Enoch-annualreport

- 1. Educating Members for Financial Success Annual Report 2014 Celebrating $100 Million in Assets! 2014 Annual Report Pickens Technical College Multimedia Graphic Design Designed By: Jenika Enoch Locations: Main Branch 751 Chambers Rd. Aurora, CO 80011 High Point Branch 18856 E Hampden Ave. Aurora, CO 80013 Pickens Technical College 500 Airport Blvd. Aurora, CO 80011 Phone: Credit Union 303-360-0987 Toll-Free 877-208-2979 Telephone Teller 303-360-7226 Main Fax 303-360-0511 Website: www.asfcu.com

- 2. 2014 President’s Report AFSCU reached the $100 million in total assets milestone in October, which is quite an accomplishment. As your financial parter we appreciate your business and support. We could not have done it without your involvement. We had another successful year, and we continue to grow and provide new services for our membership. Technology is going to be a big factor as we strategize for future products and services. Providing mobile capabilities, along with lower fees and conveniences to access your money are priorities for 2015. Our financial members continue to be very strong and compared to our peers were much better than most, especially on lower deliquency ratio, net income, and controlling expenses. During the past year we’ve heard a lot about credit card data breaches. This is a huge concern to us and our industry. We need your help in monitoring your credit card and checking accounts. We recommend that you review your accounts frequently to see if any ACH items, outgoing wires, or online transactions have taken place. Contact us immediately if you notice any unauthorized activity. We offer an Identity Recovery Service that will work on your behalf to restore your identity, monitor your credit report for twelve months, and give you peace of mind during this unfortunate circumstance. Also, we offer free document shredding in the Spring and Fall every year. Watch for details on the website, in our newsletter or at each branch. On behalf of the Board of Directors, Supervisory Committee, Management, and the staff of your credit union, we hope 2015 finds you healthy and that it will be a prosperous year for you and your loved ones. Respectfully, Brad Johnson (President and CEO, ASFCU) and your Board of Directors 1 Brad Johnson - CEO, Aurora Schools Federal Credit Union Sandra Mishler - Director, Aurora Schools Federal Credit Union Teri Lawson - Business Instructor, Hinkley High School (APS) John Lawson - Graphic Design Instructor, Pickens Technical College Roy Smith - Family Liason, Aurora Hills Middle School (APS) Sue Miles - Retired, Aurora Public Schools Todd Williams - Agency Executive, The Horace Mann Company Janet Kiyota - Business Owner, Trion Promotion and Design Chris Vann - Truancy Reduction Coordinator, Division of Equity and Engagement (APS) The ASPIRE Foundation was formed by Aurora Schools Federal Credit Union to raise money for scholarships and classroom initiatives to benefit Aurora students. Last year we held the 1st annual, “A Taste for Education” event, where we treated guests to food, wine, and craft beer tasting in an effort to raise funds for scholarships. During the event, we presented six scholarship awards to recipients from six APS high schools. Through ticket sales and a silent auction, we raised more than $6,000 for scholarships. The silent auction was a huge success and featured artwork by students from Pickens Technical College. The ASPIRE Foundation raised additional funds through other, smaller initiatives as well. We had our ASPIRE for Change Drive which raised funds and awareness during free shred day at the Credit Union. We also sold fruit cake in the Credit Union lobbies during the holidays. Moreover, our staff at ASFCU has been raising funds by saving aluminum cans. This year theASPIRE Foundation is holding its 2nd annual, “ATaste for Education” event, on May 8th at the Radisson Hotel in Aurora. We are anticipating awarding eight scholarships; seven to APS as well as a new scholarship for Cherry Creek students who attend Aurora schools. We are already working on our silent auction items and the students at Pickens Technical College are hard at work designing skateboards for this year’s event. For tickets and other information about the foundation, please call (303) 577-1069. To be notified of all upcoming ASPIRE events, please visit us at www.cuaspire.com 10

- 3. “ A good financial plan is a road map that shows us exactly how the choices we make today will affect our future. ” -Alexa Von Tobel 2 2014 Member Benefits Report Card Rewards $2 for every A, $1 for every B “Smarty Kids” Youth Savings Accounts Prizes earned for each savings deposit Auto Loans Members 18+ eligible Local Business Discounts Sprint and General Motors Overdraft Protection Lifetime Membership Once you join, you’re in for life! Co-op Transactions All Local Branches Three convenient Aurora branches 9

- 4. 2014 Supervisory Committee Report OurSupervisoryCommitteeconsistsofthreevolunteers,whoareappointedannually by the Board of Directors. The Supervisory Committee’s primary responsibility is ensuring the safety and soundness of the credit union and member funds, while also monitoring the accuracy of credit union records. To assist in fulfilling these responsibilities, the Supervisory Committee retained the public accounting of Holben, Hay, Lake, Balzer, LLC to perform interim and annual internal audits. These audit review and test branch and department operations to ensure compliance with policies and procedures and to confirm that the appropriate internal controls are in place. The Committee is responsible for thoroughly reviewing the audit reports and reporting any findings to the Board of Directors. The management team must address all recommendations and respond accordingly. Audit responses are reviewed and monitored by the Supervisory Committee at least quarterly. It is our opinion that your credit union continues to be run in a safe and sound manner. The Committee appreciates your continued confidence in our oversight role. The support and cooperation of the Board of Directors, management, and employees has assisted us in the performance of our duties and is greatly appreciated. As committee members, we take pride in being able to offer you a safe and sound envronment in which to conduct your financial business and we look forward to serving you in the years to come. Thank you for your continued support of ASFCU. 3 Total Members’ Equity Total Shares 2014 2014 2013 2013 2012 2012 2014 - $99,982,086 2013 - $96,398,003 2012 - $95,938,609 2014 - $89,502,806 2013 - $86,273,743 2012 - $86,203,714 8

- 5. “We make our members’ lives easier and improve their financial success ina changing world” 4 Net Loans & Leases Total Assets 2014 2014 2013 2013 2012 2012 2014 - $50,506,939 2013 - $53,923,991 2012 - $54,543,191 2014 - $99,982,086 2013 - $96,398,003 2012 - $95,938,609 7 Snapshot of 2014

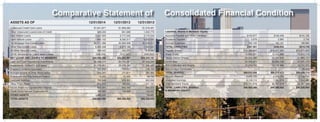

- 6. Comparative Statement of Consolidated Financial Condition Unsecured Credit Card Loans $1,641,871 $1,806,260 $1,919,461 Other Unsecured Loans/Lines of Credit 889,333 951,699 1,042,773 New Vehicle Loans 2,437,323 2,717,545 3,710,044 Used Vehicle Loans 7,963,152 8,550,317 9,503,030 1st Mortgage Real Estate Loans 30,771,286 32,992,638 30,429,619 Other Real Estate Loans 6,653,458 6,573,196 7,564,630 All Other Secured Loans 508,542 745,263 916,586 LESS: Allowance for Loan/Lease Losses (358,026) (412,927) (542,952) NET LOANS AND LEASES TO MEMBERS $50,506,939 $53,923,991 $54,543,191 Cash and Cash Equivalents Investments $3,326,513 $4,703,247 $7,342,344 Investments - 3 Months to 8 Years 41,776,951 33,476,149 31,340,287 Prepaid & Deferred Expenses 121,254 144,297 116,793 Accrued Income & Other Receivables 204,207 211,917 395,093 Foreclosed and Repossessed Assets 15,000 15,000 46,783 Land and Building 782,648 818,302 853,956 Other Fixed Assets 212,543 168,054 241,191 NCUA Share Ins Capitalization Deposit 859,501 845,445 856,023 Credit Union Service Organizations 180,080 159,666 143,287 OTHER ASSETS 1,996,450 - 59,661 TOTAL ASSETS $99,982,086 $96,398,003 $95,938,609 ASSETS AS OF 12/31/2014 12/31/2013 12/31/2012 Liabilities, Shares & Members’ Equity Accounts Payable and Other Liabilities $102,677 $130,539 $141,105 Dividends Payable 2,679 3,982 2,742 Accrued Expenses 182,105 162,121 166,883 TOTAL LIABILITIES $287,461 $296,642 $310,730 Regular Shares $18,066,650 $16,417,364 $15,371,024 Share Drafts 10,866,691 10,442,889 10,254,716 Money Market Shares 26,035,780 23,327,978 21,883,127 Certificates 24,308,951 25,284,546 27,931,476 IRA Certificates and Shares 10,204,734 10,746,966 10,741,371 Non-Member Certificates - - 99,000 TOTAL SHARES $89,502,806 $86,273,473 $86,230,714 Regular Reserve 2,042,705 2,042,705 2,042,705 Undivided Earnings 8,149,114 7,784,913 7,354,460 Total Members’ Equity $10,191,819 $9,827,618 $9,397,165 TOTAL LIABILITIES, SHARES & MEMBERS’ EQUITY $99,982,086 $96,398,003 $95,938,609 5 6