How ERP software is dealing with new financial management difficulties.pdf

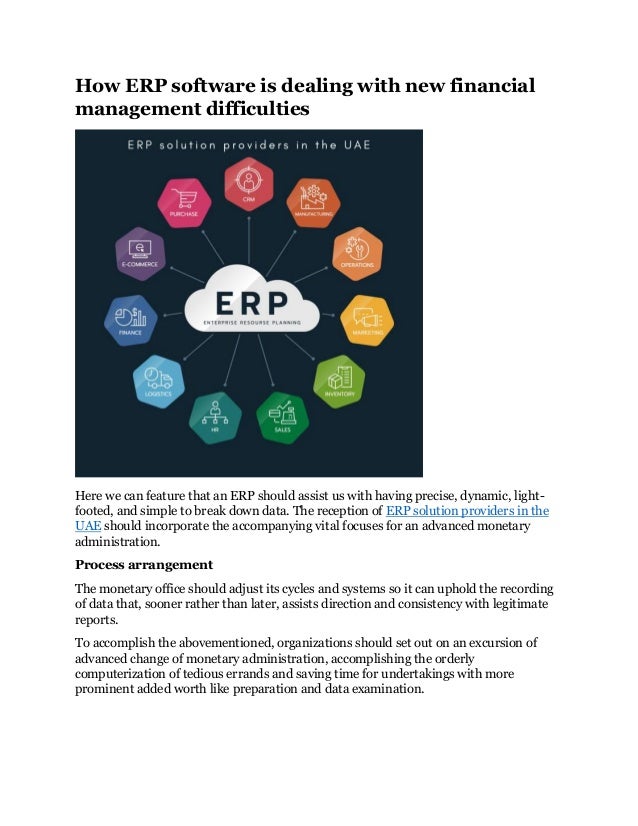

- 1. How ERP software is dealing with new financial management difficulties Here we can feature that an ERP should assist us with having precise, dynamic, light- footed, and simple to break down data. The reception of ERP solution providers in the UAE should incorporate the accompanying vital focuses for an advanced monetary administration. Process arrangement The monetary office should adjust its cycles and systems so it can uphold the recording of data that, sooner rather than later, assists direction and consistency with legitimate reports. To accomplish the abovementioned, organizations should set out on an excursion of advanced change of monetary administration, accomplishing the orderly computerization of tedious errands and saving time for undertakings with more prominent added worth like preparation and data examination.

- 2. The reception of an ERP, as an initiate for catching monetary data, will make it simpler for best practices to be carried out all through the whole monetary division and will add to: Monetary Information Visibility: Real-time access in addition to multi-faceted perspectives accessible to all partners. Execution of controls that permit observing on the web and continuously. Customization of reports that are as per the fundamental KPIs centered on the business. Robotization of functional cycles The monetary chief should go from being an expert in bookkeeping and money to an essential director, he should be viewed as a problem solver that advances the reestablishment of business the executives, bringing about more noteworthy proficiency, cost and cost control, yet particularly utilizing the development and benefit of the organization. In numerous associations, the majority of the cycles are as yet manual and extremely difficult, lessening the efficiency of the colleagues. Barely any organizations have completely tended to this test, acquainting end-with end business computerization processes in regions like records payable and exceptional solicitations. An interaction defenseless to mechanization through powerful cautions is that of Accounts Receivable. These alarms will demonstrate deviations from laid out boundaries, helping key assortment the board. Another model is invoicing, which won't just be produced on time, yet additionally the reliable recording of pay in bookkeeping and its ensuing control, working with independent direction, speed and exactness in the records. Combination of monetary cycles Combining the monetary interaction is presently a basic piece of organizations that are attempting to adjust to the new reality, where innovative applications are progressively fundamental. Manual cycles in monetary administration have been abandoned, giving way to the computerization of work in the business climate. We can't consider monetary administration to be an island, since it must, because of its essential nature, give data to a different region of the organization, for example, 1. General administration or investors 2. Business region 3. Individual Resources Area 4. Consequently, utilizing innovative apparatuses, for example, ERP in monetary administration should be accomplished:

- 3. Minimization of manual blunders: looking to keep up with cutting-edge monetary information that, through mechanization, can limit the gamble of making mistakes. Coordination: looking for incorporation with different regions like a business the executives, or the Human Resources region. Ensure consistency with legitimate guidelines: it is feasible to normalize monetary data as per the bookkeeping rules and guidelines of every country. It ought to try and permit late updates in the event that any standard changes happen.