Global Corporate & Investment Banking

- 1. Global Corporate and Investment Banking Gene Taylor Bank of America Vice Chairman and Global Corporate and Investment Banking President

- 2. Forward Looking Statements This presentation contains forward-looking statements, including statements about the financial conditions, results of operations and earnings outlook of Bank of America Corporation. The forward- looking statements involve certain risks and uncertainties. Factors that may cause actual results or earnings to differ materially from such forward-looking statements include, among others, the following: 1) projected business increases following process changes and other investments are lower than expected; 2) competitive pressure among financial services companies increases significantly; 3) general economic conditions are less favorable than expected; 4) political conditions including the threat of future terrorist activity and related actions by the United States abroad may adversely affect the company’s businesses and economic conditions as a whole; 5) changes in the interest rate environment reduce interest margins and impact funding sources; 6) changes in foreign exchange rates increases exposure; 7) changes in market rates and prices may adversely impact the value of financial products; 8) legislation or regulatory environments, requirements or changes adversely affect the businesses in which the company is engaged; 9) changes in accounting standards, rules or interpretations, 10) litigation liabilities, including costs, expenses, settlements and judgments, may adversely affect the company or its businesses; 11) mergers and acquisitions and their integration into the company; and 12) decisions to downsize, sell or close units or otherwise change the business mix of any of the company. For further information regarding Bank of America Corporation, please read the Bank of America reports filed with the SEC and available at www.sec.gov. 2

- 3. Bank of America Business Client Coverage Global Corporate and Investment Banking Global Commercial Banking Global Investment Banking Global Markets • Middle Market Banking - Corporations with Institutional investors $20MM -$2B sales > $2B sales • Mutual funds • Sponsors • Pension funds • Business Banking – $2.5MM-$20MM sales • Industry coverage • Hedge funds • Bus. and Info. • Healthcare • Corporate Investors • Commercial Real Estate Services • Natural • Asset managers Banking • Consumer/Retail Resources • Foreign reserve managers • Leasing • Financial Inst. • Real Estate • Gaming • Technology/ • Dealer Financial Services • Global Media/Telecom Industries • Business Capital 3

- 4. 2006 Bank of America Revenue / Earnings Revenue Earnings Other Other Wealth Mgt. 3% Wealth Mgt. 4% 10% 11% Global Consumer Corporate Consumer Bank Bank Global 53% and 56% Corporate Investment and Banking Investment 31% Banking 32% 4

- 5. Global Corporate and Investment Banking 2006 Revenue and Earnings Revenue Earnings ALM/Other ALM/Other Business 10% 9% Lending 25% Business Lending 33% Cap Mkts/Adv Svcs Cap 25% Mkts/Adv Svcs 36% Treasury 30% Treasury 32% 5 ALM/Other includes LatAm and Asia Commerical

- 6. Global Corporate and Investment Banking Strategy for Growth Deepen client relationships/ Goals by 2011 develop new ones • Increase revenues by $10 billion Increase our international presence • Increase earnings by $3 billion Strategically deploy capital 6

- 7. Where We Can Be Bigger • Business Banking: Increase number of clients/Increase sales of credit and cash management products • Middle Market Leveraged Finance: Increase loan origination and distribution through structured products channels • Electronic Payments: Sell more electronic payments products to clients of all size • Investment Banking in Targeted Client Groups: Focus on Middle Market clients, Financial Institutions and Financial Sponsor fee pools • International Cash Management: Increase our 2 percent non-U.S. international market share • International Investment Banking/Capital Markets: Greater market share in leveraged finance, structured finance, liquid products 7

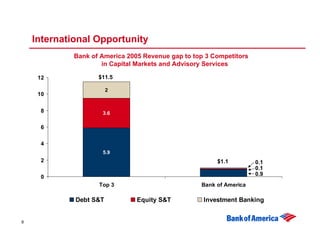

- 8. International Opportunity Bank of America 2005 Revenue gap to top 3 Competitors in Capital Markets and Advisory Services 12 $11.5 2 10 8 3.6 6 4 5.9 2 $1.1 0.1 0.1 0.9 0 Top 3 Bank of America Debt S&T Equity S&T Investment Banking 8

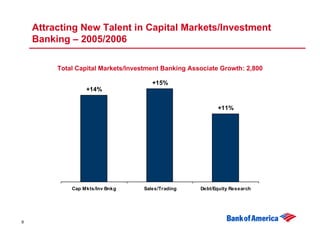

- 9. Attracting New Talent in Capital Markets/Investment Banking – 2005/2006 Total Capital Markets/Investment Banking Associate Growth: 2,800 +15% +14% +11% Cap Mkts/Inv Bnkg Sales/Trading Debt/Equity Research 9

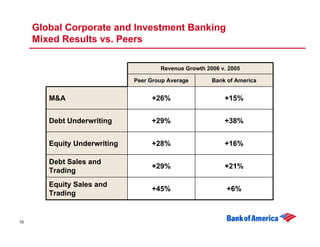

- 10. Global Corporate and Investment Banking Mixed Results vs. Peers Revenue Growth 2006 v. 2005 Peer Group Average Bank of America M&A +26% +15% Debt Underwriting +29% +38% Equity Underwriting +28% +16% Debt Sales and +29% +21% Trading Equity Sales and +45% +6% Trading 10

- 11. Winning New Business Investment Dealers Digest Deal Bank of America Role Recognition • Advisor to Sponsor consortium • Joint lead arranger and M&A Deal of the Year book-running manager on Healthcare Deal of the Year financing • Equity bridge commitment • Advisor to Blackstone • Joint book-runner on CMBS Real Estate Deal of the Year financing • Equity bridge commitment • Advisor to Sponsor consortium Technology Deal of the Year • Joint lead manager on financing 11

- 12. Investor Quality Scores 3rd 2006 Fixed Income Quality Index1 9th 2004 5th 2006 Overall Debt Overall Equity 6th 2006 Research Research 7th 2004 Ranking2 Ranking2 9th 2004 1Source: Independent research company 12 2Source: Institutional Investor, September, October, 2006

- 13. Global Corporate and Investment Banking Revenue Distribution in 2011 Product Region 3% 5% 8% 28% 24% 14% 31% 32% 89% 81% 45% 40% 2006 2011 2006 2011 Business Lending Treasury Cap Mkts/Adv Svcs Asia EMEA U.S. 13

- 14. Global Corporate and Investment Banking How we will Grow FOCUS + INTEGRATION + EXECUTION Deepen client relationships/ Goals by 2011 develop new ones • Increase revenues by $10 billion Increase our international presence • Increase earnings by $3 billion Strategically deploy capital 14

- 15. Bank of America Business Client Coverage Global Corporate and Investment Banking Global Commercial Banking Global Investment Banking Global Markets • Middle Market Banking - Corporations with Institutional investors $20MM -$2B sales > $2B sales • Mutual funds • Sponsors • Pension funds • Business Banking – $2.5MM-$20MM sales • Industry coverage • Hedge funds • Bus. and Info. • Healthcare • Corporate Investors • Commercial Real Estate Services • Natural • Asset managers Banking • Consumer/Retail Resources • Foreign reserve managers • Leasing • Financial Inst. • Real Estate • Gaming • Technology/ • Dealer Financial Services • Global Media/Telecom Industries • Business Capital 15

- 16. Global Commercial Banking Overview David Darnell President, Global Commercial Banking

- 17. Bank of America Business Client Coverage Consumer Banking Global Corporate & Investment Banking Mass Market Global Commercial Global Investment Global Markets Small Business Banking Banking 17

- 18. Bank of America Business Client Coverage Consumer Banking Global Corporate & Investment Banking Mass Market Global Commercial Global Investment Global Markets Small Business Banking Banking • Business Banking • Middle Market Banking • Commercial Real Estate Banking • Leasing • Dealer Financial Services • Business Capital 18

- 19. Global Commercial Banking – Strategic Initiatives FOCUS + INTEGRATION + EXECUTION Deepen Client Relationships Goals by 2011 Increase Grow Market Share revenues by $3.5 billion in 5 years Strategically Deploy Capital 19

- 20. Integrated Delivery Extended Team Interest Rate Investment Protection Banker Specialist Client Manager Leasing Credit Risk Specialist Management Treasury Mgmt. Sales Officer CLIENT Credit Products Officer Commercial International Service Banker Center Private/Premier Banker Core Client Team Other Product Investment Specialists Specialist Foreign Exchange Specialist 20

- 21. Global Commercial Banking: Revenue Diversity Revenue By Product Other Investment 11% Banking 4% Treasury 44% Commercial Credit 34% Consumer Credit 7% Commercial Credit represents 34% of GCB revenues vs. 58% in 2000 21

- 22. Client Management Process Client Team Activities • Client/Prospect Calls • Client Planning Sessions Management & Inspection • Activity Metrics • Outcome Metrics Client • Client Feedback • Compensation aligned with Revenue Growth Tools & Technology • Action Plans • Desktop Sales Tools 22

- 23. Client Management Process At Work August 22, 2006 has merged with Banc of America Securities LLC acted as a financial advisor to Shurgard Storage Centers, Inc. 23

- 24. Global Commercial Banking -- Deepen Client Relationships FOCUS + INTEGRATION + EXECUTION Deepen • Focus on Targeted Clients: Client – Middle Market Banking Relationships – Business Banking (credit & treasury) Goals by 2011 Increase revenues by $3.5 billion in 5 years 24

- 25. Growth Opportunity Expanding Middle Market Relationships Average Average Strategy Products per Revenue per # of Clients Relationship Relationship Expand & 1,644 8.4 $1,921M Deepen Top 10% Aggressively Remaining Targeted 14,801 5.4 $187M Grow 25

- 26. Global Commercial Banking -- Deepen Client Relationships FOCUS + INTEGRATION + EXECUTION Deepen • Focus on Targeted Clients: Client – Middle Market Banking Relationships – Business Banking (credit & treasury) Goals by 2011 Increase revenues by $3.5 billion in 5 years 26

- 27. Growth Opportunity Business Banking Client Expansion ($ in thousands) CMP Success Increased From To Goal Products/Relationship 3.0 4.0 5.0 Revenue/Relationship $11.6 $12.8 $15.0 Treasury Penetration 36% 40% 50% Credit Penetration 38% 46% 52% 27

- 28. Global Commercial Banking– Grow Market Share FOCUS + INTEGRATION + EXECUTION Increase Focus on Targeted Clients Client • Middle Market Banking Penetration • Business Banking (credit & treasury) Goals by 2011 Grow • Business Banking Increase Market • Middle Market Investment Banking revenues by Share • International (Treasury Management) $3.5 billion in 5 years 28

- 29. Growth Opportunity Middle Market Investment Banking Dual Coverage Momentum Product Mix and Revenue Growth YOY wth Revenue % G ro Growth Lift +33 CMAS 32% 41% +80% Treasury Services 41% 36% +18% Business Lending 27% 23% +12% 2005 2006 Revenue Mix Market Share of Total Fees Paid 9% 11% 29

- 30. GCB Clients Investment Banking Wallet BAC Middle Market Share of Wallet 2006 Commercial IB Fee Pool = $4.1B Dual Non-Dual Coverage Coverage 11.3% 6.4% 30

- 31. International Growth Opportunity: Grow Treasury Management market share Management Focus: U.S. clients doing business in Europe/Asia Integration: Execution of CMP in Europe/Asia 31

- 32. Global Commercial Banking – Strategically Deploy Capital FOCUS + INTEGRATION + EXECUTION Increase • Focus on Targeted Clients: Client –Middle Market Banking Penetration –Business Banking Goals by 2011 Grow • Business Banking Market • Middle Market Investment Banking Increase Share • International (Treasury Management) revenues by $3.5 billion in 5 years Strategically • International Banking Deploy • Treasury Management Capital • Business Banking 32

- 33. Global Commercial Banking – Strategic Initiatives FOCUS + INTEGRATION + EXECUTION Deepen Client Relationships Goals by 2011 Increase Grow Market Share revenues by $3.5 billion in 5 years Strategically Deploy Capital 33

- 34. Global Investment Banking Brian Brille Global Head of Investment Banking

- 35. Bank of America Business Client Coverage Global Corporate & Investment Banking Global Global Commercial Investment Global Markets Banking Banking • Manages Bank of America’s relationships with large and mid-cap corporate clients • Delivers full spectrum of Bank of America’s products • Employs integrated corporate and investment banking model • Coverage teams span ten industry groups, including Financial Sponsors 35

- 36. Global Investment Banking – Strategic Themes FOCUS + INTEGRATION + EXECUTION Goals by 2011 Integrated Delivery of the Bank’s Capabilities • Drive $2.5 billion in incremental corporate and investment banking revenues Capture Largest Fee Pool Opportunities • Achieve Top 3 share in U.S. investment banking • Become a Top 10 Grow International Presence investment bank in Europe 36

- 37. Integrated Delivery of the Bank’s Capabilities FOCUS + INTEGRATION + EXECUTION Integrated • Integrated corporate and investment bank Delivery of • Dual coverage of commercial bank clients the Bank’s • Universal bank partnerships Capabilities - Global Wealth & Investment Management 37

- 38. Integrated Corporate and Investment Banking Model Team Key Decision Maker Quarterbacks Superior Ideas and Solutions CLIENT SOLUTIONS PRODUCT HUBS Board of Directors Investment Strategic & M&A Financial Banker Equities Advisory Convertibles Debt CEO High Grade & High Yield Debt ers Cov Structured Finance geTeam Memb erag Restructurings Client-focused CFO Investment Grade Loan Syndications team providing eTeam Mem Capital Liquid Products strategically Raising Asset Backed Finance Head of Corporate aligned and & Capital Private Placements Development integrated Management era Public Finance coverage Credit & Leasing Cov ers b Treasurer Treasury & Trade Wealth Management Transaction Asset Management Corporate Services & Assistant Treasurer Operating Banker Products Primary Investment Banking Focus Joint Investment Banking and Corporate Banking Focus Primary Corporate Banking Focus 38

- 39. Integrated Delivery Initiatives Global Commercial Banking • Dual coverage of 1,300 commercial banking clients Global Markets • Early engagement of product teams (e.g. FX and Derivatives) in all capital raising and advisory situations to increase event driven revenues Global Wealth & Investment Management • Cross referral program to expand business opportunities Global Treasury Services • Leverage market leadership in GTS to drive increased revenues in both treasury services and investment banking products 39

- 40. Global Treasury Services Growth Opportunity Global Treasury Services Number of Products Penetration of Corporate Clients Per Relationship 80.0% 66.0% 6.7 5.7 2006 2011 2006 2011 • Corporate clients generate $2.0 billion, or 30%, of total GTS revenues. • Significant revenue lift from multi-product relationships • Important strategic relationship lever 40

- 41. Largest Fee Pool Opportunities FOCUS + INTEGRATION + EXECUTION Integrated Delivery of the Bank’s Capabilities Largest • Under-penetrated, high-fee pool industries Fee Pool • M&A and Equity Capital Markets Opportunities • Financial Sponsors 41

- 42. Growing Investment Banking Fee Pools Global Fee Pools 2002 - 2006 By Product ($B) Global Fee Pools 2002 - 2006 By Geography ($B) CAGR CAGR $76 19% $76 19% 17 24% $62 24 17% $62 $54 $54 13 21 $45 $45 12 19 27 22% 21 20% $38 $38 10 18 22 16 7 16 13 16 14 12 13 10 31 21% 32 15% 25 25 26 19 18 21 14 15 2002 2003 2004 2005 2006 2002 2003 2004 2005 2006 M&A Equity Debt US EMEA Other 42 Source: Thomson Financial / Freeman & Co

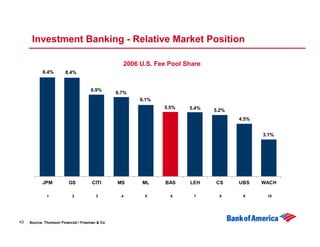

- 43. Investment Banking - Relative Market Position 2006 U.S. Fee Pool Share 8.4% 8.4% 6.9% 6.7% 6.1% 5.5% 5.4% 5.2% 4.5% 3.1% JPM GS CITI MS ML BAS LEH CS UBS WACH 1 2 3 4 5 6 7 8 9 10 43 Source: Thomson Financial / Freeman & Co

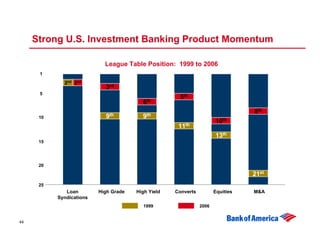

- 44. Strong U.S. Investment Banking Product Momentum League Table Position: 1999 to 2006 1 2nd 2nd 3rd 5 5th 6th 8th 10 9th 9th 10th 11th 13th 15 20 21st 25 Loan High Grade High Yield Converts Equities M&A Syndications 1999 2006 44

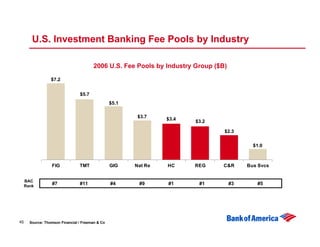

- 45. U.S. Investment Banking Fee Pools by Industry 2006 U.S. Fee Pools by Industry Group ($B) $7.2 $5.7 $5.1 $3.7 $3.4 $3.2 $2.3 $1.0 FIG TMT GIG Nat Re HC REG C&R Bus Svcs BAC Rank #7 #11 #4 #9 #1 #1 #3 #5 45 Source: Thomson Financial / Freeman & Co

- 46. Financial Institutions Universal bank model positions Bank of America well 2006 Financial Institutions Fee Pools 2006 Financial Institutions U.S. Share by Product ($B) By Competitor By Product 900 $8.0 $7.2 $6.8 11.0% 7.0 750 9.1% 6.0 8.4% 600 7.2% 5.0 6.9% $4.1 5.9% 450 4.0 4.3% 3.0 300 3.8% 3.7% 3.7% 2.0 150 1.0 0 0.0 GS CITI MS ML JPM LEH BAS UBS CS WACH US EMEA Other Rank: 1 2 3 4 5 6 7 8 9 10 M&A Equity Debt M&A Equity Debt 46 Source: Thomson Financial / Freeman & Co

- 47. Financial Sponsors Evolution of sponsor market presents attractive opportunities Total U.S. LBO Volume 1996 – 2006 ($B) 25% 22% $350 21% 18% 20% 300 $315 17% 250 % of Overall M&A 13% 15% $198 200 Volume 8% $137 150 10% 4% 5% $95 100 3% $63 3% 3% $41 $41 5% $29 $29 $41 $23 50 0 0% 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 47 Source: Buyouts Magazine: Completed Deals

- 48. Financial Sponsors – Strategies for Growth Financial Sponsors 2006 Fee Pools Financial Sponsors 2006 U.S. Fee Pools by Product ($B) by Competitor By Product $8.0 800 $7.2 10.2% 9.7% 7.0 8.7% 6.0 600 7.0% 6.8% 5.0 6.5% $4.2 5.9% 5.8% 5.4% 4.0 400 4.4% 3.0 2.0 200 1.0 $0.7 0.0 0 US EMEA Other JPM GS CS CITI LEH BAS DB MS ML UBS Rank: 1 2 3 4 5 6 7 8 9 10 M&A Equity Debt M&A Equity Debt 48 Source: Thomson Financial / Freeman & Co

- 49. Grow International Presence FOCUS + INTEGRATION + EXECUTION Integrated Delivery of the Bank’s Capabilities Capture Largest Fee Pool Opportunities Grow • Financial Sponsors / Leveraged Finance International • Financial Institutions Presence • Lever U.S strengths 49

- 50. Global Investment Banking – Grow International Presence • Core competency in leveraged finance Financial • Strong sponsor relationships in U.S. Sponsors • Sponsor fee pool in Europe growing rapidly Become a Financial • Integrated approach with Global Markets top 10 Institutions • Leverage corporate banking opportunities investment bank in Europe Lever • Capture international business of U.S. clients U.S. • Serve European clients with ties to U.S. strengths markets 50

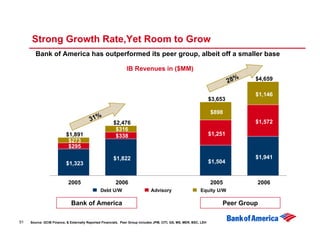

- 51. Strong Growth Rate,Yet Room to Grow Bank of America has outperformed its peer group, albeit off a smaller base IB Revenues in ($MM) 28% $4,659 $1,146 $3,653 $898 31% $2,476 $1,572 $316 $1,891 $338 $1,251 $273 $295 $1,822 $1,941 $1,323 $1,504 2005 2006 2005 2006 Debt U/W Advisory Equity U/W Bank of America Peer Group 51 Source: GCIB Finance, & Externally Reported Financials. Peer Group includes JPM, CITI, GS, MS, MER, BSC, LEH

- 52. Global Investment Banking – Strategic Themes FOCUS + INTEGRATION + EXECUTION Goals by 2011 Integrated Delivery of the Bank’s Capabilities • Drive $2.5 billion in incremental corporate and investment banking revenue Capture Largest Fee Pool Opportunities • Achieve Top 3 share in U.S. investment banking • Become a Top 10 Grow International Presence investment bank in Europe 52

- 54. Global Markets Mark Werner Head of Global Markets

- 55. Bank of America Business Client Coverage Global Corporate & Investment Banking Global Commercial Banking Global Investment Banking Global Markets • Middle Market Banking - Corporations with Institutional investors $20MM -$2B sales > $2B sales • Mutual funds • Sponsors • Pension funds • Business Banking - $2.5 MM-$20MM sales • Industry coverage • Hedge funds • Bus. & Info. • Healthcare • Corporate Investors • Commercial Real Estate Services • Natural • Asset managers Banking • Consumer/Retail Resources • Foreign reserve managers • Leasing • Financial Inst. • Real Estate • Gaming • Technology/ • Dealer Financial Services • Global Media/Telecom Industries • Business Capital 55

- 56. Global Markets – Strategic Themes FOCUS + INTEGRATION + EXECUTION INCREASE CLIENT PENETRATION Goals by 2011 • Increase revenues by $4 billion in 5 years • Become top 3 GROW INTERNATIONAL PRESENCE broker-dealer to targeted institutional clients • Reach top 10 STRATEGICALLY DEPLOY CAPITAL standing in Europe 56

- 57. Global Markets – Increase Client Penetration FOCUS + INTEGRATION + EXECUTION INCREASE CLIENT PENETRATION • Target Clients • Integrate across Bank of America • Build Infrastructure 57

- 58. Global Markets – Increase Client Penetration 1 Shift of fee pools toward Hedge Funds, Financial Institutions Hedge Funds Banks/Insurance Other Institutional Investors • Target Clients • Integrate 1993 2004 Across Bank • Build 2 Shift of assets toward Fixed Income infrastructure Fixed Income/other Equity 2001 Q106 58

- 59. Global Markets – Increase Client Penetration Commercial • Target Clients Global Wealth • Integrate Global Markets and Across Bank Consumer Investment • Build Management infrastructure Corporate Investments 59

- 60. Global Markets – Increase Client Penetration E-TRADING FASTER • Target Clients • Integrate Across Bank ANALYTICS SMARTER • Build infrastructure CLIENT PROFITABILITY BETTER 60

- 61. Global Markets – Increase Client Penetration Increased revenues with top Fixed Income- oriented Hedge Funds, Financial Institutions and Asset Managers Target Clients 50% + Integrate Across Bank = + Build infrastructure Current Sales & Estimated Sales and Trading Revenues Trading Revenues by 2011 61

- 62. Global Markets – Grow International Presence FOCUS + INTEGRATION + EXECUTION INCREASE CLIENT PENETRATION • Leverage U.S. platform overseas GROW INTERNATIONAL • Invest in Liquid Products, PRESENCE Equity Derivatives, Institutional Distribution, Structured Products 62

- 63. Global Markets – Grow International Presence Leverage strong U.S. position • Leading U.S. Swap House with Liquid Corporate and Products Institutional Investors Become a top Equity 10 investment • Top Equity Derivative House bank in Derivatives Europe • Top Real Estate Finance Structured House Products • IFR “CDO House of the Year” 63

- 64. Global Markets – Grow International Presence • Local Client Coverage Liquid • Structured Rates and Interest Rate Products Derivatives • Primary Dealership Become a top • Structured Derivatives 10 investment Equity • Third Party Distribution bank in Derivatives • Institutional Sales Coverage Europe • Real Estate Finance Structured • Collateralized Debt Products Obligations (CDOs) • Structured Credit 64

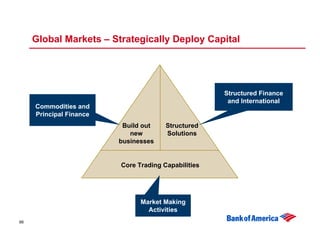

- 65. Global Markets – Strategically Deploy Capital FOCUS + INTEGRATION + EXECUTION INCREASE CLIENT PENETRATION • Increase Share in Core Trading Franchises and GROW INTERNATIONAL Structured Solutions PRESENCE • Build out Principal Finance, Special Situations, and Commodities STRATEGICALLY DEPLOY CAPITAL 65

- 66. Global Markets – Strategically Deploy Capital Structured Finance and International Commodities and Principal Finance Build out Structured new Solutions businesses Core Trading Capabilities Market Making Activities 66

- 67. Global Markets – Strategically Deploy Capital Rationale • Capitalize on market Commodities and growth Principal Finance • Leverage strengths • Client demand for capital • Utilize integrated model Build out Structured new Solutions businesses Core Trading Capabilities Market Making Activities 67

- 68. Global Markets – Strategically Deploy Capital Commercial Bank Global Markets Institutional Investor Clients Banks Middle Market Finance Group Client Managers Insurance Origination Structuring Hedge Funds Distribution 68

- 69. Global Markets – Strategic Themes FOCUS + INTEGRATION + EXECUTION INCREASE CLIENT PENETRATION Goals by 2011 • Increase revenues by $4 billion in 5 years • Become a top 3 GROW INTERNATIONAL PRESENCE broker-dealer to targeted institutional clients • Reach top 10 STRATEGICALLY DEPLOY CAPITAL standing in Europe 69

- 70. Global Treasury Services Cathy Bessant President, Global Treasury Services

- 71. Global Treasury Services • Position of strength: Operating performance and market share • Organic growth opportunities are significant • Strategic deployment of capital to preserve existing share and accelerate organic growth 71

- 72. Bank of America is the Dominant Global Provider of Treasury Services With a Track Record of Strong Growth 2005-2006 Global Competitor BAC Global Treasury Services Treasury Revenue ($B) Revenue Growth ($B) 6.7 6.7 6.0 6.0 2003- 2006 5.2 5.2 ($B) CAGR 4.9 4.8 Net 4.1 4,015 3.9 Interest 1.6 19% 3,405 3.3 Income 3.5 2,515 2.5 2,294 2.3 2.7 2.5 Noninterest 2.7 Income 2.5 2,518 2,689 2.6 2,611 2.8 2,760 .3 4% 1.9 12% 2005 2006 2005 2006 2005 2006 2005 2006 2003 2004 2005 2006 BAC JPM Citi Wach 2006 Efficiency Transaction Volume 12.1 13.0 13.7 ---- 13.2% 48.6% 56% 66.2% n/m Ratio (Billions) 2006 Op Lvg 8.3% 3.7% 2.9% n/m • #1 global provider as measured by total treasury revenue • Revenue growth of 12% (CAGR) since 2003 72 Source: Derived from company earnings reports

- 73. Achievement of Organic Growth Objectives will be Supported by Strategic Capital Deployment • Expand sales, fulfillment and servicing capabilities across all of our client segments • Strengthen international capabilities to ensure global competence • Significant investment in technology and platform 73

- 74. Expanded Distribution will Enable Client Acquisition and Deeper Penetration Sales Fulfillment Service • Expand sales distribution by ~30% • Institutionalize world class processes to ensure rapid revenue realization and sustainable, superior service levels • Enhance expertise and capabilities in strategic industry verticals 74

- 75. Strengthen International Capabilities to Ensure Global Competence International Capabilities are Client International Activities Valued by Corporate Clients U.S. Middle Market Companies BAC Share of Client Wallet by % of Doing Business Internationally Client Treasury Activity Outside U.S. 42% BAC Share of Client 40% Treasury Wallet 87% 84% 33% 75% 2003 2005 2006 0-10% 10-50% >50% ex-US ex-US ex-US Source: BAC Survey of Middle Market CFOs % Client Treasury Activity Outside U.S. • Gaining international share drives more U.S. share • 92% of our strategic investment has international relevance 75

- 76. Electronic Payment Trend Creates Unique Growth Opportunity for Bank of America Forecast US Industry Transaction Growth Rates BAC Total Volume Trends 12% 80% 60% Electronic 40% Paper 20% Image 2% 0% July July Nov. Nov. May May Jan. Mar. Sept. Jan. Mar. Sept. Electronic Paper 2004-2009 CAGR 2005 2006 Source: McKinsey/Global Concepts 76

- 77. Investment in Technology Creates Opportunity to Seize Share in Emerging Electronic Channels BAC U.S. Paper Product BAC U.S. Electronic Market Position Product Position Rank Share Rank Share Wholesale Lockbox 1 32% ACH Credit Origination 2 14% Check Clearing 1 25% Fedwire 2 10% Controlled Disbursements 1 23% Purchase Card 3 12% Electronic Data Acct Reconcilement 1 21% Interchange 3 12% Internet Info Reporting 3 10% ACH Debit Origination 5 6% • Objective: grow share in electronic capabilities • 40% of investment targeted to electronic capabilities 77 Source: Compiled from multiple industry publications

- 78. Global Treasury Services is Positioned for Growth • Position of strength • Organic growth opportunities are significant • Accelerating investment in growth 78