Global vitamins market

- 1. Global Vitamins Market Dr. Zubair Ali

- 2. Vitamins • Vitamins include single and multi-vitamin supplements made of natural or synthesized vitamins. • Ingredients in the vitamin category include: vitamin C, vitamin E, B vitamins, vitamin A/beta carotene, vitamin K, niacin, folic acid, and other single vitamins.

- 3. Multi-mineral supplements Single and multi-mineral supplements are made of natural or synthesized minerals. • Calcium • Magnesium • Chromium • Zinc • Selenium • Potassium • Iron • Silica • Manganese • Iodine • Phosphorous • Copper

- 5. • Vitamins and minerals face stiff competition amidst increasing sales of functional foods and botanical supplements which are perceived to have similar functions. ƒ • The global vitamins and minerals market was valued at $24bn in 2010, and is forecast to grow to almost $30bn by 2015. ƒ • At $11bn the US is the largest market globally; revenues are expected to grow by 3% year-on-year, reaching $12.7bn in 2015. • ƒJapan is the second largest vitamins and minerals market globally, accounting for 28% of the market in 2010. • ƒMultivitamins accounted for around 60% of Western Europe’s $2.5bn vitamins market in 2010. ƒ • The UK and other developed European markets will see modest growth to 2015.

- 6. • Despite relatively tight regulation, Brazil’s vitamins and minerals market will grow at a CAGR of around 7% to reach $1.2bn in 2015. ƒ • Between 2007 and 2010, the bulk of vitamins and minerals product launches occurred in North America, primarily the US. • ƒThere was a marked decline in the numbers of vitamins and minerals launches in the Asia Pacific region from 2007 to 2010. ƒ • Claims relating to natural aspects of the product represented the largest group of vitamins and minerals products launched in 2009 and 2010. • ƒDue to a large number of products targeted at specific life-stages and health conditions, multivitamins accounted for 63% of 2009/2010 product launches.

- 7. Global vitamins and minerals market ($bn), 2010–2015e

- 8. Selected vitamins and minerals markets ($m), 2010–15e

- 9. Selected vitamins and minerals markets ($m), 2010–2015e

- 10. Segmentation of the Western European vitamins market, 2010

- 11. Segmentation of the Western European minerals market, 2010

- 12. Regional breakdown of product launches, 2007–10

- 13. Top 15 product claims on vitamins and minerals 2009/2010

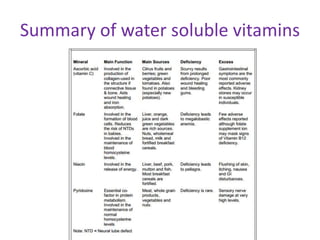

- 15. Summary of water soluble vitamins

- 16. Summary of fat-soluble vitamins

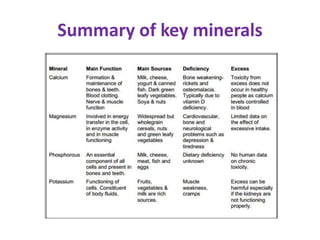

- 17. Summary of key minerals

- 18. Summary of trace elements

- 20. Specialized targeting of vitamin supplements (Occupational)

- 21. Selected Vitabiotics supplements for specific conditions

- 22. Vitamins for Pregnancy and lactation

- 23. ZETPIL -RX

- 24. Nutrivute liquid multivitamin shots- UK

- 26. Some new forms

- 27. Chocolate with Multi Vitamin & Minerals Healthy Indulgence® Dark Chocolate - Multi Vitamin & Minerals Healthy Indulgence® Dark Chocolate- Calcium Citrate 500mg with Vitamin D3 & K

- 29. Nutrients which may be added to foodstuffs in US (Recommended Dosage)

- 30. Increase in population of over 60s (m), 2010–20

- 31. United States

- 32. • The US, which is the largest global market, valued at $11bn in 2010 is expected to grow at a CAGR of 3%. • The aging population and an increasing investment in maintaining an active lifestyle among younger and middle aged consumers will be the main drivers. • The rising tide of obesity for example will create demand for supplements which are thought by consumers to assist weight loss such as calcium, magnesium and B vitamins.

- 33. Vitamins Market as per Statistica

- 37. Vitamins and Supplements top brand as per OTC market and Pharmacist recommendation in the year 2013 -USA

- 38. Multivitamins • Centrum 63% • One A Day 18% • Nature Made 9% • Nature's Bounty 6% • VitaFusion Multivites 3% • Nature's Way 1%

- 39. Children's Multivitamins • Flintstones Gummies/Multivitamins 52% • Centrum Kids 21% • L'il Critters Gummy Vites 12% • One A Day Multivitamins 6% • Disney Character Gummies 5% • One A Day Scooby-Doo Multivitamins 2% • Other 2%

- 40. Calcium Supplements • Citracal 34% • Caltrate 20% • Os-Cal 18% • Tums 11% • Nature Made 7% • Nature's Bounty 4% • Viactiv 4% • Sundown 2%

- 41. Cholesterol Management • Slo-Niacin 42% • Metamucil 35% • Nature Made CholestOff 15% • One A Day Cholesterol Plus 6% • Natrol Cholesterol Balance 2%

- 42. Bone/Joint Strengtheners • Osteo Bi-Flex 63% • Cosamin DS 20% • Schiff Move Free Advanced 8% • Nature Made TripleFlex 4% • Iceland Health Joint Relief Formula 2% • Trigosamine 2% • Flex-a-min 1%

- 43. High-Potency Vitamin C Supplements • Emergen-C 63% • Ester-C 33% • Vitafusion Power C 3% • Natrol Easy-C 1%

- 44. Immune Support • Airborne 41% • Emergen-C 33% • • Halls Defense 10% • Nature's Way System Well Ultimate Immunity 2% • Sambucol 2% • Natrol Immune Boost 1% • Other 11%

- 45. Iron Supplements • Slow FE 49% • Feosol 45% • Vitron-C 4% • Bifera 1% • Spatone pur-Absorb 1%

- 46. Magnesium Supplements • Mag-Ox 400 56% • Slow-Mag 23% • Nature Made 11% • Nature's Bounty 7% • Sundown 3%

- 47. Mood Health Supplements • Nature's Bounty St. John's Wort 57% • Nature Made SAM-e Complete 28% • Natrol 5-HTP 12% • Hyland's Nerve Tonic 3%

- 48. Nutritional Supplements • Ensure 63% • Boost 27% • Glucerna 8% • Juven 1% • Other 1%

- 49. Ocular Nutritional Supplements • Bausch & Lomb Ocuvite 38% • Bausch & Lomb PreserVision 34% • Icaps 26% • TwinLab OcuGuard Plus with Lutein 2%

- 50. Oral Nail Strengtheners • Appearex 54% • Elon Nail Matrix 46%

- 51. Probiotic Dietary Supplements • Culturelle 29% • Florastor 18% • Align Digestive Care 15% • Phillips' Colon Health 11% • Florajen 10% • Flora-Q 5% • Bacid Probiotic 4% • Probiotic Pearls 4% • Digestive Advantage 3% • Other 1%

- 52. Women's Health/Menopause Supplements • Estroven 69% • One A Day Women's Menopause Formula 25% • Enzymatic Therapy Remifemin 2% • Natrol 2% • Options Healthy Woman 2%

- 53. Estroven

- 54. Cholesterol Management, Natural • Nature Made Fish Oil 28% • Metamucil 19% • Nature's Bounty Fish Oil 17% • Schiff MegaRed 7% • Natrol Fish Oil 3% • Nature Made CholestOff 3% • Konsyl 2% • Mason Natural Fish Oil 2% • Sundown Naturals CholestHealth 2% • Ocean Blue 1% • Other 16%

- 55. Coenzyme Q10 Supplements • Nature Made 58% • Nature's Bounty 23% • Sundown Naturals 12% • Natrol 3% • Windmill 3% • Nutramax 1%

- 56. Cranberry Supplements • AZO Cranberry 64% • Nature Made 16% • Nature's Bounty 14% • Nature's Way 3% • ActiFruit Cranberry Supplement 2% • Natrol 1%

- 57. Diet Aids • Alli 41% • Slim-Fast 35% • Nutrisystem 13% • Hydroxycut 6% • Dexatrim 4% • Xenadrine 1%

- 58. Fiber Supplements • Metamucil 37% • Benefiber 28% • Citrucel 15% • FiberCon 12% • Konsyl 3% • VitaFusion Fiber Well Gummies 3% • Fiber Choice 2%

- 59. Flax Seed Oil Supplements • Nature Made 51% • Nature's Bounty 29% • Nature's Way 9% • Sundown 9% • Mason 2%

- 60. Garlic Supplements • Nature Made 37% • Garlique 31% • Nature's Bounty 18% • Kyolic 10% • Nature's Way 3% • Garlinase Fresh 1%

- 61. Herbal Supplement Brand • Nature Made 58% • Nature's Bounty 26% • Nature's Way 7% • Sundown 7% • Mason 2%

- 62. Omega-3/Fish Oil Supplements • Nature Made 42% • Nature's Bounty 25% • Schiff MegaRed 13% • Sundown 10% • Mason Natural 3% • VitaFusion Omega-3 3% • Natrol 2% • Nordic Naturals 1% • Ocean Blue 1%

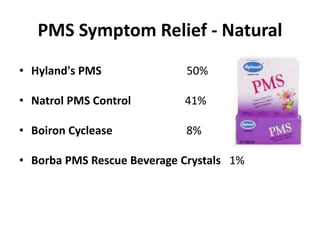

- 63. PMS Symptom Relief - Natural • Hyland's PMS 50% • Natrol PMS Control 41% • Boiron Cyclease 8% • Borba PMS Rescue Beverage Crystals 1%

- 64. Global Market

- 65. Japan • Japan is the second largest vitamins and minerals market globally, accounting for 28% of the market in 2009. • Japan will show a similar growth rate to the US, reaching $8bn in 2015. • The country’s swelling numbers of seniors combined with a continued and rising interest in supplementation for health will be the key market drivers. • Increasing obesity and cancer as consumers move to a more Western style diet are also positive. • Over-the-counter (OTC) divisions of big pharma players, Daiichi Sankyo and Eisai are the leading producers in Japan.

- 66. China • China’s vitamins and minerals market was worth around $1.5bn in 2009, and is expected to grow at a high single digit rate to exceed $2bn by 2015. • In China the use of dietary supplements for specific health benefits are well established. For this reason, single vitamins and minerals dominate the market. • Vitamins are also widely purchased for perceived beauty benefits (particularly in the case of vitamin E). To capitalize on strong and growing interest in Western lifestyle products, vitamins and supplements should be positioned in a way so as maximize scientifically basis and premium status.

- 67. • In China, vitamins and minerals are regulated and approved for sale by the State Food and Drug Administration (SFDA). As part of the approval process, the supplier must send samples to approved research labs for stability, function, toxicity and purity tests. Within around 6 months, the lab will submit a report to an SFDA committee which will either reject the product or supply a certificate authorizing marketing and distribution within the country. • China’s rapidly growing OTC market has attracted several Western big pharma companies such as Bayer, Boehringer- Ingelheim and Wyeth who are all active in the vitamins and minerals space.

- 68. Brazil • Brazil’s market is set to overtake the UK in 2011, showing a healthy CAGR of 7% to approach $1.2bn in 2015. • In the five years to 2010, Brazil’s vitamins market showed low double digit year-over-year growth. • The country’s continued economic success is the primary driver. • Regulation in the country is relatively tight in relation to other emerging nations. • In February 2010, ANVISA began enforcing new controls on OTC:

- 69. Eastern Europe • The Eastern European vitamins and supplement market is forecast to grow strongly to 2015. In 2010 the regional market was in the region of $1bn, and will approach $1.5bn in 2015 growing at a CAGR of 7–10%. • Multivitamins dominate the market, although growth is expected to come from single vitamins such as vitamin D, which currently has low penetration.

- 70. UK

- 71. UK • In line with other mature European countries, the UK market will grow more modestly, at 2%, increasing from around $820m in 2010 to $920m 2015. • In the UK, functional foods, botanicals have presented a robust challenge to the vitamins and minerals industry. Much of the growth between 2005 and 2010 came from products which target specific health concerns and life- stages, for example, glucosamine for joints and Pregnancy care. • Leading producers are Seven Seas (part of Merck KGaA), Bayer, Boots, Tesco and Sainsbury’s.

- 74. RDAs for Vitamins and Minerals EU

- 75. Russia • Vitamins and bio-additives take a special place on the Russian pharmaceutical market. • Registration of new pharmaceuticals as bio-additives is now much easier and cheaper for manufacturers, huge number of small and medium enterprises register their products this way • Russian customers are interested in vitamins and functional bio additives as they pay increasingly closer attention to preventive care and functional nutrition. • Yet only a small part of the population (no more that 10%) take vitamins on the regular basis.

- 76. Vitamins and bio-additives in Russian pharmaceutical market

- 77. Conclusions • A variety of regulatory, cultural, demographic and technological trends will impact on the vitamins and minerals market to 2015. • To maximize opportunities, vitamins and minerals producers need to focus on effective positioning and innovative product development in mature markets. • In emerging markets, where greater growth potential exists, a strong focus on effective distribution will be the key. • Across the board, adapting to the changing regulatory environment will be a precondition for efficient operation.