High wealth high touch

- 1. WELCOME

- 2. High Net Worth Families, High Risk, High Touch Service Louise A. Stanger Ed.D, LCSW, CDWF, CIP

- 7. About Dr. Louise Stanger • Clinician-Educator- Blogger • Thrive Global, Huffington, The Sober World, Recovery View • Interventionist • Author-Falling Up A Memoir of Renewal- Amazon • The Definitive Guide to Addiction Interventions-In Press Routhledge • Widow, Wife, Mother, Grandmother • Soul Cycler , Adventurer

- 8. Your Career Help People Achieve & Maintain Wellness

- 9. Objectives Recognize and define high wealth, high touch, high service Explain with case examples, 12 evidenced-based points to take into consideration when working with high net worth clients Illustrate how trauma interfaces in their lives Introduce Collective Intervention Strategies- CIS Evaluate treatment options for those impaired- Concierge & Inpatient Develop, Family, Friend Solution Focused Recovery Plan

- 10. Definitions High Net Worth Individual-HNWI $1 Million in Liquid Assets HNWI $5Million Very HNWI More the $30 millions Ultra HNWI Money comes from Passive Interests Def- current value of ones assets less liabilities (excluding those in Trust accounts)

- 11. The Wealthiest 1 percent of American Households own 40 % of the country’s wealth 2017 Washington Post

- 12. Wealth Managers Talking about Planning for Addiction Disinheritance Outright bequest Distribution of funds to siblings for benefit of the addicted beneficiary Trust Planning and yes what if the client who has issues holds the trust

- 13. Characteristics Appreciable assets Income producing assets Common stocks Bonds Private Businesses Oil/gas rights Timber lands May or may not work

- 16. Out of Balance

- 17. Sam Polk For The Love of Money Wrestler- Rager- Addict

- 23. You Have the Opportunity To Play a Key Role With the ongoing opioid epidemic, availability or marijuana and other drugs addiction has become a problem with no class lines. The story of pain medication following surgery leading to opioid addiction and heroin is everywhere along with increasing statistics on Alcohol , Marijuana and Other Drugs To Develop Partnerships with Wealth Managers, Executive Protection, Business Managers, Personal Assistants etc.

- 24. Wealth Managers Talking about Planning for Addiction Disinheritance Outright bequest Distribution of funds to siblings for benefit of the addicted beneficiary Trust Planning and yes what if the client who has issues holds the trust

- 25. Who is your Client ? Who is your client? Estate Attorney, Wealth or Business Manager, Family Member As Behavioral Health Care Professional what are your legal rights in terms of who you communicate to? It’s easier if you represent the family or the business entity and have the power to talk to the family or business manager Tricker if your client is the identified love one with the problem

- 26. Problems of the Wealthy Kids May grow up spoiled Worry about Kidnapping They are more susceptible to Lawsuits Family & Friends ask for Money

- 27. Statistics on Rich Kids Journal Development and Psychopathology (2017) Higher rates of drinking to intoxication then amounts kids in general US Population Double for taking Adderal or Ritalin By age 22 lifetime rates of addiction were 11-16& amongst women and 19-20% amongst boys By age 26 lifetime rates of addiction were 19-24% and 23- 40%

- 28. Competitive environment More Pressure to Succeed Higher levels of Anxiety & Depression Cocaine, Adderall, Marijuana , Club drugs stimulants such as Ecstasy & now Vaping “Suicide risks higher in wealthier neighborhoods

- 29. Problems of the Wealthy Strangers ask for Money They Wonder if Friends Really Like Them They Lose Old friends Wonder if Spouse really Loves Them They don’t trust money managers

- 30. Problems of The Wealthy Worry About Everything Harder to Keep ones Indiscretions a Secret People Poke Fun at You Invidious Comparison Cognitive Dissonance

- 31. More Problems Parental Inconsistency Delegation of Parental responsibilities to help Parental Denial Unrealistic Parental Expectations Miscarried Expressions of Anger Self Medication Negativism

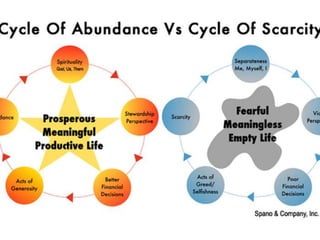

- 32. Fear of Financial Scarcity The Lie of Scarcity There’s Never Enough More Is Better Thats Just the Way it is Promoted by a Culture Of Commercialism

- 34. The Dopamine ConnectionMoney Triggers Dopamine - I get High with a little help from Receivables

- 35. Clients Come with… Children Wives Husbands Extra Marital Affairs Relatives-Intergenerational Wounds Employees Entourage of Folks

- 36. Ego “I am Not like other addicts” Disappointing Family and Friends Denial, Rationalizing, Confabulating Fear of Stigma, Fear Of leaving Work Fear of a permanent record Entitlement A way to cover Up ailments

- 39. Problematic Behaviors Substance Abuse- Mental Health Chronic Pain & Codependency & Process Disorders -Sex, Gambling,Work, Debiting, Spending, Shopping ,Religiosity, Disordered Eating, Digital etc.

- 40. A= AGE OF FIRST USE B=BIG CHANGES C=CO-EXISTING MENTAL / BEHAVIORAL HEALTH ISSUES DNA-FAMILY HISTORY Assessment Questions

- 41. Be On The LookOut Sudden Changes in Spending Lying- Increased Irritability Depressed or Overly anxious and Worried Legal Health- Physical Maladies- Lethergy Relationship Failures Work- Cheating School- Missing Classes Intergenerational Wounds

- 42. Warning Signs Over drinking in social situations Binge Drinking Use of Illicit Drugs Mood Changes Changes in Physical Appearance Changes in Spending Changes in Work or School Obsessive Thoughts about drinking, sex , gambling

- 44. Chronic Pain 133 million People Experience Chronic Pain 1 in 5 globally (more women then men ) 65% of all people experience chronic pain once in their life 75 % of all heroin users started with a prescription Annual cost of $365 billion , $154 For young people 151 people die daily (CDC)

- 47. Shame Shame is that intensely painful feeling of believing we are flawed and therefore unworthy of love and belonging. I am not good enough Brene Brown

- 49. Grief and Loss Loss is the Universal experience that occurs throughout the lifespan Grief is a form of sorrow involving feelings and thoughts caused by bereavement Responses to grief and loss influenced by culture

- 50. Trauma

- 51. What do your Clients Say about Trauma ???? Verbal abuse Physical abuse Witnessing a tragedy Not being told about something Accidents Divorce Death

- 56. Out of Control or Injurious Behavior

- 58. Stuck in Victim, Perpetrator, or Rescuer Roles

- 60. Addiction -Attachment Disorder Values are lost as we attach to substances and other unhealthy behaviors

- 61. Black and White Thinking

- 62. Suicide Ideation

- 63. Be On The LookOut Sudden Changes in Spending Lying- Increased Irritability Depressed or Overly anxious and Worried Legal -restraining orders, Backmail Health- Physical Maladies- Lethargy Relationship Failures Work- Not able to be on Stage ,not showing up or overly demanding School- Missing Classes

- 64. Watch out for Nodding Off What inside the red cup- Purple Drink on Stage Constantly going to the bathroom Screaming at Staff-Hysteria Betting Intergenerational Wounds

- 66. EMOTIONAL INTENSITY FINISH SENTENCES BAIL OUT FINANCIAL SUPPORT FOOD, CLOTHING SHELTER FEAR of FAILURE FEAR of Losing Jobs ABCD

- 67. Keeping The Status Quo SA. MH, CP etc . Organizing structure Unconscious and Conscious Gratification Strategies must be employed that change usual ways of relating, categorizing , and thinking

- 68. Secrets Dominate

- 69. Confabulations

- 70. Phone Call For Help Your client calls you in distress or your client is obviously in distress The accountant calls you The estate attorney calls you Usually they speak with rapid fire and They want something done -NOW- Fix It You lend an ear and Stop- Pause- Breathe and Listen Quick answers are not always the best answer

- 71. When working with CEO’s 12 Tips Dr. James Flowers & Louise Stanger CEO’s like to talk to Other CEO’s CEO’s like to delegate - Nondisclosure agreements There are at least two families in a high wealth person’s life Individualized Customized Treatment- Do not over promise and under deliver- Concierge

- 72. 12 Tips Boundary Setting Is Paramount Executive - Personal Team & Executive Protection as Part Of Team Secrets Dominate Education Mandatory

- 73. And Some MORE Trauma Is Commonplace Collaboration is a must _ Drs, Lawyers Etc. CIS - Collective Intervention Strategies Customized Aftercare

- 75. Collective Intervention Strategies Louise Stanger Ed.D, LCSW, CDWF, CIP

- 76. CIS? • Collective - In that to be successful there must be a team of Families, Friend, Collegues, Associates, business partners , managers or co-workers assembled to bring about change • Intervention- In that we seek to move (i.e/ motivate a person to a place of change) • Strategy, in that nothing is set in stone ; we may adapt the process as needed

- 79. Meet Jack and his family 54 yo old retired executive lives with 29 yo son Two previous treatment episodes 3 children 19, 22, 29 Wife in process of divorce- Being asked to leave treatment center as wrong placement Had to get him from A -B

- 80. Meet Josh- Age 52 Money Manager • A=Age 14 Played Pocker- family trips to Vegas • B Divorce pending 2 14 year old boys • C-Highstrugh -anxiety-poss- Mania - Cocaine- Alcohol-Pills • Dx-Hx of religiosity, Trauma workaholism, MH , holocaust survivors 3 generations • Narcissistic

- 81. Meet Jackie Adult Children Don’t Care Newly Widowed Depressed - Anxious Never Handled Funds Shopping, Spending, Pills

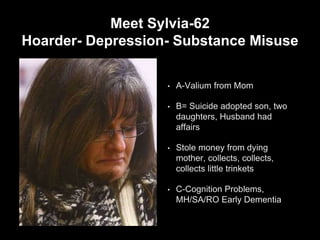

- 83. Meet Sylvia-62 Hoarder- Depression- Substance Misuse • A-Valium from Mom • B= Suicide adopted son, two daughters, Husband had affairs • Stole money from dying mother, collects, collects, collects little trinkets • C-Cognition Problems, MH/SA/RO Early Dementia

- 85. Celebrities

- 86. Meet Ed Two Families Celebrity Personal Cervical Pain Opioids Alcohol Marijuana

- 87. Meet Jake • International Soccer Player • Back and knee-Chronic Pain • Family- Mother- Father, brother, subsequent child of infant death • Family Hx of Depression, Trauma, Codependency • Religious orientations different • Secrets

- 88. Entitled -SA-MH -Chronic Pain

- 89. Meet Doug

- 90. Back Pain Severe-Not able to lift young children- possible candidate spine surgery Mother Dying -house full of edibles and pills, marijuana Multiple treatments for substance abuse ( 7 ) Does not work Stealing from wife and mother Isolating - Lying Family History- Alcohol and Pills Anxiety , Depression About Doug

- 91. What’s working!

- 93. Showing Up

- 94. Meet Maddi 10 operations - 6 treatment centers

- 95. First major accident age 14 Family History of SA , MH and Molestation Pain Body, Sexual Assault Trainer For past 9 years has been in and out of treatment centers Walking on crutches or not walking at all

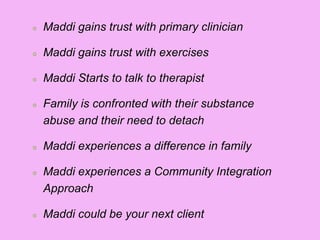

- 96. Maddi gains trust with primary clinician Maddi gains trust with exercises Maddi Starts to talk to therapist Family is confronted with their substance abuse and their need to detach Maddi experiences a difference in family Maddi experiences a Community Integration Approach Maddi could be your next client

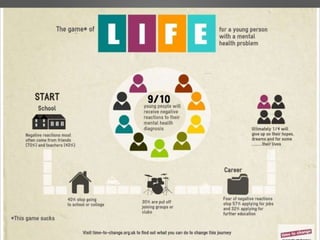

- 98. Mental Health , Substance Abuse & Young Adults

- 100. About Sally • Mother -Father South American, Jewish descent • Father Hx of Depression • Family has 4 children- Sally is the Subsequent child of an infant death - Brother died of brain tumor at 20 months, older brother age 5 dx with autism- PTS • Bullying, Isolation , No Friends • Trauma Riding , at School Sexual Assault • 4 Suicide Attempts-Disorded Eating- • Pills & Marijuana • No Formal Inpatient Treatment

- 101. Meet Debbie • Obsessive Compulsive- Boarderline-Hoarder- very bright- Photographic memory • Heavy Smoker- Isolates • Mother- Rage - Alcoholic - Hoarder • Father- Stroke - TBI • Brother- IQ 40 • Grandmother-Holocaust Survivor • Uncle -Narcissist

- 102. Louise Stanger Ed.D, LCSW, & Harry Nelson J,D. Appendix When working with Wealth Managers & Executive Protection

- 103. Please Remember This is not your area of expertise

- 104. “Make sure you help wealth managers be in a position to do something Trust Documents and client agreements should provide sufficient power for mangers and trustees to speak in case of a health crisis . Trust documents include “spendthrift”provisions allowing trustees to adjust or control spending for people with spending problems and substance abuse and mental health crisis. Different states offer different degrees of latitude to put controls on funds -age 21- 25 th and in some cases beyond Think that addiction is not an age-bound disease and have management -control mechanisms beyond these dates These are discussion you may have with parents or grandparents

- 105. “Make sure your documents put you in a position to do something”. Harry Nelson Esq. Client engagements should provide sufficient power for you to act to speak in case of a health crisis . Clients may have Trust documents include “spendthrift”provisions allowing trustees to adjust or control spending for people with spending problems and substance abuse and mental health crisis. Different states offer different degrees of latitude to put controls on funds -age 21- 25 th and in some cases beyond Think that addiction is not an age-bound disease and have management -control mechanisms beyond these dates These are discussion you may have with families and business managers etc

- 106. “Make sure your documents put you in a position to do something”. Harry Nelson Esq. Trust Documents and client agreements should provide sufficient power for mangers and trustees to speak in case of a health crisis . Trust documents include “spendthrift”provisions allowing trustees to adjust or control spending for people with spending problems and substance abuse and mental health crisis. Different states offer different degrees of latitude to put controls on funds -age 21- 25 th and in some cases beyond Think that addiction is not an age-bound disease and have management -control mechanisms beyond these dates These are discussion you may have with parents or grandparents

- 107. Make sure those involved in Executive Protection Are Knowledgable about AOD , Mental Health etc Have written contracts that allow for intervention Have an unique position with Influence and Trust

- 108. Resources Anderson, D & Gobankingrates. May 23, 2016. 10 ways Rich People Are More Worse off then You . Money Magazine Lynne Twist Founder Soul of Money Institute. May 12, 2018 The Daily Good. Investopedia Definitions of High Wealth https://www.investopedia.com/terms/h/hnwi.asp Ingraham, Christopher. Dec. 6, 2017. The richest 1 % Owns more of the country wealth… Washington Post.

- 109. Resources Stanley, Thomas & Danko William . The Millionaire Next Door: The Surprising Secrets of Americas Wealthy. Longstreet Press. 1996. Veblem, T.. The Theory of The Leisure Class (1899) Substance Abuse Treatment and Family https://www.ncbi.nlm.nih.gov/books/NBK64258/ Johns, K. The Opioid Crisis Impact on Wealth Management . Dec. 5, 2017 http://www.wealthmanagement.com/high-net- worth/opioid-crisis-impact-wealth-planning

- 110. Resources Link between Wealth and Suicide. (2012) Time .Business Insider Wang,Y. (Feb.16,2016) CDC Investigates why so many Students in Wealthy Palo Alto., Commit Suicide. Washington Post. Preidt, R. (May26, 2017 11:11 am) Experts sound alarm on Autisms “worryingly high suicide rate”. CBSnews

- 111. Resources Hokemeyer, P. , JD, PHD, July, 2015. Wealth and Addictions. https://www.drhokemeter.com/2015/07/wealth- and-addictions Stanger, L & Porter, R., Jan 2018. Working With Affluent families https://www.thriveglobal.com/stories/19468- working-with-affluent-clients-q-a-with-dr-louise-stanger- trusted-provider-network Stanger, L .& Porter, R April 2018. Hopping on The Vape Train- What are Teens and Parents to do https:www.allaboutinterventions.com/2018/05/10/hopping- on-the-vape-train-what-are-teens-and-parents-to-do/

- 112. Resources Stanger, L& Porter, R. Dec. 1, 2017 Holiday Rush: Teens & Pharm Parties. Huffington Post Stanger, L& Porter, R. Power, Privilege, Payouts; The Enablers .Oct. 27, 2017. Huffington Post Stanger, L& Porter, R. Dec. 1, 2017 . Red Bull- Monster-Rock Star -The Downside of So Called Energy Drinks . Huffington Stanger, L.& Porter, R . Dec. 1, 2017 High Wealth, High Risk, High Service. Huffington

- 113. Resources Stanger , L & Porter, R .April 5, 2017Sports Stat- Fame & Addiction .. Huffington . Stanger , L & Porter, R .March 15, 2017. Too Big To Fail: Wealthy Clients & Addiction. Huffington Luthar, S. 2003 The Culture of Affluence: Psychological Costs of Material Wealth . NCBi.nim.nih.gov.