FDI

- 1. ~ SANDESH GHOSAL IIPM AHMEDABAD 09-11 1

- 2. FDI - Meaning Factors Attracting FDI Advantages & Disadvantages Difference between FDI & FII Contribution of Countries – FDI FDI – INDIA Inflation Rate, GDP, Trade Balance, Forex Reserves IIPM AHMEDABAD 09-11 2

- 3. Direct Investments in productive assets by company incorporated in foreign country Investments in shares of local company by foreign entities An important feature of an globalized economic system Example: An Chinese company taking major stake in A m e r i c a n o r I n d i a n c o m p a n y. IIPM AHMEDABAD 09-11 3

- 4. Av a i l a b i l i t y o f r a w m a t e r i a l s & r e s o u r c e s Cheap labor Large Domestic Market Policy Liberalization – easy entry & exit Rapid technical progress Low transaction cost – interest rates, royalties & fees, f u n d t r a n s f e r, e t c . Friendly political support New Managerial & organizational techniques Political Stability IIPM AHMEDABAD 09-11 4

- 5. A D VA N TA G E S Helps in the improvement of economic development Permits transfer of latest technology & knowledge transfer Develop human capital resources Creates jobs Boosts wages & salaries of employees Rise in productivity Borrow finance at lesser rate of interest Opportunities in trade of good & services IIPM AHMEDABAD 09-11 5

- 6. D I S - A D VA N TA G E S Occur mostly in matters of operation & distribution of profits. More expensive & risky than exporting and licensing Te c h n o l o g y d e p e n d e n c e Disturbance of Domestic Economic plans Cultural Change May entail high travel & communication expenses Chances of loosing ownership to an overseas company Instability in geographical region IIPM AHMEDABAD 09-11 6

- 7. FDI FII Investment that parent company Investment made by an investor makes in foreign country in the markets of foreign nation Invest in foreign nation Need to get register in the stock exchange to make investments Cannot enter & exit easily Enter the stock market easily & withdraw if easily Aims to increase the enterprise Investment flows into the capacity or productivity or its secondary market. Helps in management control increasing capital Flows into primary market Flows into secondary market Brings capital as well as good Does not come out with great governance & better management benefits in spite of good skills governance Long term investments Short term investments IIPM AHMEDABAD 09-11 7

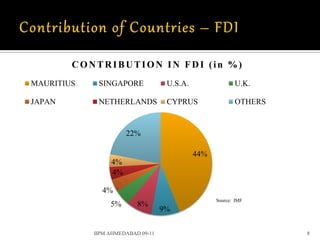

- 8. CONTRIBUTION IN FDI (in %) MAURITIUS SINGAPORE U.S.A. U.K. JAPAN NETHERLANDS CYPRUS OTHERS 22% 44% 4% 4% 4% Source: IMF 5% 8% 9% IIPM AHMEDABAD 09-11 8

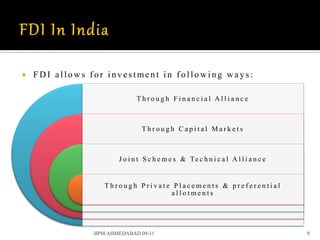

- 9. FDI allows for investment in following ways: Through Financial Alliance Through Capital Markets J o i n t S c h e m e s & Te c h n i c a l A l l i a n c e Through Private Placements & preferential allotments IIPM AHMEDABAD 09-11 9

- 10. Automatic Route Government Control Requires prior Does not require Government any prior approval & approval from considered by RBI FIPB Required to notify Regional Decision within office of RBI 4-6 weeks within 30 days of receipt inward IIPM AHMEDABAD 09-11 10

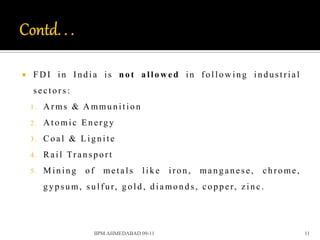

- 11. FDI in India is not allowed in following industrial sectors: 1. Arms & Ammunition 2. Atomic Energy 3. Coal & Lignite 4. Ra il Tr a n s p o rt 5. Mining of metals like iron, manganese, chrome, g y p s u m, s u l f u r, g o l d , d i a mo n d s , c o p p e r, z i n c . IIPM AHMEDABAD 09-11 11

- 12. FDI IN DIFFERENT SECTORS OF INDIA SECTOR FDI ALLOWED ROUTE H o t e l & To u r i s m 100% Automatic Insurance 26% (license from Automatic IRDA) Te l e c o m m u n i c a t i o n • Basic, Cellular, 49% Automatic VA S , communication through Satellite • ISPs, Radio paging 74% Automatic IIPM AHMEDABAD 09-11 12

- 13. FDI IN DIFFERENT SECTORS OF INDIA SECTOR FDI ALLOWED ROUTE Tr a d i n g – b u l k 100% Automatic imports, exports, cash & Carry whole sale trading Power (other than 100% Automatic atomic plants) Drugs & 100% Automatic Pharmaceuticals (Manufacture) Roads, Highways, 100% Automatic Ports & Harbours Pollution Control & 100% Automatic Management IIPM AHMEDABAD 09-11 13

- 14. FDI IN DIFFERENT SECTORS OF INDIA SECTOR FDI ALLOWED ROUTE BPO 100% Automatic C i v i l Av i a t i o n 74% Automatic Air Craft 100% Maintenance & repair operations Commodity 26% Exchanges IIPM AHMEDABAD 09-11 14

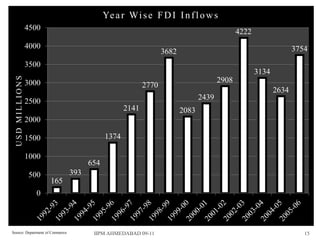

- 15. Ye a r Wi s e F D I I n f l o w s 4500 4222 4000 3754 3682 3500 3134 USD MILLIONS 3000 2908 2770 2634 2439 2500 2141 2083 2000 1500 1374 1000 654 500 393 165 0 Source: Department of Commerce IIPM AHMEDABAD 09-11 15

- 16. CURRENCY PRICES IIPM AHMEDABAD 09-11 16

- 17. Inflation Rate – Consumer Prices 9 8.3 8 7 6.7 6.4 6 5.4 5.4 5.4 5.3 5 4.2 4.2 4 3.8 Inflation Rate 3 2 1 Source: CIA World Fact Book 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 IIPM AHMEDABAD 09-11 17

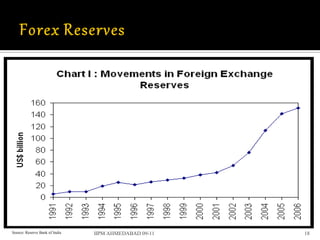

- 18. Source: Reserve Bank of India IIPM AHMEDABAD 09-11 18

- 19. Ye a r Forex Reserves Amount ( in US $ million) December 2007 272,722 December 2008 254,052 December 2009 283,643 April 2010 279,476 Source: Reserve Bank of India IIPM AHMEDABAD 09-11 19

- 20. Amount in US $ Millions 0 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 -8201.79 -20000 -13276.75 -27981.5 -40000 -46075.19 -60000 -80000 -100000 -95418 -120000 -114721 -140000 Source: Department of Commerce IIPM AHMEDABAD 09-11 20

- 21. G D P G R O W T H R AT E 12 10 9.7 9.2 8 7.7 7.2 6 4 2 0 2010 2009 2008 2007 Source: India Central Statistical Organization IIPM AHMEDABAD 09-11 21

- 22. Country Total Trade Trade Balance China PRP 163,202 -92,676 USA 155,353 12,254 United Arab Emirates 152,668 -1934 Saudi Arabia 105,602 -64303 Germany 67,602 -19497 Singapore 63,280 2934 UK 50114 524 Hong Kong 50,129 1772 Belgium 41552 -5294 Netherland 33099 19049 Source: Federal Ministry of Commerce, Government of India IIPM AHMEDABAD 09-11 22

- 23. IIPM AHMEDABAD 09-11 23