Florent

- 1. April 2010 www.venturefund.novartis.com Corporate Venture Capital Florent Gros

- 2. AGENDA Novartis Venture Funds Venture Drivers Exit Drivers European specificities

- 3. Innovative and Successful A Decade of Success Novartis Venture Fund 14 years as a leading corporate portfolio: (independent) venture capital firm ~70 private companies Strong returns driven by looking beyond to what is “strategic to the ~$750M USD Capital Base industry” ~$15-20M USD per NVF reputation viewed as progressive investment & forward thinking 45+ portfolio company board Two capital choices – Venture Fund seats and Option Fund Experienced team (Cambridge Independent decision making and Basel)

- 4. NVF Investment Criteria Unmet need / Management Clinical Impact experience Innovation Patient Benefit Superior Returns Novel proprietary science Capital / understanding of efficiency mechanism

- 5. Typical Investment Process Screen ~1000 companies and proposals per year Of the screened companies <1% conclude with an investment Lead syndicates when appropriate Multi-stage due diligence process with investment decision vested in the Novartis VC team and reviewed by independent board New investments +/- 20% stake, diluted down to +/ - 15% in later rounds, typically with board seat Follow on investments dependent on operational performance and financial discipline NVF is a long-term partner and enabler in developing the company and finding profitable exit

- 8. Evolution of Total Venture $Bn 15 14 13 12 7 6 5 2 1 06 07 08 09 06 07 08 09 06 07 08 09 06 07 08 09 06 07 08 09 Seed 1st Round 2nd Later Recap Round Stage Q1 2009 vs. Q1 2008 -80% -37% -54% -60% -38% Source: NVCA, Thomson Financial

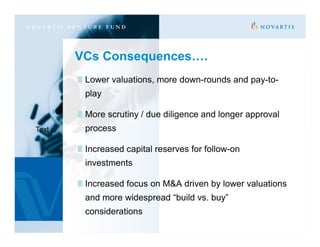

- 9. VCs Consequences…. Lower valuations, more down-rounds and pay-to- play More scrutiny / due diligence and longer approval Text process Increased capital reserves for follow-on investments Increased focus on M&A driven by lower valuations and more widespread “build vs. buy” considerations

- 10. Corporate VCs 18% 16% 14% 12% 10% 8% 6% 4% 2% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Healthcare Corporate VCs seem to be backed by stronger strategic motivations and management commitment (and probably cash flows) that ensure stability and continuity even in a downturn Source: NVCA, Thomson Financial. Kauffman Fellows

- 11. Exit Drivers

- 12. Pharma has cash for biotech assets Biotech / medtech lack cash (> 40% have more than a years’ worth cash - nearly 100 publicly-traded biotechs do not have enough cash to last 6 months) Source: Evaluate

- 13. Pharma deals continue to increase Source: PharmaVentures/Pharma deals

- 14. Exit top-performers Top performing biotechs have raised median pre-exit funding of $36m and exit at a value of $250m, generating a median ROI of 5.4; median performers have raised median pre-exit $66m and exit at $133m, generating an ROI of 1.7 Top performers have typically been exclusively venture funded pre-exit; companies with only venture funding represent 85% of the top performers in contrast to 49% of the total exited Top performers have a focused portfolio at exit; top performers 3 development and launched candidates at exit while the median have almost twice as many Source: BioCentury; Windhover; McKinsey analysis

- 15. Exit Drivers Out- and in-licensing ARE NOT major performance drivers; top performers have licensed at the same rate as the median – BUT reliance on early stage alliances does help to be attractive for VCs VCs are exclusively focused on exit, minimum 1.7x ROI Source: BioCentury; Windhover; McKinsey analysis

- 19. Funding Strategy VC activity has contracted Generalist VCs have moved away leaving a fewer specialist VC firms Venture arms of big pharma now essential players (new in 2010: Serono, Boehringer, Sanofi, Merieux etc.) Some government match-fund initiatives have emerged (UK Innovation Fund €150m, French Innobio €150 mio, Max Plack) Large European grants through the Innovation Medicines Initiatives (FP7, Eureka etc). Large local grants available in France, Belgium, Italy. Attractive tax credit in France (€1 credit for €3 invested)

- 20. Not yet out of the woods, but situation is improving Thank You! Florent Gros Managing Director Novartis Venture Funds