Financial Management

- 1. The maintenance and creation of economic value or wealth. Financial Management

- 2. Financial Management It measures and reports financial and nonfinancial information that helps managers make decisions to fulfill the goals of an organization.

- 3. 1) Profit Maximization? This Goal Ignores: a) Timing of Returns b) Uncertainty of Returns Goal of the Firm

- 4. 2) Shareholder Wealth Maximization? this is the same as: a) Maximizing Firm Value b) Maximizing Stock Price Goal of the Firm

- 5. OBJECTIVES OF FINANCIAL MANAGEMENT Relevant To Making Decisions Types Of Decisions Operating Investing Financing

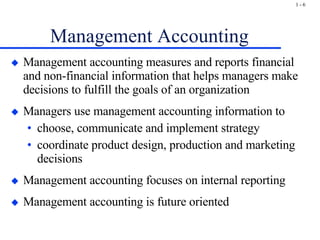

- 6. Management Accounting Management accounting measures and reports financial and non-financial information that helps managers make decisions to fulfill the goals of an organization Managers use management accounting information to choose, communicate and implement strategy coordinate product design, production and marketing decisions Management accounting focuses on internal reporting Management accounting is future oriented

- 7. Functions of Management Accounting Management accountants perform three functions Attention-directing--make visible opportunities and problems on which managers need to focus Problem-solving--conduct comparative analysis to identify the best alternatives in relation to the organization’s goals Page 11 Scorekeeping-- accumulate data and report reliable results to all levels of management

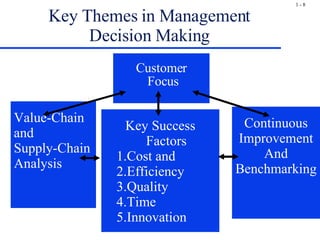

- 8. Key Themes in Management Decision Making Customer Focus Key Success Factors 1.Cost and 2.Efficiency 3.Quality 4.Time 5.Innovation Continuous Improvement And Benchmarking Value-Chain and Supply-Chain Analysis

- 9. Financial and Management Accounting The primary questions about an organization’s success that decision makers want to know are: What is the financial picture of the organization on a given day? How well did the organization do during a given period?

- 10. Financial and Management Accounting Accountants answer these primary questions with three major financial statements. Balance sheet – shows financial picture on a given day Income statement – shows performance over a given period Statement of cash flows – shows performance over a given period

- 11. Financial and Management Accounting Annual report - a document prepared by management and distributed to current and potential investors to inform them about the company’s past performance and future prospects The annual report is one of the most common sources of financial information used by investors and managers.

- 12. Financial and Management Accounting 1. The major distinction between financial and management accounting is the users of the information. Financial accounting serves external users, such as investors, creditors, and suppliers. Management accounting serves internal users, such as top executives, management, and administrators within organizations.

- 13. Management Accounting and Financial Accounting Help managers plan and control business operations Help investors, creditors, and others make investment, credit, and other decisions 2. Purpose of Information

- 14. Management Accounting and Financial Accounting Relevance Reliability, objectivity, and focus on the past 3. Focus and Time Dimension

- 15. Management Accounting and Financial Accounting Internal reports not restricted by GAAP Financial statements restricted by GAAP 4. Type of Report

- 16. Management Accounting and Financial Accounting No independent audit Annual independent audit 5.Verification

- 17. Management Accounting and Financial Accounting Detailed reports on parts of the company Summary reports primarily on the company as a whole 6.Scope of Information

- 18. Management Accounting and Financial Accounting Concern about how reports will affect employees behavior Concern about adequacy of disclosure 7.Behavioral Implications

- 20. Fund Flow Statement FFS is a method to study changes in the financial position of a business enterprise between beginning and ending financial statements dates. IT is a statement showing sources and uses of funds for a period of Time. Anthony “ The fund flow statement describes the sources from which additional funds were derived and the use to which these sources were put.”

- 21. A summary of a firm’s changes in financial position from one period to another; it is also called a sources and uses of funds statement or a statement of changes in financial position . Fund Flow Statement

- 22. Fund means working capital i.e. excess of current assets over current liabilities. Flow means movement and includes both inflow and outflow of working capital. Fund Flow Statement

- 23. Includes important noncash transactions while the cash flow statement does not. Is easy to prepare and often preferred by managers for analysis purposes over the more complex cash flow statement. Helps you to better understand the cash flow statement, especially if it is prepared under the “indirect method.” Fund Flow Statement

- 24. Uses of Fund Flow Statement It helps in the analysis of financial operations It throws light on many perplexing questions of general interest It helps in the formation of a realistic dividend policy It helps in the proper allocation of resources It acts as a future guide It helps in appraising the use of working capital It helps knowing the overall creditworthiness of a firm

- 25. Current Assets: Cash in hand Cash at bank Bills Receivable Sundry Debtors Temp. Investments Stocks/Inventories Prepaid Expenses Accrued Incomes Total Current Assets Current Liabilities: Bills Payable Sundry Creditors Outstanding Expenses Bank Overdraft Short-term Expenses Dividends Payable Proposed dividends Provision for taxation Total Current Liabilities Working Capital(CA-CL) Net increase or decrease in working capital Effect of working Capital Increase Decrease Current Year Previous Year Particulars Statement of schedule of changes in working capital

- 26. SOURCES AND APPLICATIONS OF FUNDS SOURCES APPLICATIONS Funds from operations Funds lost in operations Issue of Share Capital Redemption of Preference Share Capital Issue of Debentures and Repayment of Long-term Loans Raising of Long-term Loans and Redemption of debentures Sales of Non-Current Assets Purchase of Non-current Assets Non-trading Receipts Payment of Dividend and tax Decrease in Working capital Non-Trading Payments

- 27. Cash Flow Statement

- 28. Introduction to Statement of Cash Flows The statement of cash flows gives a direct picture of where cash came from and where cash went. Preparation of the statement of cash flows List the activities that increased (inflow) or decreased (outflow) cash. Place each inflow or outflow into the proper categories.

- 29. Introduction to Statement of Cash Flows The statement of cash flows provides a thorough explanation of the changes that occurred in a firm’s cash balance during the entire accounting period. The statement of cash flows reports cash receipts and payments of a company during a given period for operating, financing, and investing activities. “Cash” includes cash and cash equivalents.

- 30. Introduction to Statement of Cash Flows Income does not measure an entity’s performance in generating cash, especially if the income is measured using the accrual basis. In a way, accountants use both the accrual and cash bases. The accrual basis is used in the income statement. The cash basis is used in the statement of cash flows.

- 31. Introduction to Statement of Cash Flows Statement of cash flows - reports the cash receipts and cash payments of an entity during a particular period It summarizes activity over a period of time, so it must be labeled with the exact period covered. It details the changes in the cash account, much like the income statement which shows changes in retained earnings.

- 32. CASH AND CASH EQUIVALENTS Generally items that are cash or can be converted into cash within 90 days or less Cash on hand, cash in bank, certificates of deposit, money market funds, Treasury notes

- 33. Purposes of Cash Flow Statement Statement of cash flows. shows the relationship of net income to changes in cash balances. It reports past cash flows as an aid to: Predicting future cash flows Evaluating the way management generates and uses cash Determining a company’s ability to pay interest and dividends and to pay debts when they are due It identifies changes in the mix of productive assets.

- 34. Purposes of Cash Flow Statement The statement of cash flows, along with the income statement, explains why balance sheet items have changed during the period. The balance sheet shows the status of a company at a point in time. The statement of cash flows and the income statement show the performance of a company over a period of time. December 2003

- 35. Purposes of Cash Flow Statement The relationship among the balance sheet, income statement, and statement of cash flows: Balance Sheet December 31, 20X3 Balance Sheet December 31, 20X2 Income Statement Statement of Cash Flows

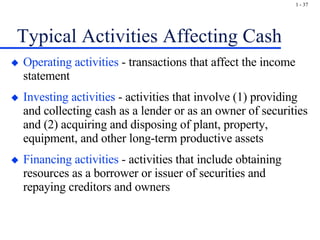

- 36. Typical Activities Affecting Cash Cash is affected by two primary areas of a firm. Operating management - largely concerned with the major day-to-day activities that generate revenues and expenses Financial management - largely concerned with where to get cash and how to use cash for the benefit of the entity

- 37. Typical Activities Affecting Cash Operating activities - transactions that affect the income statement Investing activities - activities that involve (1) providing and collecting cash as a lender or as an owner of securities and (2) acquiring and disposing of plant, property, equipment, and other long-term productive assets Financing activities - activities that include obtaining resources as a borrower or issuer of securities and repaying creditors and owners

- 38. OPERATING ACTIVITIES SALES (MARKETING) MANUFACTURING PURCHASING ADMINISTRATION COMPLIANCE WITH GOVERNMENT REGULATIONS

- 39. INVESTING ACTIVITIES PURCHASE AND SALE OF PROPERTY, PLANT, AND EQUIPMENT PURCHASE AND SALE OF STOCK OF OTHER COMPANIES

- 40. FINANCING ACTIVITIES ISSUING AND REPURCHASING OF A FIRM’S OWN STOCK BORROWING AND REPAYMENT OF LOANS PAYMENT OF DIVIDENDS

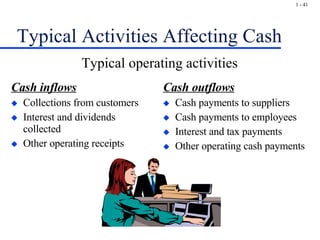

- 41. Typical Activities Affecting Cash Cash inflows Collections from customers Interest and dividends collected Other operating receipts Cash outflows Cash payments to suppliers Cash payments to employees Interest and tax payments Other operating cash payments Typical operating activities

- 42. Typical Activities Affecting Cash Cash inflows Sale of property, plant, and equipment Sale of securities that are not cash equivalents Receipt of loan repayments Cash outflows Purchase of property, plant, and equipment Purchase of securities that are not cash equivalents Making loans Typical investing activities

- 43. Typical Activities Affecting Cash Cash inflows Borrowing cash from creditors Issuing equity securities Issuing debt securities Cash outflows Repayment of amounts borrowed Repurchase of equity shares (including treasury stock) Payment of dividends Typical financing activities

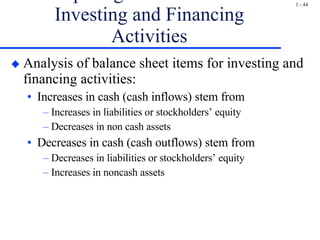

- 44. Computing Cash Flows from Investing and Financing Activities Analysis of balance sheet items for investing and financing activities: Increases in cash (cash inflows) stem from Increases in liabilities or stockholders’ equity Decreases in non cash assets Decreases in cash (cash outflows) stem from Decreases in liabilities or stockholders’ equity Increases in noncash assets

- 45. Computing Cash Flows from Investing and Financing Activities Changes in fixed assets can usually be explained by: Assets acquired Asset dispositions Depreciation Increase in net plant assets = Acquisitions - Disposals - Depreciation

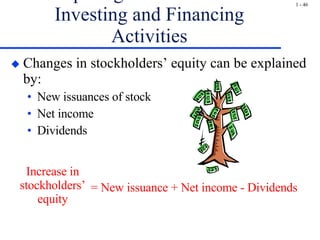

- 46. Computing Cash Flows from Investing and Financing Activities Changes in stockholders’ equity can be explained by: New issuances of stock Net income Dividends Increase in stockholders’ equity = New issuance + Net income - Dividends

- 47. Approaches to Calculating the Cash Flow from Operating Activities Two approaches may be used to compute cash flow from operating activities . Direct method - the method that calculates net cash provided by operating activities as collections minus operating distributions Indirect method - the method that adjusts the accrual net income to reflect only cash receipts and outlays Under either method, the final cash flow from operating activities will be the same.

- 48. Approaches to Calculating the Cash Flow from Operating Activities Under the direct method, income statement amounts are adjusted for changes in related asset and liability accounts. Each revenue and expense account calculated under the accrual method is adjusted to reflect the actual cash paid or received. Under the indirect method, accrual net income is adjusted to reflect only cash transactions.

- 49. Approaches to Calculating the Cash Flow from Operating Activities The FASB prefers the direct method because it shows operating cash receipts and payments in a way that is easy for investors to understand. The indirect method is more common because many people are used to thinking in terms of net income.

- 50. Transactions Affecting Cash Flows from All Sources Effects of operating transactions on cash: Sales of goods and services for cash + Sales of goods and services on credit 0 Receive dividends or interest + Collection of accounts receivable + Recognize cost of goods sold 0 Purchase inventory for cash - Purchase inventory on credit 0 Pay trade accounts payable - “ 0” denotes that the transaction has no effect on cash.

- 51. Transactions Affecting Cash Flows from All Sources Effects of operating transactions on cash: Accrue operating expenses 0 Pay operating expenses - Accrue taxes 0 Pay taxes - Accrue interest 0 Pay interest - Prepay expenses for cash - Write off prepaid expenses 0 Charge depreciation or amortization 0 “ 0” denotes that the transaction has no effect on cash.

- 52. Transactions Affecting Cash Flows from All Sources Effects of investing activities on cash: Purchase fixed assets for cash - Purchase fixed assets by issuing debt 0 Sell fixed assets + Purchase securities that are not cash equivalents - Sell securities that are not cash equivalents + Make a loan - “ 0” denotes that the transaction has no effect on cash.

- 53. Transactions Affecting Cash Flows from All Sources Effects of financing transactions on cash: Increase long-term or short-term debt + Reduce long-term or short-term debt - Sell common or preferred shares + Repurchase or retire common or preferred shares - Purchase treasury stock - Pay dividends - Convert debt to common stock 0 Reclassify long-term debt to short-term debt 0 “ 0” denotes that the transaction has no effect on cash.

- 54. A Detailed Example of the Direct Method ECO-BAG COMPANY Balance Sheet (in thousands) December 31, 20X3 and 20X2 Current assets: Current liabilities: Cash Rs 16 Rs 25 Accounts payable Rs 74 Rs 6 Accounts receivable 45 25 Wages and salaries payable 25 4 Inventory 100 60 Total current assets Rs161 Rs110 Total current liabilities 99 10 Fixed assets, gross 581 330 Long-term debt 125 5 Accum. depreciation (101 ) (110 ) Stockholders’ equity 417 315 Net 480 220 Total liabilities and Total assets Rs641 Rs330 stockholders’ equity Rs641 Rs330 ======== ======== ======== ========

- 55. A Detailed Example of the Direct Method ECO-BAG COMPANY Statement of Income (in thousands) for the Year Ended December 31, 20X3 Sales Rs200 Costs and expenses: Cost of goods sold Rs100 Wages and salaries 36 Depreciation 17 Interest 4 Total costs and expenses 157 Income before income taxes 43 Income taxes 20 Net income Rs 23 ========

- 56. A Detailed Example of the Direct Method ECO-BAG COMPANY Statement of Cash Flows (in thousands) for the Year Ended December 31, 20X3 CASH FLOWS FROM OPERATING ACTIVITIES: Cash collections from customers Rs 180 Cash payments: To suppliers Rs 72 To employees 15 For interest 4 For taxes 20 Total cash payments (111 ) Net cash provided by operating activities Rs 69

- 57. A Detailed Example of the Direct Method ECO-BAG COMPANY Statement of Cash Flows (in thousands) for the Year Ended December 31, 20X3 (continued) CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of fixed assets Rs(287) Proceeds from sale of fixed assets 10 Net cash used by investing activities (277)

- 58. A Detailed Example of the Direct Method ECO-BAG COMPANY Statement of Cash Flows (in thousands) for the Year Ended December 31, 20X3 ( continued) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issue of long-term debt Rs120 Proceeds from issue of common stock 98 Dividends paid (19) Net cash provided by financing activities 199 Net decrease in cash (9) Cash, December 31, 20X2 25 Cash, December 31, 20X3 Rs 16 ========

- 59. A Detailed Example of the Direct Method The first step in developing the statement of cash flows is to compute the amount of the change in cash from the beginning to the end of the period. This calculation is often included at the bottom of the statement. The net change is added to the beginning balance to compute the ending balance.

- 60. A Detailed Example of the Direct Method In this example, cash decreases by Rs9,000. Operating activities contribute Rs69,000 cash during the period. Investing activities use Rs277,000 cash during the period. Financing activities contribute Rs199,000 cash during the period. This example shows how a firm may have net income but still have a decline in cash.

- 61. Computing Cash Flows from Operating Activities Collections from sales to customers are usually the largest source of operating cash inflows. Disbursements for purchases of goods to be sold and operating expenses are usually the largest sources of operating cash outflows. Operating cash inflows minus operating cash outflows equals the net cash provided by (or used by) operating activities.

- 62. Working from Income Statement Amounts to Cash Amounts Accountants often compute collections and other operating cash flow items from figures in the income statement. Many accountants use the balance sheet along with additional information and familiarity with the causes of certain changes in balance sheet amounts to compute the cash flow items. However, many accounting systems are not capable of providing detailed information needed for that method.

- 63. Working from Income Statement Amounts to Cash Amounts In our example, Rs180,000 was collected from customers. That amount is determined as follows: Sales Rs200,000 Beginning accounts receivable 25,000 Potential collections Rs225,000 Ending accounts receivable 45,000 Cash collections from customers Rs180,000 =============== or Sales Rs200,000 Decrease (increase) in accounts receivable (20,000 ) Cash collections from customers Rs180,000 =============== Note that the increase in A/R means that sales > collections.

- 64. Working from Income Statement Amounts to Cash Amounts The difference between cost of goods sold and cash payments to suppliers can be determined by looking at inventory and accounts payable. Ending inventory Rs100,000 Cost of goods sold 100,000 Inventory to account for Rs200,000 Beginning inventory (60,000 ) Purchases of inventory Rs140,000 =============== Beginning trade accounts payable Rs 6,000 Purchases of inventory 140,000 Total amount to be paid in cash Rs146,000 Ending trade accounts payable (74,000 ) Accounts paid in cash Rs 72,000 ===============

- 65. Working from Income Statement Amounts to Cash Amounts The effects of inventory and accounts payable on the previous slide can be combined into one calculation as follows: Cost of goods sold Rs1,00,000 Increase (decrease) in inventory 40,000 Decrease (increase) in trade accounts payable (68,000 ) Payments to suppliers Rs 72 ,000 ===============

- 66. Working from Income Statement Amounts to Cash Amounts Cash payments to employees can be determined by examining wages and salaries payable. Beginning wages and salaries payable Rs 4,000 Wages and salaries expense 36,000 Total to be paid in cash Rs 40,000 Ending wages and salaries payable (25,000 ) Cash payments to employees Rs 15,000 ============== or Wages and salaries expense Rs 36,000 Decrease (increase) in wages & sal. payable (21,000 ) Cash payments to employees Rs 15,000 ==============

- 67. Working from Income Statement Amounts to Cash Amounts Notice in this example that both interest payable and income taxes payable were zero at the beginning and end of the period. This means that the entire amounts of interest expense and income tax expense were incurred and paid during the period, so the cash flows are the amounts of the expenses, Rs4,000 and Rs20,000, respectively.

- 68. Preparing a Statement of Cash Flows - The Indirect Method In calculating cash flows from operating activities, the alternative to the direct method is the indirect method . The indirect method is generally more convenient. The indirect method reconciles accrual net income to cash flows from operating activities.

- 69. Reconciliation of Net Income to Net Cash Provided by Operations The indirect method begins with net income. Additions or deductions are made for changes in related asset or liability accounts (items that affect net income and net cash flow differently). If a company uses the direct method, the FASB requires such a reconciliation using the indirect method.

- 70. Reconciliation of Net Income to Net Cash Provided by Operations Items included in the reconciliation: Depreciation is added back to net income because it was deducted in arriving at net income, but it does not represent a use of cash. Increases in noncash current assets result in less cash flow from operations, so such increases are deducted from net income. Decreases in noncash current assets result in more cash flow from operations, so such decreases are added back to net income.

- 71. Reconciliation of Net Income to Net Cash Provided by Operations Items included in the reconciliation (continued): Increases in current liabilities result in more cash flow from operations, so such increases are added back to net income. Decreases in current liabilities result in less cash flow from operations, so such decreases are deducted from net income.

- 72. Reconciliation of Net Income to Net Cash Provided by Operations The general rules for additions and deductions to adjust net income using the indirect method are the same as those for adjusting line items on the income statement under the direct method.

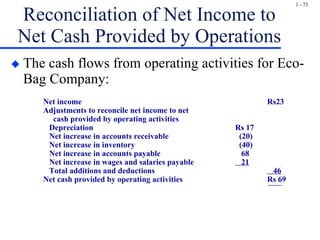

- 73. Reconciliation of Net Income to Net Cash Provided by Operations The cash flows from operating activities for Eco-Bag Company: Net income Rs23 Adjustments to reconcile net income to net cash provided by operating activities Depreciation Rs 17 Net increase in accounts receivable (20) Net increase in inventory (40) Net increase in accounts payable 68 Net increase in wages and salaries payable 21 Total additions and deductions 46 Net cash provided by operating activities Rs 69 =======

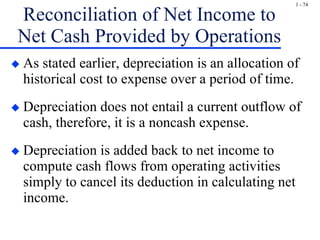

- 74. Reconciliation of Net Income to Net Cash Provided by Operations As stated earlier, depreciation is an allocation of historical cost to expense over a period of time. Depreciation does not entail a current outflow of cash, therefore, it is a noncash expense. Depreciation is added back to net income to compute cash flows from operating activities simply to cancel its deduction in calculating net income.

- 75. Reconciling Items Add charges (expenses) not requiring cash Depreciation Depletion Amortization of intangible assets Nonoperating losses Amortization of bond discount Deduct credits to income (revenue) not providing cash Nonoperating gains Amortization of bond premium Adjust for changes in current assets and liabilities relating to operating activities Changes in noncash Current Assets Changes in noncash Current Liabilities deduct increases add increases add decreases deduct decreases

- 76. Reconciling Items Non operating gains and losses are gains and losses that are not part of the normal ongoing activities of the business but are included in net income. Gains (losses) must be deducted (added back) from net income because they arise from activities other than operations. The transaction that created the gain or loss must be included elsewhere on the statement of cash flows, including the gain or loss; removing it from net income keeps the gain or loss from being included twice.

- 77. Reconciling Items Boyd Corporation sells a piece of land for Rs50,000 in cash. The land originally cost Rs75,000. The loss on the sale is Rs25,000. How does this transaction affect the operating activities section of the statement of cash flows?

- 78. Reconciling Items Net income includes the loss of Rs25,000. The cash flow from the sale is Rs50,000, but this is not cash from operations. The Rs50,000 cash flow from the sale is included in the investing activities section (sale of long-lived asset). The Rs25,000 is added back to net income in the reconciliation to avoid including elements of the sale in two places on the statement of cash flows.

- 79. Cash Flow and Earnings The income statement and the statement of cash flows fill different critical information needs. The income statement shows how a company’s owners’ equity changes as a result of operations. It matches revenues and expenses using the accrual concept and provides a measure of economic activity. The statement of cash flows focuses on the net cash flow from operating activities.

- 80. CASH FLOW STATEMENT PRINCIPAL USES ASSESS THE ABILITY TO GENERATE POSITIVE NET CASH DETERMINE THE ABILITY TO MEET OBLIGATIONS, TO PAY DIVIDENDS, TO USE EXTERNAL FINANCING ASSESS THE DIFFERENCES BETWEEN NET INCOME AND CASH FLOWS ASSESS THE EFFECTS ON FINANCIAL POSITION (BALANCE SHEET)

- 81. Ratio Analysis

- 82. Ratio Analysis The key concept of ratio analysis is establishing the relationship of one number to another number.

- 83. RATIOS Ratios are tools that enable management to: Measure and compare information within a business over several periods Compare similar businesses in the same industry

- 84. Sources of information Information used in ratios comes from: Statement of Financial Position Current ratio Liquid or quick asset ratio Debt to equity ratio Statement of Financial Performance Gross profit ratio Net profit ratio Both Statement of Financial Position and Performance Accounts receivable turnover

- 85. KEY RATIO Current ratio Equity Ratio Gross Profit Ratio Inventory Turnover Ratio Net Profit Ratio Quick Asset Ratio Accounts receivable turnover ratio

- 86. KEY RATIO Return on Equity Ratio Return on Asset Ratio Working capital ratio Debt Ratio Debt to Equity ratio

- 87. TYPES OF RATIOS: PROFITABILITY RATIOS

- 88. TYPES OF RATIOS: PROFITABILITY RATIOS

- 89. TYPES OF RATIOS: FINANCIAL STABILITY

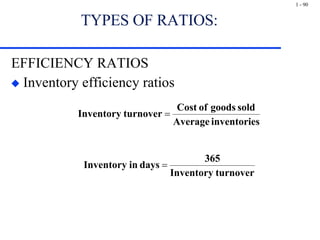

- 90. TYPES OF RATIOS: EFFICIENCY RATIOS Inventory efficiency ratios

- 91. TYPES OF RATIOS: Accounts receivable

- 92. Financial Ratios Debt Ratio Earnings per Share (EPS) Price-Earnings (P-E) Ratio Dividend-Yield Ratio Dividend-Payout Ratio

- 93. Debt Ratio The debt ratio measures the proportion of company’s assets financed by debt. Total liabilities ÷ Total assets

- 94. Debt Ratio Debt ratio = Total liabilities ÷ Total assets The debt ratio indicates the proportion of assets that is financed with debt. This ratio measures a business’s ability to pay total liabilities A low debt ratio is safer than a high debt ratio.

- 95. Debt-to-Equity Ratio This ratio expresses the relationship between liabilities and equity. Total liabilities ÷ Total equity

- 96. Earnings per Share (EPS) EPS is shown on the face of the income statement. Earnings per share is the net income per common share of stock outstanding during a period.

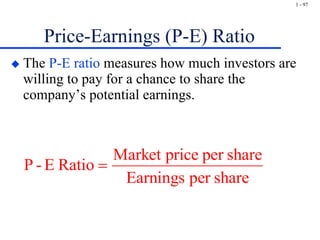

- 97. Price-Earnings (P-E) Ratio The P-E ratio measures how much investors are willing to pay for a chance to share the company’s potential earnings.

- 98. Price-Earnings (P-E) Ratio A high P-E ratio indicates that investors predict that the company’s net income will grow rapidly. The ratio is determined by the marketplace because the market price of the stock is used to compute the ratio.

- 99. Dividend-Yield Ratio The dividend-yield ratio measures dividends paid for a period compared to the market prices of the stock on a given day. Dividend-Yield Ratio

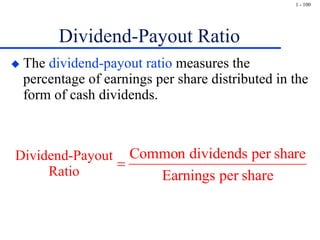

- 100. Dividend-Payout Ratio The dividend-payout ratio measures the percentage of earnings per share distributed in the form of cash dividends. Dividend-Payout Ratio

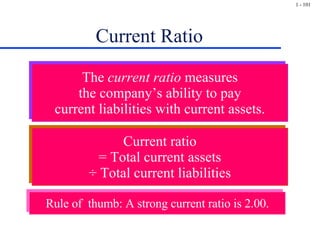

- 101. Current Ratio Current ratio = Total current assets ÷ Total current liabilities The current ratio measures the company’s ability to pay current liabilities with current assets. Rule of thumb: A strong current ratio is 2.00.

- 102. CURRENT LIABILITIES ACCOUNTS PAYABLE PAYROLL LIABILITIES SHORT-TERM NOTES & INTEREST PAYABLE INCOME TAXES PAYABLE WARRANTIES UNEARNED REVENUES CURRENT PORTION L-T DEBT

- 103. Current Liabilities Current liabilities are obligations due within one year or within the company’s normal operating cycle if it is longer than one year.

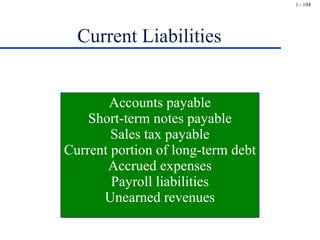

- 104. Current Liabilities Accounts payable Short-term notes payable Sales tax payable Current portion of long-term debt Accrued expenses Payroll liabilities Unearned revenues

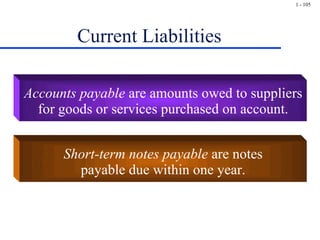

- 105. Current Liabilities Accounts payable are amounts owed to suppliers for goods or services purchased on account. Short-term notes payable are notes payable due within one year.

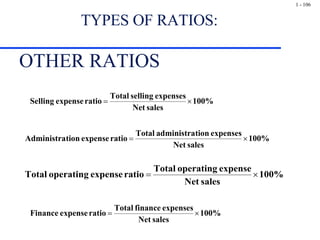

- 106. TYPES OF RATIOS: OTHER RATIOS

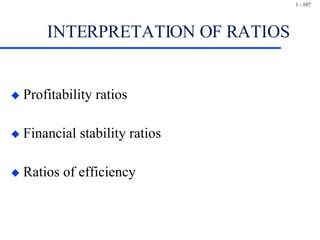

- 107. INTERPRETATION OF RATIOS Profitability ratios Financial stability ratios Ratios of efficiency

- 108. INTERPRETATION OF RATIOS INTERPRETATION OF RATIOS PROFITABILITY RATIOS Gross profit ratio Shows the return on net sales prior to adding revenue or deducting expenses Reasons gross profit ratio increases: selling prices increase and purchase price remains unchanged opening inventory undervalued closing inventory overvalued purchase bought at lower price

- 109. INTERPRETATION OF RATIOS PROFITABILITY RATIOS Gross profit ratio Reasons gross profit ratio decreases: discounts given on sales products closing inventory undervalued obsolete or damaged stock written off purchases bought at higher price but sales values not adjusted

- 110. INTERPRETATION OF RATIOS PROFITABILITY RATIOS Net profit ratio Shows the amount earned by normal activities after accounting for other revenue and expenses Measures operation efficiency Reasons net profit ratio increases: expenses decrease operating revenue increases fixed costs spread over higher sales revenue

- 111. INTERPRETATION OF RATIOS PROFITABILITY RATIOS Net profit ratio Reasons net profit ratio decreases: expenses increase at higher rate than COGS other operating revenue sources decline To arrest declining net profit margins: investigate business selling plans and techniques increase effective promotion and advertising encourage areas of operating revenue review alternative and cheaper interest rates review all expenses

- 112. INTERPRETATION OF RATIOS PROFITABILITY RATIOS Return on equity ratio Shows the return on every dollar invested in the business Return on assets Indicates the earning capacity of the business Measures efficiency of business asset usage

- 113. INTERPRETATION OF RATIOS FINANCIAL STABILITY RATIOS Working capital ratio Test of business solvency, to see if it can meet short-term debts from its current assets Shows amount of dollars to cover every dollar of liabilities The higher the ratio, the better the position of the business

- 114. INTERPRETATION OF RATIOS FINANCIAL STABILITY RATIOS Quick asset ratio Only the liquid business items that easily convert to cash are used Inventories and prepayments are excluded from current assets and the bank overdraft from current liabilities Ratio well above 1:1 is acceptable

- 115. INTERPRETATION OF RATIOS FINANCIAL STABILITY RATIOS Equity ratio Shows relationship of owner’s equity invested in business to the total assets of the business It is the degree to which the business relies on owner capital The higher the ratio, the lower the need for externally borrowed funds High equity ratio = long-term financial stability

- 116. INTERPRETATION OF RATIOS RATIOS OF EFFICIENCY Inventory turnover times Means the number of times that inventories turn over per year. Inventory turnover in days Low turnover rate indicates inventory levels are too high. Product demand may have slowed.

- 117. Interpretation Of Ratios Ratios Of Efficiency Accounts receivable turnover Measures the efficiency of management in collecting the debts of the business The shorter the period of collection, the greater the cash flow of the business. Long collection periods may lead to bad debt.

- 118. LIMITATIONS OF RATIOS Ratio analysis and interpretation can be influenced by factors such as: poor or inadequate accounting methods incomplete financial reports changes in accounting methods existence of unusual items during a financial year e.g. losses by fire management changes changes to the economy, such as an industry recession