FISCAL POLICY.pptx.pdf

- 1. FISCAL POLICY June 13, 2022 DBA - PHIHUA

- 3. WHAT IS

- 4. 4 •Definition: manipulations by the government of its own expenditures and taxes in order to influence the level of AD. •Government receives revenues from income and business taxes, T. •Government expenditures: G • If G=T: balanced budget •If G>T: budget deficit Gov needs to borrow •If G<T: budget surplus •Public/Government Debt is the gov’s accumulation of deficits minus surpluses. FISCAL POLICY

- 5. 5 •What’s it: Potential GDP refers to the maximum output an economy can produce using its existing economic resources. It represents an economy’s long-run aggregate supply. At this level of output, the economy will fully utilize all its resources and work full employment. The Supply Side: Employment and Potential GDP

- 6. 6 •Potential GDP rises along with the increased quantity quality and improved quality of production factors and technology. Its increase does not result in inflationary pressures in the economy. Therefore, in a graph, it will form a vertical line. •Another term for potential GDP is potential output, total output at full capacity, long-run output, or output at full employment. The Supply Side: Employment and Potential GDP

- 7. 7 •The potential output is an important indicator. It is useful for measuring how much an economy can produce goods and services. By comparing real GDP and potential output, you will know whether production can increase and how this will result in inflationary pressures and unemployment. Why potential GDP matters?

- 8. 8 •As an alternative, the government can also use fiscal tools to close the output gap. The government increases its spending or cuts taxes. Higher spending or lower taxes will also increase aggregate demand. Why potential GDP matters?

- 9. 9 • Investment of the private sector to economic growth. This reciprocal causality comes from investment were observed. Empirical evidence also reveals that private corporate sector saving does not Granger cause economic growth. savings and investment in the short run. The feed backs to GDP are absent in the long run • The increase in saving raises investment and the quality of investment improves. The Role of the Savings Rate in Growth Models This section presents a review of the role played by saving rates in different growth models. • Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy over a certain period of time. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP. The Supply Side: Investment, Saving and Economic Growth

- 10. 10 •Fiscal policy is a key tool of macroeconomic policy, and consists of government spending and tax policy. When government expenditure on goods and services increases, or tax revenue collection decreases, it is called an expansionary or reflationary stance. •Higher taxes or lower government expenditure is called contractionary policy. •The effects of fiscal policy can be revenue neutral, which means any change in spending is balanced by an equal and opposite change in revenue collection. Even with a revenue neutral fiscal policy stance, however, the government has a powerful tool to affect both individuals and business by the type of spending or tax policy changes it makes. The Effects of Fiscal Policy

- 11. 11 •Expansionary policies may result in a government budget deficit, though not always. If the economy is fairly healthy when spending increases, any budget surplus will be reduced, but not necessarily eliminated. A contractionary policy stance can result in budget surpluses, especially if the budget is already balanced. The effect on the budget deficit in either case, however, depends on the original budget as well as the magnitude and direction of the change in fiscal policy. •If payroll taxes and individual income tax rates are lowered, consumers will have more income to spend on all types of goods and services, boosting aggregate demand. If corporate tax rates are lowered, businesses are likely to expand and hire more workers, expanding aggregate supply as more goods are produced. The Effects of Fiscal Policy

- 14. 14 •Expansion (Growth) •Peak (Top) •Contraction (Shrinking) • Trough (Bottom Phases of the Business Cycle

- 15. 15 •High demand for goods •More jobs •People are optimistic and spend money •Businesses start •More profits and higher stock value •Higher wages •Lower unemployment Expansion

- 16. 16 •Economy stops growing •GDP reaches its maximum •Businesses stop hiring •Cycle begins to contract (or shrink) Peak

- 17. 17 •Businesses cut production and lay off workers •Number of jobs declines •Unemployment increases •People are pessimistic and stop spending money •Banks limit loans Contraction

- 18. 18 •The Economy “bottoms-out” (reaching its lowest point) •High unemployment •Stock prices drop Trough

- 19. 19 •A prolonged contraction is called a recession (contraction for over 6 months) •A recession of more than one year is called a depression Recession/Depression

- 20. 20 • 4 variables cause changes in the Business Cycle: • Business Investment When the economy is expanding, sales and profit keep rising, so companies invest in new plants and equipment, creating new jobs and more expansion. In contraction, the opposite is true • Interest Rates and Credit Low interest rates, companies make new investments, adding jobs. When interest rates climb, investment dries up and less job growth • Consumer Expectations Forecasts of an expanding economy fuels more spending, while fear of a recession decreases consumer spending • External Shocks External Shocks, such as disruptions of the oil supply, wars, or natural disasters greatly influence the output of the economy • Ex. 1992-2000 was the longest period of expansion in U.S. history. Early in 2001, signs of contraction appeared, though the Bush administration denied it. The Sept. 11th 2001 terrorist attacks quickly caused the business cycle to shift into a contraction. What keeps the Business Cycle Going?

- 21. 21

- 22. 22 •Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency •The main monetary policy instruments available to central banks are open market operation, bank reserve requirement, interest rate policy, re-lending and re-discount (including using the term repurchase market), and credit policy (often coordinated with trade policy). While capital adequacy is important, it is defined and regulated by the Bank for International Settlements, and central banks in practice generally do not apply stricter rules. MONETARY POLICY AND FRAMEWORK

- 23. 23 • As China’s economy develops and becomes more market oriented, and as its integration with the world economy continues, monetary policy will need to shoulder an increasingly large burden in ensuring stable, noninflationary growth. Rising integration, for instance, implies greater vulnerability to external shocks, and monetary policy is typically the first line of defense against such shocks. Although deeper structural reforms may be the key determinants of long-term growth, monetary policy has an important role to play in creating a stable macroeconomic environment that is essential for those reforms to take root • Monetary policy in China has in recent years operated under difficult constraints, including a fixed exchange rate regime, an underdeveloped financial system and numerous institutional weaknesses. Having an independent monetary policy is of course the first order of business. Maintenance of an exchange rate regime with limited de facto flexibility exposes the economy to significant risks of macroeconomic instability. While capital controls provide some room for maneuver for monetary policy even under such a regime, this room tends to be quite limited in practice and could result in inadequate control of investment growth and inflationary/deflationary pressures. Furthermore, the effectiveness of capital controls inevitably erodes over time as domestic and international investors find channels, including expanding trade, to evade them..

- 24. 24 Three key principles of good monetary policy • Monetary policy should be well understood and systematic. The objectives of monetary policy should be stated clearly and communicated to the public. The Congress has directed the Federal Reserve to use monetary policy to promote both maximum employment and price stability; those are the objectives of U.S. monetary policy. Fed policymakers' understanding of that statutory mandate is summarized in Monetary Policy: What Are Its Goals? How Does It Work? To be systematic, policymakers should respond consistently and predictably to changes in economic conditions and the economic outlook; policymakers also should clearly explain their policy strategy and actions to the public, and they should follow through on past policy announcements and communications unless circumstances change in ways that warrant adjusting past plans. Following this principle helps households and firms make economic decisions and plan for the future; it also promotes economic stability by avoiding policy surprises. Principles for the Conduct of Monetary Policy

- 25. 25 Three key principles of good monetary policy • the central bank should provide monetary policy stimulus when economic activity is below the level associated with full resource utilization and inflation is below its stated goal. Conversely, the central bank should implement restrictive monetary policy when the economy is overheated and inflation is above its stated goal. In some circumstances, the central bank should follow this principle in a preemptive manner. For example, economic developments such as a large, unanticipated change in financial conditions might not immediately alter inflation and employment but would do so in the future and thus might call for a prompt, forward-looking policy response. Conveying how monetary policy would respond to irregular future events is not easy, but the overarching principle remains the same: Policymakers should strive to communicate how these events may affect the future evolution of inflation and employment and set monetary policy accordingly. Principles for the Conduct of Monetary Policy

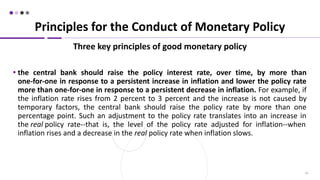

- 26. 26 Three key principles of good monetary policy • the central bank should raise the policy interest rate, over time, by more than one-for-one in response to a persistent increase in inflation and lower the policy rate more than one-for-one in response to a persistent decrease in inflation. For example, if the inflation rate rises from 2 percent to 3 percent and the increase is not caused by temporary factors, the central bank should raise the policy rate by more than one percentage point. Such an adjustment to the policy rate translates into an increase in the real policy rate--that is, the level of the policy rate adjusted for inflation--when inflation rises and a decrease in the real policy rate when inflation slows. Principles for the Conduct of Monetary Policy

- 27. 27 • The transmission of monetary policy describes how changes made by the Reserve Bank to its monetary policy settings flow through to economic activity and inflation. This process is complex and there is a large degree of uncertainty about the timing and size of the impact on the economy. In simple terms, the transmission can be summarized in two stages. • Changes to monetary policy affect interest rates in the economy. • Changes to interest rates affect economic activity and inflation. The transmission of monetary policy

- 30. 30 •END>>>>>>>