Forecasting

- 1. Forecasting In route planning, I would forecast costs (variable and fixed including allocated overhead), passenger demand, market share, prices, and resulting revenue and profitability for a given flight. Cost forecasts were based on the best data we had, which was primarily historical data. Variable costs included pilots, crew, fuel, landing fees, variable station costs, etc.. Fixed costs were primarily allocations from aircraft ownership, fixed station costs, and fixed hub costs. For well served markets, the passenger demand forecast was last year’s demand, possibly adjusted for economic growth in the origin and destination cities. In markets experiencing significant increases in capacity, demand stimulation would be forecast based on experience in similar markets. Market share predictions were generated by a computer system developed jointly by Sabre and Continental. The model’s main inputs were number of departures, quality of connections, elapsed time, time of departure, and aircraft. I manually reviewed all market share results and modified as needed based on historical experience in similar markets. Similar to demand forecasts, pricing forecasts were based on recent trends. If the market was undergoing significant capacity changes, or if there were recent changes in published pricing, we would used published pricing and experience in similar markets. Airlines

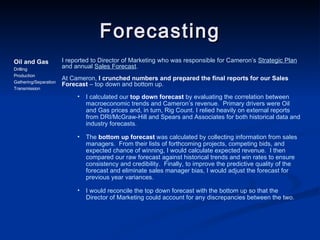

- 2. Forecasting I reported to Director of Marketing who was responsible for Cameron’s Strategic Plan and annual Sales Forecast . At Cameron, I crunched numbers and prepared the final reports for our Sales Forecast – top down and bottom up. I calculated our top down forecast by evaluating the correlation between macroeconomic trends and Cameron’s revenue. Primary drivers were Oil and Gas prices and, in turn, Rig Count. I relied heavily on external reports from DRI/McGraw-Hill and Spears and Associates for both historical data and industry forecasts. The bottom up forecast was calculated by collecting information from sales managers. From their lists of forthcoming projects, competing bids, and expected chance of winning, I would calculate expected revenue. I then compared our raw forecast against historical trends and win rates to ensure consistency and credibility. Finally, to improve the predictive quality of the forecast and eliminate sales manager bias, I would adjust the forecast for previous year variances. I would reconcile the top down forecast with the bottom up so that the Director of Marketing could account for any discrepancies between the two. Oil and Gas Drilling Production Gathering/Separation Transmission