Emission Reduction Purchase Agreement (ERPA) - Buying and Selling Carbon Credits (UNDP presentation)

- 1. © 2007 UNDP. All Rights Reserved Worldwide. Proprietary and Confidential. Not For Distribution Without Prior Written Permission. UNDP MDG Carbon Facility Bio Carbon Certification Course Panama October 15 through 20, 2007 Module 9a: Buying and Selling Carbon Credits Day 2 (16 October 2007) Prepared and Presented by Marina Olshanskaya and Robert Kelly

- 2. Presentation Overview Emission Reduction Purchase Agreement (ERPA): role and key issues, clauses and terms Obligations of buyer and seller Types of agreement, prices and delivery Balancing risks, price and contractual terms Special case of non-permanence: how do expiring CERs work and who bears the replacement risk?

- 3. Emission Reduction Purchase Agreement (ERPA) Contracts form the basis of the market. For a well-functioning market, contracts should: Define the product Set out rights and responsibilities Allocate risks Buying carbon poses unique challenges and specific risks The product does not physically exist Purchased in immature markets From people who do not know what/whether they can sell Where the rules are constantly changing/do not exist

- 4. Role of ERPA for the Seller Define future value of CERs to integrate in project financial model Use ERPA as collateral to obtain project finance Receive upfront payment for CERs to cover start-up costs Maximize future revenues from CERs Minimize project financial risks (e.g. non-payment for main project deliverables) Mitigate non-market project risks (e.g. DNA approval)

- 5. ERPA: key clauses Definitions: what is to be sold (VERs, CERs, ERUs) Determining legal title to the CERs and modalities for its transfer Key terms: volume, price and delivery Appropriate warranties, conditionalities, force majeure Miscellaneous: Communication with Executive Board Payment of share of proceeds, taxes, etc

- 6. ERPA: obligations Buyer’s Obligations Sellers’ Obligations Communicate with the CDM Executive Board as the Focal point (can be Seller/Buyer or both) Ensure they have an account ready to receive delivery of the CERs Pay for the CERs Replace tCERs and lCERs with CERs Complete Validation and obtain Registration for the Project Develop and Implement Monitoring Plan Carry out Verification and Certification to ensure issuance of CERs and Deliver CERs to the buyer

- 7. ERPA: type of agreement Type I: Spot Agreement (becoming popular) Status of CERs: issued, ready for delivery Payment: immediate, on delivery Risk to buyer/seller: negligible Type II: Future Delivery Agreement (most common) Status of CERs: non-issued, to be delivered in the future Payment: future on delivery OR advanced Risk to Buyer: Small -> large (upfront payment) Risk to Seller: Small -> very large (guaranteed delivery) Type III: Call/put Options Buyer/Seller has the right, but NO OBLIGATION to buy/sell CERs at a certain point in the future for a fixed price

- 8. ERPA: type of pricing Fixed price More confidence in ERPA values Hedge against market downfalls Good when Seller wishes to use the CER revenue to leverage project finance Indexed price (EUA –X%) Reassures Seller that they have a buyer while allow to retain upside potential in bull market Difficult to calculate ERPA value Combination of fixed and floating: Enable the Seller to secure minimum price, but also share in any rises in the market value of CERs Floating P Fixed/Indexed P Fixed P Price (P) Time

- 9. ERPA: delivery Definition: CERs: receipts into a registry account nominated by the Buyer VERs: submission of Verification report ERUs: transfer of ERUs from a seller country’s to buyer country’s accounts Time: Mostly annually, but shorter or longer periods are also possible Normally before 30 April – compliance day in EU ETS Delivery guarantee: Normal when upfront payment is provided by the Buyer Appropriate for larger projects supported by financially stable companies Otherwise can turn ERPA from an asset into a liability and undermine the usefulness of ERPA to secure debt financing

- 10. Legal Agreements in CDM Project Cycle PPs – project participants; DNA – Designated National Authority DOE – Designated Operational Entity, CDM EB – CDM Executive Board Exclusivity Agreement / Letter of Intent ERPA (Type II) * * Conditional on DNA approval, validation ®istration ERPA (Type II) * * Conditional on validation ®istration ERPA (Type II) * * Conditional on registration ERPA (Type I - CERs) ERPA (Type I - VERs) ERPA (Type II) (1) Identifying CDM project (PIN) - PPs (2) Preparing Project Design Document (PDD) - PPs (3) Getting approval from each Party involved - DNA (4) Validation - DOE (5) Registration – CDM EB (6) Monitoring - PPs (7) Verification and Certification - DOE (8) Issuance of CERs – CDM EB (9) Distribution of CERs - PPs Delivery risk Price

- 11. Balancing risks, price and contractual terms Assign risks to those parties which can manage them better Every risk that is passed on from Seller to Buyer has a cost implication: high risk = lower price Country risk: Sovereign risk - borne by Buyer (price) Non-approval by DNA – warranty by Seller Currency fluctuation – borne by Seller Project entity risk: Financial credibility – provision of bank guarantees or demonstrating financial closure before ERPA signing Non financial credibility - having in place internal risk management system, ISO certification, etc

- 12. CDM/Carbon specific risks Legal disputes over CER ownership ERPA require the seller to provide warranties as to the CER ownership to guarantee clear and undisputable legal title Legal nature of CERs is still being discussed: whether CERs constitute a commodity, a security, a permit or another type of intangible right Few national laws (no in non-annex I countries) contain definitions of CERs and rules for determining its legal title In the absence of national legislation, legal title on CERs can also be fixed through the Letter of Approval by DNA

- 13. Balancing risks, price and contractual terms Project performance risk: Overcollateralization – purchase less than 100% of ERs Legal seniority - 1st right to purchase ERs Managing post-2012 CERs Minimum delivery amount (guaranteed) Firm commitment Options Outside agreement 0% 50% 100%

- 15. Sequestration under the CDM Sequestration – limited to afforestation / reforestation under the CDM The key characteristic of sequestration – subject to ‘reversibility risk’ Also termed ‘non-permanence’ Sequestration – carbon credits are awarded for greenhouse gases that are captured and stored As long as the GHGs remain in storage, the carbon credits have value But storage can be reversed – e.g. forest fires, pests, soil erosion, theft of trees

- 16. Expiring CERs Address the permanence problem Limited temporal validity – essentially carbon ‘leases’ The buyer is essentially deferring his compliance to a future commitment period Lower market price than ‘normal’ CERs Conservative approach Many projects will lead to long-term climate benefits that extend well beyond the project crediting period, but the associated credits expire nonetheless 2 types: temporary CERs (tCERs) long-term CERs (lCERs)

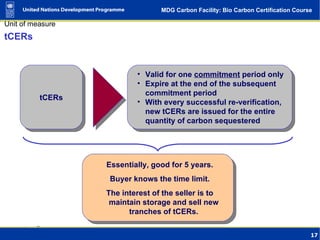

- 17. tCERs tCERs Valid for one commitment period only Expire at the end of the subsequent commitment period With every successful re-verification, new tCERs are issued for the entire quantity of carbon sequestered Essentially, good for 5 years. Buyer knows the time limit. The interest of the seller is to maintain storage and sell new tranches of tCERs.

- 18. lCERs lCERs Only expire at the end of the project’s last crediting period – potential 60-year validity lCERs are issued every 5 years for the net increase in sequestered carbon Theoretically, good for up to 60 years. But must be replaced within 1 month of a reversal being detected. Buyer bears replacement risk.

- 19. tCERs vs lCERs Theoretically, lCERs are more valuable lCERs need only be replaced at the end of the crediting period (potentially 60 years) tCERs are likely to have additional fees and taxes associated with their 5-yearly renewal BUT…the buyer bears replacement risk for lCERs – lCERs come with uncertainty Seller may not wish to be locked-in to a 60-year contract with a buyer

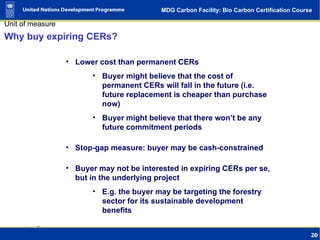

- 20. Why buy expiring CERs? Lower cost than permanent CERs Buyer might believe that the cost of permanent CERs will fall in the future (i.e. future replacement is cheaper than purchase now) Buyer might believe that there won’t be any future commitment periods Stop-gap measure: buyer may be cash-constrained Buyer may not be interested in expiring CERs per se, but in the underlying project E.g. the buyer may be targeting the forestry sector for its sustainable development benefits

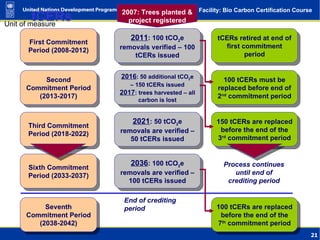

- 21. tCERs First Commitment Period (2008-2012) Second Commitment Period (2013-2017) Third Commitment Period (2018-2022) Sixth Commitment Period (2033-2037) Seventh Commitment Period (2038-2042) End of crediting period 2007: Trees planted & project registered 2011 : 100 tCO 2 e removals verified – 100 tCERs issued tCERs retired at end of first commitment period 2016 : 50 additional tCO 2 e – 150 tCERs issued 2017 : trees harvested – all carbon is lost 100 tCERs must be replaced before end of 2 nd commitment period 2021 : 50 tCO 2 e removals are verified – 50 tCERs issued 150 tCERs are replaced before the end of the 3 rd commitment period 2036 : 100 tCO 2 e removals are verified – 100 tCERs issued Process continues until end of crediting period 100 tCERs are replaced before the end of the 7 th commitment period

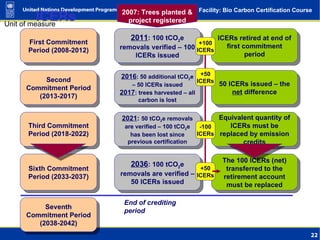

- 22. lCERs First Commitment Period (2008-2012) Second Commitment Period (2013-2017) Third Commitment Period (2018-2022) Sixth Commitment Period (2033-2037) Seventh Commitment Period (2038-2042) End of crediting period 2007: Trees planted & project registered 2011 : 100 tCO 2 e removals verified – 100 lCERs issued lCERs retired at end of first commitment period 2016 : 50 additional tCO 2 e – 50 lCERs issued 2017 : trees harvested – all carbon is lost 50 lCERs issued – the net difference 2021 : 50 tCO 2 e removals are verified – 100 tCO 2 e has been lost since previous certification Equivalent quantity of lCERs must be replaced by emission credits 2036 : 100 tCO 2 e removals are verified – 50 lCERs issued The 100 lCERs (net) transferred to the retirement account must be replaced +100 lCERs +50 lCERs -100 lCERs +50 lCERs

- 23. THANK YOU FOR YOUR KIND ATTENTION

Editor's Notes

- Any commercial deal carries risk, but a deal involving an intangible commodity such as carbon and taking place under a fragile regime like the Kyoto Protocol carries greater uncertainty than most.

- Transfer the legal title: a) upon issuance by CDM Board; b) upon submission of Verification Report; c) upon receipt of payment Warranty: In business and legal transactions, a warranty is an assurance by one party to the other party that certain facts or conditions are true or will happen; the other party is permitted to rely on that assurance and seek some type of remedy if it is not true or followed. A conditions precedent (CP) clause is an advisable and common way to mitigate political and institutional risks accompanying a CDM or JI project. These clauses can take many forms and can even remove all obligations of the parties if the project is not ultimately registered, or is otherwise incapable of generating CERs. Many ERPAs will contain CP clauses that address the risk of non-delivery because of non-operation of the ITL. Force Majeure: in addition to normal clauses, might include CDM specific events, i.e. elated to CDM EB, failure to establish a registry account, ratify Kyoto Protocol, failure or malfunction of the project which prevents generation of CERs (CERSPA) – important when project depends on unpredictable biological circumstance (methane recovery) – all up to negotiation Managing shortfalls: various options, normally minimum delivery guarantee, E.g. if there is a shortfall in CERs of more than 50% of the scheduled delivery (CERUPT) Communication with EB: entities listed as project participants in the PDD have the right to communicate with EB on a number of project related issues, including where to distribute the CERs once they are issued. It is important for the Buyer to have the right to communicate with EB directly and advise on distribution, while most current market templates does not provide for that and leave communication with EB solely with the seller. Payment of costs: ERPA should contain provisions relating to the payment of costs leading to the creation of CERs (monitoring, certification, issuance, other national and international levies): normal practice – seller is responsible for covering these costs, but often a buyer would advnace (MDG Carbon) and then recover these costs from the CER proceeds. Allocation of cost would be reflected in CER price.

- For example: under CERUPT programme, the Dutch Government has an option to make advance payment of up to 50% of the total contract price. Normally advance is available through gov-nt CER purchase programmes (Dutch, WB, Austria) and is accompanied by lower price and requirements for guaranteed delivery

- Fixed price – the simplest and most secure, but doesn’t allow to maximize revenues (particularly in the bulling market) Indexed price – refers to a spot market price (i.e EU ETS) to calculate the unit at certain time (i.e. at the time of delivery). Consequently, unit price will fluctuate and change with every payment. This entails opportunities and risks to both buyer and seller, depending on thr market situation. Key dawnfall is that neither buyer nor seller can calculate the carbon revenue (costs) and the total value of the agreement. Combination – of fixed and indexed price guarantees a minimum price and reduces the impact that spot pirce calculation might have on unit price. Possible to compe up with minimum ERPA value and thus facilitate long-term planning.

- Determining where delivery is to occur is principally influenced by how “delivery” is defined

- LoI: At an early stage of development, the parties generally tend to enter into binding legal relations through a simpler agreement which simply secures an arrangement between the buyer and seller to deal exclusively between themselves of a defined period and gives them sufficient time to perfom due diligence and negotiate the final agreement. LoI may also contain a Term Sheet providing a summary of the major terms that will ultimately be fixed in ERPA. Pre-ERPA commercial negotiations will focus primarily on price, quantity, and timing but should also deal, at least preliminarily, with risk-sharing.

- Broadly speaking, risks fall into two categories: macro and project. Within individual host countries sovereign political and regulatory risk deals with how countries are implementing the project-based mechanisms and how favourable they are to carbon transactions and investment. Most buyers have a very high perception of country and entity risk and price their offer accordingly However, unique to carbon projects is what might be termed “cultural risk”. Almost every emission reduction purchase agreement (ERPA) signed to date has involved at least one party that is a novice to such a deal. The buyer will usually be the more sophisticated player and will often serve the roles both of purchasing the carbon and also of providing basic education about the Kyoto Protocol, and even climate change science.

- One of the major risk management issues in carbon contracting is to ensure the legal ownership of the underlying GHG emission reductions and that such ownership is securely transferred through contractual arrangements

- Often, ERPA would include absolute minimum delivery requirements well below the expected performance of the project so that only delivery failure beyond these shortfalls will be a breach of ERPA. ERPA should also clearly provide for any option rights and the price at which the option will be exercised

- Illustrative example – assumes a 30-year crediting period without renewal. 2016: notice that the 150 tCERs issued in 2016 remain valid during the commitment period in which they are issued – even though the trees are cut down in 2017

- Illustrative example – assumes a 30-year crediting period without renewal. 2021: where the DOE’s certification report indicates a reversal of GHG removals since the previous certification, an equivalent quantity of lCERs must be replaced.