EOG 2Q 2017

- 1. NYSE Stock Symbol: EOG Common Dividend: $0.67 Common Shares Outstanding: 577 Million Internet Address: http://www.eogresources.com 2Q 2017 Investor Relations Contacts David J. Streit, Vice President IR/PR (713) 571-4902, dstreit@eogresources.com Kimberly M. Ehmer, Director IR/PR (713) 571-4676, kehmer@eogresources.com W. John Wagner, Engineer IR (713) 571-4404, wjwagner@eogresources.com

- 2. Copyright; Assumption of Risk: Copyright 2017. This presentation and the contents of this presentation have been copyrighted by EOG Resources, Inc. (EOG). All rights reserved. Copying of the presentation is forbidden without the prior written consent of EOG. Information in this presentation is provided “as is” without warranty of any kind, either express or implied, including but not limited to the implied warranties of merchantability, fitness for a particular purpose and the timeliness of the information. You assume all risk in using the information. In no event shall EOG or its representatives be liable for any special, indirect or consequential damages resulting from the use of the information. Cautionary Notice Regarding Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, including, among others, statements and projections regarding EOG's future financial position, operations, performance, business strategy, returns, budgets, reserves, levels of production, costs and asset sales, statements regarding future commodity prices and statements regarding the plans and objectives of EOG's management for future operations, are forward-looking statements. EOG typically uses words such as "expect," "anticipate," "estimate," "project," "strategy," "intend," "plan," "target," "goal," "may," "will," "should" and "believe" or the negative of those terms or other variations or comparable terminology to identify its forward-looking statements. In particular, statements, express or implied, concerning EOG's future operating results and returns or EOG's ability to replace or increase reserves, increase production, reduce or otherwise control operating and capital costs, generate income or cash flows or pay dividends are forward-looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, EOG's forward-looking statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG's control. Important factors that could cause EOG's actual results to differ materially from the expectations reflected in EOG's forward-looking statements include, among others: • the timing, extent and duration of changes in prices for, supplies of, and demand for, crude oil and condensate, natural gas liquids, natural gas and related commodities; • the extent to which EOG is successful in its efforts to acquire or discover additional reserves; • the extent to which EOG is successful in its efforts to economically develop its acreage in, produce reserves and achieve anticipated production levels from, and maximize reserve recovery from, its existing and future crude oil and natural gas exploration and development projects; • the extent to which EOG is successful in its efforts to market its crude oil and condensate, natural gas liquids, natural gas and related commodity production; • the availability, proximity and capacity of, and costs associated with, appropriate gathering, processing, compression, transportation and refining facilities; • the availability, cost, terms and timing of issuance or execution of, and competition for, mineral licenses and leases and governmental and other permits and rights-of-way, and EOG’s ability to retain mineral licenses and leases; • the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations; environmental, health and safety laws and regulations relating to air emissions, disposal of produced water, drilling fluids and other wastes, hydraulic fracturing and access to and use of water; laws and regulations imposing conditions or restrictions on drilling and completion operations and on the transportation of crude oil and natural gas; laws and regulations with respect to derivatives and hedging activities; and laws and regulations with respect to the import and export of crude oil, natural gas and related commodities; • EOG's ability to effectively integrate acquired crude oil and natural gas properties into its operations, fully identify existing and potential problems with respect to such properties and accurately estimate reserves, production and costs with respect to such properties; • the extent to which EOG's third-party-operated crude oil and natural gas properties are operated successfully and economically; • competition in the oil and gas exploration and production industry for the acquisition of licenses, leases and properties, employees and other personnel, facilities, equipment, materials and services; • the availability and cost of employees and other personnel, facilities, equipment, materials (such as water) and services; • the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; • weather, including its impact on crude oil and natural gas demand, and weather-related delays in drilling and in the installation and operation (by EOG or third parties) of production, gathering, processing, refining, compression and transportation facilities; • the ability of EOG's customers and other contractual counterparties to satisfy their obligations to EOG and, related thereto, to access the credit and capital markets to obtain financing needed to satisfy their obligations to EOG; • EOG's ability to access the commercial paper market and other credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements; • the extent to which EOG is successful in its completion of planned asset dispositions; • the extent and effect of any hedging activities engaged in by EOG; • the timing and extent of changes in foreign currency exchange rates, interest rates, inflation rates, global and domestic financial market conditions and global and domestic general economic conditions; • political conditions and developments around the world (such as political instability and armed conflict), including in the areas in which EOG operates; • the use of competing energy sources and the development of alternative energy sources; • the extent to which EOG incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage; • acts of war and terrorism and responses to these acts; • physical, electronic and cyber security breaches; and • the other factors described under ITEM 1A, Risk Factors, on pages 13 through 22 of EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and any updates to those factors set forth in EOG's subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. In light of these risks, uncertainties and assumptions, the events anticipated by EOG's forward-looking statements may not occur, and, if any of such events do, we may not have anticipated the timing of their occurrence or the duration and extent of their impact on our actual results. Accordingly, you should not place any undue reliance on any of EOG's forward-looking statements. EOG's forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law, to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise. Oil and Gas Reserves; Non-GAAP Financial Measures: The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only “proved” reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also “probable” reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as “possible” reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include "potential" reserves and/or other estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, available from EOG at P.O. Box 4362, Houston, Texas 77210-4362 (Attn: Investor Relations). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC's website at www.sec.gov. In addition, reconciliation and calculation schedules for non-GAAP financial measures can be found on the EOG website at www.eogresources.com.

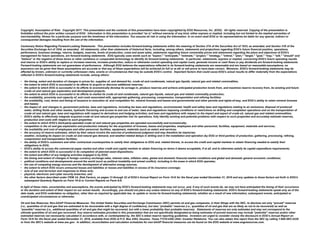

- 3. EOG _0817-3 Exceeded High End of All U.S. Production Targets Delivered Per Unit LOE, Transportation and DD&A Rates Below Target Reduced CWC* in Delaware, Powder River and DJ Basins Achieved YTD Asset Sale Proceeds of $175 Million Increased U.S. Crude Oil Growth Forecast to 20% from 18%** Maintained Capex Guidance of $3.7-$4.1 Billion*** Balance Capex + Dividend with Discretionary Cash Flow - Complete ≈ 480 Net Wells - Average 26 Rigs in 2017 * CWC = Drilling, Completion, Well-Site Facilities and Flowback. ** Based on midpoint of 2017 guidance, as of August 1, 2017. *** Based on full-year estimates, as of August 1, 2017. 2Q 2017 FY 2017

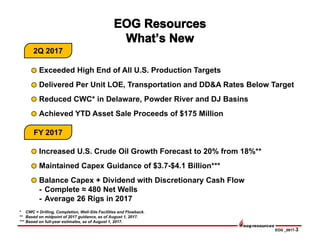

- 4. EOG _0817-4 U.S. Leader in Return on Capital Employed U.S. Oil Growth Leader Among Lowest Cost Producers in Global Oil Market Commitment to Safety and the Environment Create Significant Long-Term Shareholder Value

- 5. EOG _0817-5 High Return Oil Growth • Fastest U.S. Horizontal Driller • Industry Leading Completion Technology • Self-Sourcing Materials / Services • Low Infrastructure & Production Cost • Proven Track Record of Execution • Internal Prospect Generation • First Mover Advantage • Best Rock / Best Plays • Low Cost Acreage • Most Prolific U.S. Horizontal Wells • Large Proprietary Data Marts • Real-Time Data Capture • Predictive Algorithms • 65+ In-House Desktop / Mobile Apps • Fast / Continuous Tech Advancement Exploration Operations Information Technology • Rate-of-Return Driven • Decentralized / Non-Bureaucratic • Multi-Disciplined Teamwork • Innovative / Entrepreneurial • Every Employee is a Business Person Culture

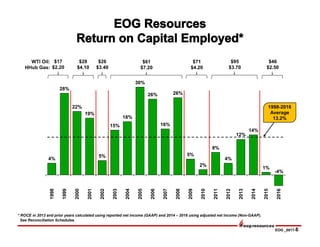

- 6. EOG _0817-6 WTI Oil: HHub Gas: 4% 28% 22% 19% 5% 15% 18% 30% 26% 16% 26% 5% 2% 8% 4% 12% 14% 1% -4% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 * ROCE in 2013 and prior years calculated using reported net income (GAAP) and 2014 – 2016 using adjusted net income (Non-GAAP). See Reconciliation Schedules. $17 $2.20 $28 $4.10 $61 $7.20 $71 $4.20 $95 $3.70 $46 $2.50 $26 $3.40 1998-2016 Average 13.2%

- 7. EOG _0817-7 278.3 335.0 2016 2017E** * Data from 2016 completed wells. Calculated using futures strip prices in February 2017. See reconciliation schedule. ** Based on midpoint of 2017 guidance, as of August 1, 2017. 17.34 15.75 2016 2017E** Non-PremiumPremium DD&A $/BOE U.S. Production MBOD Direct ATROR* First Year Gross Oil (Bbl/ well) Direct Finding Cost ($/BOE) > 100% ≈ 200,000 ≈ $7 ≈ 20% ≈ 100,000 ≈ $13 Drives Higher ROCE

- 8. EOG _0817-8 $30 $40 $50 $60 * Percent of domestic gross completed wells which are premium. 14% 23% 50% 80% 2014 2015 2016 2017 Est 2018+ Est 100%+ 10% 60% 30% Oil: * See reconciliation schedules. Premium Drilling Direct ATROR* (Minimum Return for Premium) Shifting to Premium Locations (% Completed Premium Wells*) 90+% * Estimated potential reserves net to EOG, not proved reserves. 6.5 BnBoe* ≈7,200 Net Undrilled Locations >10 Years of Drilling

- 9. EOG _0817-9 Resource Potential** * Premium locations are shown on a net basis and are all undrilled. ** Estimated potential reserves net to EOG, not proved reserves. Per Well Feb 2016 Aug 2016 Sep 2016 May 2017 2.0 BnBoe 625 MBoe 3.5 BnBoe 815 MBoe 5.1 BnBoe 850 MBoe 6.5 BnBoe 900 MBoe ≈3,200 ≈4,300 ≈6,000 ≈7,200

- 10. EOG _0817-10 0 200 400 600 800 1,000 1,200 1,400 EOGA B C D E F G H I J K L M N O P Q R S T U V W X Y Z AA 52 9 24 4 18 13 22 20 9 3 24 61 5 3 3 23 61 20 163 8 18 26 34 28 26 49 17 51 7,000’ Lateral Boed Delaware Basin Oil Average daily six-month production, normalized to 7,000’ lateral. All horizontal wells from original operator, January 2016 – June 2017. Gas production converted at 20:1. Wolfcamp formation, Wolfcamp reservoir designation, all counties. Delaware Basin peer companies: APA, APC, BHP, CDEV, COP, CXO, EGN, JAG, MTDR, OXY, PE, RDS, REN, XEC and XOM. Midland Basin peer companies: APA, CVX, CXO, ECA, EGN, FANG, OXY, PE, PXD, RSPP, SM and XOM. Source: IHS Performance Evaluator, supplied by IHS Global Inc.; Copyright (2017). Well Count Midland Basin Oil Solid Colors: Oil Gray Bar: Natural Gas

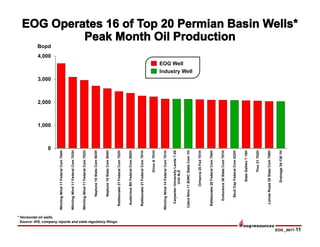

- 11. EOG _0817-11 0 1,000 2,000 3,000 4,000 WhirlingWind11FederalCom704H WhirlingWind11FederalCom703H WhirlingWind11FederalCom702H Neptune10StateCom503H Neptune10StateCom504H Rattlesnake21FederalCom702H AudaciousBtlFederalCom002H Rattlesnake21FederalCom701H OrionA701H WhirlingWind14FederalCom701H CarpenterUniversityLands7-20 Unit4LS CabraNino11B3NCStateCom1H Orrtanna20Fed701H Rattlesnake28FederalCom704H Endurance36StateCom701H SkullCapFederalCom022H StateGalileo715H Thor21702H LomasRojas26StateCom708H Drainage34-1361H EOG Well * Horizontal oil wells. Source: IHS, company reports and state regulatory filings. Industry Well Bopd

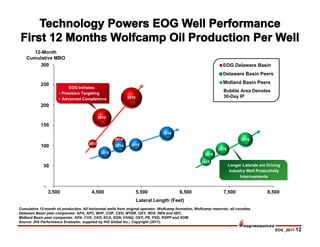

- 12. EOG _0817-12 - 50,000 100,000 150,000 200,000 250,000 300,000 3,500 4,500 5,500 6,500 7,500 8,500 EOG Delaware Basin Delaware Basin Peers Midland Basin Peers Lateral Length (Feet) 12-Month Cumulative MBO 2016 2016 2016 2013 2015 2014 2015 20152014 2014 2013 2013 250 200 150 100 50 300 Longer Laterals are Driving Industry Well Productivity Improvements Bubble Area Denotes 30-Day IP Cumulative 12-month oil production. All horizontal wells from original operator. Wolfcamp formation, Wolfcamp reservoir, all counties. Delaware Basin peer companies: APA, APC, BHP, COP, CXO, MTDR, OXY, RDS, REN and XEC. Midland Basin peer companies: APA, CVX, CXO, ECA, EGN, FANG, OXY, PE, PXD, RSPP and XOM. Source: IHS Performance Evaluator, supplied by IHS Global Inc.; Copyright (2017). EOG Initiates: • Precision Targeting • Advanced Completions

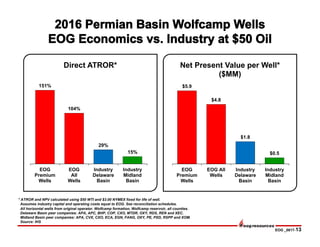

- 13. EOG _0817-13 * ATROR and NPV calculated using $50 WTI and $3.00 NYMEX fixed for life of well. Assumes industry capital and operating costs equal to EOG. See reconciliation schedules. All horizontal wells from original operator. Wolfcamp formation, Wolfcamp reservoir, all counties. Delaware Basin peer companies: APA, APC, BHP, COP, CXO, MTDR, OXY, RDS, REN and XEC. Midland Basin peer companies: APA, CVX, CXO, ECA, EGN, FANG, OXY, PE, PXD, RSPP and XOM. Source: IHS Direct ATROR* Net Present Value per Well* ($MM) 151% 104% 29% 15% EOG Premium Wells EOG All Wells Industry Delaware Basin Industry Midland Basin $5.9 $4.8 $1.8 $0.5 EOG Premium Wells EOG All Wells Industry Delaware Basin Industry Midland Basin

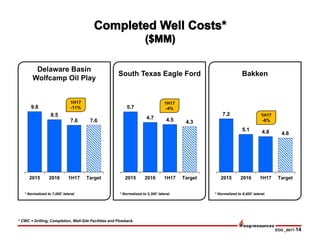

- 14. EOG _0817-14 7.2 5.1 4.8 4.6 2015 2016 1H17 Target 5.7 4.7 4.5 4.3 2015 2016 1H17 Target * CWC = Drilling, Completion, Well-Site Facilities and Flowback. 9.8 8.5 7.6 7.6 2015 2016 1H17 Target Delaware Basin Wolfcamp Oil Play South Texas Eagle Ford Bakken * Normalized to 5,300’ lateral. * Normalized to 8,400’ lateral.* Normalized to 7,000’ lateral. 1H17 -11% 1H17 -4% 1H17 -6%

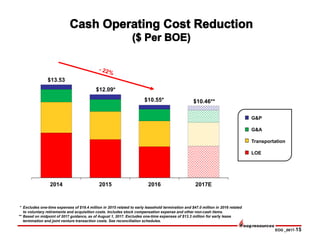

- 15. EOG _0817-15 2014 2015 2016 2017E $13.53 $12.09* $10.55* G&P G&A Transportation LOE * Excludes one-time expenses of $19.4 million in 2015 related to early leasehold termination and $47.0 million in 2016 related to voluntary retirements and acquisition costs. Includes stock compensation expense and other non-cash items. ** Based on midpoint of 2017 guidance, as of August 1, 2017. Excludes one-time expenses of $13.3 million for early lease termination and joint venture transaction costs. See reconciliation schedules. $10.46**

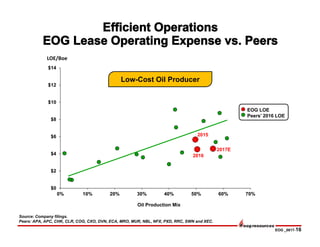

- 16. EOG _0817-16 $0 $2 $4 $6 $8 $10 $12 $14 0% 10% 20% 30% 40% 50% 60% 70% LOE/Boe 2015 Source: Company filings. Peers: APA, APC, CHK, CLR, COG, CXO, DVN, ECA, MRO, MUR, NBL, NFX, PXD, RRC, SWN and XEC. Oil Production Mix EOG LOE Peers’ 2016 LOE 2016 2017E Low-Cost Oil Producer

- 17. EOG _0817-17 $MM Source: FactSet consensus, U.S E&P Companies >$500MM market cap, as of 7/24/17. Consensus 2017 WTI oil price ≈ $50. * Discretionary cash flow less capex and dividends. EOG (1,000) (750) (500) (250) 0 250 500 750 1,000 1,948 2017 Consensus Cash Flow After Capex & Dividend Based on ≈ $50 WTI

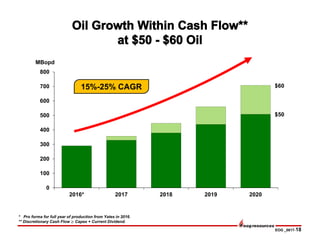

- 18. EOG _0817-18 0 100 200 300 400 500 600 700 800 2016* 2017 2018 2019 2020 $60 * Pro forma for full year of production from Yates in 2016. ** Discretionary Cash Flow Capex + Current Dividend. $50 MBopd 15%-25% CAGR

- 19. EOG _0817-19

- 20. EOG _0817-20 Real-Time Data Streams from Every Asset EOG Proprietary Data Marts Desktop Mobile In-House Developed: • Algorithms • Data Science • Software Predictive Analytics “A Control Room in Your Pocket” Frac Fleets Rigs Wells on Production EOG Proprietary Data • Logs • Cores • 3-D Seismic • Micro Seismic • Reservoir Models Optimized for Big Data Processing Comprehensive: Covers All Aspects of EOG Business Completions: Optimize Advanced Designs to Geologic Setting Precision Lateral Targeting: Petrophysical Modeling of “Best Target” Geosteering: Integrated with Petrophysical Models Decentralized Decision Making: 65+ EOG Proprietary Applications

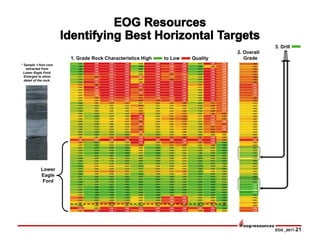

- 21. EOG _0817-21 Lower Eagle Ford 1. Grade Rock Characteristics High to Low Quality 2. Overall Grade 3. Drill * Sample 1-foot core extracted from Lower Eagle Ford. Enlarged to show detail of the rock.

- 22. EOG _0817-22 Contain Events Closer to Wellbore Enhance Complexity to Contact More Surface Area Note: Microseismic dots represent well stimulation events during completions.

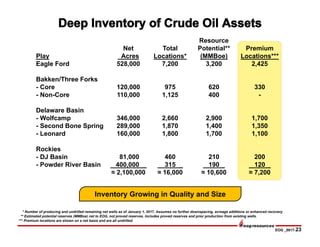

- 23. EOG _0817-23 Play Net Acres Total Locations* Resource Potential** (MMBoe) Premium Locations*** Eagle Ford 528,000 7,200 3,200 2,425 Bakken/Three Forks - Core - Non-Core 120,000 110,000 975 1,125 620 400 330 - Delaware Basin - Wolfcamp 346,000 2,660 2,900 1,700 - Second Bone Spring 289,000 1,870 1,400 1,350 - Leonard 160,000 1,800 1,700 1,100 Rockies - DJ Basin - Powder River Basin 81,000 400,000 _ 460 315 _ 210 190 _ 200 120 _ ≈ 2,100,000 ≈ 16,000 ≈ 10,600 ≈ 7,200 * Number of producing and undrilled remaining net wells as of January 1, 2017. Assumes no further downspacing, acreage additions or enhanced recovery. ** Estimated potential reserves (MMBoe) net to EOG, not proved reserves. Includes proved reserves and prior production from existing wells. *** Premium locations are shown on a net basis and are all undrilled. Inventory Growing in Quality and Size

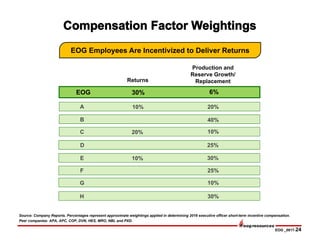

- 24. EOG _0817-24 Production and Reserve Growth/ ReplacementReturns A 20% B 40% C 10% D F 25% 10% EOG 6%30% E G 10% H 30% Source: Company Reports. Percentages represent approximate weightings applied in determining 2016 executive officer short-term incentive compensation. Peer companies: APA, APC, COP, DVN, HES, MRO, NBL and PXD. EOG Employees Are Incentivized to Deliver Returns 20% 25% 10% 30%

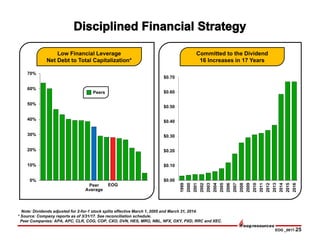

- 25. EOG _0817-25 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Note: Dividends adjusted for 2-for-1 stock splits effective March 1, 2005 and March 31, 2014. * Source: Company reports as of 3/31/17. See reconciliation schedule. Peer Companies: APA, APC, CLR, COG, COP, CXO, DVN, HES, MRO, NBL, NFX, OXY, PXD, RRC and XEC. Committed to the Dividend 16 Increases in 17 Years 0% 10% 20% 30% 40% 50% 60% 70% Low Financial Leverage Net Debt to Total Capitalization* Peer Average Peers EOG

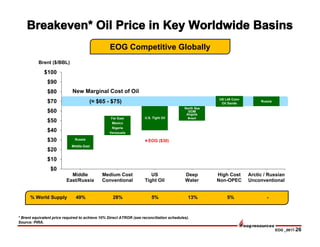

- 26. EOG _0817-26 Middle East Venezuela Brazil Russia Nigeria Angola US L48 Conv Mexico GOM $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Middle East/Russia Medium Cost Conventional US Tight Oil Deep Water High Cost Non-OPEC Arctic / Russian Unconventional * Brent equivalent price required to achieve 10% Direct ATROR (see reconciliation schedules). Source: PIRA. Brent ($/BBL) 49% 28% 5% 13% 5% -% World Supply US L48 Conv Oil Sands New Marginal Cost of Oil (≈ $65 - $75) North Sea U.S. Tight OilFar East Russia EOG ($30) * EOG Competitive Globally

- 27. EOG _0817-27 Brushy Canyon Leonard A Leonard B 1st Bone Spring 2nd Bone Spring 3rd Bone Spring Upper Wolfcamp Middle Wolfcamp Lower Wolfcamp 4,800’ One World Trade Center 1,792’ Battery Park to Wall Street to City Hall 4,800’ Middle Bakken Lower Eagle Ford 40’ 150’ Battery Park Wall Street City Hall

- 28. EOG _0817-28 Net Resource Potential 6.0 BnBoe* 6,330 Net Locations; 7,200’ Laterals Average 13 Rigs Operating in 2017 Significant Infrastructure Installed - Water Sourcing, Gathering and Recycling - Sand Rail-Car Unloading Facilities - Oil and Gas Gathering and Takeaway Low LOE Per-Unit Rate Test Permian Northwest Shelf in 2017 Eddy Lea Loving Winkler Culberson Ward Reeves Chaves Roosevelt Northwest Shelf 143,000 Net Acres Delaware Basin 416,000 Net Acres EOG 559,000 Net Acres * Estimated potential reserves net to EOG, not proved reserves. Includes 462 MMBoe of proved reserves booked at December 31, 2016 and prior production from existing wells.

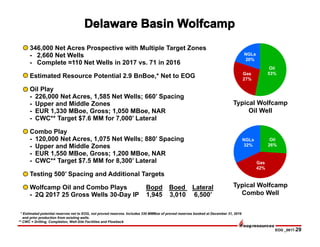

- 29. EOG _0817-29 346,000 Net Acres Prospective with Multiple Target Zones - 2,660 Net Wells - Complete ≈110 Net Wells in 2017 vs. 71 in 2016 Estimated Resource Potential 2.9 BnBoe,* Net to EOG Oil Play - 226,000 Net Acres, 1,585 Net Wells; 660’ Spacing - Upper and Middle Zones - EUR 1,330 MBoe, Gross; 1,050 MBoe, NAR - CWC** Target $7.6 MM for 7,000’ Lateral Combo Play - 120,000 Net Acres, 1,075 Net Wells; 880’ Spacing - Upper and Middle Zones - EUR 1,550 MBoe, Gross; 1,200 MBoe, NAR - CWC** Target $7.5 MM for 8,300’ Lateral Testing 500’ Spacing and Additional Targets Wolfcamp Oil and Combo Plays Bopd Boed Lateral - 2Q 2017 25 Gross Wells 30-Day IP 1,945 3,010 6,500’ * Estimated potential reserves net to EOG, not proved reserves. Includes 330 MMBoe of proved reserves booked at December 31, 2016 and prior production from existing wells. ** CWC = Drilling, Completion, Well-Site Facilities and Flowback NGLs 32% Typical Wolfcamp Combo Well Gas 42% Oil 26% Gas 27% NGLs 20% Oil 53% Typical Wolfcamp Oil Well

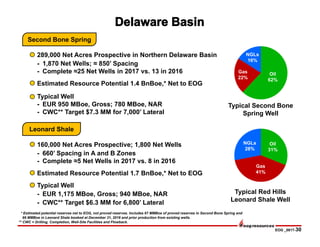

- 30. EOG _0817-30 289,000 Net Acres Prospective in Northern Delaware Basin - 1,870 Net Wells; ≈ 850’ Spacing - Complete ≈25 Net Wells in 2017 vs. 13 in 2016 Estimated Resource Potential 1.4 BnBoe,* Net to EOG Typical Well - EUR 950 MBoe, Gross; 780 MBoe, NAR - CWC** Target $7.3 MM for 7,000’ Lateral * Estimated potential reserves net to EOG, not proved reserves. Includes 67 MMBoe of proved reserves in Second Bone Spring and 66 MMBoe in Leonard Shale booked at December 31, 2016 and prior production from existing wells. ** CWC = Drilling, Completion, Well-Site Facilities and Flowback. NGLs 16% Typical Second Bone Spring Well Gas 22% Oil 62% 160,000 Net Acres Prospective; 1,800 Net Wells - 660’ Spacing in A and B Zones - Complete ≈5 Net Wells in 2017 vs. 8 in 2016 Estimated Resource Potential 1.7 BnBoe,* Net to EOG Typical Well - EUR 1,175 MBoe, Gross; 940 MBoe, NAR - CWC** Target $6.3 MM for 6,800’ Lateral NGLs 28% Typical Red Hills Leonard Shale Well Gas 41% Oil 31% Second Bone Spring Leonard Shale

- 31. EOG _0817-31 -10 40 90 140 190 240 0 90 180 270 360 0 50 100 150 200 250 300 350 0 90 180 270 360 Delaware Basin Second Bone Spring Wells Average Cumulative Production* Delaware Basin Wolfcamp Oil Wells Average Cumulative Production* (MBoe) Producing Days * Normalized to 4,500-foot lateral. 2015 Producing Days (MBoe) 2015 2016 2016 * Normalized to 4,500-foot lateral.

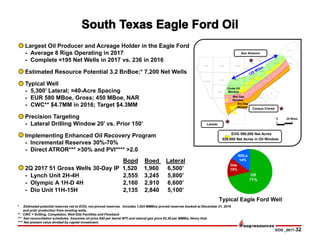

- 32. EOG _0817-32 WEBB FRIO BEE UVALDE DIMMIT BEXAR KINNEY ZAVALA MEDINA LA SALLE LAVACA MAVERICK LIVE OAK ATASCOSA DE WITT FAYETTE MCMULLEN WILSON GONZALES KARNES GUADALUPE Oil 71% Gas 15% NGLs 14% Typical Eagle Ford Well Largest Oil Producer and Acreage Holder in the Eagle Ford - Average 8 Rigs Operating in 2017 - Complete ≈195 Net Wells in 2017 vs. 236 in 2016 Estimated Resource Potential 3.2 BnBoe;* 7,200 Net Wells Typical Well - 5,300’ Lateral; ≈40-Acre Spacing - EUR 580 MBoe, Gross; 450 MBoe, NAR - CWC** $4.7MM in 2016; Target $4.3MM Precision Targeting - Lateral Drilling Window 20’ vs. Prior 150’ Implementing Enhanced Oil Recovery Program - Incremental Reserves 30%-70% - Direct ATROR*** >30% and PVI**** >2.0 Bopd Boed Lateral 2Q 2017 51 Gross Wells 30-Day IP 1,520 1,960 6,500’ - Lynch Unit 2H-4H 2,555 3,245 5,800’ - Olympic A 1H-D 4H 2,160 2,910 6,600’ - Dio Unit 11H-15H 2,135 2,840 5,100’ * Estimated potential reserves net to EOG, not proved reserves. Includes 1,003 MMBoe proved reserves booked at December 31, 2016 and prior production from existing wells. ** CWC = Drilling, Completion, Well-Site Facilities and Flowback *** See reconciliation schedules. Assumes oil price $40 per barrel WTI and natural gas price $2.50 per MMBtu Henry Hub. **** Net present value divided by capital investment. Crude Oil Window Dry Gas Window Wet Gas Window 0 25 Miles San Antonio Corpus Christi Laredo EOG 590,000 Net Acres 528,000 Net Acres in Oil Window

- 33. EOG _0817-33 0 25 50 75 100 125 150 175 0 90 180 270 360 Eagle Ford East Wells Average Cumulative Oil Production* 2012 2013 2014 Eagle Ford West Wells Average Cumulative Oil Production* (Mbo) Producing Days * Normalized to 6,600-foot lateral. 2015 0 25 50 75 100 125 150 175 0 90 180 270 360 Producing Days * Normalized to 4,600-foot lateral. (Mbo) 2012 2013 2014 2015 2016 2016

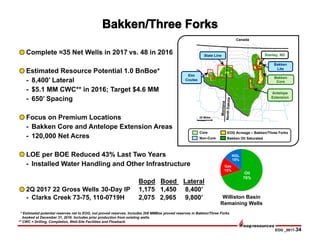

- 34. EOG _0817-34 * Estimated potential reserves net to EOG, not proved reserves. Includes 208 MMBoe proved reserves in Bakken/Three Forks booked at December 31, 2016. Includes prior production from existing wells. ** CWC = Drilling, Completion, Well-Site Facilities and Flowback. Complete ≈35 Net Wells in 2017 vs. 48 in 2016 Estimated Resource Potential 1.0 BnBoe* - 8,400’ Lateral - $5.1 MM CWC** in 2016; Target $4.6 MM - 650’ Spacing Focus on Premium Locations - Bakken Core and Antelope Extension Areas - 120,000 Net Acres LOE per BOE Reduced 43% Last Two Years - Installed Water Handling and Other Infrastructure Bopd Boed Lateral 2Q 2017 22 Gross Wells 30-Day IP 1,175 1,450 8,400’ - Clarks Creek 73-75, 110-0719H 2,075 2,965 9,800’ Gas 15% Williston Basin Remaining Wells Oil 70% NGL 15% Canada Bakken Core Antelope Extension Bakken Lite State Line Elm Coulee EOG Acreage – Bakken/Three Forks Bakken Oil Saturated 20 Miles Stanley, ND Core Non-Core

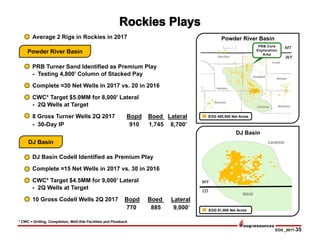

- 35. EOG _0817-35 PRB Turner Sand Identified as Premium Play - Testing 4,800’ Column of Stacked Pay Complete ≈30 Net Wells in 2017 vs. 20 in 2016 CWC* Target $5.0MM for 8,000’ Lateral - 2Q Wells at Target 8 Gross Turner Wells 2Q 2017 Bopd Boed Lateral - 30-Day IP 910 1,745 8,700’ DJ Basin Codell Identified as Premium Play Complete ≈15 Net Wells in 2017 vs. 30 in 2016 CWC* Target $4.5MM for 9,000’ Lateral - 2Q Wells at Target 10 Gross Codell Wells 2Q 2017 Bopd Boed Lateral 770 885 9,000’ Powder River Basin DJ Basin DJ Basin EOG 81,000 Net Acres Laramie Weld CO WY Powder River Basin Campbell Crook Weston NiobraraConverse Natrona Johnson Sheridan WY MT EOG 400,000 Net Acres PRB Core Exploration Area Average 2 Rigs in Rockies in 2017 * CWC = Drilling, Completion, Well-Site Facilities and Flowback.

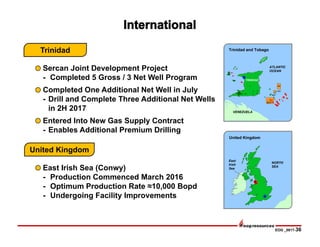

- 36. EOG _0817-36 East Irish Sea (Conwy) - Production Commenced March 2016 - Optimum Production Rate ≈10,000 Bopd - Undergoing Facility Improvements Sercan Joint Development Project - Completed 5 Gross / 3 Net Well Program Completed One Additional Net Well in July - Drill and Complete Three Additional Net Wells in 2H 2017 Entered Into New Gas Supply Contract - Enables Additional Premium Drilling TRINIDAD ATLANTIC OCEAN U(a) VENEZUELA 4(a) U(b) SECC NORTH SEA East Irish Sea Trinidad and Tobago United Kingdom Trinidad United Kingdom

- 37. Copyright; Assumption of Risk: Copyright 2017. This presentation and the contents of this presentation have been copyrighted by EOG Resources, Inc. (EOG). All rights reserved. Copying of the presentation is forbidden without the prior written consent of EOG. Information in this presentation is provided “as is” without warranty of any kind, either express or implied, including but not limited to the implied warranties of merchantability, fitness for a particular purpose and the timeliness of the information. You assume all risk in using the information. In no event shall EOG or its representatives be liable for any special, indirect or consequential damages resulting from the use of the information. Cautionary Notice Regarding Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, including, among others, statements and projections regarding EOG's future financial position, operations, performance, business strategy, returns, budgets, reserves, levels of production, costs and asset sales, statements regarding future commodity prices and statements regarding the plans and objectives of EOG's management for future operations, are forward-looking statements. EOG typically uses words such as "expect," "anticipate," "estimate," "project," "strategy," "intend," "plan," "target," "goal," "may," "will," "should" and "believe" or the negative of those terms or other variations or comparable terminology to identify its forward-looking statements. In particular, statements, express or implied, concerning EOG's future operating results and returns or EOG's ability to replace or increase reserves, increase production, reduce or otherwise control operating and capital costs, generate income or cash flows or pay dividends are forward-looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, EOG's forward-looking statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG's control. Important factors that could cause EOG's actual results to differ materially from the expectations reflected in EOG's forward-looking statements include, among others: • the timing, extent and duration of changes in prices for, supplies of, and demand for, crude oil and condensate, natural gas liquids, natural gas and related commodities; • the extent to which EOG is successful in its efforts to acquire or discover additional reserves; • the extent to which EOG is successful in its efforts to economically develop its acreage in, produce reserves and achieve anticipated production levels from, and maximize reserve recovery from, its existing and future crude oil and natural gas exploration and development projects; • the extent to which EOG is successful in its efforts to market its crude oil and condensate, natural gas liquids, natural gas and related commodity production; • the availability, proximity and capacity of, and costs associated with, appropriate gathering, processing, compression, transportation and refining facilities; • the availability, cost, terms and timing of issuance or execution of, and competition for, mineral licenses and leases and governmental and other permits and rights-of-way, and EOG’s ability to retain mineral licenses and leases; • the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations; environmental, health and safety laws and regulations relating to air emissions, disposal of produced water, drilling fluids and other wastes, hydraulic fracturing and access to and use of water; laws and regulations imposing conditions or restrictions on drilling and completion operations and on the transportation of crude oil and natural gas; laws and regulations with respect to derivatives and hedging activities; and laws and regulations with respect to the import and export of crude oil, natural gas and related commodities; • EOG's ability to effectively integrate acquired crude oil and natural gas properties into its operations, fully identify existing and potential problems with respect to such properties and accurately estimate reserves, production and costs with respect to such properties; • the extent to which EOG's third-party-operated crude oil and natural gas properties are operated successfully and economically; • competition in the oil and gas exploration and production industry for the acquisition of licenses, leases and properties, employees and other personnel, facilities, equipment, materials and services; • the availability and cost of employees and other personnel, facilities, equipment, materials (such as water) and services; • the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; • weather, including its impact on crude oil and natural gas demand, and weather-related delays in drilling and in the installation and operation (by EOG or third parties) of production, gathering, processing, refining, compression and transportation facilities; • the ability of EOG's customers and other contractual counterparties to satisfy their obligations to EOG and, related thereto, to access the credit and capital markets to obtain financing needed to satisfy their obligations to EOG; • EOG's ability to access the commercial paper market and other credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements; • the extent to which EOG is successful in its completion of planned asset dispositions; • the extent and effect of any hedging activities engaged in by EOG; • the timing and extent of changes in foreign currency exchange rates, interest rates, inflation rates, global and domestic financial market conditions and global and domestic general economic conditions; • political conditions and developments around the world (such as political instability and armed conflict), including in the areas in which EOG operates; • the use of competing energy sources and the development of alternative energy sources; • the extent to which EOG incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage; • acts of war and terrorism and responses to these acts; • physical, electronic and cyber security breaches; and • the other factors described under ITEM 1A, Risk Factors, on pages 13 through 22 of EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and any updates to those factors set forth in EOG's subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. In light of these risks, uncertainties and assumptions, the events anticipated by EOG's forward-looking statements may not occur, and, if any of such events do, we may not have anticipated the timing of their occurrence or the duration and extent of their impact on our actual results. Accordingly, you should not place any undue reliance on any of EOG's forward-looking statements. EOG's forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law, to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise. Oil and Gas Reserves; Non-GAAP Financial Measures: The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only “proved” reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also “probable” reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as “possible” reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include "potential" reserves and/or other estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, available from EOG at P.O. Box 4362, Houston, Texas 77210-4362 (Attn: Investor Relations). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC's website at www.sec.gov. In addition, reconciliation and calculation schedules for non-GAAP financial measures can be found on the EOG website at www.eogresources.com.