Hard Creek Nickel Investor Presentation

- 1. Turnagain Project Emerging Giant Over 2 million tonnes of 18% Ni Concentrate 27 year mine life Hard Creek Nickel Corporation HNC:TSX www.hardcreeknickel.com September 2012

- 2. Cautionary Statement The Preliminary Economic Assessment (PEA) results released on October 20, 2011were authored by AMC Mining Consultants (Canada) Ltd. The PEA includes the use of inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. The study is preliminary in nature and there is no assurance the mining, metal production or cash flow scenarios outlined in this report would ever be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. This presentation uses the terms “measured”, “indicated” and “inferred” resources. We advise U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories would ever be converted to reserves. This presentation contains “forward-looking statements”. Such forward-looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company’s plans to materially differ from any future results, performance or achievements expended or implied to such forward-looking statements. Known risks include, but are not limited to, financing risks, commodity price risks, scheduling risks and engineering risks. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made, and readers are advised to consider such forward-looking statements in light of the risks set forth in the companies continuous disclosure filings as found at www.sedar.com. The information contained in this presentation has been reviewed by Neil Froc, P.Eng. a Qualified Person. 2

- 3. Mining Friendly Location Turnagain Project 3

- 4. Northwest British Columbia • Roads (pavement to Dease Lake) • Power (Extending to Bob Quinn 2014) • Port (Stewart - shipping concentrate) 4

- 5. Local Access 5

- 6. Site Access By Air 6

- 7. Site Access By Ground 7

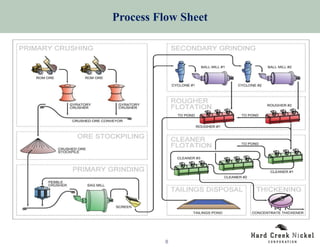

- 8. Process Flow Sheet 8

- 9. Large Project AMC Mining Consultants PEA – October 2011 Open pit mine plan Milling 763 million tonnes Mine life of 27.2 year * Based on 70,570 metres of drilling in 270 drill holes 9

- 10. Projected Turnagain Nickel Production 10

- 11. Global Smelter Capacity vs. Concentrate Supply 1100 1000 Concentrate Feed Concentrate Smelter 900 Nickel Concentrate /kt Requirement Potential Concentrate Requirement 800 700 600 500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Source: Brook Hunt – A Wood Mackenzie Company 11

- 12. Financial Analysis Ni price per lb. $7.65 $8.50 $9.35 (-10%) (Base) (+10%) NPV8 pre tax $0.71 billion $1.29 billion $1.88 billion NPV8 after tax $0.39 billion $0.72 billion $1.06 billion IRR pre tax 12.6% 15.9% 19.0% IRR after tax 11.2% 13.5% 15.6% NPV8 is depreciated net present value at a discount rate of 8%. 12

- 13. Capital Costs (US $millions) Initial Expansion Total Year 5 LOM Mine 244 68 406 Processing 986 406 1,392 Other & Sustaining 95 18 478 Working Capital 32 0 32 TOTALS $ 1,319 $ 492 $ 2,308 218 tonne 13

- 14. Operating Costs US$/tonne ore Year 1-5 Year 6-21 LOM Mining 3.11 3.11 2.52 Processing (incl. Tailings) 4.69 4.38 4.44 General and Administration 0.57 0.29 0.33 Total Operating Cost $ 8.37 $ 7.78 $ 7.29 C1 cost to produce 1 lb. of Nickel: $4.25 C1 cost is the total cost to produce 1 lb. of Nickel, including transportation costs and smelter charges, net of byproduct credits. 14

- 15. Turnagain Project Status •Major new supply of premium quality 18% Ni concentrate •Economically viable •Low technical risk Cut-off Grade of 0.10 % Ni Tonnage Ni % Co % Measured 227,379,000 0.22 0.014 •Upside for platinum/palladium to concentrate Indicated 638,103,000 0.21 0.013 Measured & Indicated 865,482,000 0.21 0.013 •Very large deposit and open to expansion Inferred 976,295,000 0.20 0.013 Ultramafic 1 588 hectares Resource 289 hectares 15

- 16. Turnagain Complex PGE Zone 16

- 17. PGE Zone Geology 17

- 18. Pt+Pd Soil Anomalies 18

- 19. Cu Soil Anomalies 19

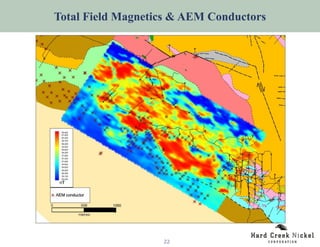

- 20. Total Field Magnetics 20

- 21. AEM Conductors 21

- 22. Total Field Magnetics & AEM Conductors 22

- 23. DB Target 23

- 24. DB Cross Section A B 24

- 25. DB Target 25

- 26. Summary • Identify partner for taking Turnagain to Feasibility • Turnagain PGE exploration • Nickel and PGE exploration in BC 26

- 27. Hard Creek Nickel Board of Directors Mr. Mark Jarvis, President CEO – Director Mr. Jarvis has more than 25 years experience in exploration and development of mineral resources, both in oil and gas and metals. After a career in financing exploration projects as a stockbroker, Mr. Jarvis moved to the corporate side of the business in 1996. He joined the board of Ultra Petroleum, which at the time was a small oil and gas exploration and development company with a large unconventional gas deposit. As Director responsible for Corporate Finance, he raised the equity capital necessary to prove the concept and to establish enough production to finance further growth with debt. Ultra Petroleum has grown from a market capitalization of $10 million to its current capitalization of more than $5 billion. Mr. Jarvis became CEO and President of Hard Creek Nickel Corp. in January, 2004. During his tenure the company has drilled off a giant nickel sulphide deposit and has assembled a team of talented professionals dedicated to developing the resource. Mr. Cliff Carson, B.A. Econ. - Director Mr. Carson was President and Director of Diamond Fields Resources Inc. from May 1995 until July 1996, during which time Diamond Fields was acquired by Inco in a $4.6 billion transaction. Prior to that time Mr. Carson was Senior Vice President, Marketing and Sales at Falconbridge Ltd. He has also served as a member of the Advisory Board for Nikkelverk Nickel Refinery at Kristiansand, Norway and is the past Chairman of the Nickel Development Institute. Mr. Carson holds a B.A. with Honors in Economics from Simon Fraser University. Mr. Gary Johnson - Director Mr. Johnson is a metallurgist with over 30 years experience in all aspects of the mining industry. In his early career he gained broad operational and project experience in a range of operations in Africa and Australia. Mr. Johnson spent ten years as Chief Metallurgist for a large gold producer before forming his own specialized hydrometallurgical consulting company in 1998. During this period he worked closely with LionOre Mining International to develop the Activox® process for treating sulphide concentrates. In 2006, LionOre acquired Mr. Johnson’s company and he then joined LionOre as a senior executive. In 2007, LionOre was successfully taken over by MMC Norilsk Nickel. Mr. Johnson became a Managing Director of Norilsk’s Australian operations in operations in 2009. Mr. Johnson currently owns his own consulting company specializing in high level metallurgical and strategic advice. 27 27

- 28. Hard Creek Nickel Board of Directors Tom Milner, P.Eng – Director Mr. Milner holds a Bachelors Degree in Civil Engineering from Carleton University and a Masters Degree in Mining Engineering from McGill University. Mr. Milner has over 30 years experience in the mining industry. In 2003, Mr. Milner was awarded the Canadian Institute of Mining Proficiency Medal to recognize the contribution made to the development of the Mining Industry and Institute at the local Branch level. Mr. Milner was Chief Operating Officer for Taseko Mines Ltd. responsible for the successful 2004 restart of the producing open pit copper-molybdenum Gibraltar Mine located in south central B.C. Lyle Davis, P.Eng (Alberta) MBA – Non Executive Chairman of The Board and Director Mr. Davis is an independent director of the Company, and chairman of the board of directors. Mr. Davis is the principal of Ellardee Group Capital Inc., a firm he founded in 1999 to provide corporate finance, advisory and management services to public companies. He has a Bachelors Degree in Civil Engineering from Queen’s University and an MBA from the University of British Columbia, and is a member of the Association of Professional Engineers, Geologists, and Geophysicists of Alberta. Mr. Davis is a director of Condor Resources Inc. and Lock and Load Retaining Walls Ltd. George Sookochoff, B. Comm – Director Mr. Sookochoff graduated from the University of British Columbia in 1975 with a Bachelor of Commerce Degree. He currently serves as President and CEO of the International PBX Ventures. He was appointed as a Director of Hard Creek Nickel in November 2003. Mr. Sookochoff has over 27 years experience in the junior mining exploration sector. 28 28