Group 10 global economy & india

- 1. GLOBAL ECONOMY & INDIAPRESENTED BY: GROUP 10 ALOK KUMAR 1510006 NIYAS N 1510031

- 2. AGENDA • Introduction • Objective • Review of Literature • Methodology • Indian Economy on Global Scale • Reforms & Economic Crisis • Conclusion • Recommendation 2

- 3. Introduction • Fastest growing major economy* in the world & will continue at 7-7.75% during FY2016-17 • Market based • GDP: ₹ 122.15 trillion at 2011-12 constant prices • Population: 1.31 billion & Labor force- 513.7 million • Unemployment rate- 4.9% urban, 5.1% rural, 5% national • Exports- 272.4 billion 3 *Central Statistics Organisation, 2016 Agricultur e, 17.05% Services, 53.23% Industry, 29.72% GDP COMPOSITION Source: World Bank, http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators#

- 4. OBJECTIVE • Indian Economy vs Global Economies on different macroeconomic indicators • Indian Economy performance in Agriculture, Manufacturing & Service Sector • 1991 Reforms and Impact of Asian & Global Economic crisis 4 GLOBAL ECONOMY US UK Japan INDIA China

- 5. Review of Literature • Economies has been area of interest for researcher from a long time. • Economist, Government bodies as well as private institution are involved in analyzing the economy of a country. • S. Ghosh (2015) published a paper containing effect of colonial rule in Indian economy. • Government of India published a report in December 2007 containing details of global crisis and impact on India. • IMF and World-Bank also published various reports containing cause and effect of Asian Crisis as well as Global Crisis. • Ministry of finance releases yearly report on economic situation of India. 5 Research by Economists & Private Institutions Indian Government Reports IMF Reports

- 6. Methodology 6 Data Collection • IMF database • World Bank Database Plot & Comparison • Developed Countries: US, UK & Japan • Developing Countries: China Analysis • India performance in Agriculture, Manufacturing & Service Sector

- 7. Indian Economy on Global Scale 7 6.91% 7.56% 2.63% -7.00% -2.00% 3.00% 8.00% 13.00% 18.00% 23.00% GDP Annual Growth % China India United States World Between 1980 and 2010, India achieved a growth of 6.2 per cent, while the world as a whole registered a growth rate of 3.3 per cent Source: World Bank, http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators#

- 8. Indian Economy on Global Scale 8 Brazil is on the top with 4.23% of GDP being equivalent to FDI inflow India’s FDI inflow ranges between 1-2% and increasing 4.23% 0.09% 0.61% 0.75% 0.99% 0.75% 2.11% 3.66% 1.65% 2.10% 5.23% 2.87% -1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 FDI Inflow (% of GDP) Brazil China India Japan United States World Source: World Bank, http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators#

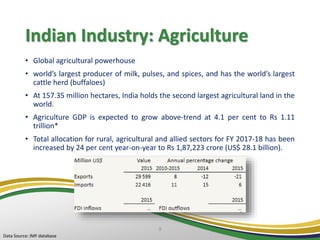

- 9. Indian Industry: Agriculture • Global agricultural powerhouse • world’s largest producer of milk, pulses, and spices, and has the world’s largest cattle herd (buffaloes) • At 157.35 million hectares, India holds the second largest agricultural land in the world. • Agriculture GDP is expected to grow above-trend at 4.1 per cent to Rs 1.11 trillion* • Total allocation for rural, agricultural and allied sectors for FY 2017-18 has been increased by 24 per cent year-on-year to Rs 1,87,223 crore (US$ 28.1 billion). 9 Data Source: IMF database

- 10. Indian Industry: Manufacturing • India’s ranking 6th among the world’s 10 largest manufacturing countries • Strong technical and engineering capabilities- IITs and NITs • Constant Share in GDP despite growth in exports • The cost of manpower is relatively low as compared to other countries. 10 Source: World Bank, http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators#

- 11. Indian Industry: Service • India in the 8th place currently amongst the top 10 exporters of services in the world. • India’s share in global services exports was 3.2 per cent in 2014-15, double that of its merchandise exports in global merchandise exports at 1.7 per cent • The multiplier effect on ancillary industries owing to the growth in the services sector 11 53.23% 68.29% 45.00% 50.00% 55.00% 60.00% 65.00% 70.00% Service Industry (% of GDP) India World • Key driver of India’s economic growth & most attractive sector for FDI (Foreign Direct Investment) inflows. • Growing at 10 per cent per annum, the fastest growing in the world. Source: World Bank, http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators#

- 12. Indian Economy- 1991 Reforms • The fiscal crisis of 1990 was triggered by Rajiv Gandhi’s fiscal profligacy in the 1980s and the oil price hike of 1990 led to unmanageable balance of payments deficit* • Liberalization in Economy started on 24 July 1991. • End of License Permit Raj • Opening for Foreign Investments • It was seen as the only way out for India after the balance of payments crisis that brought the country to its knees. • The first year of reform saw a total foreign investment of only $74 million. • As of March 2016, India has attracted $10.55 billion worth of FDI. 12*Source: New Indian Express, http://www.newindianexpress.com/opinions/2016/aug/09/India-after-25-yrs-of- liberalisation-1507206--1.html

- 13. Indian Economy & Asian Crisis • Series of currency devaluation in Asian Miracle Countries- Thailand was 1st • Hit East Asia and caused stock market declines, reduced import revenues and government upheaval. • Attributed to inflow of short term Foreign capital though the Total Factor Productivity remained low and lack of government intervention • IMF provided $36 billion to support reform programs in the three worst-hit countries—Indonesia, Korea, and Thailand. • India: short term external debt was tightly controlled; the current account deficit was manageable • Weak trade link with east Asian Countries helps in isolation from Crisis. • Since 1991, RBI continues to follow policy of 'Managed Floating which helped in stabilizing the currency during the crisis 13

- 14. Indian Economy & Global Crisis 14 Back-Drop Boom in World Economy US Economy Growth: Interest Rate & Deregulation Rapid Increase in Credit & Loans Development Securitization and Repackaging of Loans Excessive Leverage Mismatch between Financial Innovation & Regulation Failure of Global Corporate Governance Dimensions Global Spread Decline in credibility of IMF and World Bank State Capitalism and Protectionism Credit Crunch Lack of confidence and credibility in Financial Market

- 15. Indian Economy & Global Crisis • Started in August 2007 with the sub-prime mortgage crisis in the US • India: Total net capital flows fell from US$17.3 billion in April-June 2007 to US$13.2 billion in April-June 2008 • FDI Inflow increased to $16.7bn while Outflow decreased to $6.4bn. • Sensex down from 20000 to <9000 in a year, Stock prices lost its 90% value • No contagion in banking sector due to very limited exposure to US mortgage market • RBI shifted policy from monetary tightening to monetary easing in order to maintain comfortable domestic and foreign liquidity. • Govt. launched three fiscal stimulus packages between Dec 08 and Feb 09 having combined impact of about 3% of GDP. 15

- 16. Conclusion • Globalization has taken us a long way from 1991 which has resultant in the advancement our country. • India opened up in 1990 at time when domination of knowledge-intensive sector was beginning • India’s post colonial policy emphasis on expanding public funded higher education resulted in creation of an extensive network of publicly funded colleges and universities throughout the country. • India has been able to create and nurture technological capability due to its technology policy • “knowledge of English language which we had inherited from our colonial past” • Skilled manpower & English language naturally led to the flourishing of IT sector • India is yet to make a successful transition towards a fully knowledge-driven economy 16

- 17. Suggestions • India is yet to reach the levels of the league of technologically advanced nations. • Requirement of tapping the potentials for labour intensive “low end” sectors • Clearing the log of pending infrastructure development projects and rationalizing the tendering processes of projects in rail, roads, aviation, etc sectors to promote trade 17 A proactive policy framework that resolves infrastructure deficits and improves labour productivity through investments in health, education and technology Increase in bilateral trade with neighbouring countries to infuse new possibilities of trade and commerce and enhance friendly relations

- 18. 18

- 19. References: • India’s Role in the Emerging World Order by UMMU SALMA BAVA, FES Briefing Paper, • Globalization of Indian Economy, Economic Survey 2008-09 http://www.indiabudget.nic.in • Indian And Global Economy, http://www.indiabudget.nic.in • Reflections on india’s emergence in the world economy by s. Ghosh 2015 • Global economic crisis and its impact on India, rajya sabha secretariat, new delhi, june 2009 • East Asian Crisis and Currency Pressure: The Case of India by Pami Dua, August 07, http://www.cdedse.org/pdf/work158.pdf • World Economic Outlook 2016-17, IMF, http://www.imf.org/external/ns/cs.aspx?id=29 Your Date Here Your Footer Here 19