Growth of financial sector in india

- 2. Growth of Financial Sector in India Vinay Shankar Pradeep Beniwal

- 3. About Financial Sector Financial Sector is the backbone of the economy and it is indeed critical to nurture the growth of this important sector in order to ensure sustained growth rate. When the Indian economy was liberalized in the year 1991, a road map was also set forth for financial sector reforms. 2nd largest component after trade, hotels, transport and communication all combined together in GDP. GDP contribution is approximately 15 %.

- 4. Components of Financial Sector Banking Sector Insurance Sector Other Financial Services 1. Capital Market 2. Mutual Fund 3. NBFCs (Non-Banking Financial Institutions) 4. MFIs (Microfinance Institutions)

- 6. Banking Structure in India

- 7. Banking Sector $1.4 trillion Banking Deposits $1.8 trillion bank assests Bank Account penetration from 35%to 53% from 2011 to 2014. (mainly due to Jan dhan yojna). 41 % unbanked population Total no. of Schedule Commercial Banks in India is 157. Banking stands second in terms of employment (average share of 28%). The banking sector is projected to create upto 2 million new jobs in the next 5-10 years, driven by issuance of new license and efforts to expand financial services into rural areas. The Indian banking system has been continuously expanding with the number of SCB branches increasing at a CAGR of 7.8% during FY09 to FY13. The Indian banking system has been continuously expanding with the number of SCB branches increasing at a CAGR of 7.8% during FY09 to FY13. The private sector banks have been expanding at a faster rate (7.1% CAGR in number of branches) compared to public sector banks (- 1.1% ) and foreign banks (-10%).

- 10. Growth Rate of Deposit

- 11. Growth of Deposit & Assests

- 12. Growth of assets of Nationalised Bank

- 13. Technological Changes in Banking Sector ATMs Mobile Banking Net Banking Core Banking Stiff competition from other banks.

- 14. Banks and Payment options

- 18. Capital Market A Capital Market is a market for Securities (debt or equity), where business enterprises (companies) and governments can raise long-term funds. The Primary Market is that part of the capital markets that deals with the issue of new securities Companies, governments or public sector institutions can obtain funding through the sale of a new stock or bond issue for Growth & Expansion IPO (Initial Public Offering) FPO (Follow-on Public offering) The Secondary Market, also known as the Aftermarket, is the financial market where previously issued securities and financial instruments such as Stock & Bonds are bought and sold.

- 19. Capital Market Stock, Equity & Share are same things which give you ownership rights. Bonds are debt instrument issued for a period of more than one year with the purpose of raising capital by borrowing. It does not give you ownership right. At present 22 recognized stock exchange BSE & NSE is the prominent one. During 50’s – Uncontrolled Speculation – Known as “Satta Bazar”- Companies like Tata Steel, Bombay Dyeing etc. 70’s – Govt. Intervention- Dividend should be min. of 12 % of face value In 90’s, there was a major scam which paved the way to Major reforms in Indian Equity market. Harshad Mehta scam ($740 million that too in 90’s !!!! ). SEBI (Security & Exchange Board of India) is the governing & regulatory body.

- 20. 1987-88, 24 1994-95, 58 1998-99, 163 2002-03, 279 2007-08, 645 2012-13, 1263 2014-15, 1660 2015-16, 1568 0 200 400 600 800 1000 1200 1400 1600 1800 1987-88 1994-95 1998-99 2002-03 2007-08 2012-13 2014-15 2015-16 BillionUSD STOCK MARKET CAPTALIZATION

- 21. Mutual Funds A Mutual Fund is a professionally managed type of collective investment scheme that pools money from many investors and invests typically in investment securities (stocks, bonds, short-term money market instruments, other mutual funds, other securities, and/or commodities such as precious metals) The mutual fund will have a fund manager that trades (buys and sells) the fund's investments in accordance with the fund's investment objective. Unit Trust of India (UTI) established in the year 1963 by an act of Parliament- Complete Monopoly. Entry of public sector fund- In November 1987, SBI Mutual Fund from the State Bank of India became the first non-UTI mutual fund in India. Entry of private sector fund - permission given to private sector funds including foreign fund management companies to enter the mutual fund industry in 1993. By 1994-95, about 11 private sector funds had launched their schemes.

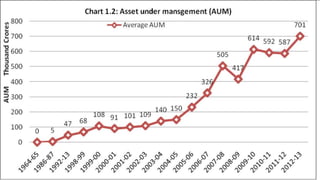

- 22. Robust growth and stricter regulation from the SEBI after the year 1996 Government offered tax benefits to the investors in order to encourage them. from Rs.25 crore in 1965 to Rs.701443 crore in March 2013. number of schemes offered by Indian mutual funds from 403 schemes in 2002-03 to 1294 schemes in 2011-12 has shown the inclination of investors towards mutual fund. The Indian mutual fund industry is in its growth phase and possesses a tremendous scope. The main reasons for poor growth of mutual fund industry in India is the lack of awareness for mutual funds and lack of trust on mutual fund companies.

- 25. NBFC NBFC (Non-Banking Financial Company) Must have heard about “Sharda Chit Fund” scam. Banks Does not have fair penetration in rural areas. NBFCs are engaged in the business of loans and advances, acquisition of shares, stock, bonds hire-purchase, insurance business or chit business but does not indulge in agriculture or industrial activity or the sale, purchase or construction of immovable property. Total Assets‟ size of NBFCs is around 14 percent of that of scheduled commercial banks. NBFCs help promote inclusive growth in the country catering both rural as well as urban. Credit grew an average 24.3% per year for NBFCs as against 21.4% for banks. This shows that more customers are opting for NBFCs. Different from bank as these can’t draw cheque in their name & no deposit scheme.

- 27. MFI MFI (Micro-Financing Institution) An organization that offers financial services to low income populations. In India, most microfinance loans are between US$ 100 (INR 4,800) and US$ 415 (INR 20,000). Bandhan, Microcredit Foundation of India, Microcredit Foundation of India are in the list of the world's top 50 microfinance institutions a/c FORBES ahead of ‘Grameen Bank’ (Md. Yunus, Nobel Peace Prize). In addition to the provision of credit, many other services such as savings, insurance, money transfers, counseling, etc. The loans are without collateral & for short term.

- 28. 14.1 22.6 26.7 24.98 57.8 66.1 0 10 20 30 40 50 60 70 FY08 FY09 FY10 MFI No. of customer (in Million) Loans (in Billion) 0

- 29. Insurance Sector

- 30. Insurance Sector An arrangement by which a company or the state undertakes to provide a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium. The insurance industry of India consists of 53 insurance companies of which 24 are in life insurance business and 29 are non-life insurers. Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company. sole national re-insurer, namely, General Insurance Corporation of India (GIC Re). India's life insurance sector is the biggest in the world with about 360 million policies which are expected to increase at a Compound Annual Growth Rate (CAGR) of 12-15 per cent over the next five years. The country’s insurance market is expected to quadruple in size over the next 10 years from its current size of US$ 60 billion. During this period, the life insurance market is slated to cross US$ 160 billion.

- 31. Ministry of Finance Insurance Regulatory & Development Authority (IRDA) Life Insurance (24) Public (1) Private(23) Non-Life Insurance (29) Public(6) Private(23) Re-insurer (1) GIC-Re

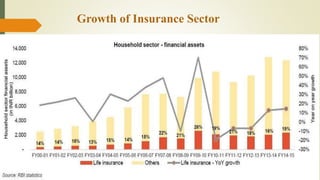

- 32. Insurance Sector The general insurance business in India is currently at Rs 78,000 crore (US$ 11.7 billion) premium per annum industry and is growing at a healthy rate of 17 per cent. Unified Package Insurance Scheme (Bhartiya Krishi Bima Yojana) by Govt. features like crop insurance, health cover, personal accident insurance, live stock insurance, insurance cover for agriculture implements like tractors and pump sets, student safety insurance and life insurance. FDI increased from 26 % to 49%. India's insurable population is anticipated to touch 750 million in 2020, with life expectancy reaching 74 years. Demographic factors such as growing middle class, young insurable population and growing awareness of the need for protection and retirement planning will support the growth of Indian life insurance.

- 36. Growth of Non-life Insurance

- 37. Growth of Insurance Sector

- 38. RRB- Regional Rural Bank NPS- National Pension Scheme UCB- Urban Co-operative Banks

- 39. References International Journal of Arts, Humanities & Management Studies RBI Website IRDA website Google Wikipedia IBEF (Indian Brand & Equity Foundation) Forbes.com Economics Times World Bank Website

Editor's Notes

- An initial public offering (IPO) is the first sale of stock by a private company to the public. IPOs are often issued by smaller, younger companies seeking the capital to expand, but can also be done by large privately owned companies looking to become publicly traded.

- Market capitalization is the total dollar market value of all of a company's outstanding shares. Market capitalization is calculated by multiplying a company's shares outstanding by the current market price of one share

- Return on assets (ROA) is a financial ratio that shows the percentage of profit a company earns in relation to its overall resources. It is commonly defined as net income divided by total assets.