Estonia joins the euro what can we learn

- 1. Free Slides from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/ Estonia Joins the Euro: What Can We Learn? Post prepared June 20, 2010 Terms of Use: These slides are made available under Creative Commons License Attribution—Share Alike 3.0 . You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics , from BVT Publishers.

- 2. Estonia Joins the Euro Estonia, one of the EU’s smallest members, has officially been admitted to the euro area, effective January 1, 2011 What are the advantages and drawbacks of a common currency? What can we learn from Estonia’s decision to join the euro at a time when the common European currency is facing a crisis? Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/ Background: The euro was introduced in electronic form in 1999 and in paper form in 2002 as the common currency of 11 European countries. Since then the euro area has expanded. Estonia will be its 17 th member

- 3. Advantages and Drawbacks of a Common Currency Advantages: A common currency link to a large, stable economy is a proven way to end or avoid extreme inflation ( hyperinflation ) A common currency rate lowers the costs of trade and promotes economic and financial integration Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/ Drawbacks: A country with a shared currency cannot change interest rates or exchange rates to pursue macroeconomic goals With no independent monetary policy, a country with a common currency must take extra care to maintain sound fiscal policy For the most part, these advantages and drawbacks apply equally to countries with a true common currency like the euro and to countries that have their own currency but maintain a fixed exchange rate relative to another currency

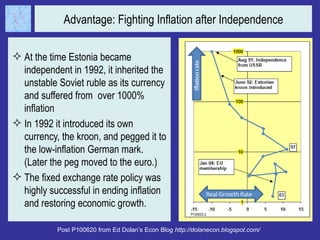

- 4. Advantage: Fighting Inflation after Independence At the time Estonia became independent in 1992, it inherited the unstable Soviet ruble as its currency and suffered from over 1000% inflation In 1992 it introduced its own currency, the kroon, and pegged it to the low-inflation German mark. (Later the peg moved to the euro.) The fixed exchange rate policy was highly successful in ending inflation and restoring economic growth. Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

- 5. Advantage: Economic Integration Until 1991 Estonia was part of the Soviet Union and had limited trade links to Western Europe Thanks in part to its fixed exchange rate policy, Estonia now has strong trade ties with the EU (75 percent of all of its external trade). Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

- 6. Drawback: Inflation Returns after EU Membership The drawbacks of a fixed exchange rate began to be felt during the boom that followed accession to the EU Financial inflows and rapid growth brought a temporary return of inflation and a housing price bubble Under the fixed exchange rate policy, neither monetary tightening nor devaluation could be used to moderate the boom Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

- 7. Drawback: A Hard Landing After the Global Crisis With a fixed exchange rate, Estonia could not use currency depreciation to soften the impact of the global crisis in 2008-09. EU members with fixed exchange rates, like Estonia and Latvia, were hit harder by the crisis than those like Poland and the Czech Republic, which maintained floating exchange rates 2010 is expected to see a start of recovery in all of these countries Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

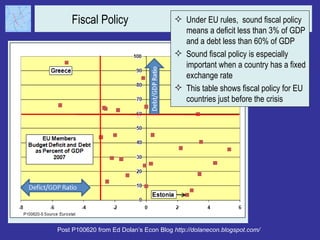

- 8. Fiscal Policy Under EU rules, sound fiscal policy means a deficit less than 3% of GDP and a debt less than 60% of GDP Sound fiscal policy is especially important when a country has a fixed exchange rate This table shows fiscal policy for EU countries just before the crisis Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

- 9. Fiscal Policy Greece vs. Estonia Both Greece and Estonia have fixed exchange rates In both countries, the crisis increased the debt and deficit and required budget cuts In Greece, which started from a terrible budget position, the cuts were catastrophic In Estonia, with much more room to maneuver, the cuts were painful but did not completely disrupt the economy Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/

- 10. What have we learned? Lesson 1: A fixed exchange rate or common currency is an excellent way to fight extreme inflation Lesson 2: The trade-promoting properties of a fixed exchange rate or common currency are especially valuable to a small country that has close trade ties to its currency partners Lesson 3: A fixed exchange rate or common currency makes it more difficult for a country to adjust to external economic shocks Lesson 4: Because a fixed exchange rate or common currency reduces a country’s room to maneuver in a crisis, it is especially important to maintain a sound fiscal policy during good times Post P100620 from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/