Food Processing Sectoral Report - October 2016

- 1. 11OCTOBER 2016 FOOD PROCESSING For updated information, please visit www.ibef.orgOCTOBER 2016

- 2. 22OCTOBER 2016 For updated information, please visit www.ibef.org Executive Summary…………………......…...3 Advantage India……………………................4 Market Overview and Trends…………..……6 Porters Five Forces Analysis………….…...17 Strategies Adopted…………………….……19 Growth Drivers………………………….……21 Opportunities………………………….……..34 Success Stories………………………….…..37 Useful Information……………………...……43 FOOD PROCESSING OCTOBER 2016

- 3. 33OCTOBER 2016 For updated information, please visit www.ibef.org EXECUTIVE SUMMARY 2nd largest arable land in the world • India has the tenth-largest arable land resources in the world with 161 million tonnes. With 20 agri-climatic regions, all 15 major climates in the world exist in India. The country also possesses 46 of the 60 soil types in the world Largest producer of milk • India is the largest producer of milk and second – largest producer of fruits and vegetables Largest livestock population • India has the largest livestock population of around 512 million, globally. This comprises 119 million milch (in-milk and dry) animals, 80.06 million goats and 44.56 million sheep, as of FY15. The segment contributes about 25% to the country’s farm GDP Rising consumption expenditure • Consumer spending in 2015 was USD1 trillion; it is likely to reach USD3.6 trillion by 2020 Source: World Travel and Tourism Council, Directorate of Statistics, TechSci Research Note: GDP - Gross Domestic Product FOOD PROCESSING Favourable location for exports • Strategic geographic location and proximity to food importing nations favour India in terms of exporting processed foods

- 5. 55OCTOBER 2016 Growing demand For updated information, please visit www.ibef.org ADVANTAGE INDIA Strong demand growth • Demand for processed food rising with growing disposable income, urbanisation, young population and nuclear families • Household consumption set to double by 2020 • Changing lifestyle and increasing expenditure on health and nutritional foods Food processing hub • India benefits from a large agriculture sector, abundant livestock, and cost competitiveness • Investment opportunities to arise in agriculture, food infrastructure, and contract farming • Diverse agro-climatic conditions encourage cultivation of different crops Policy support • Sops to private sector participation; 100% FDI under automatic route. Investment in April 2000-March 2016 stood at USD6.82 billion • Promoting rationalisation of tariff and duties relating to food processing sector. • Setting up of National Mission on Food Processing • Foreign Trade Policy 2015-2020 Increasing investments • Government expects USD21.9 billion of investments in food processing infrastructure by 2015 • Investments, including FDI, would rise with strengthening demand and supply fundamentals • Launch of infrastructure development schemes to increase investments in food processing infrastructure 2015 India’s food processing industry: USD258 billion 2020E India’s food processing industry: USD482 billion Advantage India FOOD PROCESSING Source: DIPP, Ministry of External Affairs, ASA and Associates, TechSci Research Notes: 2015E – Estimate for 2015; Estimates are from UBM India Pvt Ltd press release, FDI – Foreign Direct Investment

- 6. MARKET OVERVIEW AND TRENDS FOOD PROCESSING

- 7. 77OCTOBER 2016 For updated information, please visit www.ibef.org THE FOOD PROCESSING SECTOR COMPRISES SIX MAJOR SEGMENTS Source: Indiabusiness.nic.in, Ministry of Agriculture, Directorate of Statistics, APEDA, Indiastat, Meat & Poultry Processing Board, FAOSTAT, Assocham, Department of Animal Husbandry, Dairying & Fisheries, Economic Times (US Department of Agriculture) Notes: FY – Indian Financial Year (April – March), E- Estimate, (1) - 3rd Estimate, MT - Million Tonnes FOOD PROCESSING Food processing Fruits and vegetables(1) Milk Meat and poultry Marine products Grain processing Consumer food India is the world’s 2nd largest producer of fruits and vegetables. The government expects the processing in this sector to grow by 25% of the total produce by 2025. In 2015-2016, the total production in horticulture sector (fruits and vegetables) is estimated at 282.5 million tonnes. India is the largest producer of milk in the world, with the production estimated at 146.3 million tonnes in FY15 India is the largest producer of buffalo meat (1.4 MT in 2015) and the second largest producer of goat meat (0.91 MT in 2015). India is also the second largest egg producer (78.4 billion) and third largest producer of broiler meat (4.2 million tonnes in 2016), globally Total fish production in India is estimated at 13.0 MT during 2015-16. Andhra Pradesh stood as the largest producer of fish with production of 741.3 Thousand Tonnes during 2015-2016 (upto June 2015) India produces more than 200 million tonnes of different food grains every year. Total food grains production reached 270.10 MT in FY16 (As per Ministry of Agriculture) Among the fastest growing segments in India; it includes – Packaged food Aerated soft drinks Packaged drinking water Alcoholic beverages

- 8. 88OCTOBER 2016 For updated information, please visit www.ibef.org FOOD PROCESSING SECTOR AND ITS SEGMENTS Contribution of food processing industry to India’s GDP through manufacturing (FY16(1)) The food processing industry is one of the largest industries in India and ranks fifth in terms of production, consumption and exports. As per the latest data available, food processing sector is expected to reach USD258 billion in FY15. In FY15, food processing industry constituted 14 percent to India’s GDP through manufacturing FOOD PROCESSING 14% 86% Food processing Other Source: Ministry of Food Processing Industries (MOFPI), TechSci Research Note: (1) – Till December 2015, As per latest data available

- 9. 99OCTOBER 2016 For updated information, please visit www.ibef.org VALUE CHAIN IN FOOD PROCESSING SECTOR AND KEY PLAYERS Source: MOFPI, TechSci Research. Note: NCMSL - National Collateral Management Services Limited FOOD PROCESSING Farmers, cooperatives and private companies Warehouses, cold storage and silos Retail shops, malls, cash and carry Farmers, Amul, ITC, Pepsi, Hindustan Unilever Ltd Food Corporation of India, NCMSL, Arshiya International General Merchant Stores, Bharti- Walmart, Future Retail, Aditya Birla Retail Limited Inputs Production Procurement and storage Processing Retailing Seeds, Fertilizers and Farm equipment Grading, sorting, milling and packing National Seeds Corporation Limited, Cargill and Advanta India Ltd ITC ltd, Cargill, Adani Enterprises, Olam International Key activities Major players

- 10. 1010OCTOBER 2016 For updated information, please visit www.ibef.org The unorganised sector accounts for 42% of India’s food processing industry The sizeable presence of small-scale industries points to the sector’s role in employment generation Though the market falls under the unorganised sector in the country, the organised sector has a larger share in the secondary processing segment than the primary one Rice mills account for the largest share of processing units in the organised sector In FY15, the organised sector is estimated to account for 30% of India’s food processing industry LARGE PRESENCE OF THE UNORGANISED SECTOR FOOD PROCESSING Unorganised sector has the largest share in the sector(1) (FY16) Source: Ministry of Food Processing Industries (MOFPI), Annual Report MOFPI (2015-2016), TechSci Research Note: (1)- As per latest data available 70% 30% Unorganized Sector & Small Scale Industies Organized Sector

- 11. 1111OCTOBER 2016 For updated information, please visit www.ibef.org Healthy contribution to employment generation Source: Ministry of Food Processing Industries Annual Report 2013-14, TechSci Research Notes: FY – Indian Financial Year (April – March) E:Estimated (1)- As per latest data available Policymakers have identified food processing as a key sector in encouraging labour movement from agriculture to manufacturing As per Annual Survey of Industries for 2012–13, there were 1.6 million persons engaged in registered food processing sector During FY08–13, employment in the registered food processing sector rose at a CAGR of 1.3% Food products generated the highest employment in the country in 2011-12 (12.1%) By 2024, food processing sector is expected to employ 9 million people in India FOOD PROCESSING IS A KEY CONTRIBUTOR TO EMPLOYMENT GENERATION IN INDIA(1) FOOD PROCESSING CAGR: 11.8% 1.5 1.6 1.6 1.7 1.8 1.6 9 FY08 FY09 FY10 FY11 FY12 FY13 FY24E

- 12. 1212OCTOBER 2016 For updated information, please visit www.ibef.org Changing consumer tastes • Wide array of products, coupled with increasing global connectivity, has led to a change in the tastes and preference of domestic consumers • This trend has been bolstered by rising incomes, increasing urbanisation, a young population, and the emergence of nuclear families. Consumer preference is moving towards healthier snacks Entry of international companies • Liberalisation and growth of organised retail have made the Indian market more attractive for global players • With a large agriculture sector, abundant livestock, and cost competitiveness, India is fast emerging as a sourcing hub of processed food. Danone, Nestle, Kraft Foods, Mondelez International, Heinz are the international players in food processing market in India NOTABLE TRENDS IN THE INDIAN FOOD PROCESSING SECTOR FOOD PROCESSING Rising demand on Indian products in international market • Strategic geographic location and continuous increase in raw material production help India to supply cheaper products to other countries • India’s exports of processed food and related items rose at a CAGR of 21.5% during FY11–16(1), accounting for USD19,337.4 million in FY16(1) • Companies like Haldiram’s and Bikarnervala have a presence in over 70 countries, whereby they provide Indian snacks. Note: FY – Indian Financial Year (April – March), (1) Data upto December 2015

- 13. 1313OCTOBER 2016 For updated information, please visit www.ibef.org Higher consumption of Horticulture Crops • There is a surge in demand for fruits & vegetables as a result of a shift in consumption. • Accordingly, Indian farmers are also shifting production towards horticulture crops to cash in on the growing demand. Emphasis on Healthier Ingredients • Food processing companies are serving health and wellness as a new ingredient in processed food, given that health conscious consumers prefer food products with lower carbohydrate content and with low cholesterol edible oils. e.g. zero-per cent transfat snacks and biscuits, slim milk, whole wheat products, etc. ITC is planning to launch multigrain Bingo to increase its share in healthy snacks market Note: FY – Indian Financial Year (April – March) NOTABLE TRENDS IN THE INDIAN FOOD PROCESSING SECTOR FOOD PROCESSING Packaging as a Purchase Influencer and Communicator • Food packaging has enabled today’s consumers to look for various options, and compare the value offerings thereof, before making a purchase. • Packaging has also helped enhance ‘carry ability’ of products and increase their shelf life. A Shift from Usefulness in Processing to Usefulness to Consumers • Product innovation is always needed as consumers not only prefer safe ingredients and additives but also useful ones • This creates opportunities mainly in product innovation, specialised products, and product extensions for the various existing food processors as well as new entrants • Consumers have become aggressive in demanding better, safer, and convenient food products and are willing to pay a higher price for health and convenience.

- 14. 1414OCTOBER 2016 For updated information, please visit www.ibef.org Frozen and Processed Goodness • Frozen processed foods offer both convenience and nutrition • The increase in spending capacities and the concurrent time-paucity has led to the continuous development of such frozen processed food products as frozen vegetables (e.g. peas, potato, corn, etc.) and such non-vegetarian products as chicken, fish, and meat products. Food processing market accounts for 32% of the total food market in India Sensible Snacking • Domestic consumers are now tuned in to the greater variety of foods available, thanks to both wider variety in offerings as well as their own international exposure. ITC and PepsiCo are shifting their focus on healthier snacks as the market for healthy snacks is growing with double speed Note: FY – Indian Financial Year (April – March) NOTABLE TRENDS IN THE INDIAN FOOD PROCESSING SECTOR FOOD PROCESSING Product Innovation as the Key to Expansion Strengthening Procurement via Direct Farmer-Firm Linkages • Contract farming has been operational in India for a long time now; however, the experience of the private sector players involved therein has been a mixed bag of successes and failures • Largely, it has helped both the processing companies, via increasing sales and therefore augmenting their incomes, as well as providing access to better technology and fetching better prices by securing an assured market for Indian farmers. examples include Nestlé, PepsiCo, Venky’s, Milkfed, and Mahagrapes, among others. • It is now the norm for food processing companies to offer value-addition; those who hitherto offered solely milk have now added other dairy products to their repertoire. • This helps the processors to not only reduce wastage, but also expand uses and realise higher returns. In 2015, Bonhomia has announced to launch ‘Boho’ coffee machines , the company is the first one to manufacture coffee and tea capsule in India. • In FY16, Ministry of Food Processing Industries has granted fund of USD18.81 million for the ongoing Mega Food Park projects. As on September 2016, a Mega Food Park has been setup by the government in Ludhiana.

- 15. 1515OCTOBER 2016 For updated information, please visit www.ibef.org Source: Company website, TechSci Research COOPERATIVES DOMINATE DAIRY SECTOR; PRIVATE PLAYERS LEAD OTHERS FOOD PROCESSING Alcoholic beverages Aerated soft drinks and packaged drinking water Packaged food Fruits, vegetables, processed grain Milk and milk products Meat, poultry and marine products Consumer Food

- 16. 1616OCTOBER 2016 For updated information, please visit www.ibef.org AGRI EXPORT ZONES IN INDIA Source: APEDA, TechSci Research FOOD PROCESSING Jammu & Kashmir: Apples, walnuts Punjab: Basmati Rice, vegetables, potatoes Himachal Pradesh: Apples Rajasthan: Coriander, Cumin Gujarat: Mangoes, vegetables, sesame seeds, onions Andhra Pradesh: Vegetables, mango pulp, grapes, gherkins, chili, mangoes Maharashtra: Grapes, grape wine, mangoes, flowers, Kesar Mango, onion, pomegranate, banana, oranges West Bengal: Pineapple, lychee, Darjeeling tea, vegetables, mango, potatoes Uttar Pradesh: Basmati rice, potatoes, mangoes, vegetables Uttarakhand: Basmati rice, aromatic and medicinal plants, flowers, lychee Madhya Pradesh: Onions, garlic, seed spices, lentils, wheat, oranges, grams, potatoes Karnataka: Gherkins, rose onions, flowers, vanilla Tamil Nadu: Flowers, mangoes, cashew nuts, cut flowers Assam: Ginger Kerala: Horticulture products, Medicinal Plants Orissa: Ginger and Turmeric Sikkim: Flowers (Orchids) & Cherry Pepper, Ginger Jharkhand: Vegetables

- 17. PORTERS FIVE FORCES ANALYSIS FOOD PROCESSING

- 18. 1818OCTOBER 2016 For updated information, please visit www.ibef.org PORTER FIVE FORCES ANALYSIS FOOD PROCESSING Competitive Rivalry Threat of New Entrants Substitute Products Bargaining Power of Suppliers Bargaining Power of Customers • Capital Intensive - High investments are required to set up processing units; this acts as an entry barrier for new players • Low bargaining power of suppliers as the population largely relies on unorganised sector for products such as milk and vegetables • Tastes and preferences of consumers in certain products change and hence brand loyalty is low in these products • Low switching cost makes consumers switch from one supplier to another • No close substitutes of products such as milk, fresh fruits and vegetables are available in the market • Due to a large influence of unorganised sector in the industry, the competition is intense • Existence of brand loyalty in certain products towards existing firms such as Amul in case of butter limits competition in these products Competitive Rivalry (Medium) Threat of New Entrants (Medium) Substitute Products (Low) Bargaining Power of Customers (High) Bargaining Power of Suppliers (Low)

- 20. 2020OCTOBER 2016 For updated information, please visit www.ibef.org STRATEGIES ADOPTED Source: TechSci Research • Companies have been moving up the value chain; for example, cooperatives are transitioning from being pure producers of milk to offering a wide range of dairy products. In 2015, Amul announced to launch first branded lactose free milk in India. • Both domestic and global firms have been focusing on product innovation to cater to domestic tastes, while also introducing international flavours; for example Ruchi Soya is innovating by entering into the ready-to-cook segment to meet the needs of people with significant time constraint to provide a rich source of protein in the breakfast category • In 2016, Pepsi would begin selling new Diet Pepsi Classic Sweetener Blend containing aspartame and will also continue to sell the aspartame-free versions of Diet Pepsi • Low-cost price strategy is adopted so as to make the product affordable to the consumers by guaranteeing them value for money. The main aim is to provide quality products to the consumers at minimum cost, e.g., Amul Milk • Parle and Sunfeast works on their pricing and costs so as to make the products available at economical prices • In 2015, Zespri International New Zealand based company tied up with Mumbai Dabbawalas to sell new variants of fruits in India • Many global and Indian companies are getting into joint ventures to make global products available in India. Starbucks and TATA Alliance is one of the largest joint ventures • Bharti Enterprises and Delmonte Pacific Ltd is the largest fresh baby corn exporter in India • In 2016, Future Consumers and LT foods entered into a joint venture to enhance manufacturing and distribution of rice and related products across the country Rising business and product innovation Low - cost price strategy Joint Ventures and Tie ups FOOD PROCESSING

- 22. 2222OCTOBER 2016 STRONG FUNDAMENTALS AND POLICY SUPPORT AIDING GROWTH For updated information, please visit www.ibef.org Source: Ministry of Agriculture, TechSci Research FOOD PROCESSING Large domestic market Growing demand Strong domestic demand Supply-side advantagesRising export opportunities Rising disposable incomes Growing middle class, urbanisation, a young population Changing lifestyles and food habits India’s greater integration with the global economy Increasing exports with advantage of proximity to key export destinations Expected spike in global demand as emerging markets grow at a fast pace Favourable climate for agriculture; wide variety of crops Large livestock base aids dairy and meat processing sector Inland water bodies, long coastline help marine products Policy support Vision 2015 plan targets trebling of food processing sector Mega food parks, Agri Export Zones to attract FDI and aid infrastructure Approval of National Mission on Food Processing

- 23. 2323OCTOBER 2016 For updated information, please visit www.ibef.org RISING INCOME AND GROWING MIDDLE CLASS TO DRIVE DEMAND FOR PROCESSED FOOD Rising disposable incomes • Strong growth in per-capita income has resulted in greater demand for food items • Incomes have increased at a brisk pace in India and would continue rising considering the country’s strong economic growth prospects. According to IMF, nominal per capita income is projected to grow at CAGR of 4.94% over 2010-19E • During 2015-19, per capita income is expected to expand at a CAGR of 8.09% • There has also been a shift in demand: • From carbohydrates to meat products (in line with the various phases of economic growth); and • To convenience foods, and organic and diet foods • Strong economic growth since the 1990s has led to: • Rapid urbanisation and a growing middle class; and • Nuclear families and dual income households • Coupled with a young population and increasing media penetration, this has led to a surge in demand for packaged food, alcoholic and non-alcoholic beverages, snacks, savouries, etc. Rising per-capita income in India Source: IMF, World Bank, TechSci Research Notes: E - Estimate, F - Forecast FOOD PROCESSING 1430.2 1552.5 1514.8 1504.5 1600.9 1617.3 1747.5 1874.9 2026.7 2207.6 -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 0.0 500.0 1000.0 1500.0 2000.0 2500.0 GDP per capita, current prices Growth Rate

- 24. 2424OCTOBER 2016 For updated information, please visit www.ibef.org Exports in USD billion Source: Agricultural & Processed Food Products Export Development Authority (APEDA), DGCIS, TechSci Research Note: FY – Indian Financial Year (April –March), (1) – Data for April 2016 During FY11–16, India's exports of processed food and related products (inclusive of animal products) grew at a CAGR of 11.74%, reaching USD16.2 billion Main export destinations for food products have been the Middle East and Southeast Asia In FY17(1), India’s exports stood at USD1.3 billion FOOD PROCESSING INDIA’S EXPORTS OF PROCESSED FOOD AND RELATED PRODUCTS CAGR: 11.74% 9.3 17.3 21.7 22 21.5 16.2 1.3 FY11 FY12 FY13 FY14 FY15 FY16 FY17⁽¹⁾

- 25. 2525OCTOBER 2016 SHARES IN EXPORTS OF PROCESSED FOOD AND RELATED PRODUCTS Rising demand from rest of the world • Accounting for 28.4% of the overall export value of key processed products, animal and related products accounted for the largest value share in FY16 • In FY16, share of exports of cereals stood at 38.21% • Growth has primarily resulted from • Greater exports to advanced economies; and • More demand from emerging/developing economies as they experience strong growth Source: APEDA Agri Exchange, TechSci Research FOOD PROCESSING Shares in APEDA exports (FY16)Exports of key processed products (USD million, FY15 and FY16) For updated information, please visit www.ibef.org 38.21% 28.4% 7.8% 6.7% 0.43% 17.9% Cereals Animal Products Fresh Fruits and Vegetables Processed Fruits and vegetables Floriculture Other Processed Foods 4518.11 3334.71 1552.15 828.76 202.29 75.39 1221.83 5411.33 4067.91 3477.96 2314.58 496.57 151.54 79.65 73.19 1277.56 4597.7 2881.22 BasmatiRice NonBasmati Rice Guargum Wheat OtherCereals Floriculture Freshfruitsand vegetables AnimalProducts OtherProcessed Foods FY15 FY16

- 26. 2626OCTOBER 2016 For updated information, please visit www.ibef.org Supply-side advantages • Growth in food product exports has been aided by: • Significant improvements in product and packaging quality; and • Greater private sector participation • India has a location advantage – it is geographically close to key export destinations (Middle East, South East Asia) • USA is the top destination for processed products from India • Vietnam, Saudi Arabia, Iran, and UAE are the other major destinations for Indian exports Major destinations of processed food and agricultural related product exports in FY16 (USD million) Source: Ministry of Food Processing Industries, APEDA, Ministry of Commerce & Industry, TechSci Research FOOD PROCESSING EXPORTERS GAINING FROM RISING GLOBAL DEMAND AND LOCATION ADVANTAGES 1997.12 1228.86 725.55 1120.37 598.33 359.68 231.7 591.8 307.16 445.57 Vietnam SaudiArabia USA UAE Malaysia Egypt Kuwait Iran Bangladesh Nepal

- 27. 2727OCTOBER 2016 For updated information, please visit www.ibef.org India’s comparative advantage lies in its favourable climate, large agriculture sector and livestock base, long coastline, and inland water resources India also has an edge in cost of production compared to its competitors in Asia and the developed world In FY15, milk production is estimated around 146.3 million tonnes In August 2015, rice production is estimated around 104.8 million tonnes FOOD PROCESSING Units Global rank(1) Arable land (million hectares) 161 2 Area under irrigation (million hectares) 55 1 Coast line ('000 kilometers) 7.5 7 Cattle (million) 3.1 1 Source: World Bank, FAOSTAT, CIA World Fact book, Ministry of Agriculture, Tea Board, APEDA, Directorate of Statistics, Indian Council of Agricultural Research (ICAR), TechSci Research Note: (1) represents 4th advance estimates Production (million tonnes) FY15 Global Share(1) (%) Global rank(1) Milk (Cow & Buffalo) 141.1 17% 1 Pulses(1) 17.2 21% 1 Buffalo meat 1.4 42.8% 1 Bananas 28.1 27.8% 1 Mangoes and Guavas 22.7 39.0% 1 Tea 1.1 28% 2 Rice (Paddy) (1) 104.8 22% 2 Sugarcane(1) 359.3 21% 2 Wheat(1) 88.94 15% 1 INDIA HAS A DISTINCT COMPETITIVE ADVANTAGE OVER PEERS

- 28. 2828OCTOBER 2016 For updated information, please visit www.ibef.org Encouragement to private sector • 100% export-oriented units allowed to sell up to 50% of their produce in the domestic market • Export earnings exempt from corporate taxes Tax incentives and other sops • Services like pre conditioning, ripening, waxing, retail packing, precooling, labelling of fruits and vegetables have been exempted from service tax • Excise duty of 2% without CENVAT credit or 6% excise duty with CENVAT credit is imposed on peanut butter condensed milk • Import duty scrapped on capital goods and raw materials for 100% export-oriented units • Full excise duty exemption for goods that are used in installation of cold storage facilities Relaxed FDI norms • 100% FDI permitted under automatic route (except for alcohol, beer, and sectors reserved for small scale industries) • Repatriation of capital and profits permitted • With the recent clearance of Foreign Direct Investment (FDI) in multi-brand food retail, the government is looking to double food processing levels to 20 per cent Source: Ministry of Food Processing Industries, APEDA, TechSci Research Note: FDI – Foreign Direct Investment FOOD PROCESSING STRONG POLICY SUPPORT GIVES FOOD PROCESSING SECTOR A BOOST … (1/2) Mega Food Parks • The scheme based on “Cluster” approach, which creates a well-defined agri/horticultural processing zone with better support of infrastructure and well-established supply chain • Aims at providing mechanisms to link agricultural production to the market by bringing farmers, processors and retailers together • Under Union Budget 2015-16, USD19.65 million has been allotted for Mega Foodpark Scheme • Final approval has been received for 21 mega food parks, out of which, only 4 food parks are operational • As per Union Budget 2016-2017, government allocated USD89.62 million under National Mission to food processing sector

- 29. 2929OCTOBER 2016 For updated information, please visit www.ibef.org Focus on infrastructure • The sector has been assigned priority status for bank credit. • 60 Agri Export Zones (AEZ) have been set up across the country • In Union Budget 2015-16, government has announced to make a provision of USD53.8 million to develop infrastructure Incentives for development of storage facilities • Investment-linked tax incentive of 100% deduction of capital expenditure for setting up and operating cold chain facilities (for specified products), and for setting up and operating warehousing facilities (for storage of agricultural produce). Till 2015, 112 storage infrastructure projects have been approved, out of which 50 have been completed and 62 are in progress towards completion Source: Ministry of Food Processing Industries (MOFPI), APEDA, TechSci Research FOOD PROCESSING STRONG POLICY SUPPORT GIVES FOOD PROCESSING SECTOR A BOOST … (2/2) Focus on R&D and modernisation • The government launched initiatives such as for the Setting Up/Upgradation of Quality Control/Food Testing Laboratory, R&D and Promotional Activity scheme and the Technology Upgradation/Setting Up/Modernisation/Expansion of Food Processing Industries Scheme. During 2014-15, 8 food testing laboratories were set up, 20 R&D projects were completed and government allocated USD4.9 million for mentioned initiatives. National Mission on Food Processing • MOFPI launched a new Centrally Sponsored Scheme (CSS) National Mission on Food Processing to promote facilities for post-harvest operations, including setting up of food processing industries in India. In Union Budget 2016-17, government has announced to spend USD1.1 million in Union territories only

- 30. 3030OCTOBER 2016 For updated information, please visit www.ibef.org Cumulative FDI inflows (April 2000 to March 2016) in food and agriculture sector (USD million) Source: Department of Industrial Policy & Promotion, TechSci Research Note: FDI – Foreign Direct Investment Between April 2000 and March 2016, FDI in agriculture machinery and food processing industry in India stood at USD6.815 billion and USD0.433 billion, respectively Demand growth, supply advantages, and policy support have been instrumental in attracting FDI The government’s main focus is on supply-chain related infrastructure, such as cold storage, abattoirs and food parks FOREIGN INVESTMENTS FLOWING IN; RISE IN PLAN EXPENDITURE FOOD PROCESSING 44% 33% 11% 5% 3% 3% 1% National Mission on Food Processing Infrastructure development Strengthening of institutions Food Safety, R&D and Promotional Activities Venture Capital Fund 11th plan projects to be implemented under NMFP Innovation Fund Scheme 12th Five Year Plan (2012-17) outlay shares: Food Processing Plan allocation to the Food Processing sector: USD2.9 billion 6815.69 2376.96 1844.31 589.06 433.99 109.62 188.51 0 0.5 1 1.5 2 2.5 3 0 1000 2000 3000 4000 5000 6000 7000 8000 FoodProcessing Fermentation AgriculturalServices VegetableOil Agricultural Machinery Tea&Coffee Sugar Cumulative FDI Inflows Share of total FDI Inflows%

- 31. 3131OCTOBER 2016 For updated information, please visit www.ibef.org Source: Thompson ONE Banker, Assorted news articles, TechSci Research RISING PRIVATE EQUITY (PE) FUNDING; M&A ACTIVITY STABLE … (1/2) FOOD PROCESSING Major PE investments in food and agriculture Date Company Investor Type of business Deal value (USD million) September, 2015 Sahayog Dairy Acumen Milk producer 1.7 August, 2015 Cremica CX-Partners Manufacturer of Snacks 24.56 April, 2014 Bikaji Foods International Ltd Lihthouse Funds LLC Manufacturer and wholesale snacks 14.9 July, 2013 VKL Seasonings India Value Fund Seasonings 44.19 July, 2013 Kohinoor Foods Al Dahra Hordings Rice 21.17 June, 2013 Milltec Group Multiples Private Equity Technology and machinery developer for agro mills and plants 43.2 April, 2013 Bush Foods Overseas Hassad Food Rice 147.3

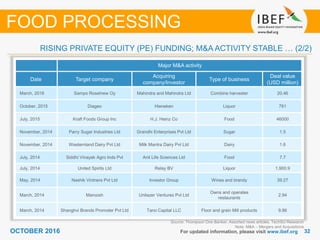

- 32. 3232OCTOBER 2016 For updated information, please visit www.ibef.org Source: Thompson One Banker, Assorted news articles, TechSci Research Note: M&A – Mergers and Acquisitions RISING PRIVATE EQUITY (PE) FUNDING; M&A ACTIVITY STABLE … (2/2) FOOD PROCESSING Major M&A activity Date Target company Acquiring company/Investor Type of business Deal value (USD million) March, 2016 Sampo Roselnew Oy Mahindra and Mahindra Ltd Combine harvester 20.46 October, 2015 Diageo Hieneken Liquor 781 July, 2015 Kraft Foods Group Inc H.J. Heinz Co Food 46000 November, 2014 Parry Sugar Industries Ltd Grandhi Enterprises Pvt Ltd Sugar 1.5 November, 2014 Westernland Dairy Pvt Ltd Milk Mantra Dairy Pvt Ltd Dairy 1.6 July, 2014 Siddhi Vinayak Agro Inds Pvt Anil Life Sciences Ltd Food 7.7 July, 2014 United Spirits Ltd Relay BV Liquor 1,900.9 May, 2014 Nashik Vintners Pvt Ltd Investor Group Wines and brandy 39.27 March, 2014 Maroosh Unilazer Ventures Pvt Ltd Owns and operates restaurants 2.94 March, 2014 Shanghvi Brands Promoter Pvt Ltd Tano Capital LLC Floor and grain Mill products 9.86

- 33. 3333OCTOBER 2016 For updated information, please visit www.ibef.org SECTOR HAS BEEN ATTRACTING FOREIGN JV PARTNERS FOR A LONG TIME Source: Thompson ONE Banker, TechSci Research Note: JV – Joint Venture Players such as McCormick had identified India as a strategic market way back in the 1990s Global players such as Hershey are now keen on entering the increasingly attractive Indian market Established players such as Nestle and Coke are extending their global JVs to India FOOD PROCESSING Foreign players Indian partner Type of business Stake ratio Year R&R Ice Cream Nestle Ice Cream 50:50 2016 Pepsi-Cola Products Philippines Inc. (PCPPI) PepsiCo, Inc. Snacks and beverages NA 2015 American Pistachio Growers VKC nuts Dry Fruits NA 2015 Select Ready Foods OSI Group LLC Animal Products NA 2014 Kagome and Mitsui Ruchi Soya Industries Tomato products 60:40 2013 Starbucks Corporation Tata Global Beverages Beverage 50:50 2012 Molson Coors Cobra India Brewing NA 2011 Dan Cake Phadnis Group Cake and biscuits 66:34 2011 McCormick Kohinoor Foods Ltd Basmati and food products 85:15 2011 McCormick Eastern Condiments Seasonings 26:74 2010 Hershey Godrej Chocolates 51:49 2007

- 35. 3535OCTOBER 2016 For updated information, please visit www.ibef.org OPPORTUNITIES Source: Make in India, TechSci Research Notes: PPP – Public Private Partnership, AEZ – Agri Export Zones, FDI – Foreign Direct Investment FOOD PROCESSING Untapped market with strong growth potential • Fragmented market leads to lower processing levels and value addition • The government plans to raise value addition to 35% by 2015 from 20% in 2005 • PPP modules ideal for the private sector • Strong demand growth; household consumption set to double by 2020 Potential global outsourcing hub • Global supermarket majors looking at India as a major outsourcing hub • India enjoys favourable supply- side fundamentals (abundant raw materials supply, cost advantages) • The government has helped by investing in AEZs, mega food parks, easier credit • The establishment of food parks – a unique opportunity for entrepreneurs, including foreign investors to enter in the Indian food processing sector. • With an investment of USD1.6 billion, process of setting up 42 mega food parks in PPP is underway, as of 2015 Supply chain infrastructure and contract farming • Both firms and the government are eager to boost efficiency and access to markets • Investment potential of USD22 billion in food processing infrastructure; 100% FDI in this area • Firms increasingly taking recourse to contract farming in order to secure supply • Supply chain infrastructure – this niche has investment potential in food processing infrastructure, the government’s main focus is on supply chain related infrastructure like cold storage, abattoirs and food parks.

- 36. 3636OCTOBER 2016 37.5 544.4 1,088.5 0 200 400 600 800 1,000 1,200 10th Five Year Plan 11th Five Year Plan 12th Five Year Plan For updated information, please visit www.ibef.org OPPORTUNITIES IN INFRASTRUCTURE DEVELOPMENT Fund allocated for infrastructure development in food processing industry (USD million) Notes: PPP – Public Private Partnership, AEZ – Agri Export Zones, FDI – Foreign Direct Investment The government’s focus and launch of various schemes to provide excellent infrastructure facility in food processing sector open up various opportunity for private investors Various schemes launched by the government provide capital grant, subsidy, duty free export of products and tax incentives to investors. These includes schemes such as Mega Food Parks Scheme, Scheme for integrated Cold Chain and Scheme for Modernisation of Abattoirs. The government’s focus on infrastructure is likely to lead to a sharp rise in the number of cold storage units Project-wise fund allocated in 12th Five-Year Plan (USD million) CAGR: 27.2% FOOD PROCESSING 677.0 349.0 58.1 Mega Food Parks Scheme Scheme for Integarted Cold Chain Scheme for Modernsiation of Abattoirs

- 38. 3838OCTOBER 2016 For updated information, please visit www.ibef.org OPERATION FLOOD: INDIA GAINS SELF SUFFICIENCY IN MILK PRODUCTION Source: Press Release Ministry of Agriculture, National Dairy Development Board, GCMMF (www.amul.com), TechSci Research ‘Operation Flood’ was the ‘billion litre idea’ of Dr Varghese Kurien, also known as the Father of the White Revolution. His efforts made India self-sufficient in edible oils as well Operation Flood was initiated in 1970 by the National Dairy Development Board (NDDB) to achieve national self- sufficiency in milk production by creating nationwide milk grids India became the world’s largest milk producer in FY2000, with the output of 78 MT. It has retained its position since then, with the country’s estimated milk production standing at 146.3 MT in FY15 As per Government of India, Ministry of Finance, India ranks first in milk production accounting for 18.5% of the world’s production in FY15, recording a growth of 6.26% over FY14 Dairy cooperatives offer employment opportunities to about 12 million agricultural families FOOD PROCESSING Phase I (Jul,1970 – Mar,1981) Phase II (Jul,1981 – Mar,1985) Phase III (Jul,1985 – Mar,1996) Dairy cooperative societies (‘000) 13.3 34.5 72.5 Members (million) 1.8 3.6 9.3 Milk procurement (million kg/day) 2.6 5.8 11.0 Liquid milk marketing (million litres/ day) 2.9 5.0 10.0 Milk drying capacity (million tonnes/ day 261 507.5 842

- 39. 3939OCTOBER 2016 For updated information, please visit www.ibef.org GCMMF (Amul) sales (USD billion) Source: GCMMF (www.amul.com), thehindubusinessline.com, TechSci Research Notes: CAGR – Compound Annual Growth Rate, FY – Indian Financial Year (April – March) Gujarat Cooperative Milk Marketing Federation (GCMMF) is the largest food products marketing organisation in India Set up in 1967, it is India’s largest exporter of dairy products and has been accorded ‘trading house’ status During FY16, the Federation recorded the highest growth of 187% in turnover over the last six years, to reach a value of USD3.5 billion by FY16 Amul is the fastest growing dairy organisation in the world. It has risen to 15th position in the list of dairy companies in the world in September 2014, from 20th position in 2012 Amul is planning to invest USD24.5 million in Punjab for expansion Amul is expected to procure 21.7 thousand tonnes milk per day by January 2016 THE AMUL SAGA: A COOPERATIVE MOVEMENT LEADS THE WAY … (1/2) FOOD PROCESSING CAGR: 16.29% 0.9 1.3 1.5 1.7 2.1 2.4 2.5 3.0 3.4 3.5 4.6 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY18F

- 40. 4040OCTOBER 2016 For updated information, please visit www.ibef.org Source: GCMMF (www.amul.com), TechSci Research Main brand: Amul Products: milk (including flavoured), butter, margarine, cheese, curd, desserts, infant food FOOD PROCESSING Facts and features (FY16) Producer members (million) 3.6 Village societies 18,600 Milk processing capacity (million litres/ day) 38.0 Total milk collection (FY15, billion litres) 5.4 Daily milk collection (FY15, million litres) 14.9 Milk drying capacity (million tonnes/ day) 860 Notable awards Authority Excellent performance in dairy product exports for 11 consecutive years APEDA CIO International IT Excellence Award (2003) for positive business performance through resourceful IT management and best practices IDG’s CIO Magazine (USA) International Dairy Federation Marketing Award (2007) for Amul’s pro-biotic ice cream launch International Dairy Federation THE AMUL SAGA: A COOPERATIVE MOVEMENT LEADS THE WAY … (2/2)

- 41. 4141OCTOBER 2016 Primary focus on crushing and trading activities Expansion of extraction and refining capacity; focus on branded products Focus on developing upstream business; secured access to 185,000 hectares of palm plantation; major expansion of refining capacity For updated information, please visit www.ibef.org RUCHI SOYA: ONE OF THE WORLD’S FASTEST GROWING FMCG COMPANY Source: News release Ruchi Soya website, TechSci Research FOOD PROCESSING Top edible oil producer in India with market share of 18.2% Strong presence in Edible oil and meal market Sales growth at a CAGR of 14.1% over FY11-15 Net profit generated in FY16 is USD134.23 million Revenues for FY16 are USD4.25 billion Organic growth phase Strong brands such as Nutrela, Vanasapati and Sunrich Focus on R&D Acquisitions of companies and plats facilities 2001–04 2005–08 2008–15 Aggressive acquisitions of lands for soya and palm plantations India’s No 1 cooking oil and soya food maker Launched dal analogue and butter margarine The company is planning to enter in ready to eat food market 2016: Company got ranked among “Top 5 Packaged Food Companies in India” 2016: Received approval from Government of Karnataka to set up manufacturing units at Dakshina Kannada as on 10 June 2016

- 42. 4242OCTOBER 2016 For updated information, please visit www.ibef.org Source: Company Annual Report, TechSci Research Note: KRBL - Khushi Ram and Behari Lal FOOD PROCESSING Salient characteristics • KRBL is world’s largest rice miller and basmati rice exporter • It has strong brand presence through global retail giants like Carrefour, Bharti - Walmart, Spencer and Future Group • It is the largest producer of contract farming basmati rice in the world • The company accounts for 25% of India’s total exports of branded basmati rice • KRBL is well-integrated in terms of farming, rice processing, oil production and power generation KRBL: LEADER IN GLOBAL RICE MARKET Sales (USD million) Exports (USD million) 141 182.8 172.8 211.8 210.8 FY11 FY12 FY13 FY14 FY15 337.5 340.3 349.8 385 485.2 531.4 524.9 FY10 FY11 FY12 FY13 FY14 FY15 FY16

- 44. 4444OCTOBER 2016 INDUSTRY ASSOCIATIONS Agricultural and Processed Food Products Export Development Authority (APEDA) NCUI Building 3, Siri Institutional Area, August Kranti Marg, New Delhi – 110 016 Phone: 91 11 26513204, 26514572, 26534186 Fax: 91 11 26526187 E-mail: headq@apeda.com Marine Products Export Development Authority (MPEDA) MPEDA House, Panampilly Avenue PB No 4272, Cochin-682 036 Phone: 91 484 2311979/2311803 Fax: 91 484 2313361 e-mail: mpeda@vsnl.com, mpeda@mpeda.nic.in For updated information, please visit www.ibef.org FOOD PROCESSING

- 45. 4545OCTOBER 2016 GLOSSARY … (1/2) For updated information, please visit www.ibef.org AEZ: Agri Exports Zones MFP: Mega Food Parks CAGR: Compound Annual Growth Rate FDI: Foreign Direct Investment MT: Million Tonnes IIP: Index of Industrial Production FY: Indian Financial Year (April to March) So FY12 implies April 2011 to March 2012 GOI: Government of India INR: Indian Rupee PPP: It could denote two things (mentioned in the presentation accordingly) – Purchasing Power Parity (used in calculating per-capita GDP) Public Private Partnership (a type of joint venture between the public and private sectors) FOOD PROCESSING

- 46. 4646OCTOBER 2016 GLOSSARY … (2/2) For updated information, please visit www.ibef.org PE: Private Equity APEDA: Agriculture & Processed food products Export Development Authority GCMMF: Gujarat Cooperative Milk Marketing Federation USD: US Dollar Wherever applicable, numbers have been rounded off to the nearest whole number FOOD PROCESSING

- 47. 4747OCTOBER 2016 Exchange rates (Fiscal Year) For updated information, please visit www.ibef.org EXCHANGE RATES Exchange rates (Calendar Year) FOOD PROCESSING Year INR equivalent of one USD 2004–05 44.81 2005–06 44.14 2006–07 45.14 2007–08 40.27 2008–09 46.14 2009–10 47.42 2010–11 45.62 2011–12 46.88 2012–13 54.31 2013–14 60.28 2014-15 61.06 2015-16 65.46 2016-2017E 66.95 Source: Reserve bank of India, Average for the year Year INR equivalent of one USD 2005 43.98 2006 45.18 2007 41.34 2008 43.62 2009 48.42 2010 45.72 2011 46.85 2012 53.46 2013 58.44 2014 61.03 2015 64.15 2016 (Expected) 67.22

- 48. 4848OCTOBER 2016 India Brand Equity Foundation (IBEF) engaged TechSci to prepare this presentation and the same has been prepared by TechSci in consultation with IBEF. All rights reserved. All copyright in this presentation and related works is solely and exclusively owned by IBEF. The same may not be reproduced, wholly or in part in any material form (including photocopying or storing it in any medium by electronic means and whether or not transiently or incidentally to some other use of this presentation), modified or in any manner communicated to any third party except with the written approval of IBEF. This presentation is for information purposes only. While due care has been taken during the compilation of this presentation to ensure that the information is accurate to the best of TechSci and IBEF’s knowledge and belief, the content is not to be construed in any manner whatsoever as a substitute for professional advice. TechSci and IBEF neither recommend nor endorse any specific products or services that may have been mentioned in this presentation and nor do they assume any liability or responsibility for the outcome of decisions taken as a result of any reliance placed on this presentation. Neither TechSci nor IBEF shall be liable for any direct or indirect damages that may arise due to any act or omission on the part of the user due to any reliance placed or guidance taken from any portion of this presentation. For updated information, please visit www.ibef.org DISCLAIMER FOOD PROCESSING