Half year results for the six months ended 30 September 2014

- 1. WS Atkins plc Half year results for the six months ended 30 September 2014 13 November 2014

- 2. Uwe Krueger Chief executive officer

- 3. Good results despite currency headwinds Strong performance in Middle East and Energy 3 •Revenue up 2% excluding effects of currency, acquisitions and disposals •Underlying profit before tax up 5% •Underlying operating margin of 6.4%, up 90 basis points year on year •Mixed UK and improving North American performance •Strong financial position with net funds of £155.3m •Interim dividend increased by 4.8% to 11.0p •Outlook for the full year unchanged.

- 4. Heath Drewett Group finance director

- 5. Financial summary 5 30 Sep 2014 30 Sep 2013 Revenue £831.4 m £915.4 m (9.2) % Operating profit £44.6 m £49.7 m (10.3) % Operating margin 5.4 % 5.4 % - bp Underlying operating profit £53.0 m £50.7 m 4.5 % Underlying operating margin 6.4 % 5.5 % 90 bp Underlying profit before tax £46.9 m £44.7 m 4.9 % Underlying diluted EPS 37.7 p 35.9 p 5.0 % Dividend per share 11.0 p 10.5 p 4.8 % Work in hand 89.1 % 87.7 % Average staff numbers 17,569 17,715 (0.8) % Net funds £155.3 m £136.1 m 30 Sep 2014 31 Mar 2014 Closing staff numbers 17,898 17,489 2.3 %

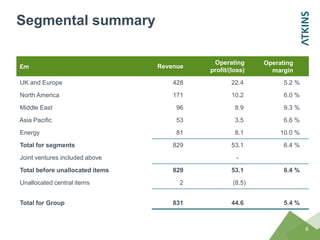

- 6. Segmental summary 6 £m Revenue Operating profit/(loss) Operating margin UK and Europe 428 22.4 5.2 % North America 171 10.2 6.0 % Middle East 96 8.9 9.3 % Asia Pacific 53 3.5 6.6 % Energy 81 8.1 10.0 % Total for segments 829 53.1 6.4 % Joint ventures included above - Total before unallocated items 829 53.1 6.4 % Unallocated central items 2 (8.5) Total for Group 831 44.6 5.4 %

- 7. UK and Europe Mixed performance 7 30 Sep 2014 30 Sep 2013 Revenue (£m) 428.3 525.4 (18.5) % Operating profit (£m) 22.4 27.7 (19.1) % Operating margin 5.2 % 5.3 % (10) bp Work in hand 85 % 87 % Average staff numbers 9,335 9,924 (5.9) % 30 Sep 2014 31 Mar 2014 Closing staff numbers 9,414 9,544 (1.4) %

- 8. UK Mixed trading 8 •Revenue in continuing businesses down 4% (excluding highways services revenue of £73.7m in prior year) and operating profit down 8.5%, against a strong first half comparator •Market downturn in aerospace and outstanding contract variations in rail impacting margin performance •Our highways and design and engineering businesses have performed well, driven by continuing investment in infrastructure by the UK Government •Next phase of operational excellence announced, including reorganisation of our six businesses. 30 Sep 2014 30 Sep 2013 Revenue (£m) 398.5 488.4 (18.4) % Operating profit (£m) 22.7 26.2 (13.4) % Operating margin 5.7 % 5.4 % 30 bp Work in hand 86 % 88 % Average staff numbers 8,610 9,184 (6.3) % 30 Sep 2014 31 Mar 2014 Closing staff numbers 8,737 8,810 (0.8) %

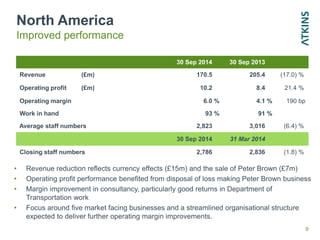

- 9. North America Improved performance 9 •Revenue reduction reflects currency effects (£15m) and the sale of Peter Brown (£7m) •Operating profit performance benefited from disposal of loss making Peter Brown business •Margin improvement in consultancy, particularly good returns in Department of Transportation work •Focus around five market facing businesses and a streamlined organisational structure expected to deliver further operating margin improvements. 30 Sep 2014 30 Sep 2013 Revenue (£m) 170.5 205.4 (17.0) % Operating profit (£m) 10.2 8.4 21.4 % Operating margin 6.0 % 4.1 % 190 bp Work in hand 93 % 91 % Average staff numbers 2,823 3,016 (6.4) % 30 Sep 2014 31 Mar 2014 Closing staff numbers 2,786 2,836 (1.8) %

- 10. North America analysis Progress despite currency headwinds 10 30 Sep 2014 30 Sep 2013 Revenue (£m) Consultancy 137.5 164.1 Peter Brown - 6.9 Faithful+Gould 33.0 34.4 North America 170.5 205.4 Operating profit/(loss) (£m) Consultancy 8.4 9.4 Margin 6.1% 5.7% Peter Brown - (3.3) Faithful+Gould 1.8 2.3 Margin 5.5% 6.7% North America 10.2 8.4 Margin (%) 6.0% 4.1%

- 11. Middle East Strong first half performance 11 •Focus remains on three key markets: UAE, Qatar and Kingdom of Saudi Arabia and three sectors: rail, infrastructure and property •Significant performance improvement driven by major metro project wins and improving property market in the UAE •Strong pipeline of future project opportunities. 30 Sep 2014 30 Sep 2013 Revenue (£m) 96.0 82.6 16.2 % Operating profit (£m) 8.9 4.2 112 % Operating margin 9.3 % 5.1 % 420 bp Work in hand 97 % 90 % Average staff numbers 2,288 1,979 15.6 % 30 Sep 2014 31 Mar 2014 Closing staff numbers 2,428 2,071 17.2 %

- 12. Asia Pacific Good consultancy performance 12 •Revenue growth includes Confluence acquisition in October 2013 •Margin dilution reflects further investment in diversification in the region and mainland China slowdown •Positive second half outlook despite mainland China slowdown and risk of project delays in Hong Kong. 30 Sep 2014 30 Sep 2013 Revenue (£m) 53.4 49.2 8.5 % Operating profit (£m) 3.5 3.4 2.9 % Operating margin 6.6 % 6.9 % (30) bp Work in hand 92 % 93 % Average staff numbers 1,542 1,317 17.1 % 30 Sep 2014 31 Mar 2014 Closing staff numbers 1,566 1,498 4.5 %

- 13. Energy Strong first half performance 13 •Strong profit growth, in part due to impact of bid costs in prior year •Nuclear Safety Associates acquisition achieved regulatory approval •Looking ahead, attractive pipeline and international growth underpinned further by recent Houston Offshore Engineering acquisition. 30 Sep 2014 30 Sep 2013 Revenue (£m) 81.3 83.4 (2.5) % Operating profit (£m) 8.1 6.4 26.6 % Operating margin 10.0 % 7.7 % 230 bp Work in hand 80 % 78 % Average staff numbers 1,499 1,401 7.0 % 30 Sep 2014 31 Mar 2014 Closing staff numbers 1,616 1,461 10.6 %

- 14. Cash flow 14 •Working capital performance reflects increasing lock-up in the UK •Cash flow targets embedded in management incentive schemes •Net funds at 30 September of £155.3m (Sep 2013: £136.1m). £m 30 Sep 2014 30 Sep 2013 Operating profit 44.6 49.7 Depreciation/amortisation 11.6 11.4 Impairment of goodwill 2.8 - Working capital (35.6) (33.5) Pension (16.0) (16.0) Other 6.1 (2.0) Cash flow from operating activities 13.5 9.6

- 15. Working capital 15 First half increase driven by lock-up 2014 2012 Operating profit 104.1 Depreciation/amortisation 28.6 Working capital (27.0) Pension (21.0) Provisions/other (1.8) Cash flow from operating activities 82.9 £m 30 Sep 2014 31 Mar 2014 D Trade receivables 300.6 281.9 Amounts recoverable on contracts 125.3 93.2 Fees invoiced in advance (175.2) (155.5) Lock-up 250.7 219.6 (31.1) Other receivables/prepayments 46.9 43.0 (3.9) Trade payables (70.6) (63.1) 7.5 Other payables/accruals (232.7) (234.5) (1.8) Other (6.3) Movement in working capital (35.6)

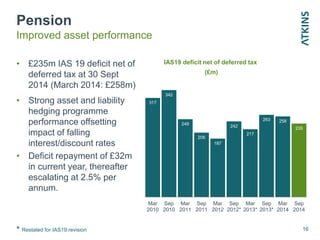

- 16. Pension Improved asset performance 16 •£235m IAS 19 deficit net of deferred tax at 30 Sept 2014 (March 2014: £258m) •Strong asset and liability hedging programme performance offsetting impact of falling interest/discount rates •Deficit repayment of £32m in current year, thereafter escalating at 2.5% per annum. 317 342 249 206 187 242 217 263 258 235 Mar 2010 Sep 2010 Mar 2011 Sep 2011 Mar 2012 Sep 2012* Mar 2013* Sep 2013* Mar 2014 Sep 2014 IAS19 deficit net of deferred tax (£m) * Restated for IAS19 revision

- 17. Summary 17 •Good first half performance •Delivery of strategy continues •Outlook for the remainder of 2014/15 is for continued underlying growth and performance in line with expectations.

- 18. Uwe Krueger Chief executive officer

- 19. 19 Our strategy First half progress update Positives •Operational excellence remains a priority as we drive margin improvement towards our 8% goal •Portfolio optimisation continues with the sale of our Polish business •Ongoing growth in Energy, with skills added through NSA and HOE acquisitions •Focused approach delivering strong results in the Middle East •Strong financial position with net funds of £155m at September 2014 Challenges •Resolving UK rail contract variations •Reduced demand in aerospace market.

- 20. Acquisition strategy 20 •Organic growth remains our priority, augmented by appropriate M&A •Focused on additional skills and/or geographic presence •Cultural fit is critical •Primarily expected to be ‘bolt-on’ in terms of scale •Given the Group’s financial position, more significant opportunities will also be considered •Dedicated central team to identify targets and support execution/implementation. Disciplined approach

- 21. Creating a differentiated offering 21 Clients Collaboration Technology/ innovation External alliances and internal cooperation Driving advances in design and engineering of projects. Increased client intimacy and focus

- 22. Our clients Increasing focus 22 •Thought leadership – a real differentiator eg Future Proofing Cities, Central planning office, Qatar •Key account management and CRM tools •target and prioritise key clients •a systematic approach to business development (Miller Heiman) •Selling our Group wide skillbase eg EDF •Agility – responding to changing markets •Potential co-investments.

- 23. 23 Collaboration Value creation through internal cooperation UK+ Europe North America Energy Asia Pacific Middle East New Technical Professional Organisation West Kowloon Cultural District Riyadh Metro UK reorganisation EDF GDC

- 24. 24 Collaboration Value creation through external partnerships Metros Domestic and international opportunities Nuclear activities Vinci Samsung Chinese contractors URENCO FCC Assystem Colombo Port City Sri Lanka Window of Canton

- 25. Technology/ innovation 25 We undertake around £40m p.a. of innovation and research & development •This is both our clients’ programmes and investment from Atkins •Examples include: •Scenarios planning for the UK water sector •High speed rail centre for excellence at Heriot Watt University •Composite materials research.

- 27. Our people A critical differentiator 27 •Well established graduate and UK apprenticeship programmes •Global leadership programme with Saïd Business School •University partnerships •Retention •Viewpoint internal survey •Confidence in our knowledge (88% positive) and its contribution to meeting client objectives (86% positive) remains very high •94% care about the success of our organisation.

- 28. Summary 28 •Good first half performance •Delivery of strategy continues •Outlook for the remainder of 2014/15 is for continued underlying growth and performance in line with expectations.

- 29. WS Atkins plc Half year results for the six months ended 30 September 2014 13 November 2014

- 31. Profit bridge Underlying profit before tax 31 54.8 44.7 46.9 39.0 1.0 11.1 2.2 0.5 4.4 4.0 Sept. 2013 reported Amortisation Profit on disposal Underlying 2013 Increase in underlying profit Underlying 2014 Profit on disposal Exceptional transaction costs Amortisation & impairment Sept. 2014 reported

- 32. UK revenue by sector Impact of highways services disposal 32 29% 23% 13% 10% 8% 8% 3% 3% 3% 2012/13 H1 2014/15 Roads Rail (inc. mass transit) Defence and security Water and environment Aerospace and aviation Other Buildings Education Urban development 36% 16% 11% 8% 7% 6% 5% 3% 9%

- 33. Working capital movement 33 Regional lock-up £m 30 Sep 2014 31 Mar 2014 Inc/(Dec) Lock-up UK and Europe 106.1 87.1 19.0 North America 78.3 69.4 8.9 Middle East 66.1 67.3 (1.2) Other (net) 0.1 (4.2) 4.4 Total 250.7 219.6 31.1

- 34. Net funds reconciliation 34

- 36. 36 Key to icons

- 37. From the air to the ground How our expertise in aircraft composite materials has delivered innovative solutions for new sectors 37

- 38. GIS Modelling & Monitoring Rapid assessment of flood schemes 38 Fast 80% time saving assessing flood scheme economics Screen locations to identify optimum solution Visualise impacts using 3D maps

- 39. StormCaster, Nationwide, USA Helping communities forecast storms Produce a climate change-aware 90 year forecast of storms in your community A groundbreaking forecasting algorithm produced through a partnership between Atkins and Texas A&M university A publicly available web App that brings climate science to communities

- 40. Central reclamation phase III, Hong Kong Wave-absorbing seawall to reduce reflected waves 40 Improving the wave climate at new piers enhanced the berthing operation, i.e. reduced chance of having accidents Enhanced the marine traffic condition within Victoria Harbour by reducing reflected waves generated from marine traffic

- 41. Digital Imaging for Condition Asset Management (DIFCAM) The use of optional techniques Reduced cost by rapid data capture Improved safety less time track-side Improved quality detailed 3D spatial data

- 42. 42 Used by clients in all 10 FEMA regions in the United States Presently the only publicly available software capable of automating FEMA specified flood maps Flood Map Desktop, Nationwide, USA Reducing the cost of flood map creation

- 43. Disclaimer 43 The information in this presentation pack, which does not purport to be comprehensive, has been provided by Atkins and has not been independently verified. While this information has been prepared in good faith, no representation or warranty, express or implied, is or will be made and no responsibility or liability is or will be accepted by Atkins as to or in relation to the accuracy or completeness of this presentation pack or any other written or oral information made available as part of the presentation and any such liability is expressly disclaimed. Further, whilst Atkins may subsequently update the information made available in this presentation, we expressly disclaim any obligation to do so. The presentation contains indications of likely future developments and other forward-looking statements that are subject to risk factors associated with, among other things, the economic and business circumstances occurring from time to time in the countries, sectors and business segments in which the Group operates. These and other factors could adversely affect the Group’s results, strategy and prospects. Forward-looking statements involve risks, uncertainties and assumptions. They relate to events and/or depend on circumstances in the future which could cause actual results and outcomes to differ materially from those currently expected. No obligation is assumed to update any forward-looking statements, whether as a result of new information, future events or otherwise.