Guy september 2017 ir presentation

- 1. September 2017 A SCARCE ASSET IN A TRUE MINING DISTRICT

- 2. www.guygold.com 2 This presentation of Guyana Goldfields Inc. (the "Company") contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or developments in our industry, to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "aims," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Information inferred from the interpretation of drilling results and information concerning mineral resource and mineral reserve estimates may also be deemed to be forward looking statements, as such information constitutes a prediction of what might be found to be present when and if a project is actually developed. Forward-looking statements this document include statements regarding: the Company's expectations regarding drilling and exploration activities on properties in which the Company has an interest; and the Company's statements regarding estimates of reserves and resources on properties in which the Company has an interest. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of their respective dates. Important factors that could cause actual results to differ materially from the Company's expectations include among others, risks related to fluctuations in mineral prices; uncertainties related to raising sufficient financing to fund planned work in a timely manner and on acceptable terms; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the estimation of resources and reserves; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overrun or unanticipated expenses in the work program; the risk of environmental contamination or damage resulting from the Company's operations; risks associated with title to mineral properties; and other risks and uncertainties discussed appear elsewhere in the Company's documents filed from time to time with the Toronto Stock Exchange and Canadian securities regulators. These statements are based on a number of assumptions, including assumptions regarding general market conditions, the availability of financing for proposed transactions and programs on reasonable terms, the cost of exploration and development and the ability of outside service providers to deliver services in a satisfactory and timely manner. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as expressly required by applicable securities laws, the Corporation undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change. This presentation uses the terms "Inferred Resource", "Indicated Resource", “Measured Resource” and "Mineral Resource". The Company advises readers that although these terms are recognized and required by Canadian securities regulations (under National Instrument 43-101 "Standards of Disclosure for Mineral Projects"), the US Securities and Exchange Commission does not recognize these terms. Readers are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. In addition, "Inferred Resources" have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that any part of an Indicated or Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, or economic studies except for a Preliminary Assessment as defined and permitted under National Instrument 43-101. Readers are cautioned not to assume that part or all of an Inferred Resource exists, or is economically or legally mineable. The Mineral Resources stated in this presentation are not Mineral Reserves and, in the absence of a current feasibility study, do not demonstrate economic viability. The determination of Mineral Reserves can be affected by various factors including environmental, permitting, legal, title, taxation, socio-political, and marketing issues. FORWARD LOOKING STATEMENT

- 3. www.guygold.com 3 Cash position of US$65.4M vs. debt of US$68.8M as at June 30, 2017 Reserve & Resource growth through further infill drilling within Golden Square Mile at Aleck Hill and Mad Kiss testing high grade shoots at depth, along dip and along strike extensions Organic Growth High grade Au producer with +15 years reserve life with upside Simple metallurgy and mine plan, positive grade reconciliation to date Exceptional free cash flow generation A Scarce Asset No by-products Minimal currency exposure Oil price hedged for the near term up to 2019 100% Pure Gold Exposure +200,000 acre land package in highly prospective & underexplored greenstone belt Targeting open pit exploration targets within a 30km radius from Aurora Mill Focus on Iroma, Sulphur Rose and Wynamu targets District Potential Strong Balance Sheet INVESTMENT HIGHLIGHTS

- 4. www.guygold.com 4 Proven and Probable Reserves Grade – Precious Metals Only (g/t Au equivalent) Source: Company filings and BMO Capital Markets Note: Includes precious metals, converted to AuEq grade using LT pricing of US$1,250/oz Au and US$18.00/oz Ag when not converted by the company. (1) (2) (3) WHAT STANDS US APART? Aurora is a High Grade Gold Mine 3.4 2.9 2.7 2.3 2.2 1.7 1.5 1.3 1.3 1.2 1.0 1.0 0.8 0.7 0.7 0.6 0.4 Median: 1.3 g/t SEMAFO Guyana Torex Alacer Primero Alamos OceanaGold B2Gold IAMGOLD Eldorado Tahoe Detour New Gold Kinross Centerra Silver Standard Yamana

- 5. www.guygold.com 5 2017 Performance: On Track To Meet Guidance Q1 2017 Q2 2017 FY Guidance Gold Produced (ounces) 40,900 29,700 160-180k Cash costs per ounce – before royalty¹ ($/ounce) 516 757 500-550 All-in sustaining1 (“AISC”) ($ per ounce) 861 1,144 775-825 Cost of sales (prod, royalty and dep) ($/ounce) 827 1,164 800-850 Gold Sold (ounces) 40,700 30,000 Average Realized Gold Price US$/ounce 1,227 1,263 Gross Revenue (US$ mlns) 50M 38M Ore mined (tonnes) 498,800 511,600 Waste mined (tonnes) 2,389,700 3,097,200 Total Mined (tonnes) 2,888,400 3,608,800 Strip ratio (waste:ore) 4.8 6.1 Tonnes mined per day 32,100 39,700 Ore processed (tonnes) 602,800 515,600 Tonnes processed per day 6,700 5,700 Head grade g/t Au 2.44 2.06 Recovery (%) 89.7 86.5 1 This is a non-IFRS measure. Refer to non-IFRS Performance Measures section in the latest MD&A Excellent health, safety and environmental track record with +3,500,000 employee hours worked without a lost time incident !

- 6. www.guygold.com 1. This is a non-IFRS measure. Refer to non-IFRS Performance Measures section in the latest MD&A. 6 2017 Guidance: 2H/17 Higher Production & Lower Costs • Lower end of the guidance range of 160,000 – 180,000 ounces of gold is expected to be achieved. • Due to mine sequencing, which envisions a significant increase in head grade over the second half of the year, gold production is expected to be higher in the second half of the year relative to the first half. In addition, stripping ratio is expected to be materially lower in 2H/17. • Due to the timing of sustaining capital expenditures, AISC¹ are expected to be lower in the second half of the year relative to the first half. 2017 Guidance (@ $1,200/oz) Gold production (ounces) 160,000 – 180,000 Cost of sales (production costs, royalty and depreciation) ($ per ounce) $800 - $850 Cash cost¹, excluding royalty ($ per ounce) $500 - $550 AISC¹ ($ per ounce) $775 - $825

- 7. www.guygold.com 7 Mill Expansion from 5ktpd to 8ktpd: Internally Funded Source: February 2017 NI-43 101 Technical Report Tracking On-Schedule and On-Budget Fully permitted and funded internally • Expected to result in: • Recovery: 1% increase • Throughput: Increased to 8,000tpd (25-50% SAP feed blend) • Expansion work in four key areas: 1. Leach Circuit Capacity Increase 2. Elution / Acid Wash / Electrowinning Capacity Increase 3. Pre-leach Thickener Installation 4. Carbon Management & Recovery Improvements • Project completion date is Q1 2018 • Cost of the project is approx. US$ 21M

- 8. www.guygold.com 8 Mill Expansion: On Schedule and On Budget

- 9. www.guygold.com 9 Mill Expansion: On Schedule and On Budget

- 10. www.guygold.com 10 SITE LAYOUT: Aurora Gold Mine

- 11. www.guygold.com 11 SITE LAYOUT: Aurora Gold Mine Rory’s Knoll Walcott Hill Mad Kiss Aleck Hill NW Aleck Hill

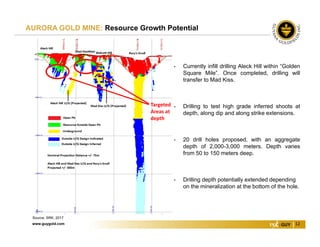

- 12. www.guygold.com 12 AURORA GOLD MINE: Resource Growth Potential Source: SRK, 2017 • Currently infill drilling Aleck Hill within “Golden Square Mile”. Once completed, drilling will transfer to Mad Kiss. • Drilling to test high grade inferred shoots at depth, along dip and along strike extensions. • 20 drill holes proposed, with an aggregate depth of 2,000-3,000 meters. Depth varies from 50 to 150 meters deep. • Drilling depth potentially extended depending on the mineralization at the bottom of the hole. Targeted Areas at depth

- 13. www.guygold.com 13 SITE EXPLORATION DRILLING: Aleck Hill • Drilling to test high grade inferred shoots at depth, along dip and along strike extensions. • 10 drill holes proposed, with an aggregate depth of ~1,000 meters. • Depth varies from 50 to 150 meters deep. • Drilling depth potentially extended depending on the mineralization at the bottom of the hole.

- 14. www.guygold.com 14 SITE EXPLORATION DRILLING: Aleck Hill Completed drilling on hole PAHD‐3, currently surveying. Rock Contact – 36m Completed Depth – 100m Core logging commenced Currently drilling PAHD‐1 (TD: 120) Current Depth: 109m Rock Contact: 33m Next Hole: PAHD‐2 Current Drilling Complete Next Hole

- 15. www.guygold.com 15 SITE EXPLORATION DRILLING: Mad Kiss • Drilling to test high grade inferred shoots at depth, along dip and along strike extensions. • 10 drill holes proposed, with an aggregate depth of ~2,000 meters. • Depth varies from 50 to 200 meters deep. • Drilling depth potentially extended depending on the mineralization at the bottom of the hole.

- 16. www.guygold.com 16 Expected completion by end of Q1 2018Mill Expansion UPCOMING CATALYSTS Multiple brownfield and greenfield targets Brownfield: Aleck Hill Mad Kiss Swamp Vein Greenfield: Iroma Sulphur Rose Wynamu Exploration

- 17. www.guygold.com 17 GUIANA SHIELD: Known Gold Region

- 18. www.guygold.com 18 CUYUNI BASIN: A TRUE MINING DISTRICT: Looking for Mine #2 • 1 Operating Aurora Gold Mine • 1 Sulphur Rose secondary resource • Multiple near-mine saprolite targets • 1,200 square km land package • Long history of artisanal mining • Highly prospective greenstone belt Looking for Mine #2

- 19. www.guygold.com 19 BROWNFIELDS EXPLORATION: AH & MK in “GSM”, Swamp Vein, Marupa & Iroma Brownfields Exploration Targets • Within “Golden Square Mile” • Aleck Hill & Mad Kiss • Delineation drilling testing high grade shoots at depth, along dip and along strike extensions. • Outside “Golden Square Mile” • Swamp Vein • Iroma: • Largest geochem anomaly

- 20. www.guygold.com 20 Iroma: Near Mine Open Pit Feed Target • Mineralisation hosted in Cuyuin Fm(Sediments) at intersection of NW and NE structural trend. • 8.5km long central zone of anomalous gold. • Pork Knocker operations active in central portion • Preparations to establish a camp in Iroma prospect and mobilization of heavy equipment and drill rig are underway. • What’s next: • Trenching – 17 trenches with an aggregate length of 4,800m. The trenches will test the 12km long >50 ppb gold anomaly. • Drilling – a six (6) hole drill program totaling 1,600m. This will test in bedrock significant results of saprolite drilling in 2013 (best results of 9m @ 2.28 g/t Au including 3m @ 8.17 g/t Au).

- 21. www.guygold.com 21 SULPHUR ROSE: A Mine In the Making • 23 km from Aurora Mine in a straight line • Completed over 2,000m of trenching at Sulphur Rose West and N1 prospects. • Completed over 1,000m, 6-hole drill program at Greater Sulphur Rose Area (GSRA) to test anomalous trench results and geophysics targets. Complete assay results are awaited. • Next phase of exploration work is to conduct a ground magnetic survey at N1 prospect using the company’s own survey crew.

- 22. www.guygold.com 22 GREENFIELDS EXPLORATION: Wynamu A regional soil sampling program is ongoing and nearly complete covering a northeast trending corridor from Kalaloo to Wynamu. Ten (10) trenches with a total length of 1,500 meters are proposed for early Q3’17 to test a series of gold anomalies identified by deep auger sampling. A ten (10) hole drill program is proposed to test a significant gold anomaly and trench sampling with best results of 58m @ 1.21 g/t Au. This work is expected to be commenced in Q3’17 after access is prepared.

- 24. www.guygold.com 24 Symbol: TSX: GUY Total Shares Outstanding 173,036,629 Options 6,371,684 Warrants 0 52 week: Hi/Lo C$9.40 / C$4.10 Market Cap (at C$ 4.42) C$765 million Cash Balance (June 30, 2017) US$65.4 million Debt (June 30, 2017) US$68.8 million Top 10 Shareholders Shares % The Baupost Group 20.6M 12.0% Van Eck 17.2M 9.94% Rafferty Asset Management 8.3M 4.8% M&G Investment Mgmt 7.2M 4.2% Patrick Sheridan Jr. (Founder) 6.0M 3.5% Fidelity Investments 5.6M 3.2% Fiera Capital 5.3M 3.0% Franklin Resources (Templeton) 4.8M 2.8% Sentry Investments 3.9M 2.3% Oppenheimer 3.3M 1.9% CORPORATE SNAPSHOT

- 25. www.guygold.com 25 Guyana is the only English speaking country in South America British common law and secure tenure - part of the Commonwealth Democratically elected government under parliamentary system Long history of significant gold production: Gold was the largest export of the country Royalty: 5%: Gold price $1,000/oz or less 8%: Gold price $1,000/oz + Corporate income tax: 27.5% with no withholding tax on interest payments MINING FRIENDLY JURISDICTION & GOVERNMENT

- 26. www.guygold.com 26 Road Access to Aurora LOGISTICS & INFRASTRUCTURE

- 27. www.guygold.com 27 Focus on health and safety of our employees, the well-being of our community and the protection of the natural environment Hiring in the region, giving priority to local communities: 96% are Guyanese nationals Scholarship and job/skills training Supporting local communities Local sourcing of goods and services Business opportunities Participation in municipal development Sustainable development initiatives in community CSR AND SUSTAINABLE DEVELOPMENT

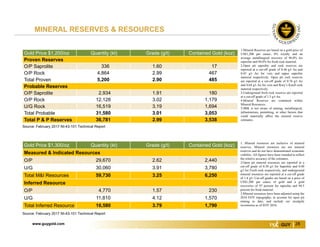

- 28. www.guygold.com 28 Gold Price $1,200/oz Quantity (kt) Grade (g/t) Contained Gold (koz) Proven Reserves O/P Saprolite 336 1.60 17 O/P Rock 4,864 2.99 467 Total Proven 5,200 2.90 485 Probable Reserves O/P Saprolite 2,934 1.91 180 O/P Rock 12,128 3.02 1,179 U/G Rock 16,519 3.19 1,694 Total Probable 31,580 3.01 3,053 Total P & P Reserves 36,781 2.99 3,538 Gold Price $1,300/oz Quantity (kt) Grade (g/t) Contained Gold (koz) Measured & Indicated Resources O/P 29,670 2.62 2,440 U/G 30,060 3.91 3,780 Total M&I Resources 59,730 3.25 6,250 Inferred Resource O/P 4,770 1.57 230 U/G 11,810 4.12 1,570 Total Inferred Resource 16,580 3.79 1,790 MINERAL RESERVES & RESOURCES Source: February 2017 NI-43-101 Technical Report Source: February 2017 NI-43-101 Technical Report 1.Mineral Reserves are based on a gold price of US$1,200 per ounce, 8% royalty and an average metallurgical recovery of 96.0% for saprolite and 94.0% for fresh rock material. 2.Open pit saprolite and rock reserves are reported at a cut-off grade of 0.44 g/t Au and 0.42 g/t Au for vein and upper saprolite material respectively. Open pit rock reserves are reported at a cut-off grade of 0.76 g/t Au and 0.64 g/t Au for vein and Rory’s Knoll rock material respectively. 3.Underground fresh rock reserves are reported at a cut-off grade of 1.5 g/t Au. 4.Mineral Reserves are contained within Mineral Resources. 5.SRK is not aware of mining, metallurgical, infrastructure, permitting, or other factors that could materially affect the mineral reserve estimates. 1. Mineral resources are inclusive of mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability. All figures have been rounded to reflect the relative accuracy of the estimates. 2.Open pit mineral resources are reported at a cut-off grade of 0.30 g/t for Saprolite and 0.40 g/t for Fresh rock respectively, and underground mineral resources are reported at a cut-off grade of 1.8 g/t. Cut-off grades are based on a price of US$1,300 per ounce of gold and a gold recoveries of 97 percent for saprolite and 94.5 percent for fresh material. 3.Mineral resources have been adjusted using the 2016 EOY topography, to account for open pit mining to date, and include ore stockpile inventories as of EOY 2016.

- 29. www.guygold.com 29 BOARD & SENIOR OFFICERS Alan Ferry Lead Director Geologist that has been Involved in the investment industry for over 28 years as a mining analyst and a mining corporate finance specialist. Patrick Sheridan Jr. Founder, Executive Chairman and Director Over 25 years of experience in the mining industry Has actively explored in Guyana since 1996 and is the founder of Guyana Goldfields and lead the discovery of the Aurora and Sulphur Rose deposits Scott A. Caldwell President & CEO and Director Mining engineer with 35+ years experience building and operating gold and base metal mines worldwide Former President, CEO and Director of Allied Nevada Gold Corp. from 2006 - 2013 Michael Richings Director 40+ years of development and operational experience in the resource sector. Mr. Richings is currently the Chairman of the Board for Vista Gold, where he also served as CEO from 2007 to 2012 Rene Marion Director 25+ years of diversified management and senior technical experience with resource industry expertise in operations, mineral exploration, and mine development, along with a successful history of corporate development. Wendy Kei Director Chartered Professional Accountant and previously served as CFO of Dominion Diamond Corporation (formerly Harry Winston). Jean-Pierre Chauvin Director 40+ years of combined experience in mining operations and construction management. David Beatty Director 25+ years of financial capital markets and resource management experience. Daniel Noone Director and VP, Exploration Over 25 years of experience of international mineral exploration and development Former VP of Peru for Aquiline Resources Paul J. Murphy Executive VP, Finance & CFO Over 40 years of financial experience and former Head of PricewaterhouseCoopers LLP Western’s World Mining Practice

- 30. www.guygold.com 30 Scientific and Technical Information The qualified person for the mineral resource and reserve estimates and other scientific and technical information herein are as follows: The compilation of the technical report in support of the 2017 feasibility study was completed by Tim Carew, PGeo, Robert McCarthy, PEng, and Christopher Elliott, FAusImm. By virtue of their education, membership to a recognized professional association and relevant work experience, Tim Carew, Robert McCarthy and Christopher Elliott are independent Qualified Persons as defined by National Instrument 43-101. Tim Carew, Robert McCarthy and Christopher Elliott have reviewed, approved and verified the technical content within this presentation. The qualified person for the other scientific and technical information in this presentation, is Daniel Noone, BApSci (Geo), MBA, and has approved the contents of this presentation. Technical and scientific information contained herein, including the mineral resource and reserve estimates relating to the Aurora Gold Project is derived from the ““Independent Technical Report Updated Feasibility Study, Aurora Gold Mine Project, Republic of Guyana” dated February 2, 2017 (the “Technical Report”). We have filed the Technical Report under our profile at www.sedar.com. For details of the data verification procedures employed by the QPs and the key assumptions, parameters and methods used to estimate the mineral resource and mineral reserve estimates, please see the Technical Report. For information about known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources or mineral reserves, please see the Technical Report. Securities Laws This presentation does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such would be prohibited. This presentation is not an offer to sell, or a solicitation of an offer to purchase, any securities in the United States. The securities referred to in this presentation will not be registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the U.S. Securities Act of 1933 and applicable state securities laws. The information contained in this presentation does not and is not intended to constitute a "valuation," "formal valuation," "appraisal," "prior valuation," or a "report, statement or opinion of an expert" for purposes of any securities legislation in Canada or otherwise. Currency Unless otherwise indicated, all dollar values herein are in United States dollars. SCIENTIFIC, TECHNICAL AND SECURITIES INFORMATION

- 31. www.guygold.com 31 Jacqueline Wagenaar VP, IR & Corporate Communications Tel: (416) 628 5936 x.5295 Email: jwagenaar@guygold.com