Future Watch summary: Future growth opportunities in global biobanks market

- 1. 1 BUSINESS FINLAND- EXECUTIVE SUMMARY The Growth Pipeline™ Company Powering clients to a future shaped by growth May 2020 FINAL REPORT FUTURE WATCH

- 2. 2 THE TOTAL BIOBANKING MARKET WILL REACH $54.71 BN IN 2020 AND GROW AT A CAGR OF 4.5% IN 2020-2026 TO REACH $71.22 BN IN 2026. Application CAGR (2019-2026) Research 4.3% Therapeutics 5.0% Sample Type CAGR (2019-2026) Bio-Fluids 3.9% Tissue Cells 6.1% DNA/RNA 2.6% Stem Cells 4.6% Global Biobank Market (Application and Sample) Therapeutic Applications for Biobanks are Likely to Increase with a Focus on Biomarkers, Oncology, Chronic Therapies Biobank Market Trends • Increase in Genome based research projects leveraging large collections of bio-data • Increase in R&D activities using biospecimens in precision oncology, stem cell research, cell and gene therapies, etc. • Increase in the Chronic Diseases have utilized the large population based data of biobanks • Utilization of sample data for research and data monetization is the next key value driver for the biobanks • Legal and Ethical Challenges remain high • High operational costs for biobanks • Lack of standardization, lengthy procedures and processes • Insufficient awareness about Biobanking activities Drivers Barriers The sole purpose of samples is to produce Biodata enabling patient stratification for precision medicine and the Biobanks can make use multiple business models for data monetization: 1. Research Providers 2. Data Owners 3. Service Providers 67% 33% Biobank Market by Application (2019) Research Therapeutics 40% 26% 15% 5% 14% Biobank Market by Sample (2019) Bio-fluids Human Tissue/Tumor Cells Stem Cells DNA/RNA Growth will be Driven by Human Tissue/Tumor Cells and Stem Cells due to their Novel Therapeutic Applications in rare diseases, regenerative medicines, targeted therapies, which are the focus of commercial and academic research globally Research providers Utilizing Samples and Sample Data for research projects Data Owners Access to Sample Data is the core offering. Service Providers Utilizing sample data and technology to provide additional services.

- 3. 3 KEY AREAS THAT WILL DRIVE THE FUTURE GROWTH FOR THE FINNISH BIOBANKS Biobanks have evolved from sample repository centers to active research partners in personalized medicine applications Companion Diagnostics Co- Development Large-Scale Genome Sequencing Projects Oncology Clinical Development Digital Pathology and Imaging Services The global companion diagnostics market is expected to reach $8.1 billion by 2023 with a CAGR of 21.2% between 2017-2023. By therapeutic area the oncology segment is expected to account for highest growth rate. The European next generation genome sequencing services market is forecast to grow at a CAGR of 15.4% from 2016 to 2023 to reach $605.0 million by 2023. Bioinformatics and application based services to provide competitive edge Immuno-oncology therapies are key application area in the oncology therapeutic category. The overall market for such therapies is expected to reach a revenue of $3.9 billion in 2022. With increasing need for digital workflow and technology for biospecimen assessment in pathology cases, digital information technologies offer the possibility to track the entire life cycle of a biosample The RWE market has witnessed a number of partnership and acquisition activities as companies aim to improve their technical expertise. The focus areas in RWE solutions include use of OMICS data, cloud computing, real time diagnostics, among others Real World Evidence Studies

- 4. 4 • High sample quality, good scientific record and accreditation are key selection criteria for the Pharma. • The scientific, commercial and the procurement team is involved in the entire process of selecting the biobank, however the chief decision makers are head of R&D and head of Procurement. • One Stop access to data is emerging to be a key attractive attribute for Pharma due to increasing data utilization and ease of access to data • Value based pricing is the desired model with quality of samples, timely availability, and rarity of the samples as key attributes • High utilization of data services and samples for diagnostics, immunoassay studies, biomarkers, and sequencing applications. • This makes capabilities such as online access, integration with systems, sample integrity, among the key attributes for the Biobanks. • Healthtech partner with the vendors exclusively for data using data rent model where temporary access to data is granted. Traditional Customers Emerging Customers 70% 15% 15% *Biobanks Projects (2019) Academic Institutions Pharmaceuticals Others (Biotech, Healthtech, CSO, etc. ) • Academic are the major partners of Biobanks. • Strategic fit, well defined engagement models and robust marketing outreach can strengthen the partnership and create further opportunities to tap new customers, especially pharma. THE SHIFTING INDUSTRY PARADIGM TOWARDS COMMERCIAL PARTNERSHIPS WITH PHARMA, BIOTECH, CROS, CDMOS AND DIGITAL SOLUTION PROVIDERS IS EXPECTED TO TRIGGER THE MARKET GROWTH. * n=17 biobanks (based on survey) Technology Vendors CSO (CRO/ CDMO) • CSOs focus on sample variety, regulatory expertise, and good scientific record as key attributes. • With stringent project timelines CSOs tend to adopt a more flexible engagement in order to deal with dynamic demand in sample and services requirements. • Revenue sharing model for CSOs is tied the outcomes or milestones achieved by the CSO for Pharma company Pharma/ Biotech Academia

- 5. 5 A NUMBER OF LEADING BIO-BANKS IN THE US, UK, SWEDEN, AND DENMARK HAVE TAKEN STRIDES TO ADOPT AND IMPLEMENT INDUSTRY BEST PRACTICES IN THE LAST FEW YEARS • UK holds vast resources of biobanks, managed by academics and industry partners. UK Biobank has a highly diverse set of funding sources including govt. orgs, charities, commercial partners, NGOs, etc. • Across Sweden, millions of samples with related data are held in different types of biobanks which play a major role in enhancing the precision medicine ecosystem and biobanks have robust commercial partnerships . The presence of startups, clinical informatics, R&D centers, Biobanks, commercial organizations create an ecosystem that supports precision medicine research • In Denmark, the population cohorts, genomic databases, epidemiological research combined with sample management and data analytics capabilities act as key enablers for the Biobanks. DNB has a highly sophisticated sample management system with highly automated sample handling with 8 high-throughput Hamilton STAR robots, biomarker analysis for 6000 samples and DNA extraction for 1200 samples per day. • Across US there are biobanks , small and large scale, focusing on population as well as diseases for effective translational research and have a dedicated sales and marketing outreach. Kaiser Permanente Biobank has an annual budget of 2-3% for marketing activities USA • All of US Biobank • NCI Biobank • UMMC biobank • Biome Biobank • Kaiser Permanente Research Bank UK • UK Biobank • CIGMR Biobank Sweden • Biobank Vast • Uppsala Biobank • KI Biobank • SMB Biobank Iceland • Decode Genetics France • IARC Biobank Denmark • Danish National Biobank • Danish Cancer Biobank • RBGB Biobank Austria • Biobank Graz 32% 41% 20% 7% Biobank Market Share by Region (2019) North America Europe Asia Pacific LAMEA

- 6. 6 FINNISH BIOBANKS CAN DIFFERENTIATE THEMSELVES TO PROVIDE A UNIQUE VALUE PROPOSITION AND INCREASE THEIR COMPETITIVE STANDING WITH CUSTOMERS Oncology Clinical Development and Genome Sequencing can be the immediate growth levers for the Biobanks while strengthening the capabilities in digital pathology, companion diagnostics and RWE studies A greater participation in regional and international networks will enable to increase the competitive standing of the Finnish Biobanks compared to their global counterparts A greater participation in regional and international networks will enable to increase the competitive standing of the Finnish Biobanks compared to their global counterparts Sample management and data infrastructure capabilities of Finnish Biobanks are competitive and have seen rapid progress. One stop Shop capabilities are expected to boost engagement with the partner and data services offerings. While the sample utilization of the Finnish Biobanks is at par with global standards, much needs to be done to improve the customer acquisition strategies in terms of: • Working with diverse customer type • Having well defined engagement models • Robust marketing and business development activities Biobank Source: Frost & Sullivan Service Scope Social Sustainability Operational Sustainability Financial Sustainability Customer Acquisition UK Biobank has a highly diverse set of funding sources. Funding includes core funding for sample storage and management and project based funding such as in genotyping, imaging studies, and biochemical markers KI Biobank collaborated with Janssen to for a real world evidence study using the comprehensive data from Swedish registries and research expertise of KI in Sweden. The focus research areas include- Depression, B-cell malignancies, Prostate Cancer, Psoriasis Participation of biobanks in networks/collaboration studies: Biome Biobank (USA)- ignite network, emerge network. NHGRI, ISBER CIGMR Biobank (UK)- BBMRI, MNDA, Arthiritis Research UK, Innovative Medicines Initiative (IMI) Uppsala Biobank (Sweden)- Swedeheart, SCAPIS, CONCEPTION, ULSAM, U-CAN Study Biobanks such as Danish National Biobank, UK Biobank, have well defined pricing model for engagements and multiple funding sources Uppsala Biobank engages in 3 different models with the end- users

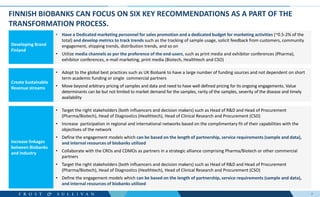

- 7. 7 FINNISH BIOBANKS CAN FOCUS ON SIX KEY RECOMMENDATIONS AS A PART OF THE TRANSFORMATION PROCESS. • Have a Dedicated marketing personnel for sales promotion and a dedicated budget for marketing activities (~0.5-2% of the total) and develop metrics to track trends such as the tracking of sample usage, solicit feedback from customers, community engagement, shipping trends, distribution trends, and so on • Utilize media channels as per the preference of the end-users, such as print media and exhibitor conferences (Pharma), exhibitor conferences, e-mail marketing, print media (Biotech, Healthtech and CSO) Developing Brand Finland • Adopt to the global best practices such as UK Biobank to have a large number of funding sources and not dependent on short term academic funding or single commercial partners • Move beyond arbitrary pricing of samples and data and need to have well defined pricing for its ongoing engagements. Value determinants can be but not limited to market demand for the samples, rarity of the samples, severity of the disease and timely availability Create Sustainable Revenue streams • Target the right stakeholders (both influencers and decision makers) such as Head of R&D and Head of Procurement (Pharma/Biotech), Head of Diagnostics (Healthtech), Head of Clinical Research and Procurement (CSO) • Increase participation in regional and international networks based on the complimentary fit of their capabilities with the objectives of the network • Define the engagement models which can be based on the length of partnership, service requirements (sample and data), and internal resources of biobanks utilized • Collaborate with the CROs and CDMOs as partners in a strategic alliance comprising Pharma/Biotech or other commercial partners • Target the right stakeholders (both influencers and decision makers) such as Head of R&D and Head of Procurement (Pharma/Biotech), Head of Diagnostics (Healthtech), Head of Clinical Research and Procurement (CSO) • Define the engagement models which can be based on the length of partnership, service requirements (sample and data), and internal resources of biobanks utilized Increase linkages between Biobanks and Industry

- 8. 8 FINNISH BIOBANKS CAN FOCUS ON SIX KEY RECOMMENDATIONS AS A PART OF THE TRANSFORMATION PROCESS. • Expand the data collection from the donors and increase the variety of data types viz. Exogenous data, Clinical/Dx data, OMICS data and remote care data from multiple sources such as patient questionnaire, physical activity monitoring, environmental measures, health outcomes studies, imaging data, genotyping data and so on • Utilization of data services is high for the Pharma and the Healthtech segment and data based partnerships can be explored with data rent model under which the Biobank can grant temporary access to data to the end-users while keeping the ownership of the data with themselves • Enhance the digitization capabilities through the Fingenius portal. Key attributes for such a portal include easy login details, lesser complexity in access of sample information and data, less complicated navigation for additional features, contact details of the Biobank personnel, frequent updates of the Finnish Biobank activities and so on Enabling Digitization and Data Services • Identify growth levers to in different service segments to differentiate the offerings. For example molecular and genetic epidemiology (cancer causation), molecular pathology, and pharmacogenomics/pharmacoproteomics, single cell transcriptome analysis and so on. • Finnish Biobank can continue to Invest in further strengthening sample management infrastructure for storage, distribution and sample variety. Focus on research repositories hosting biomedical and clinical data and consider performance attributes for track the utilization and effectiveness. • Work on retaining talent pool and hiring specialized human capital for biobanking services. Capacity expansion • Ease interpretation of existing laws and policies around data access, sharing, sample utilization, etc. by regular hosting of webinars, Q and A sessions with the target audience • Have a robust project management plan and standard operating procedures (SOPs) with details of activities, stakeholder responsibility for the activities, delivery timelines, current status, work breakdown structure (WBS). Ease of Business

Editor's Notes

- https://www.ckbiobank.org/site/ https://openbioresources.metajnl.com/articles/10.5334/ojb.56/ https://crukcambridgecentre.org.uk/news/funding-europe-wide-tumour-cell-biobank https://www.genomeweb.com/sequencing/regeneron-partners-abbvie-alnylam-astrazeneca-biogen-pfizer-sequence-uk-biobank-samples#.Xcj4Y1czbIU https://www.medstarhealth.org/mhri/focusblog/2019/02/02/indivumed-medstar-collaboration-reaches-milestone-for-medstar-health-cancer-biobank/ https://snyder.ucalgary.ca/research/precision-medicine-nephrology http://phrma-docs.phrma.org/sites/default/files/pdf/chart_pack-value_of_personalized_medicine.pdf

- https://www.ckbiobank.org/site/ https://openbioresources.metajnl.com/articles/10.5334/ojb.56/ https://crukcambridgecentre.org.uk/news/funding-europe-wide-tumour-cell-biobank https://www.genomeweb.com/sequencing/regeneron-partners-abbvie-alnylam-astrazeneca-biogen-pfizer-sequence-uk-biobank-samples#.Xcj4Y1czbIU https://www.medstarhealth.org/mhri/focusblog/2019/02/02/indivumed-medstar-collaboration-reaches-milestone-for-medstar-health-cancer-biobank/ https://snyder.ucalgary.ca/research/precision-medicine-nephrology http://phrma-docs.phrma.org/sites/default/files/pdf/chart_pack-value_of_personalized_medicine.pdf

- https://www.reuters.com/brandfeatures/venture-capital/article?id=65658 https://www.pfizer.com/science/research-development/precision-medicine