Fundraising Hacks - Pioneers Festival 2015 by Fred Destin at Accel Partners

- 1. 1

- 2. @fdestin

- 4. The Hustle Pan-European Network Vertical Focus Coverage Cross Border FinTech Next-Gen Infrastructure & Security Mobile Marketplaces Strong Companies in Leading Geos Strategic Relationships with European Teams Mind Share Within Europe Shared Global CRM 8,000+ Tracked companies Calls with founders Meetings 2,000+ 1,000+ 21 3

- 5. Dealfow = Lifeblood. Mostly outbound. • Portfolio companies act as local “Accel Ambassadors” • Organization focused on uncovering opportunities early • Methods: AppAnnie, Mattermark, systematic press coverage (new products releases, awards, HN etc) • Strong local presence: hosted over 500 entrepreneurs across 10 events in 9 cities over the last year

- 6. Reality check You are trying to get the attention of people who have 8 - 12 meetings per day and may not remember your name At any time you are competing with: - 10+ other projects inside a fund and - 100+ startups in the market at large Efficient time management is the #1 skill required to survive as a venture capitalist

- 8. 1: Completely Disagree 10: Completely Agree Survey Results 97 responses Bias towards early stage Over 50% found the process of raising VC confusing, opaque and frustrating

- 9. How many investors did you meet ? 28% met less than 5 Investors 59% met less than 10 Investors How long did it take ? 66% spent more than 3 mo 26% spent more than 6 mo

- 10. Star Investments Recent activity Board Load Cultural Fit “It was clear to me which partner I should approach at a given firm” All about the right partner 1: Completely Disagree 10: Completely Agree

- 11. Number of Accel-funded startups where contact came from cold email 1 “I managed to get meetings only through introductions” Sometimes … cold emailing works So what ?

- 12. Intellectually lazy Pattern recognition pushed too far Lesson givers Know it alls “In general, the VCs I met displayed a strong grasp of my business” What an indictment of European VC !

- 13. Invaluable insights Inspired to excel Kicked my butt Some VC's offered advice and insights that I found very meaningful to my business Common theme : some VC’s stand out … in a sea of mediocrity 28% Burnt

- 14. What characteristics matter most to you in a VC ? Trustworthy Entrepreneur Friendly Quality and Depth of Network Experienced Supportive Track record of success Risk Taking Collaborative Global Platform / Global Reach Visionary Hands-On and Engaged Influential Analytical Expert Thought Leader Innovative Emerging, rising star 0 17.5 35 52.5 70

- 15. Process was transparent and fast Process opacity drives entrepreneurs mad “Founders don’t care about difficulties, they complain about unkowns” I got a clear no

- 16. Entrepreneur’s VC turnoffs Approach Engagement Behavior Intellectually Lazy Patronizing Tell you what to do instead of asking questions Know-it-alls ADD Do not take time to understand Lack of risk taking mentality Focused only on financials ARROGANT Cold Unapproachable Unresponsive “Radar Play” Send young attractive associates at events playing interested and driving endless follow-ons ARROGANT Not responsive Slow Unprepared Checking email ! Playing for time Hanging around the hoop Fund competitors Aggressive on terms Bait-and-switch ARROGANT 21 3 16

- 17. Now What ? “Overall, I've met with pretty nice people. Most of them are lazy/dumb as f*ck and spend too much time in networking events/conference, drinking champagne, living off their management fees, but they’re friendly :) So the worst that happened was probably agreeing to countless meetings where VC's would just squeeze market info, without real appetite.”

- 18. 18

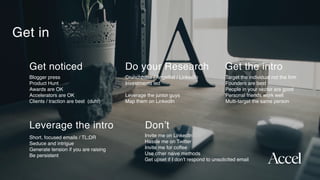

- 20. Get in Do your Research Don’t Get the intro Crunchbase / Angellist / LinkedIn Investments led Leverage the junior guys Map them on LinkedIn Invite me on LinkedIn Hassle me on Twitter Invite me for coffee Use other naive methods Get upset if I don’t respond to unsolicited email Target the individual not the firm Founders are best People in your sector are good Personal friends work well Multi-target the same person Get noticed Blogger press Product Hunt Awards are OK Accelerators are OK Clients / traction are best (duh!) Leverage the intro Short, focused emails / TL;DR Seduce and intrigue Generate tension if you are raising Be persistent

- 21. Fundraising facts Fact 2: You are talking to too few investors Fact 1: Inbound Marketing Wins 21 Fact 3: You are over-estimating your chances of success

- 22. First call or meetingTurndown 75% In-depth meeting Engaged process Turndown 50% Turndown 75% Turndown 50% Turndown 50% Partnership presentation Term-sheet presented and deal done 1,000 teams 250 teams 125 teams 30 teams 15 teams Illustrative Funnel

- 24. JohnAccel 2. In-depth meetingDestin Concerned about US Fundraising is a campaign SteveIndex 1. First MeetingRimer Scheduled 5/30 JohnSequoia 0. Intro MadeBotha Chase 5.27 Mark L.A16Z 1. First MeetingJordan Scheduled 6/12 IntroFund StagePartner Status comment … SteveDST Seeking IntroLindfors To Do

- 25. Some founder pitch advice Dry run with friends + Train on 2 shitty funds Know your metrics cold Your pitch must be perfectly prepared so that Understand your audience Know your unit economics cold Know your risks and be open about them Be exciting and memorable Be brave, confident and totally honest Enjoy yourself - good humour is contagious You can deviate effectively You can focus on the audience’s reactions You can always stay on track DON’T Pitch the market Pitch the competition Give long answers to questions Get sidetracked for too long Fear silence Get funded (vs. being right) Get to the next meeting Create relationship Detect toxic investors YOUR OBJECTIVES

- 26. Level Up - Hacks Build intangible value : visible board, visible advisors Practice concerted pitching Give anyone an excuse to say no Give overly punchy price guidance Miss any short term numbers Hide bad news Badmouth the competition Disclose widely that you are fundraising Disclose who you are talking to Treat bad offers seriously Ever take money from assholes Engineer regular, personalized progress points Pace news flow (e.g. new customer wins) Engineer tension in the process (at the right time) Work to (credible) deadlines Frame the market yourself & reframe questions Prepare the data ahead of time (e.g. cohorts) Practice data rationing Volunteer diligence contacts DON’T

- 27. Don’t ever stop running the business

- 28. And remember … everyone starts small Drew Houston and Arash Ferdowsi's apartment in 2007 Mike Cannon-Brookes and Scott Farquhar’s first office, based out of the local Kinko’s Sachin Bansal and Binny Bansal in 2008 at their first office, which was also the warehouse Ilkka Paananen sitting at his cardboard desk in 2010 Mark Zuckerberg’s dorm room in 2005 where the first versions of Facebook were built Girish Mathrubootham in FreshDesk’s first office where rent was $160 per Cloudera founding team in their first office in 2009 Stewart Butterfield working out of Tiny Speck’s first office in 2010

- 29. Be a VC - happy founder 1. Being turned down is the norm 2. You can build (real) relationships 3. You are part of an ecosystem 4. Pay-it-forward 29

- 30. Reach for The Stars