Evento Mobilidade 2016 - Tendências do marketing cross device - Armando Rodriguez e Mike Bevans - Yahoo!

- 1. A MOBILE FIRST WORLD T H E S H I F T T O

- 2. A MOBILE FIRST WORLD T H E S H I F T T O

- 3. 3 W H A T ’ S C O V E R E D Rapid Adoption: What are the drivers impacting the pace of smartphone ownership? Factors expediting the shift: How should advertisers and publishers be building for a mobile majority first world? Thinking Beyond Ownership: Now the majority of consumers own a smartphone, but so what? To understand mobile migration patterns and which factors will accelerate the shift to a mobile-first for consumers and advertisers Background

- 4. 4 RAPID ADOPTION PATTERNS H O W S M A R T P H O N E S A R E D I F F E R E N T

- 5. 5

- 6. A D O P T I O N C U R V E F O R M O D E R N C O N V E N I E N C E S 100 50 1900 1915 1930 1945 1960 1975 1990 2005 The adoption curve for modern conveniences has shortened considerably Adoption curve since 1900 Source: Visual Economics TELEPHONE ELECTRICITY AUTO RADIO STOVE CLOTHES DRYER MICROWAVE DISHWASHER COLOR TV CELL PHONE INTERNET VCR FRIDGE CLOTHES WASHER AIR CONDITIONING COMPUTER 6

- 7. 2014 2015 2016 2017 2018 2019 2020 Smartphone ownership reaching majority ownership rates across all major markets 7 Source: eMarketer | 2016 UKUSA BRAZILMEXICO Adoption Rate 50% ADOPTION 87.3% 86.0% 80.0% 63.7% 69.0% ARGENTINA

- 8. The speed of smartphone adoption can be attributed to the multiple products it has replaced 8 Source: eMarketer Report / Press Play: Infographic by Nicolas Rapp / Soure: Appliance, Sept Issue, multiple years REPLACEMENT CYCLES FOR ELECTRONICS PRODUCTS PRODUCT AVG. LIFE (YEARS) Cordless telephone 8 Color TV 8 CD Player 6 Telephone answering machine 6 VCR 5 Camcorder 5 Fax 4 PC 2 Mobile Phones 1 REPLACEMENT TIME

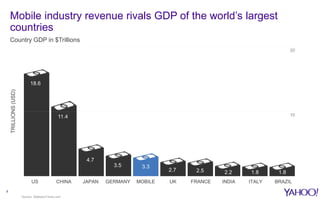

- 9. US CHINA JAPAN GERMANY MOBILE FRANCE UK ITALY RUSSIA Source: BCG, Flurry US CHINA JAPAN GERMANY MOBILE UK FRANCE INDIA ITALY BRAZIL TRILLIONS(USD) 18.6 11.4 4.7 3.5 3.3 2.7 2.5 2.2 1.8 1.8 10 20 Mobile industry revenue rivals GDP of the world’s largest countries Country GDP in $Trillions 9 Source: StatisticsTimes.com

- 10. 10 Developing for larger screens Creating experience for cross-screen, not mobile only Adapting to trends in the app revolution Factors that will expedite the shift to a Smartphone Dominant world

- 11. Developing for larger screens Creating experience for cross-screen, not mobile only Adapting to trends in the app revolution Factors that will expedite the shift to a mobile lead world 11

- 12. What does a Smartphone Dominant consumer look like? 12 MOBILE FIRST. 67% state that their smartphone replaces their PC, & is the main way they access the internet MOBILE LEAD. 75% of their digital time is a mobile device; +50% vs. an average smartphone owner MOBILE IMMERSED. +50% more activities done on a mobile devices vs. an average smartphone owner Users who spend most of their times on their smartphones, and are using them to replace their PC

- 13. 78% It's more efficient to do things on my computer than on my smartphone More efficient, better user experiences will accelerate the shift to Smartphone Dominance Factors that are holding back consumers from being Smartphone Dominant Among Future Smartphone Dominant Users 13 User Experience (easier to type, read, easier to browse/compare) 67% Data & Internet Improvements 54% Better Apps 44%

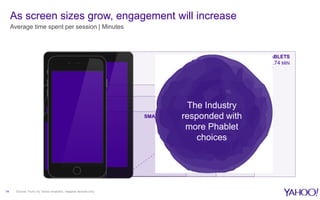

- 14. FULL-SIZE TABLETS 9.74 MIN As screen sizes grow, engagement will increase 14 SMALL TABLETS 6.88 MIN MEDIUM PHONES 4.18 MIN SMALL PHONES 3.8 MIN Average time spent per session | Minutes Source: Flurry by Yahoo Analytics, mapped devices only, The Industry responded with more Phablet choices

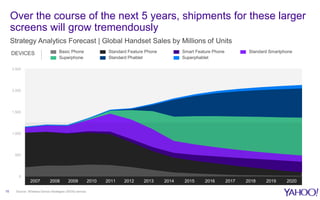

- 15. Over the course of the next 5 years, shipments for these larger screens will grow tremendously Strategy Analytics Forecast | Global Handset Sales by Millions of Units 15 Source: Wireless Device Strategies (WDS) service 0 500 1.000 1.500 2.000 2.500 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 DEVICES Basic Phone Standard Feature Phone Smart Feature Phone Standard Smartphone Superphone Standard Phablet Superphablet

- 16. Developing for larger screens Creating experiences for cross-screen, not mobile only Adapting to trends in the app revolution Factors that will expedite the shift to a mobile lead world 16

- 17. Smartphone Dominant users are more digitally active across PC and Mobile # of Different Activities Done Last Day Used 17 SMARTPHONE DOMINANT USERS # OF ACTIVITIES DONE ON DEVICE CURRENT SD FUTURE SD Smartphone 16 11 Computer 11 14 TOTAL 27 25 +3.5 more than the average smartphone owner

- 18. Smartphone Dominant users want digital experiences to go across devices % Smartphone users agree 18 D4_12. How much do you agree or disagree with the following statements about devices? / Smartphone Dominant In Future (n=2913) “I'm using multiple devices at the same time more often than I did in the past”51% TOTAL 66% CURRENT SD 56% FUTURE SD

- 19. In fact, 2 in 5 smartphone owners go across devices daily to continue the same digital activity In the past day, I continued a digital experience across the following devices 19 42% Will go across devices on at least one digital activity (Among total smartphone users) 42% 28% 23% 16% 15% 14% DEVICE TO DEVICE – CURRENT SMARTPHONE DOMINATE USERS Smartphone to Computer Computer to Smartphone Smartphone to Tablet Tablet to Computer Computer to Tablet Tablet to Smartphone

- 20. Communication, content & search related activities currently span across devices most Sequential Experience Activities For Any Device – Mobile, Tablet & PC Among those who had a sequential activity 20 PHOTOS 29% ONLINE VIDEO 35% SOCIAL NETWORK 44% EMAIL 59% SEARCH 42% CONTENT 48% PHOTOS 29% ONLINE VIDEO 35% SOCIAL NETWORK 44% EMAIL 59% SEARCH 42% CONTENT 48% OTHER MENTIONS Banking 29% Shopping 29% Playing games 28% Streaming music/radio 26% Using an IM or a texting app 26% Work/school 20% Finding directions/using GPS 20%

- 21. Developing for larger screens Recognizing that it’s cross screen, not mobile only Adapting to trends in the app revolution Factors that will expedite the shift to a mobile lead world 21

- 22. 45% 49% 57% 60% 48% 55% I strongly prefer apps over mobile websites All mobile websites should deliver an app-like experience It’s clear that apps have won! I agree with the following statements 22 Current SDTotal Future SDSmartphone Users In fact, 88% of digital time spent is spent on apps as opposed to WAP Source: Flurry, ComScore, NetMarketShare

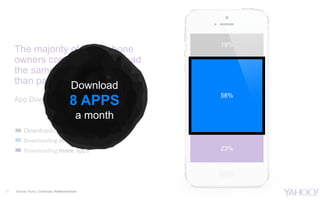

- 23. The majority of smartphone owners continue to download the same number of apps than past years App Downloads vs. A Year Ago 23 Downloading about the same Downloading fewer apps Downloading more apps 23% 58% 19% Download 8 APPS a month Source: Flurry, ComScore, NetMarketShare

- 24. Saw an ad about it 39% I need it for a specific task 53% Task-based apps and replacing an existing app are top reasons users download new apps 24 Replace an existing app 49% Read about in an article 39% Friend told me about it 41% How did you hear about these apps | Among Actively Downloading Motivations to download apps | Among Total

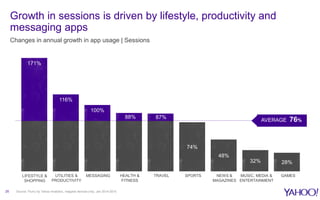

- 25. Growth in sessions is driven by lifestyle, productivity and messaging apps Changes in annual growth in app usage | Sessions 25 74% 48% 32% 28% 171% 116% 100% 88% 87% LIFESTYLE & SHOPPING AVERAGE 76% UTILITIES & PRODUCTIVITY MESSAGING HEALTH & FITNESS TRAVEL SPORTS NEWS & MAGAZINES MUSIC, MEDIA & ENTERTAINMENT GAMES Source: Flurry by Yahoo Analytics, mapped devices only, Jan 2014-2015

- 26. However, what will move media experiences even further is phablet ownership 26 30% 53% 29% 158% 144% 130% SPORTS NEWS & MAGAZINES MUSIC, MEDIA & ENTERTAINMENT PhabletsAll device types% Growth in category usage % over index 427% 172% 255% Source: Flurry by Yahoo Analytics, mapped devices only, Jan 2014-2015

- 27. IMPLICATIONS FOR ADVERTISERS S M A R T P H O N E S H I F T

- 28. VIEWING HABITS HAVE SHIFTED GROWTH YOY 25% GROWTH YOY 13% DECLINE YOY 3% 28

- 29. Yahoo 2016 Confidential & Proprietary. DIGITAL IS THE NEW BLACK MILLENNIALS ARE CUTTING THE CORD of Millennials have replaced TV within digital sites and apps 58% AND ARE MORE DISTRACTED THAN EVER of the time a consumer viewed an ad on TV, their attention was diverted to another digital device 57% 29

- 30. Deep fragmentation of audiences THE RESULT 30

- 31. Digital Trends in Brazil (2020) Source: eMarketer, March & September, 2016 11.3M New Internet users (~80% penetration) 25.2M Additional Smartphones (64% penetration) $1.7B Increase in Digital Spend ($4.7B) 72% Mobile ad spend / Total digital spend ($3.4B) 31

- 32. DATA The new currency: a medium of exchange with great value for consumers and marketers 32

- 34. © 2016 BRIGHTROLL ALL RIGHTS RESERVED. CONFIDENTIAL AND PROPRIETARY. Technology to help you reach audiences at scale both on and off Yahoo. TECHNOLOGY Deep data from the most complete set of signals, including sources like mail, search, content, mobile app usage and social. DATA Leading news, sports, finance and lifestyle properties for brand building and content marketing. CONTENT Yahoo offers personalized messages at scale… 34

- 35. GLOBAL USERS 1B 165B 2.7BDAILY ACTIVITES MOBILE DEVICES EMAIL SEARCH CONTENT CONSUMPTION MOBILE APP USAGE REGISTRATION / DEMO By combining insights from multiple signals and platforms 35

- 36. © 2016 BRIGHTROLL ALL RIGHTS RESERVED. CONFIDENTIAL AND PROPRIETARY. GLOBAL USERS 1B 165B DAILY ACTIVITES 2.7B MOBILE DEVICES USER REGISTRATION / DEMO EMAIL MOBILE SEARCH CONTENT CONSUMPTION NATIVE CROSS-DEVICE VIDEO DISPLAY Advertiser data Third party data 36

- 37. Yahoo Native Ads Native Ad Specs CREATIVE ASSETS MP41200X627 627X627 Ad Title, Description, Landing Page Native: engaging and effective ad format 37 na·tive ad·ver·tis·ing n. A form of paid media where the ad experience follows the natural form and function of the user experience in which it is placed.

- 38. Identity and creative execution are key for driving Mobile growth 38

- 39. 39 TAKEAWAYS MORE SPACE When building a mobile strategy, companies should account for the rapid adoption of larger phablet devices. More screen space = more ways to connect with your user. Native ad formats account for this size naturally and beautifully. INTEGRATED MOBILE BUDGETS Mobile ad budgets should not be thought in isolation. With 2 in 5 consumers crossing devices daily, siloed mobile budgets should evolve to larger cross-device buys. Native advertising, that runs specifically on responsive design, is a must-buy that creates that efficiency and ease for marketers. DATA CREATES OPPORTUNITIES Data has become a fundamental tool for marketers, helping with improving insights, targeting, and ability to measure results, and inspiring more relevant and valuable creative. MEDIA PARTNER IS NOW YOUR DATA PARTNER Yahoo collects 165B signals each day. Combining Yahoo’s data with advertiser and 3rd party data allows for superior targeting at scale.

- 40. THANK YOU

- 41. IAB BRASIL DATA DRIVEN MARKETING IN A DEVICE AGNOSTIC WORLD

- 42. DATA 42

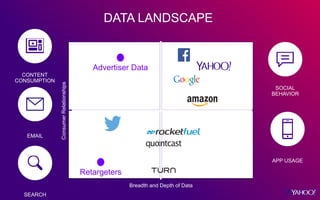

- 44. ConsumerRelationships Breadth and Depth of Data Advertiser Data Retargeters APP USAGE SOCIAL BEHAVIOR CONTENT CONSUMPTION SEARCH EMAIL DATA LANDSCAPE

- 45. Market Scarcity Performance Purchase Search CRM Website Visits Brand Followers Demo Geo Country Techno Interests Location Lifestage DIGITAL MARKETING THRIVES ON SPECIFICITY Lifestyle Travel Plans

- 46. 46Source: Online SurveyYahoo 2016. Confidential & Proprietary. Territories occupied by different screens based on correspondence mapping PASSIVE ACTIVE FUNCTIONAL Note: this is a largely consistent picture among younger 16-24 year old and older 25-44 year old age groups Engaging Comforting Entertaining Convenient Personal Supportive Trustworthy Informative EMOTIVE Consumer Behaviour Across Multiple Devices

- 47. Most Favourable Screen for Commercial Activities 47Yahoo 2016. Confidential & Proprietary. Which screen is most suitable for ? Source: Online Survey Researching a city break 35% 18% Booking tickets for an event 33% 19% Watching a branded content film 28% 22% Sharing event experiences 47% 18% Retail rewards 48% 10%

- 48. Consumers want to interact with brands 48Source: Depth Interviews Open to commercial momentsClosed to commercial moments Yahoo 2016. Confidential & Proprietary. Shopping Travelling Exercising Socialising Relaxing

- 49. THE FUTURE OF DIGITAL MARKETING IS AUDIENCE CENTRIC, DEVICE AND FORMAT AGNOSTIC 49

- 50. Deep and Unique Audience Insights Engaging Formats Across Devices Audience Centric Approach Millions of users mapped to more than one device

- 53. Incomplete measurement across platforms and devices Difficulty in tying online campaigns to offline sales Need to measure user engagement beyond the click 33% of marketers fear omni-channel approaches Challenges for Marketers Need to connect the dots

- 54. Yahoo’s Approach to Measurement A set of simple and turn-key measurement solutions across channels and devices 54 SCALABLE OPEN ACTIONABLE Ability to use your preferred partner through our third- party measurement partnerships. A holistic view into how your campaigns are working so you can optimize ROI.

- 55. Measuring Marketing Impact Offline Sales/ Behavior Online Behavior Brand Impact Verification • Offline Purchase • Offline Spend • Store Visits • Engagement with Ads • Clicks • Conversions/Actions • App Installs • Conversion Value • Search Lift • Awareness • Favorability • Intent • Recommendation • Reach & Frequency Audience Composition - Viewability - Fraud - Brand Safety 55

- 56. Campaign Report 56 Holistic campaign wrap-up for online campaign metrics and performance BENEFITS • View campaign overview, trends, search lift, target audience, cross-device attribution, reach and frequency analysis all in one dashboard • Optimize campaign tactics including audience targeting, frequency and cross-device media mix • Inform future marketing strategy

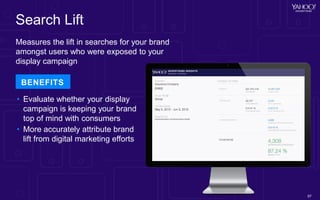

- 57. Search Lift 57 Measures the lift in searches for your brand amongst users who were exposed to your display campaign BENEFITS • Evaluate whether your display campaign is keeping your brand top of mind with consumers • More accurately attribute brand lift from digital marketing efforts

- 58. Yahoo Synergy 58 A cross-channel analytics solution that provides a unified view of your marketing campaigns BENEFITS Learn to: • Measure the impact of one marketing strategy on another • See how low-funnel and branding campaigns work in conjunction • Optimize media mix

- 59. Cross Device Report 59 Enables conversion attribution regardless of the devices where the ads were served BENEFITS • Gain visibility and understand the impact of post-click and post-view conversions across devices • Optimize media spend across channels

- 60. Case Study Cross Device Targeting 0,00% 0,10% 0,20% 0,30% 0,40% PC+Mobile+Tablet PC+Mobile Any Cross-Screen Mobile+Tablet PC+Tablet PC Only 88% Lift CONVERSIONRATE

- 61. Viewability Measurement 61 Across all ad formats and Yahoo ad platforms BENEFITS • Better performance (more brand exposure) • Better analysis (improved attribution modeling and cross media measurement) • Increased transparency

- 62. Audience Verification 62 Yahoo allows advertisers to use their preferred measurement vendor to verify: • Audience composition • Viewability • Fraud • Brand safety BENEFITS Advertisers can be confident that campaigns were viewed by their intended target on the right sites. PARTNERS INCLUDE

- 63. Brand Effectiveness Study 63 Automated turn-key solution to measure brand and behavioral impact of campaigns using control/exposed methodology BENEFITS Measure lift in: • Brand awareness • Brand favorability • Consideration • Purchase intent • Branded search • Site visitation PARTNERS INCLUDE

- 64. Your referee shouldn’t also be playing the game. “ “ Importance of Independent Measurement

- 65. 3 Questions Every Advertiser Should Ask 1 Are you able to measure my campaigns across platforms and devices? 2 Are you able to measure offline sales impact of my campaigns? 3 Do you allow third-party measurement for my campaigns?

- 66. THE FUTURE OF DIGITAL MARKETING IS AUDIENCE CENTRIC, DEVICE AND FORMAT AGNOSTIC 66

- 67. THANK YOU