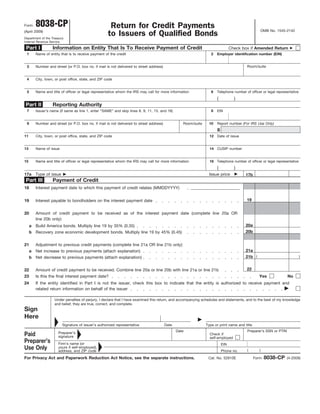

Form 8038-CP Return for Credit Payments to Issuers of Qualified Bonds

- 1. 8038-CP Return for Credit Payments Form OMB No. 1545-2142 (April 2009) to Issuers of Qualified Bonds Department of the Treasury Internal Revenue Service Part I Information on Entity That Is To Receive Payment of Credit Check box if Amended Return 1 Name of entity that is to receive payment of the credit 2 Employer identification number (EIN) Room/suite 3 Number and street (or P.O. box no. if mail is not delivered to street address) 4 City, town, or post office, state, and ZIP code Name and title of officer or legal representative whom the IRS may call for more information 5 6 Telephone number of officer or legal representative ( ) Part II Reporting Authority 8 7 Issuer’s name (if same as line 1, enter “SAME” and skip lines 8, 9, 11, 15, and 16) EIN 9 Number and street (or P.O. box no. if mail is not delivered to street address) Room/suite 10 Report number (For IRS Use Only) 8 11 City, town, or post office, state, and ZIP code 12 Date of issue 13 Name of issue 14 CUSIP number Name and title of officer or legal representative whom the IRS may call for more information 16 Telephone number of officer or legal representative 15 ( ) 17a Type of issue Issue price 17b Part III Payment of Credit 18 Interest payment date to which this payment of credit relates (MMDDYYYY) 19 19 Interest payable to bondholders on the interest payment date 20 Amount of credit payment to be received as of the interest payment date (complete line 20a OR line 20b only): 20a a Build America bonds. Multiply line 19 by 35% (0.35) 20b b Recovery zone economic development bonds. Multiply line 19 by 45% (0.45) 21 Adjustment to previous credit payments (complete line 21a OR line 21b only): 21a a Net increase to previous payments (attach explanation) 21b ( ) b Net decrease to previous payments (attach explanation) 22 22 Amount of credit payment to be received. Combine line 20a or line 20b with line 21a or line 21b 23 Is this the final interest payment date? Yes No 24 If the entity identified in Part I is not the issuer, check this box to indicate that the entity is authorized to receive payment and related return information on behalf of the issuer Under penalties of perjury, I declare that I have examined this return, and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Sign Here Signature of issuer’s authorized representative Date Type or print name and title Date Preparer’s SSN or PTIN Preparer’s Paid Check if signature self-employed Preparer’s Firm’s name (or EIN Use Only yours if self-employed), ( ) address, and ZIP code Phone no. 8038-CP For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 52810E Form (4-2009)