travis Lynch GU #4-H 8.0 $/Lateral Ft. 2,500 RF Gamble 24H #1 14.6 60 2,000 Blake 10H #1 20.3 1,500 40 1,000 20 2009 Activity 500 Spud in March: Hamilton 12H #1 and 0 0 Miller Travis R.F. Blake Annette Green 22H #1 Land Co. Lynch Gamble 10H #1 10H #1 GU #4-H 24H #1 J R Gamble will TD in March with first sales in April Drilling Completion $/Lateral Ft. 2–4 rigs running during 2009 20

- 21. Brazil to Become a Meaningful Contributor Pinaúna (100%) Environmental permitting has slowed pace 15–20 MBOE/d peak production Brazil Copaiba Well (18%) Drilled, tested and currently evaluating Rio de Janeiro Camarupim (24%) 50–60 MMcfe/d peak rate Tot Well (35%) First production 2Q 2009 Drilled and currently evaluating 21

- 22. E&P Outlook 2009 capital program focused on low-risk, value-adding programs Plan is highly flexible Capital pace slowed while seeking to capture lower service costs Preserving inventory while advancing key programs 22

- 23. 2009 Hedge Positions Full-Year 2009 151 TBtu Ceiling Average cap $14.97/MMBtu 8 TBtu 143 TBtu 168 TBtu 2009 Gas $7.33 $15.41 $9.10 fixed price ceiling floor Balance at 176 TBtu Market Price Average floor $9.02/MMBtu Floor 1.5 MMBbls 2009 Oil1 $45.00 fixed price ~75% of domestic natural gas2; gas hedges valued at $730 MM as of 12/31/08 $110/Bbl oil swaps monetized for $186 MM Note: See full Production-related Derivative Schedule in Appendix 1Reflects positions after monetization of oil swaps 23 2Includes proportionate share of Four Star equity volumes

- 24. 2010 Hedge Positions Positions as of March 3, 2009 45 TBtu Ceiling Average cap $7.88/MMBtu 41.7 TBtu 19.8 TBtu 24.7 TBtu Balance at 2010 Gas $7.00 $9.45 $6.61 Market Price floor ceiling fixed price Floor 66 TBtu Average floor $6.86/MMBtu 24 Note: See full Production-related Derivative Schedule in Appendix

- 25. Focus Going Forward Execute on committed pipeline backlog On time/budget Majority of capital risk has been mitigated Create value at E&P Flexible capital expenditures Preserve inventory of opportunities Be prepared for low-price scenario in 2010 and 2011 25

- 26. El Paso Corporation Mark Leland Executive Vice President & Chief Financial Officer Barclays 2009 Fixed Income Energy & Pipeline Conference March 25, 2009

- 27. Appendix 27

- 28. Disclosure of Non-GAAP Financial Measures The SEC’s Regulation G applies to any public disclosure or release of material information that includes a non-GAAP financial measure. In the event of such a disclosure or release, Regulation G requires (i) the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a reconciliation of the differences between the non-GAAP financial measure presented and the most directly comparable financial measure calculated and presented in accordance with GAAP. The required presentations and reconciliations are attached. Additional detail regarding non-GAAP financial measures can be reviewed in El Paso’s full operating statistics, which will be posted at www.elpaso.com in the Investors section. El Paso uses the non-GAAP financial measure “earnings before interest expense and income taxes” or “EBIT” to assess the operating results and effectiveness of the company and its business segments. The company defines EBIT as net income (loss) adjusted for (i) items that do not impact its income (loss) from continuing operations, such as extraordinary items and discontinued operations; (ii) income taxes; and (iii) interest and debt expense. The company excludes interest and debt expense so that investors may evaluate the company’s operating results without regard to its financing methods or capital structure. EBITDA is defined as EBIT excluding depreciation, depletion and amortization. El Paso’s business operations consist of both consolidated businesses as well as investments in unconsolidated affiliates. As a result, the company believes that EBIT, which includes the results of both these consolidated and unconsolidated operations, is useful to its investors because it allows them to evaluate more effectively the performance of all of El Paso’s businesses and investments. El Paso believes that the non-GAAP financial measures described above are also useful to investors because these measurements are used by many companies in the industry as a measurement of operating and financial performance and are commonly employed by financial analysts and others to evaluate the operating and financial performance of the company and its business segments and to compare the operating and financial performance of the company and its business segments with the performance of other companies within the industry. These non-GAAP financial measures may not be comparable to similarly titled measurements used by other companies and should not be used as a substitute for net income, earnings per share or other GAAP operating measurements. 28

- 29. 29

- 30. 30

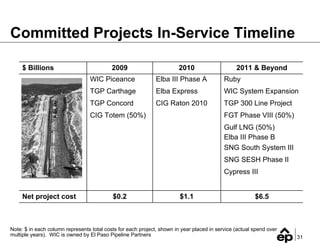

- 31. Committed Projects In-Service Timeline $ Billions 2009 2010 2011 & Beyond WIC Piceance Elba III Phase A Ruby TGP Carthage Elba Express WIC System Expansion TGP Concord CIG Raton 2010 TGP 300 Line Project CIG Totem (50%) FGT Phase VIII (50%) Gulf LNG (50%) Elba III Phase B SNG South System III SNG SESH Phase II Cypress III Net project cost $0.2 $1.1 $6.5 Note: $ in each column represents total costs for each project, shown in year placed in service (actual spend over multiple years). WIC is owned by El Paso Pipeline Partners 31

- 32. YE 2008 Reserves Bcfe 582 Approx. 3.0 Tcfe at $7/$70 299 2851 5602 3,109 2,547 YE 2007 Extensions & Production Purchases & Revisions YE 2008 Discoveries Sales Commodity Prices Henry Hub WTI YE07 $6.80/MMbtu $95.98/Bbl YE08 $5.71/MMbtu $44.60/Bbl Note: Includes proportionate share of Four Star equity volumes 1Includes (303) Bcfe of sales and 18 Bcfe of acquisitions 32 2Includes (490) Bcfe of price-related revisions and (70) Bcfe of performance-related revisions

- 33. Production-Related Derivatives Schedule 2009 2010 2011–2012 Notional Avg. Hedge Notional Avg. Hedge Notional Avg. Hedge Volume Price Volume Price Volume Price Natural Gas (TBtu) ($/MMBtu) (TBtu) ($/MMBtu) (TBtu) ($/MMBtu) Economic—EPEP Fixed price—Legacy 4.6 $ 3.56 4.6 $3.70 6.8 $3.88 Fixed price 3.6 $12.06 20.1 $7.28 Ceiling 142.9 $15.41 19.8 9.45 Floor 167.7 $ 9.10 41.7 $7.00 Avg. ceiling 151.1 $14.97 44.5 $7.88 6.8 $3.88 Avg. floor 175.9 $ 9.02 66.4 $6.86 6.8 $3.88 2009 Notional Avg. Hedge Volume Price Crude Oil (MMBbls) ($/Bbl) Economic—EPEP Fixed price 1.50 $45.00 33 Note: Positions are as of March 3, 2009 (Contract months: Jan 2009–Forward)

- 34. Reserves Update (Bcfe) Int’l Subtotal Four Star Total E&P Domestic 1/1/08 2,606 247 2,853 256 3,109 Production (268) (4) (272) (27) (299) Extensions & Discoveries 577 – 577 5 582 Purchases 18 – 18 – 18 Sales (303) – (303) – (303) Price Revisions (299) (177) (476) (14) (490) Perform. Revisions (72) – (72) 2 (70) 12/31/08 2,259 66 2,325 222 2,547 34

- 35. Non-GAAP Reconciliation 2009 EBIT & EBITDA $ Billions, Except EPS EBITDA 3.1–3.3 Less: DD&A 1.0-1.1 EBIT 2.0–2.3 Less: Interest 1.0 Less: Taxes 0.4 – 0.5 Net Income 0.6–0.8 EPS $0.85–$1.05 Note: Numbers may not foot due to rounding 35