Graphite Presentation

- 1. GRAPHITE Sait UYSAL Mining Professional Turkey www.saituysal.com.tr

- 2. What is Graphite? • Graphite is a natural form of carbon with the chemical formula C and is characterized by its hexagonal crystalline structure. It occurs naturally in metamorphic rocks such as marble, schist and gneiss 2

- 3. Graphite at A Glance The mineral graphite is one of the allotropes, and pure form of carbon. Allotropes of carbon are; - Graphite - Diamond - Coal Graphite is; - Excellent HEAT conductor - Excellent ELECTRICITY conductor - Heat resistant (Melting Point 3927 C°) - Chemical and Corrosion resistant - Resistant to acids and oxidising agents - Lubricating

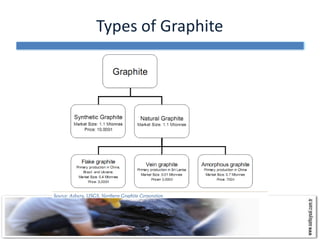

- 5. Applications By Graphite Type

- 7. Why Graphite is; Hot Critical Strategic?

- 8. 1. Supply Side Problem • China Producing 80% of world natural graphite • China has a 20% export duty and 17% VAT on graphite, • Factories is closed in Hunan Province, creating a government-sponsored monopoly on amorphous graphite resources • Other Countries: Brazil, North Korea, Canada, Norway, Mexico, Ukraine, Sri Lanka, Madagascar

- 9. Chinese portion in total graphite export 86,00% 84,00% 82,00% 80,00% Chinese portion in total graphite export 78,00% 76,00% 74,00% 72,00% 2007 2008 2009 2010 2011

- 11. 2. High Price

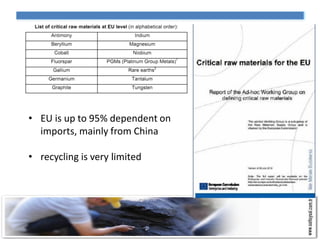

- 15. 3. Raw Material Security – Critical Materials

- 16. • EU is up to 95% dependent on imports, mainly from China • recycling is very limited

- 17. BGS Industrial Minerals Risk List 2012

- 18. 4. Growing Demand and Technology • 3-5% Annual growth rate of Traditional demand • Discovery of Graphene • Lithium-ion batteries&Fuel cells –EV, E-Bike, HEV • Nuclear technology – Pebble Bed Reactors • Plastics and composite frames (Boeing Co.'s new Dreamliner) • Solar Energy • Industrialization and Urbanization of China, India and emerging economies

- 19. Li-ion Batteries – Fuel Cells • The growth of electric cars, bikes and scooters, all rely on Li-ion batteries and fuel cells • 10 times more graphite than Li (by weight) to make Li ion batteries • In an electric car battery 1.8 kg graphite /per kilowatt hour (KWh) needed. For an EV 30-50 Kg natural graphite is used for battery

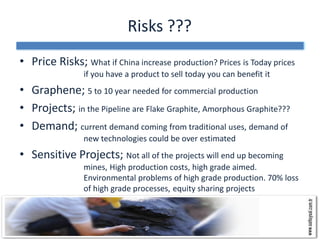

- 22. Risks ??? • Price Risks; What if China increase production? Prices is Today prices if you have a product to sell today you can benefit it • Graphene; 5 to 10 year needed for commercial production • Projects; in the Pipeline are Flake Graphite, Amorphous Graphite??? • Demand; current demand coming from traditional uses, demand of new technologies could be over estimated • Sensitive Projects; Not all of the projects will end up becoming mines, High production costs, high grade aimed. Environmental problems of high grade production. 70% loss of high grade processes, equity sharing projects

- 23. Risks ??? • EV – Li-ion Batteries; Expensive, not user friendly, it needs time EV markets are; Japan, USA, EU – Developed countries. Recycling could be possible

- 24. Graphite in Turkey • Majority of the graphite occurrences in Turkey is mainly “amorphous” type. • A graphite occurrence around Balikesir city (West part of Turkey) has bigger crystalline structure. Most promising, most graphitized and high Carbon contented graphite mineralization explored in Balikesir, Yozgat, Konya, Kastamonu and Adıyaman cities. • Occurrences in other places like Kutahya, Mugla, Bandirma is mostly semi graphite

- 25. Graphite Mineralizations Map of Turkey

- 26. Production in Turkey 1985-1999 Production Consumption Year (tonnes) (tonnes) 1985 - 4.100,00 1986 3.586,00 4.000,00 Production (tonnes) - 1987 8.900,00 3.400,00 30.000,00 1988 12.911,00 13.000,00 25.000,00 1989 11.000,00 12.000,00 1990 18.712,00 18.712,00 20.000,00 1991 26.763,00 26.763,00 15.000,00 Production 1994 5.000,00 25.000* (tonnes) - 10.000,00 1995 5.000,00 25.000* 1996 5.000,00 25.000* 5.000,00 1997 5.000,00 25.000* 0,00 1990 1998 1985 1986 1987 1988 1989 1991 1994 1995 1996 1997 1998 5.000,00 25.000* 1999 5.000,00 25.000* Source: Turkey State Planning Institute, 8th Quinquennially Development Plan, 2001 * = Rounded roughly www.saituysal.com.tr March 2012

- 27. Production in Turkey 2003-2009 Year Production Production (tonnes) (tonnes) 2003 0,00 3.500,00 3.000,00 2004 28,00 2.500,00 2005 0,00 2.000,00 2006 0,00 1.500,00 Production (tonnes) 2007 1.000,00 0,00 500,00 2008 3.236,00 0,00 2009 2.400,00 Source: http://www.migem.gov.tr/links/istatistikler/2003_2009_URETIM_%20BILGILERI.mht Migem = Turkish Republic Ministry of Energy and Natural Resources - General Directorate of Mining Affairs www.saituysal.com.tr March 2012

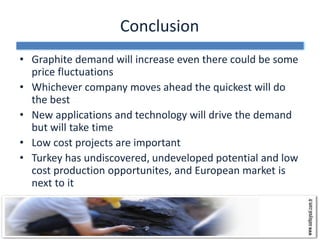

- 28. Conclusion • Graphite demand will increase even there could be some price fluctuations • Whichever company moves ahead the quickest will do the best • New applications and technology will drive the demand but will take time • Low cost projects are important • Turkey has undiscovered, undeveloped potential and low cost production opportunites, and European market is next to it