Greece Crisis

- 2. Financial crisis of Greece

- 3. President: Karolos Papoulias (2005) Prime Minister: George Papandreou (2009) Population (2009 est.): 10,737,428 (growth rate: 0.1%); birth rate: 9.4/1000 ; Monetary unit: Euro

- 4. Greece, a developed country with a high standard of living and very high Human Development Index; A top five tourist destination since at least the 80s Greece had shifted to the Euro in 2001.

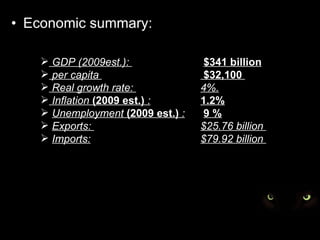

- 5. Economic summary: GDP (2009est.): $341 billion per capita $32,100 Real growth rate: 4%. Inflation (2009 est.) : 1.2% Unemployment (2009 est.) : 9 % Exports: $25.76 billion Imports: $79.92 billion

- 7. Debt Crisis of Greece Greek government funding crisis

- 8. Greece has a 12.7% deficit of its GDP. National debt has exceeded 300 billion Euros. Greece has US$ 25 billion dollar of its debt that must be immediately re-financed Debt crisis

- 9. The Greek government requested that the EU/IMF bailout package (made of relatively high-interest loans) be activated. The Euro zone legally requires that national deficit be within a 3% limit if GDP. With Greece’s deficit of 12.7% of the GDP, the European Central Bank is legally not allowed to engineer a typical bail-out, partly due to political aspects of the EU treaty.

- 10. The size of the bailout is expected to be €45 billion ($61 billion) and it is expected to take three weeks to negotiate With a payout within weeks of €8.5 billion of Greek bonds becoming due for repayment .

- 11. Fitch ratings has called Greece as “Eurozone’s weakest member” Greece’s debt is 113%of its GDP.

- 12. Greek Government Funding Crisis : The Greek economy was one of the fastest growing in the euro zone during the 2000s From 2000 to 2007 it grew at an annual rate of 4.2% Estimated tax evasion costs the Greek government over $20 billion per year. Investors placed about €20bn ($28bn, £17bn) in orders for the five-year, fixed-rate bond

- 13. Greek crisis hurts EU reputation A default by one member of the 27 participants in the Euro-zone will lead to the collapse of the Euro Countries of the European Union are allocating 20 to 25 billion Euros to Greece as a rescue package to help it get over the financial crisis Expectations of a weaker Euro, dollar becomes stronger relative the Euro

- 14. Greece must change or sink !

- 15. Real estate industry Greek political parties Systemic corruption and “clientelism Tax inspectorate Health sector

- 16. Thank You