First Principles of Investing in Fintech

- 1. First Principles Of Investing In Fintech

- 2. Infrastructure to exchange resources with unknown people and businesses What Is Finance?

- 3. What This Used To Mean Infrastructure to exchange resources with unknown people

- 4. What This Means Today Infrastructure to exchange resources with unknown people What This Means Today Infrastructure to exchange resources with unknown people

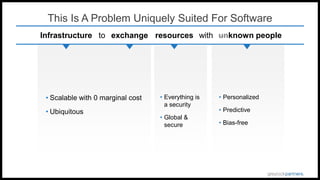

- 5. This Is A Problem Uniquely Suited For Software Infrastructure to exchange resources with unknown people • Scalable with 0 marginal cost • Ubiquitous • Everything is a security • Global & secure • Personalized • Predictive • Bias-free

- 6. Payments Infrastructure to exchange resources with unknown people OLD NEW • Instant, 0/low fee • Trustless systems

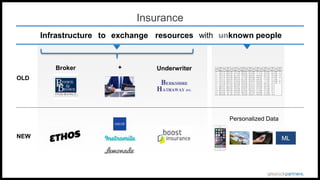

- 7. Insurance Infrastructure to exchange resources with unknown people OLD NEW Broker Underwriter+ ML Personalized Data

- 8. Lending Infrastructure to exchange resources with unknown people OLD NEW

- 9. FINTECH EVOLUTION: WHERE ARE WE?

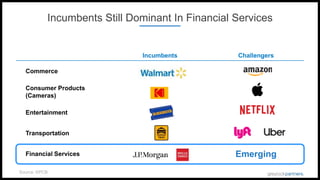

- 10. Incumbents Still Dominant In Financial Services Incumbents Challengers Commerce Consumer Products (Cameras) Entertainment Transportation Financial Services Emerging Source: KPCB

- 11. PHASE 1 Acquire customers PHASE 2 Remove friction PHASE 3 Use data to better allocate capital PHASE 4 Digital-first experiences ILS FinTech Evolution O P P O R T U N I T Y

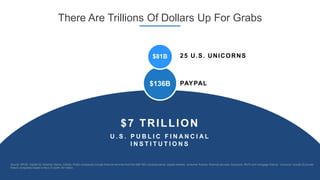

- 12. There Are Trillions Of Dollars Up For Grabs $7 TRILLION U . S . P U B L I C F I N A N C I A L I N S T I T U T I O N S PAYPAL$136B 25 U.S. UNICORNS$81B Source: KPCB, Capital IQ, Goldman Sachs, Fidelity. Public companies include financial services from the S&P 500 including banks, capital markets, consumer finance, financial services, insurance, REITs and mortgage finance. “Unicorns” include 25 private fintech companies based in the U.S worth >$1 billion.

- 13. Outlier Unicorns Have Similar Characteristics $2.0bn $1.1bn As of Q1 ‘17 $1.6bn $2.7bn $1.7bn $2.7bn Source: Goldman Sachs, Pitchbook

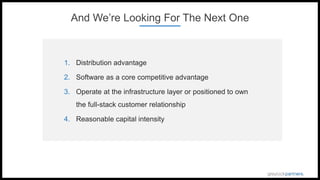

- 14. And We’re Looking For The Next One 1. Distribution advantage 2. Software as a core competitive advantage 3. Operate at the infrastructure layer or positioned to own the full-stack customer relationship 4. Reasonable capital intensity

- 15. WHAT WOULD AN OUTLIER COMPANY LOOK LIKE?

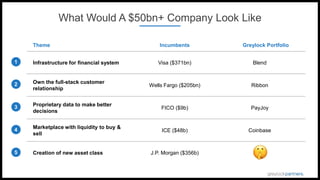

- 16. What Would A $50bn+ Company Look Like Theme Incumbents Greylock Portfolio Infrastructure for financial system Visa ($371bn) Blend Own the full-stack customer relationship Wells Fargo ($205bn) Ribbon Proprietary data to make better decisions FICO ($9b) PayJoy Marketplace with liquidity to buy & sell ICE ($48b) Coinbase Creation of new asset class J.P. Morgan ($356b) 1 2 3 4 5

- 17. Re-consolidation in The West: The Opportunity2 Traditional Banks with Traditional Services Startups Challenge by Filling in The Gaps It’s Already Happening in The East Source: KPCB

- 18. High Frequency Low Frequency Deep Relationship w/ Customer Light Relationship w/ Customer Where Should You Start?2 O P P O R T U N I T Y

- 19. Infrastructure to exchange resources with unknown people and businesses What Is Finance? If you’re re-inventing any of these words with software, I want to meet you.

Editor's Notes

- Excited to explain fintech to one of the founders of paypal Data Light How are approach to fintech is differentiated? Investments that haven’t worked out? JM feedback Are we being too selective relative to our peer set? Any on this list that we regret passing on? Growth for Plaid, Opendoor? Belief in entrepreneur on Act 2 Blind spots Financial background Fear of capital intensity Monopoly style business vs. large TAM Sad we passed on or missed? Nova credit – too hard Tala & Branch – large, lucrative Divvy – good team Mynd -- Khosla & AH – bigger swings around capital intensity Too focused on differentiation & moat in the face of massive TAMs SM – too long Cut a lot of early section Characteristics we look at, companies we’re tracking What are the points of real engagement What are we wrong on? Capital intensive vs. not? Spend more time on this one Fintech portfolio for our top competitors, last 3 years Money into a few companies what are they & why? Like Coinbase Source Kleiner Send it out ahead of time 10 seconds per slide 2 points on each slide, 10-20 second Framework upfront To re-enforce our framework, valuation in public markets Conditions for over ride Massive market Consumer traction CAC/LTV Back-up primary investors Interesting vs. not interesting Of the companies we’ve looked at what are the business metrics? 5-20M in revenue vs. 20M+ Portfolios of competitors – companies that are working

- Starting with a definition of finance -- People and businesses

- Clunky POS systems, the New York Stock Exchange trading resources like the USD & stock certificates and tools like FICO and actuarial table to compensate for risk of interacting with unknown people Brick & mortar branches Clunky POS terminals Exchanging resources like the USD & stock certificates Spreadsheets to generalize risk of unknown people On-premise servers Brick & mortar distribution POS terminals & marketplaces & exchanges Resources – USD & stock certificates The way you solved for unknown people through credit bureaus and actuarial tables not percise or personalized Known/unknown people and companies??

- This entire world is now being re-built digitally With new resources like digital currencies Solving for unknown people with personalized Data Non-physical world based version of everything that preceded Servers in the cloud Phone in everyone’s pocket Payments with one line of code & new exchanges to buy & sell Expanding the definition of resources to include digital currencies and previously alternative assets Unknown people are becoming known through data + ML

- So, this is clearly a problem well suited for software

- Huge value creation across all layers of payments, especially where there’s historical high friction and fees like int’l remittances What does this look like by vertical Every aspect of payment systems are being re-built digitally A lot of value is being created by owning each one of these key pieces in the digital world from payments to digital currencies Excess fees taken by middlemen are going away In payments, you went from clunky POS terminals, cash and credit Developer tools & mobile payments for people and businesses Instant, 0/low fee Trustless systems

- Brokers & underwriters are becoming digital Actuarial tables are being replaced or agumenting with sensors, drones and data from your phone to personally underwrite risk Brick and mortar brokers, paper binders, large underwriters with actuarial tables Full-stack, direct to consumer, digital w. personalized & on-demand risk.

- Lending moving away from brick and mortar branches with paper loans to platforms like blend and affirm Data for underwriting is becoming more precise & accessible across mortgages, payday loans & POS financing, brick and mortar banks with high fees and slow processes Digital, instant, convenient and personalized Personalized data opens up a new wave of personalization and access

- Many other categories digital player has become dominant, this hasen’t happened yet in finance

- Opportunity across all three of these phases This is a timeline of where we are in the fintech evolution Started with aggregation websites like bankrate that served as lead-gen to traditional finance companies It evolved into making analog processes digital, taking out the friction with web flow vs. paper Moved to using data science to make better decisions And has evolved into unlocking opportunities that never existed before like digital currencies and alternative asset clases backed by data

- PayPal: 115bn Square: $32bn Stripe: $20bn Affirm: 1.7bn Coinbase: 8bn Robinhood: 6bn Ant Finacial: 150bn

- Two real outliers – ant financial which owns the customer in China and you have Stripe which owns digital infrastructure AvidXchange – accounts payable – b2b payments Symphony -- messaging

- Many of this has informed the characteristics of what we find attractive we’ve shared before – Buckets 3 & 4 is where we can challenge our thinking

- Look at our portfolio, Coinbase created a marketplace to buy & sell crypto, PayJoy data play in emerging markets and Ribbon own the customer relationship starting with a home purchase There are 5 categories of huge winners in this new world Own the full-stack customer (WeChat & Ant Financial) & add-on services Proprietary access to data to either deliver a better product directly or be a necessary point of reference for others

- Breadth, depth, frequency & trust

- Starting with a definition of finance -- People and businesses