ford 2007 Q3 Financial Result

- 1. THIRD QUARTER EARNINGS REVIEW NOVEMBER 8, 2007 (PRELIMINARY RESULTS)

- 2. BUSINESS OVERVIEW Alan Mulally President and Chief Executive Officer SLIDE 1

- 3. TOTAL COMPANY 2007 THIRD QUARTER FINANCIAL RESULTS Third Quarter First Nine Months O / (U) O / (U) 2007 2006 2007 2006 Wholesales (000) 1,487 20 4,910 (119) Revenue (Bils.) $ 41.1 $ 4.0 $128.3 $ 8.5 Continuing Operations (Excluding Special Items)* Pre-Tax Profits (Mils.) $ 194 $1,300 $ 746 $1,971 After-Tax Profits (Mils.) (24) 826 63 809 Earnings Per Share** (0.01) 0.44 0.03 0.43 Special Items Pre-Tax (Mils.) $ (350) $4,908 $ (20) $8,135 Net Income After-Tax Profits (Mils.) $ (380) $4,868 $ 88 $7,076 Earnings Per Share** (0.19) 2.60 0.05 3.78 Automotive Gross Cash (Bils.)*** $ 35.6 $ 12.0 $ 35.6 $ 12.0 * See Slide 7 and Appendix for reconciliations to GAAP ** Earnings per share is calculated on a basis that includes pre-tax profit, provision for taxes, and minority interest; see Appendix for method of calculation *** Automotive Gross Cash includes cash and cash equivalents, net marketable securities, loaned securities and short-term Voluntary Employee Beneficiary Association (VEBA) assets SLIDE 2

- 4. TOTAL COMPANY THIRD QUARTER 2007 PROGRESS • Committed to executing the four priorities of our plan -- restructuring the Company, accelerating product development, funding our plan and improving our balance sheet, and working effectively as one team • Significant improvement in Automotive Operations compared with the same period a year ago • Ford North America reported a loss of $1 billion, a $1.1 billion improvement compared with 2006 • Profitable at Ford South America, Ford Europe, Ford Asia Pacific & Africa, and Mazda • Premier Automotive Group reported a loss but results were substantially improved from a year ago • Ford Credit continues to be profitable • Continued to explore potential sale of Jaguar and Land Rover • Have been conducting a strategic review of Volvo SLIDE 3

- 5. TOTAL COMPANY THIRD QUARTER / FIRST NINE MONTHS HIGHLIGHTS • North America – Ford posted 11% improvement in the 2007 Third Quarter U.S. Global Quality Research System (GQRS) study – Ford Taurus, Taurus X and Mercury Sable earned Top Safety Pick ratings from the Insurance Institute for Highway Safety (IIHS) – Ford Mustang convertible earned five star ratings in crash test and rollover categories from the National Highway Traffic and Safety Administration (NHTSA) – Ford SYNC received Popular Mechanics “Breakthrough Award” • South America – Ford South America sales up 19% in First Nine Months • Europe and PAG – Ford Europe sales up more than 5% in First Nine Months – Kuga, Ford’s planned C-segment 4x4 crossover, received strong reviews – Best-ever quarter for Land Rover sales • Asia Pacific & Africa – Ford China sales up 27% year to date – Nanjing Assembly Plant opened in China SLIDE 4

- 6. FINANCIAL RESULTS Don Leclair Chief Financial Officer SLIDE 5

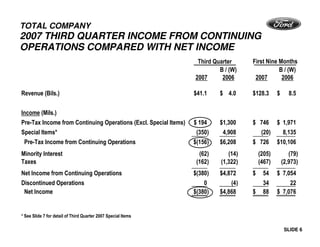

- 7. TOTAL COMPANY 2007 THIRD QUARTER INCOME FROM CONTINUING OPERATIONS COMPARED WITH NET INCOME Third Quarter First Nine Months B / (W) B / (W) 2007 2006 2007 2006 Revenue (Bils.) $41.1 $ 4.0 $128.3 $ 8.5 Income (Mils.) Pre-Tax Income from Continuing Operations (Excl. Special Items) $ 194 $1,300 $ 746 $ 1,971 Special Items* (350) 4,908 (20) 8,135 Pre-Tax Income from Continuing Operations $(156) $6,208 $ 726 $10,106 Minority Interest (62) (14) (205) (79) Taxes (162) (1,322) (467) (2,973) Net Income from Continuing Operations $(380) $4,872 $ 54 $ 7,054 Discontinued Operations 0 (4) 34 22 Net Income $(380) $4,868 $ 88 $ 7,076 * See Slide 7 for detail of Third Quarter 2007 Special Items SLIDE 6

- 8. TOTAL COMPANY 2007 THIRD QUARTER SPECIAL ITEMS Third First Quarter Nine Months (Mils.) (Mils.) Ford North America Separation Programs $ 110 $ (709) Related OPEB Curtailment 213 1,321 Related Pension Curtailment 0 (175) Gain on Sale of an ACH Operation 5 5 Subtotal Ford North America $ 328 $ 442 PAG Sale of Aston Martin (1) 213 PAG Net Gains on Certain Undesignated Hedges 37 219 PAG Personnel Reduction Programs / Other (32) (113) Ford Europe Personnel Reduction Programs / Other (39) (128) Ford Asia Pacific and Africa Personnel Reduction Programs / Other (1) (11) Ford Asia Pacific and Africa Joint Venture Equity Impairment (10) (10) Loss on Conversion of Trust Preferred Securities (632) (632) Total Pre-Tax Special Items $ (350) $ (20) Memo: Special Items Impact on Earnings Per Share* $(0.18) $ 0 * Earnings per share from continuing operations is calculated on a basis that includes pre-tax profit, provision for taxes, and minority interest; see Appendix for method of calculation SLIDE 7

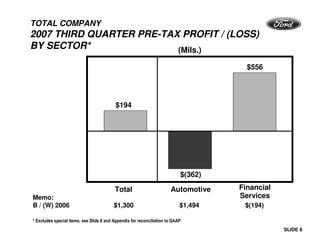

- 9. TOTAL COMPANY 2007 THIRD QUARTER PRE-TAX PROFIT / (LOSS) BY SECTOR* (Mils.) $556 $194 $(362) Total Automotive Financial Memo: Services B / (W) 2006 $1,300 $1,494 $(194) * Excludes special items; see Slide 6 and Appendix for reconciliation to GAAP SLIDE 8

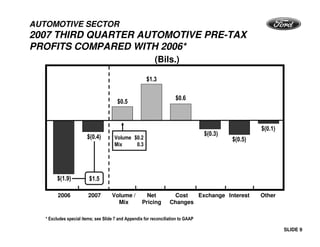

- 10. AUTOMOTIVE SECTOR 2007 THIRD QUARTER AUTOMOTIVE PRE-TAX PROFITS COMPARED WITH 2006* (Bils.) $1.3 $0.6 $0.5 $(0.1) $(0.4) $(0.3) Volume $0.2 $(0.5) Mix 0.3 $(1.9) $1.5 2006 2007 Volume / Net Cost Exchange Interest Other Mix Pricing Changes * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP SLIDE 9

- 11. AUTOMOTIVE SECTOR 2007 FIRST NINE MONTHS COST CHANGES* 2007 Costs B / (W) 2006 (Bils.) Total $1.8 Bils. $0.9 $0.8 $0.8 $0.5 $0.4 $(0.1) Incl. Commodity Costs $(1.0) $(1.5) Warranty Mfg. / Net Spending- Pension / Overhead Advertising Engrg. Product Related OPEB & Sales Costs Promotions Memo: Third Quarter $0.2 $0.2 $(0.2) $0.2 $0 $0.2 $0 * At constant volume, mix, and exchange; excludes special items SLIDE 10

- 12. AUTOMOTIVE SECTOR 2007 THIRD QUARTER PROFIT / (LOSS) BY SEGMENT* (Mils.) $(391) $386 $293 $30 $18 $29 $(97) $(362) $(1,021) Total North South Europe P.A.G. Asia Pacific Mazda & Other America America & Africa Assoc. Auto Operations $2,018 Memo: B / (W) 2006 $1,494 $1,052 $185 $306 $411 $86 $(22) $(524) * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP SLIDE 11

- 13. AUTOMOTIVE SECTOR -- FORD NORTH AMERICA THIRD QUARTER KEY METRICS -- 2007 vs. 2006 Wholesales (000) Revenue (Bils.) Pre-Tax Profits (Mils.)* 651 641 $16.5 $15.4 $(1,021) $(2,073) 2006 2007 2006 2007 2006 2007 Memo: U.S. Market Share 15.5% 13.4% U.S. Dealer Inventories 652 538 * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP SLIDE 12

- 14. AUTOMOTIVE SECTOR -- FORD NORTH AMERICA 2007 THIRD QUARTER AUTOMOTIVE PRE-TAX PROFITS COMPARED WITH 2006* (Bils.) $1.0 $0.4 $0 $(0.2) $(0.1) Volume $(0.1) Mix 0.5 Mfg. / Engineering $ 0.5 Overhead 0.2 $(1.0) Net Product Costs (0.3) Warranty (0.4) $(2.1) $1.1 2006 2007 Volume / Net Cost Exchange Other Mix Pricing Changes * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP SLIDE 13

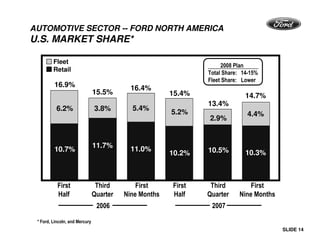

- 15. AUTOMOTIVE SECTOR -- FORD NORTH AMERICA U.S. MARKET SHARE* Fleet 2008 Plan Retail Total Share: 14-15% Fleet Share: Lower 16.9% 16.4% 15.5% 15.4% 14.7% 13.4% 6.2% 3.8% 5.4% 5.2% 4.4% 2.9% 11.7% 11.0% 10.7% 10.5% 10.3% 10.2% First Third First First Third First Half Quarter Nine Months Half Quarter Nine Months 2006 2007 * Ford, Lincoln, and Mercury SLIDE 14

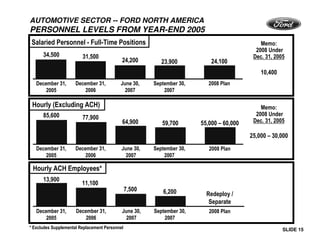

- 16. AUTOMOTIVE SECTOR -- FORD NORTH AMERICA PERSONNEL LEVELS FROM YEAR-END 2005 Salaried Personnel - Full-Time Positions Memo: 2008 Under 34,500 31,500 Dec. 31, 2005 24,200 23,900 24,100 10,400 December 31, December 31, June 30, September 30, 2008 Plan 2005 2006 2007 2007 Hourly (Excluding ACH) Memo: 85,600 2008 Under 77,900 Dec. 31, 2005 64,900 59,700 55,000 – 60,000 25,000 – 30,000 December 31, December 31, June 30, September 30, 2008 Plan 2005 2006 2007 2007 Hourly ACH Employees* 13,900 11,100 7,500 6,200 Redeploy / Separate December 31, December 31, June 30, September 30, 2008 Plan 2005 2006 2007 2007 * Excludes Supplemental Replacement Personnel SLIDE 15

- 17. AUTOMOTIVE SECTOR -- FORD NORTH AMERICA ASSEMBLY CAPACITY (Millions - Annualized) Maximum Installed Capacity 2008 Plan Straight Time Manned Capacity Capacity Utilization Maximum Installed 84% Straight Time Manned 100 4.8 3.8 3.8 3.6 3.6 3.0 2.9 3.0 Fourth Quarter Second Quarter Third Quarter 2008 Plan 2005 2007 2007 SLIDE 16

- 18. AUTOMOTIVE SECTOR -- FORD NORTH AMERICA OPERATING COST REDUCTIONS* Cumulative Costs B / (W) Than December 31, 2005 (Bils.) 2008 Plan $5 Billion $2.3 $2.3 $1.5 December 31, 2006 June 30, 2007 September 30, 2007 Memo: Period Performance $1.5 $0.8 $0 * At constant volume, mix and exchange; excludes special items SLIDE 17

- 19. AUTOMOTIVE SECTOR -- FORD SOUTH AMERICA THIRD QUARTER KEY METRICS -- 2007 vs. 2006 Wholesales (000) Revenue (Bils.) Pre-Tax Profits (Mils.)* 116 $2.1 101 $1.5 $386 $201 2006 2007 2006 2007 2006 2007 Memo: Market Share** 11.5% 10.4% * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP ** South American 2007 market share based on estimated vehicle retail sales for our six major markets in that region SLIDE 18

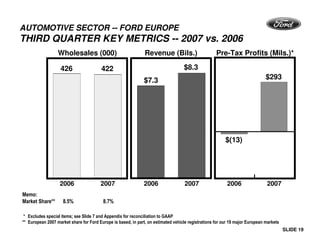

- 20. AUTOMOTIVE SECTOR -- FORD EUROPE THIRD QUARTER KEY METRICS -- 2007 vs. 2006 Wholesales (000) Revenue (Bils.) Pre-Tax Profits (Mils.)* 426 422 $8.3 $7.3 $293 $(13) 2006 2007 2006 2007 2006 2007 Memo: Market Share** 8.5% 8.7% * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP ** European 2007 market share for Ford Europe is based, in part, on estimated vehicle registrations for our 19 major European markets SLIDE 19

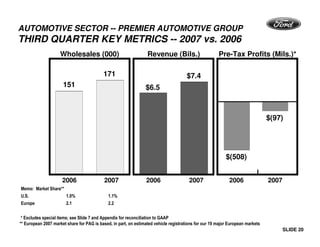

- 21. AUTOMOTIVE SECTOR -- PREMIER AUTOMOTIVE GROUP THIRD QUARTER KEY METRICS -- 2007 vs. 2006 Wholesales (000) Revenue (Bils.) Pre-Tax Profits (Mils.)* 171 $7.4 151 $6.5 $(97) $(508) 2006 2007 2006 2007 2006 2007 Memo: Market Share** U.S. 1.0% 1.1% Europe 2.1 2.2 * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP ** European 2007 market share for PAG is based, in part, on estimated vehicle registrations for our 19 major European markets SLIDE 20

- 22. AUTOMOTIVE SECTOR -- FORD ASIA PACIFIC AND AFRICA / MAZDA 2007 THIRD QUARTER PRE-TAX PROFITS* (Mils.) $48 $30 $18 Asia Pacific and Asia Pacific Mazda and Africa / Mazda and Africa Assoc. Operations Memo: B / (W) 2006 $64 $86 $(22) * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP SLIDE 21

- 23. AUTOMOTIVE SECTOR -- FORD ASIA PACIFIC AND AFRICA THIRD QUARTER KEY METRICS -- 2007 vs. 2006 Wholesales (000) Revenue (Bils.) Pre-Tax Profits (Mils.)* 124 129 $1.8 $1.6 $30 $(56) 2006 2007 2006 2007 2006 2007 Memo: Market Share** 2.5% 2.4% * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP ** Asia Pacific and Africa 2007 market share is based on estimated vehicle sales for our twelve major markets in that region SLIDE 22

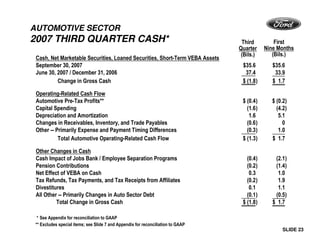

- 24. AUTOMOTIVE SECTOR 2007 THIRD QUARTER CASH* Third First Quarter Nine Months (Bils.) (Bils.) Cash, Net Marketable Securities, Loaned Securities, Short-Term VEBA Assets September 30, 2007 $35.6 $35.6 June 30, 2007 / December 31, 2006 37.4 33.9 Change in Gross Cash $ (1.8) $ 1.7 Operating-Related Cash Flow Automotive Pre-Tax Profits** $ (0.4) $ (0.2) Capital Spending (1.6) (4.2) Depreciation and Amortization 1.6 5.1 Changes in Receivables, Inventory, and Trade Payables (0.6) 0 Other -- Primarily Expense and Payment Timing Differences (0.3) 1.0 Total Automotive Operating-Related Cash Flow $ (1.3) $ 1.7 Other Changes in Cash Cash Impact of Jobs Bank / Employee Separation Programs (0.4) (2.1) Pension Contributions (0.2) (1.4) Net Effect of VEBA on Cash 0.3 1.0 Tax Refunds, Tax Payments, and Tax Receipts from Affiliates (0.2) 1.9 Divestitures 0.1 1.1 All Other -- Primarily Changes in Auto Sector Debt (0.1) (0.5) Total Change in Gross Cash $ (1.8) $ 1.7 * See Appendix for reconciliation to GAAP ** Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP SLIDE 23

- 25. AUTOMOTIVE SECTOR 2007 – 2009 OPERATING CASH FLOW AND RESTRUCTURING EXPENDITURES Present Plan Forecast (Bils.) (Bils.) Operating Cash Flow - Accelerate Subvention Payments to Ford Credit $ (2) $ (5) - Other Operating Cash Flow (8) (2) - (3) Total Operating Cash Flow $(10) $ (7) - (8) Restructuring (Employee Separation) (7) (5) - (6) Total Operating and Restructuring Cash Flow $(17) $(12) - (14) Memo: - Operating and Restructuring Cash Flow Excl. Change in Subvention $(15) $ (7) - (9) - Ford Credit Distributions (not incl. above) 0 5 SLIDE 24

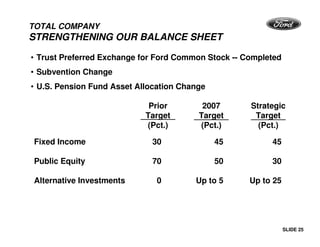

- 26. TOTAL COMPANY STRENGTHENING OUR BALANCE SHEET • Trust Preferred Exchange for Ford Common Stock -- Completed • Subvention Change • U.S. Pension Fund Asset Allocation Change Prior 2007 Strategic Target Target Target (Pct.) (Pct.) (Pct.) Fixed Income 30 45 45 Public Equity 70 50 30 Alternative Investments 0 Up to 5 Up to 25 SLIDE 25

- 27. FINANCIAL SERVICES SECTOR 2007 THIRD QUARTER PRE-TAX PROFIT / (LOSS) BY SEGMENT (Mils.) $556 $546* $10 Total Ford Credit Other Memo: B / (W) 2006 $(194) $(184) $(10) * Includes net profit of $205 million related to market valuation adjustments from derivatives SLIDE 26

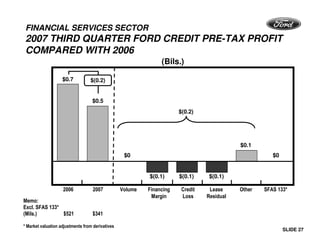

- 28. FINANCIAL SERVICES SECTOR 2007 THIRD QUARTER FORD CREDIT PRE-TAX PROFIT COMPARED WITH 2006 (Bils.) $0.7 $(0.2) $0.5 $(0.2) $0.1 $0 $0 $(0.1) $(0.1) $(0.1) 2006 2007 Volume Financing Credit Lease Other SFAS 133* Margin Loss Residual Memo: Excl. SFAS 133* (Mils.) $521 $341 * Market valuation adjustments from derivatives SLIDE 27

- 29. FINANCIAL SERVICES SECTOR LIQUIDITY HIGHLIGHTS • Diverse committed capacity provides funding flexibility and protects liquidity -- liquidity in excess of utilization remains $27 billion • Completed Third Quarter funding plan • Ford Credit’s Asset Backed Commercial Paper – We had several weeks in August and September where we issued overnight commercial paper at higher costs – Outstanding amount temporarily reduced • Demand for Ford Credit’s assets remains strong SLIDE 28

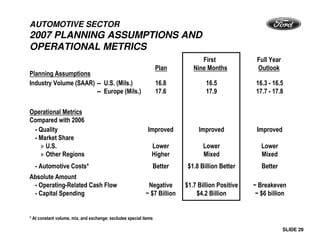

- 30. AUTOMOTIVE SECTOR 2007 PLANNING ASSUMPTIONS AND OPERATIONAL METRICS First Full Year Plan Nine Months Outlook Planning Assumptions Industry Volume (SAAR) -- U.S. (Mils.) 16.8 16.5 16.3 - 16.5 -- Europe (Mils.) 17.6 17.9 17.7 - 17.8 Operational Metrics Compared with 2006 - Quality Improved Improved Improved - Market Share » U.S. Lower Lower Lower » Other Regions Higher Mixed Mixed - Automotive Costs* Better $1.8 Billion Better Better Absolute Amount - Operating-Related Cash Flow Negative $1.7 Billion Positive ~ Breakeven - Capital Spending ~ $7 Billion $4.2 Billion ~ $6 billion * At constant volume, mix, and exchange; excludes special items SLIDE 29

- 31. AUTOMOTIVE SECTOR PRODUCTION VOLUMES Third Quarter Fourth Quarter Actual Forecast O / (U) O / (U) Units 2006 Units 2006 (000) (000) (000) (000) North America 637 (5) 645 39 Europe 416 (8) 480 (2) P.A.G. 160 24 188 9 SLIDE 30

- 32. TOTAL COMPANY 2007 OUTLOOK Comparison Outlook With Plan Automotive Operations Loss, but improved vs. 2006 Better Other Automotive -- Interest $(0.5) billion Better Financial Services $1.3 - $1.4 billion profit* Equal / Better Pre-Tax Operating Results** Small loss to breakeven Better After-Tax Operating Results** Loss, but improved vs. 2006 Better Special Charges $(1) - $(2) billion*** Equal Net Income Loss, but improved vs. 2006 Better * Excluding market valuation adjustments from derivatives ** Excluding Special Items *** Excluding gain / loss associated with future divestitures SLIDE 31

- 33. TOTAL COMPANY FORWARD-YEAR KEY BUSINESS METRICS Status • Profitable in North America and Total Automotive in 2009 On Plan • $5 billion cost reductions in North America by 2008 compared with 2005 On Plan • 14 - 15% U.S. market share (Ford, Lincoln-Mercury) On Plan • $17 billion cash outflow in 2007 – 2009 to fund operating losses and restructuring (employee Better separations) than Plan SLIDE 32

- 34. TOTAL COMPANY KEY PRIORITIES / OVERVIEW • We remain committed to our plan and are encouraged with our progress; recognize we have a long way to go • Our plan remains the same: – Restructure the company; be profitable at lower volume and changed mix – Accelerate product development and reduce manufacturing complexity – Secure financing; improve the balance sheet – Leadership and teamwork SLIDE 33

- 35. SAFE HARBOR Risk Factors Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Continued decline in market share; • Continued or increased price competition resulting from industry overcapacity, currency fluctuations or other factors; • An increase in or acceleration of market shift away from sales of trucks, sport utility vehicles, or other more profitable vehicles, particularly in the United States; • A significant decline in industry sales, particularly in the United States or Europe, resulting from slowing economic growth, geo-political events or other factors; • Lower-than-anticipated market acceptance of new or existing products; • Continued or increased high prices for or reduced availability of fuel; • Currency or commodity price fluctuations; • Adverse effects from the bankruptcy or insolvency of, change in ownership or control of, or alliances entered into by a major competitor; • Economic distress of suppliers that has in the past and may in the future require us to provide financial support or take other measures to ensure supplies of components or materials; • Labor or other constraints on our ability to restructure our business; • Work stoppages at Ford or supplier facilities or other interruptions of supplies; • Single-source supply of components or materials; • Substantial pension and postretirement health care and life insurance liabilities impairing our liquidity or financial condition; • Worse-than-assumed economic and demographic experience for our postretirement benefit plans (e.g., discount rates, investment returns, and health care cost trends); • The discovery of defects in vehicles resulting in delays in new model launches, recall campaigns or increased warranty costs; • Increased safety, emissions (e.g., CO2), fuel economy, or other (e.g., pension funding) regulation resulting in higher costs, cash expenditures, and/or sales restrictions; • Unusual or significant litigation or governmental investigations arising out of alleged defects in our products or otherwise; • A change in our requirements for parts or materials where we have entered into long-term supply arrangements that commit us to purchase minimum or fixed quantities of certain parts or materials, or to pay a minimum amount to the seller (quot;take-or-payquot; contracts); • Adverse effects on our results from a decrease in or cessation of government incentives; • Adverse effects on our operations resulting from certain geo-political or other events; • Substantial negative Automotive operating-related cash flows for the near- to medium-term affecting our ability to meet our obligations, invest in our business or refinance our debt; • Substantial levels of Automotive indebtedness adversely affecting our financial condition or preventing us from fulfilling our debt obligations (which may grow because we are able to incur substantially more debt, including additional secured debt); • Inability of Ford Credit to access debt or securitization markets around the world at competitive rates or in sufficient amounts due to additional credit rating downgrades, market volatility, market disruption or otherwise; • Higher-than-expected credit losses; • Increased competition from banks or other financial institutions seeking to increase their share of financing Ford vehicles; • Changes in interest rates; • Collection and servicing problems related to finance receivables and net investment in operating leases; • Lower-than-anticipated residual values or higher-than-expected return volumes for leased vehicles; and New or increased credit, consumer or data protection or other regulations resulting in higher costs and/or additional financing restrictions. We cannot be certain that any expectation, forecast or assumption made by management in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion of these risks, see quot;Item 1A. Risk Factorsquot; in our 2006 Form 10-K Report. SLIDE 34

- 36. APPENDIX

- 37. TOTAL COMPANY CALCULATION OF EARNINGS PER SHARE Third Quarter 2007 First Nine Months 2007 Cont. Ops. -- Cont. Ops. -- Net Excl. Net Excl. Income Special Items Income Special Items (Mils.) (Mils.) (Mils.) (Mils.) Numerator After-Tax Profits $ (380) $ (24) $ 88 $ 63 Impact on Income from assumed exchange of convertible notes and convertible trust preferred securities 0 0 0 0 Income for EPS $ (380) $ (24) $ 88 $ 63 Denominator Average shares outstanding 2,003 2,003 1,930 1,930 Net issuable shares, primarily stock options 0 0 12 12 Convertible notes 0 0 0 0 Convertible trust preferred securities 0 0 0 0 Average shares for EPS 2,003 2,003 1,942 1,942 EPS $(0.19) $(0.01) $ 0.05 $ 0.03 Appendix 1 of 14

- 38. TOTAL COMPANY 2007 THIRD QUARTER EFFECTIVE TAX RATE Continuing Operations Excluding Special Items Including Special Items PBT Taxes Tax Rate PBT Taxes Tax Rate (Mils.) (Mils.) (Pct.) (Mils.) (Mils.) (Pct.) PBT $194 $(156) Less: Unconsolidated Subsidiaries (53) (53) Adjusted PBT $141 $ (49) 35.0% $(209) $ 73 (35.0)% Tax Credits / Adjustments 33 (23.4) (208) 99.5 Ongoing Tax Before Valuation Allowance $ (16) 11.6% $(135) 64.5% Deferred Tax Asset Valuation Allowance (140) 99.0 (27) 13.5 Tax Provision $(156) 110.6% $(162) 78.0% Appendix 2 of 14

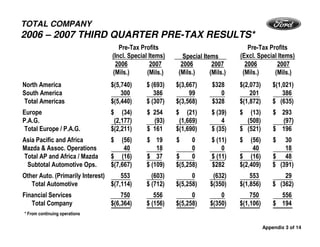

- 39. TOTAL COMPANY 2006 – 2007 THIRD QUARTER PRE-TAX RESULTS* Pre-Tax Profits Pre-Tax Profits (Incl. Special Items) Special Items (Excl. Special Items) 2006 2007 2006 2007 2006 2007 (Mils.) (Mils.) (Mils.) (Mils.) (Mils.) (Mils.) North America $(5,740) $ (693) $(3,667) $328 $(2,073) $(1,021) South America 300 386 99 0 201 386 Total Americas $(5,440) $ (307) $(3,568) $328 $(1,872) $ (635) Europe $ (34) $ 254 $ (21) $ (39) $ (13) $ 293 P.A.G. (2,177) (93) (1,669) 4 (508) (97) Total Europe / P.A.G. $(2,211) $ 161 $(1,690) $ (35) $ (521) $ 196 Asia Pacific and Africa $ (56) $ 19 $ 0 $ (11) $ (56) $ 30 Mazda & Assoc. Operations 40 18 0 0 40 18 Total AP and Africa / Mazda $ (16) $ 37 $ 0 $ (11) $ (16) $ 48 Subtotal Automotive Ops. $(7,667) $ (109) $(5,258) $282 $(2,409) $ (391) Other Auto. (Primarily Interest) 553 (603) 0 (632) 553 29 Total Automotive $(7,114) $ (712) $(5,258) $(350) $(1,856) $ (362) Financial Services 750 556 0 0 750 556 Total Company $(6,364) $ (156) $(5,258) $(350) $(1,106) $ 194 * From continuing operations Appendix 3 of 14

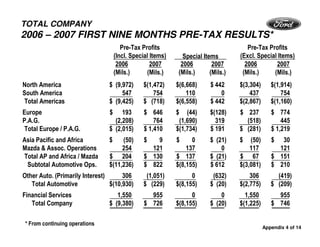

- 40. TOTAL COMPANY 2006 – 2007 FIRST NINE MONTHS PRE-TAX RESULTS* Pre-Tax Profits Pre-Tax Profits (Incl. Special Items) Special Items (Excl. Special Items) 2006 2007 2006 2007 2006 2007 (Mils.) (Mils.) (Mils.) (Mils.) (Mils.) (Mils.) North America $ (9,972) $(1,472) $(6,668) $ 442 $(3,304) $(1,914) South America 547 754 110 0 437 754 Total Americas $ (9,425) $ (718) $(6,558) $ 442 $(2,867) $(1,160) Europe $ 193 $ 646 $ (44) $(128) $ 237 $ 774 P.A.G. (2,208) 764 (1,690) 319 (518) 445 Total Europe / P.A.G. $ (2,015) $ 1,410 $(1,734) $ 191 $ (281) $ 1,219 Asia Pacific and Africa $ (50) $ 9 $ 0 $ (21) $ (50) $ 30 Mazda & Assoc. Operations 254 121 137 0 117 121 Total AP and Africa / Mazda $ 204 $ 130 $ 137 $ (21) $ 67 $ 151 Subtotal Automotive Ops. $(11,236) $ 822 $(8,155) $ 612 $(3,081) $ 210 Other Auto. (Primarily Interest) 306 (1,051) 0 (632) 306 (419) Total Automotive $(10,930) $ (229) $(8,155) $ (20) $(2,775) $ (209) Financial Services 1,550 955 0 0 1,550 955 Total Company $ (9,380) $ 726 $(8,155) $ (20) $(1,225) $ 746 * From continuing operations Appendix 4 of 14

- 41. TOTAL COMPANY THIRD QUARTER EMPLOYMENT DATA BY BUSINESS UNIT* June 30, Sept. 30, 2007 2007 Automotive (000) (000) North America 104 96 South America 14 14 Total Americas 118 110 Europe 67 67 P.A.G 43 42 Total Europe / P.A.G. 110 109 Asia Pacific and Africa 17 17 Total Automotive Ops. 245 236 Financial Services 12 12 Total Company 257 248 * This slide includes the approximate number of individuals employed by us and our consolidated entities (including entities we do not control) Appendix 5 of 14

- 42. TOTAL COMPANY 2007 THIRD QUARTER SUMMARY Wholesales Revenue Pre-Tax Profits* 2006 2007 2006 2007 2006 2007 (000) (000) (Mils.) (Mils.) (Mils.) (Mils.) North America 651 641 $15,380 $16,505 $(2,073) $(1,021) South America 101 116 1,523 2,064 201 386 Total Americas 752 757 $16,903 $18,569 $(1,872) $ (635) Europe 426 422 $ 7,275 $ 8,328 $ (13) $ 293 P.A.G. 151 171 6,490 7,408 (508) (97) Total Europe / P.A.G. 577 593 $13,765 $15,736 $ (521) $ 196 Asia Pacific and Africa** 124 129 $ 1,622 $ 1,782 $ (56) $ 30 Mazda and Assoc. Operations*** 14 8 251 183 40 18 Total AP and Africa / Mazda 138 137 $ 1,873 $ 1,965 $ (16) $ 48 Subtotal Automotive Ops. 1,467 1,487 $32,541 $36,270 $(2,409) $ (391) Other Auto. (Primarily Interest) 0 0 0 0 553 29 Total Automotive 1,467 1,487 $32,541 $36,270 $(1,856) $ (362) Financial Services 0 0 4,554 4,808 750 556 Total Company 1,467 1,487 $37,095 $41,078 $(1,106) $ 194 * Excludes special items; see Slide 7 and Appendix for reconciliation to GAAP ** Included in wholesales of Asia Pacific and Africa are Ford-badged vehicles sold in China and Malaysia by certain unconsolidated affiliates totaling about 51,000 and 38,000 units in 2007 and 2006, respectively. “Revenue” above does not include revenue from these units *** Includes consolidation of Automotive Alliance International (AAI): wholesales and revenue from production of Mazda6 vehicles only; pre-tax profits include Ford’s share of Mazda’s results and profits from AAI’s production of Mazda6 vehicles only Appendix 6 of 14

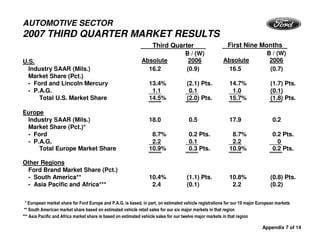

- 43. AUTOMOTIVE SECTOR 2007 THIRD QUARTER MARKET RESULTS Third Quarter First Nine Months B / (W) B / (W) U.S. Absolute 2006 Absolute 2006 Industry SAAR (Mils.) 16.2 (0.9) 16.5 (0.7) Market Share (Pct.) - Ford and Lincoln Mercury 13.4% (2.1) Pts. 14.7% (1.7) Pts. - P.A.G. 1.1 0.1 1.0 (0.1) Total U.S. Market Share 14.5% (2.0) Pts. 15.7% (1.8) Pts. Europe Industry SAAR (Mils.) 18.0 0.5 17.9 0.2 Market Share (Pct.)* - Ford 8.7% 0.2 Pts. 8.7% 0.2 Pts. - P.A.G. 2.2 0.1 2.2 0 Total Europe Market Share 10.9% 0.3 Pts. 10.9% 0.2 Pts. Other Regions Ford Brand Market Share (Pct.) - South America** 10.4% (1.1) Pts. 10.8% (0.8) Pts. - Asia Pacific and Africa*** 2.4 (0.1) 2.2 (0.2) * European market share for Ford Europe and P.A.G. is based, in part, on estimated vehicle registrations for our 19 major European markets ** South American market share based on estimated vehicle retail sales for our six major markets in that region *** Asia Pacific and Africa market share is based on estimated vehicle sales for our twelve major markets in that region Appendix 7 of 14

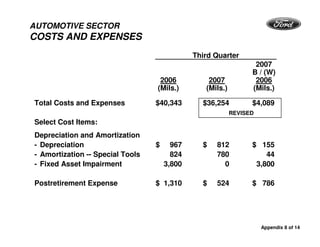

- 44. AUTOMOTIVE SECTOR COSTS AND EXPENSES Third Quarter 2007 B / (W) 2006 2007 2006 (Mils.) (Mils.) (Mils.) Total Costs and Expenses $40,343 $36,254 $4,089 REVISED Select Cost Items: Depreciation and Amortization - Depreciation $ 967 $ 812 $ 155 - Amortization -- Special Tools 824 780 44 - Fixed Asset Impairment 3,800 0 3,800 Postretirement Expense $ 1,310 $ 524 $ 786 Appendix 8 of 14

- 45. AUTOMOTIVE SECTOR GROSS CASH RECONCILIATION TO GAAP Sept. 30, 2007 Memo: Dec. 31, Sept. 30, B / (W) Sept. 30, June 30, 2006 2007 Dec. 31, 2006 2006 2007 (Bils.) (Bils.) (Bils.) (Bils.) (Bils.) Cash and Cash Equivalents $16.0 $18.9 $ 2.9 $13.5 $17.1 Marketable Securities 11.3 7.2 (4.1) 7.8 13.7 Loaned Securities 5.3 7.8 2.5 0.6 4.6 Total Cash / Market. and Loaned Securities $32.6 $33.9 $ 1.3 $21.9 $35.4 Securities-In-Transit (0.5) (0.4) 0.1 0 (0.3) Short-Term VEBA Assets 1.8 2.1 0.3 1.7 2.3 Gross Cash $33.9 $35.6 $ 1.7 $23.6 $37.4 Appendix 9 of 14

- 46. AUTOMOTIVE SECTOR GAAP RECONCILIATION OF OPERATING-RELATED CASH FLOWS 2007 First Third B / (W) Nine Months Quarter Than 2006 of 2007 (Bils.) (Bils.) (Bils.) Cash Flows from Operating Activities of Continuing Operations $ 3.1 $ 3.4 $ 5.9 Items Included in Operating-Related Cash Flows - Capital Expenditures (1.6) 0.2 (4.2) - Net Transactions Between Automotive and Financial Services Sector (0.3) (0.2) (0.8) - Net Cash Flows from Non-Designated Derivatives 0.2 0.2 0.7 Items Not Included in Operating-Related Cash Flows - Cash Impact of Jobs Bank Benefits & Separation Programs 0.4 0.2 2.1 - Net (Sales) / Purchases of Trading Securities (3.4) (3.3) (1.9) - Pension Contributions 0.2 0.1 1.4 - VEBA Cash Flows -- Net Reimbursement for Benefits Paid (0.5) 0.8 (0.8) - Tax Refunds and Tax Payments from Affiliates 0.2 0.5 (1.9) Other 0.4 0.1 1.2 Operating-Related Cash Flows $(1.3) $ 2.0 $ 1.7 Appendix 10 of 14

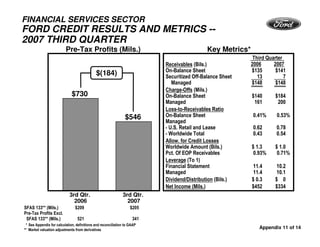

- 47. FINANCIAL SERVICES SECTOR FORD CREDIT RESULTS AND METRICS -- 2007 THIRD QUARTER Pre-Tax Profits (Mils.) Key Metrics* Third Quarter Receivables (Bils.) 2006 2007 On-Balance Sheet $135 $141 $(184) Securitized Off-Balance Sheet 13 7 Managed $148 $148 Charge-Offs (Mils.) $730 On-Balance Sheet $140 $184 Managed 161 200 Loss-to-Receivables Ratio $546 On-Balance Sheet 0.41% 0.53% Managed - U.S. Retail and Lease 0.62 0.78 - Worldwide Total 0.43 0.54 Allow. for Credit Losses Worldwide Amount (Bils.) $ 1.3 $ 1.0 Pct. Of EOP Receivables 0.93% 0.71% Leverage (To 1) Financial Statement 11.4 10.2 Managed 11.4 10.1 Dividend/Distribution (Bils.) $ 0.3 $ 0 Net Income (Mils.) $452 $334 3rd Qtr. 3rd Qtr. 2006 2007 SFAS 133** (Mils.) $209 $205 Pre-Tax Profits Excl. SFAS 133** (Mils.) 521 341 * See Appendix for calculation, definitions and reconciliation to GAAP ** Market valuation adjustments from derivatives Appendix 11 of 14

- 48. FORD CREDIT KEY METRIC DEFINITIONS In addition to evaluating Ford Credit’s financial performance on a GAAP financial statement basis, Ford Credit management also uses other criteria, some of which were previously disclosed in this presentation and are defined below. Information about the impact of on-balance sheet securitization is also included below: Managed Receivables -- receivables reported on Ford Credit’s balance sheet and receivables Ford Credit sold in off-balance-sheet securitizations and continues to service Serviced Receivables -- includes managed receivables and receivables Ford Credit sold in whole-loan sale transactions (i.e., receivables for which Ford Credit has no continuing exposure or risk of loss) Charge-offs on Managed Receivables -- charge-offs associated with receivables reported on Ford Credit’s balance sheet plus charge-offs associated with receivables Ford Credit sold in off-balance sheet securitizations and continues to service Equity -- shareholder’s interest and historical stockholder’s equity reported on Ford Credit’s balance sheet Impact of On-Balance Sheet Securitization -- finance receivables (retail and wholesale) and net investment in operating leases reported on Ford Credit's balance sheet include assets included in securitizations that do not qualify for accounting sale treatment. These assets are available only for repayment of the debt or other obligations issued or arising in the securitization transactions; they are not available to pay the other obligations of Ford Credit or the claims of Ford Credit's other creditors. Debt reported on Ford Credit's balance sheet includes obligations issued or arising in securitizations that are payable only out of collections on the underlying securitized assets and related enhancements Appendix 12 of 14

- 49. FINANCIAL SERVICES SECTOR FORD CREDIT RATIO DEFINITIONS In addition to evaluating Ford Credit’s financial performance on a GAAP financial statement basis, Ford Credit management also uses other criteria, some of which were previously disclosed in this presentation and are defined below: Charge-offs Loss-to-Receivables Ratio = Average Receivables Leverage: Total Debt - Financial Statement Leverage = Equity Retained Interest in Securitized Securitized Cash, Cash Off-Balance Off-Balance Equivalents & Adjustments for Sheet Sheet Marketable Hedge Accounting - Managed Leverage Total Debt + Receivables - Receivables - Securities* - on Total Debt = Equity + Minority - Adjustments for Interest Hedge Accounting on Equity * Excludes marketable securities related to insurance activities Appendix 13 of 14

- 50. FINANCIAL SERVICES SECTOR FORD CREDIT RECONCILIATIONS OF MANAGED LEVERAGE TO FINANCIAL STATEMENT LEVERAGE Sept. 30, Sept. 30, 2006 2007 Leverage Calculation (Bils.) (Bils.) Total Debt* $134.5 $133.1 Securitized Off-Balance Sheet Receivables Outstanding 12.9 7.6 Retained Interest in Securitized Off-Balance Sheet Receivables (1.1) (0.8) Adjustments for Cash, Cash Equivalents and Marketable Securities** (17.4) (12.0) Adjustments for Hedge Accounting (0.2) 0 Total Adjusted Debt $128.7 $127.9 Total Stockholder’s Equity (incl. minority interest) $ 11.8 $ 13.0 Adjustments for Hedge Accounting (0.5) (0.3) Total Adjusted Equity $ 11.3 $ 12.7 Managed Leverage (to 1) 11.4 10.1 Financial Statement Leverage (to 1) 11.4 10.2 * Includes $52 billion and $62 billion on September 30, 2006 and September 30, 2007, respectively of long-term and short-term asset-backed debt that is payable out of collections on these receivables and interests in operating leases and the related vehicles and is not the legal obligation of Ford Credit ** Excludes marketable securities related to insurance activities Appendix 14 of 14