How to Win in Marketplaces

- 1. Powered by Conversations That Matter: How to win in marketplaces

- 2. Welcome Dayoán Daumont Consulting Partner, EMEA Ogilvy Consulting Ed Kim Global Managing Partner Ogilvy Consulting Pierre Kremer Consulting Director Ogilvy Consulting Hazem El Zayat Chief Digital Officer, Ogilvy MENA Alessandra Dal Bianco Managing Director, Brazil Ogilvy Consulting Sheilen Rathod President, Ogilvy China

- 3. Tell us where you are dialing in from! What’s the weather like in your city?

- 4. Do you want this deck? Global Ogilvy Website https://www.ogilvy.com/ideas

- 5. How To Win in Marketplaces Now present in all regions of the world, marketplaces have fundamentally changed the commerce landscape, the way we shop, and how businesses go to market with their products and services. And although marketplaces are based on the same concept of first- and third-party selling, they are vastly different from each other. But how do brands accelerate growth? And what are the requirements for success?

- 7. Marketplaces have been dominating the eCommerce landscape • $1.97Tr spent globally across marketplaces in 2019 • Marketplaces account for 57% of global online retail sales • Marketplace GMV grew 18% 2018-2019 • Alibaba achieved 1T GMV in 2019 Top marketplaces by region (users per month): • Taobao: 580M • JD: 284.7M • TMALL: 177.1M • Amazon: 2.3B • eBay: 637.9M • Walmart: 446.4M • Amazon: 1.6B • eBay: 633.8M • AliExpress: 220.2M • Trendyol: 80.2M • N11: 76.9M • GittiGidiyor: 46.6M • Mercado Libre: 519.8M • Americanas: 133.8M • Amazon: 56.6M Asia US Europe MENA LATAM

- 8. More than half of the marketplaces we know now were launched in the last 7 years 54 of the 100 top marketplaces launched in 2011 or later. 1995 2000 2005 2010 2015 2020 Online marketplaces broken down by year launched

- 9. Marketplaces create stickiness to drive engagement, loyalty & revenue Alibaba’s ecosystem JD.com’s ecosystem Amazon’s ecosystem Mercado’s ecosystem

- 10. COVID-19 Acceleration While the coronavirus pandemic has plunged the globe into widespread economic downturn, eCommerce sales are still growing by 16.5% globally. With more than 90% of consumers in UAE and Saudi Arabia switching their shopping to online, and a 129% year-over-year growth in U.S. & Canadian eCommerce orders as of April 21 2020, consumers are turning to online retail for their shopping needs. Despite supply chain challenges, in Q2, Amazon’s revenue increased 40% in Q2 and profits by $2.7b YoY The coronavirus pandemic has shown how important online consumer services and technology are for society and the economy. Consumers are turning to online marketplaces for their low prices and convenience, and marketplaces are evolving to meet growing demand.

- 11. Marketplaces are not just retailers Food Aggregators have seen tremendous growth and they cover many sectors and present opportunities for FMCG companies. Revenue in the Online Food Delivery segment is project to reach $136M in 2020. The revenue is expected to show a CAGR of 7.5% between 2020-2024 resulting in a project volume of $182M by 2024. Delivery Platforms with Dark Kitchens On-Demand Food Delivery On-Demand Groceries

- 12. Although marketplaces are different their success is based on being reactive, efficient, and - most of all - obsessive about the consumer To win the focus must be on the Commerce Customer Experience

- 13. 13 In this session we will cover 4 case studies that illustrate how focusing on the commerce customer experience led our clients to success The importance of operations to drive performance Amazon in EMEA Establishing Partnerships with Food Aggregators in LATAM Winning in Marketplace Festivals in Asia The Importance of Localisation in MENA

- 14. How to win - Events and Promotions (ASIA) Winning in marketplace festivals

- 15. 15 28%By 2023 online will make up of total retail sales in Asia 260bnGrocery is the fastest growing category USD by 2023 26.5%With a CAGR of 2.5tlnBy 2023, online sales will reach USD in Asia *Forrester 2019 Driven by changing consumer behaviour, and hastened by the outbreak of Covid-19, the marketing landscape in Asia is quickly transforming. WHAT IS HAPPENING ACROSS ASIA? Finding the sweet-spot between brand, shopper & platform

- 16. SC Johnson | Ogilvy Consulting THE MOST COMPLEX COMMERCE REGION Each platform with its own requirements on inventory, relationships… and content

- 17. FESTIVALS DOMINATE THE MARKETING CALENDAR 48+ major festivals across Asia Festivals have become a significant part of the eCom landscape in Asia. Some see them as a sales and promotional ‘evil’ that cannot be avoided. We see them as a way penetrate new audiences, grow brand and drive sales.

- 18. TMALL JD WECHAT LAZADA Pop Me! SHOPEE Pop Me! DTC EXECUTING FESTIVALS FOR THE LARGEST BRANDS Clients across platforms

- 19. September 1, 2020September 1, 2020 Data • Business • Category • Customer • Platforms & Channels • Persona & Journey Connections • Search • Connections Planning • Content Co-ops • Gaming Co-ops CRM / Relevance • Relevance at each Touch • Progressive Profiling • Segmentation • Re-marketing • Personalisation Commerce • Transaction • Maturity Assessment • Festival Activation • Brand day activations Martech • Advertising Technology • Marketing Technology • Dash-boarding • Light Automation Distinct outcome & experience More effective acquisition of customers Higher ROI against customer segments Visibility and cut through conversion during shopping seasons Technology enablement & personalization at scale Build Brand in Digital World Generate Leads, Sales & Drive Loyalty Scaleable & Repeatable WE HAVE AN APPROACH TO BUILD BRAND AND DRIVE SALES On commerce platforms - during festival peaks

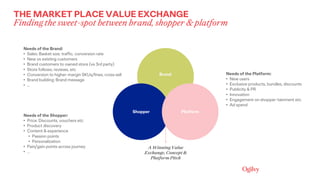

- 20. Opportunity/Challenge • Increasing importance of marketplaces and festivals, especially multi-brand • Intense competition for platform festivals • Bands must “pitch” platforms, which they struggle with Why Clients Struggle • Requires thorough understanding of platform needs and what’s worked in the past • Complex politically within client organisations Our Solution • 3-way value exchange: Shopper, brand & platform • Sold as a workshop to bring together various stakeholders THE MARKET PLACE VALUE EXCHANGE Finding the sweet-spot between brand, shopper & platform Brand Shopper Platform

- 21. Needs of the Brand: • Sales: Basket size, traffic, conversion rate • New vs existing customers • Brand customers to owned store (vs 3rd party) • Store follows, reviews, etc • Conversion to higher-margin SKUs/lines, cross sell • Brand building: Brand message • … Needs of the Shopper: • Price: Discounts, vouchers etc • Product discovery • Content & experience • Passion points • Personalization • Pain/gain points across journey • … Needs of the Platform: • New users • Exclusive products, bundles, discounts • Publicity & PR • Innovation • Engagement on shopper-tainment etc • Ad spend THE MARKET PLACE VALUE EXCHANGE Finding the sweet-spot between brand, shopper & platform Brand Shopper Platform Brand A Winning Value Exchange, Concept & Platform Pitch

- 22. 9/11 THE BIGGEST FESTIVALS Are long in the making Store/Brand Announce Double 11 Participation Engaging Consumers And Anticipate the Event Sales of Special SKUs Encourage Add-to-Cart for On-sale products Buy, Buy, Buy EARLY STAGE RECRUIT STAGE PRE-SALE STAGE PRE-DOUBLE 11 DOUBLE 11 9/30 10/21 11/01 11/10 11/11

- 23. 9/11 EARLY STAGE RECRUIT STAGE PRE-SALE STAGE PRE-DOUBLE 11 DOUBLE 11 9/30 10/21 11/01 11/10 11/11 41% of Sales Parents, 25-40 Long purchase journey View average 25 SKUs per day Shop for kids or pets Stocking purpose Babycare category should pay special attention 38% of Sales Female, 18-35 High-level Taobao shoppers Shop for beauty & apparel Decisive shoppers 21% of Sales Single Male Impulsive Shopper Shop for big-ticket items such as furniture or snacks Day shoppers 11/11 11/11 THE BIGGEST FESTIVALS Attract different customers at different times 11/11 PIONEER SPECTATOR EC NATIVE

- 24. Business Analysis Festival Program Idea Customer Decision Journeys Strategic Way-in Value Exchange Digital Engagement Idea Livestreaming Idea Traffic TTl & Break Down KPI Measurement and Budget Allocation Media and KOL PlanO2O Idea Campaign Strategy Consumer InsightConsumer & Platform Understanding GWP Idea THINK CREATE REALIZE SERVICES THAT DELIVER BRAND ON FESTIVALS Established process with multiple outputs

- 25. October 24, 2019 25

- 26. key learnings

- 27. Festivals are a must to grow audiences, generate sales but brands must not lose their purpose Don’t do it last minute. Success in Festivals requires planning Know your consumers and when they shop Think omni-channel. Demand generation is not just on the platform You must find the sweet-spot between brand, shopper & platform

- 28. How to win - Leveraging Partnerships (LATAM) Growing through strategic partnerships with Marketplaces

- 29. Different and multiple merchants across markets

- 30. Largest marketplace in LATAM

- 31. Business Overview Q2 2020

- 32. The number of new buyers on Mercado Livre continues to grow Source: Internal data Mercado Libre Period COVID-19 (24/02 to 03/05/2020) vs. same period of 2019 Therewasanincreaseof 45%duringthisperiodvs.same periodlastyear 5MMNew Buyers

- 33. In LATAM region, different from other mature eComm markets, there is room for special agreements and negotiations. We at Ogilvy can support you win in Mercado Libre establishing long term partnerships.

- 34. Ogilvy can support you in setting up your store and services properly Mercado Libre Ecosystem

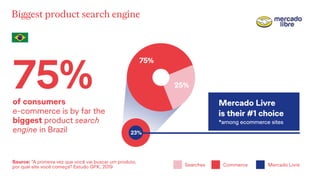

- 35. Biggest product search engine 23%

- 36. Opportunity to position the brand on the platform

- 37. Beyond the online store and regular banners

- 38. Beyond the online store and regular banners

- 39. Beyond the online store and regular banners

- 40. Mercado Livre offers welcomes opportunities for partnership and negotiations to develop customized mid and long-term projects, where brands can perform at their best.

- 42. Coca-Cola B2B Digital Commerce saw a great opportunity in a particular segment: delivery platforms or food aggregators Coca-Cola B2B Digital Commerce saw a great opportunity in a particular segment: delivery platforms or food aggregators

- 43. Food aggregators has an exponential growth opportunities FOOD AGGREGATORS E-RETAILERS FOOD AGGREGATORS E-RETAILERS SALES MIX PARTNERS

- 44. Home delivery orders represented 7% of the medium Brazilian annual budget

- 45. Ofconsumers believethedrinkis veryexpensiveinthe platform Source:2018ifoodusersbaseresearch 74% Don’tfindthe packingisthe rightone 18% Simplyforget toorder 17% Main order detractors

- 46. How to increase relevance on delivery, growing incidence of Coca-Cola products in the orders?

- 47. In this complex world of multi-brands and multi-business ambitions, we at Ogilvy Consulting support Coca-Cola in their strategic partnership with business plan and decision making.

- 49. To prevent people from scheming Coca-Cola drinks in their orders and promoting its business growth, it was necessary to build up a win-win relationship between brand, key accounts and food aggregators.

- 50. Annual Callendar

- 51. Order now Order at Rappi McDonald’s with Coca-Cola Mc Delivery with your favorite Burgers up to 50%OFF! Combo Meals with 2 classics of your choice + 1 beverage for only R$24.80. * Choose Between: Big Mac, Cheddar McMelt, Quarter Pounder with Cheese, McChicken, Triple Cheeseburger, Double Burger Bacon and Double Barbecue. Buy nowGet R$15 OFF 2 Mc Combo Meals with Coca-Cola Haven't you order at Rappi yet? Coca-Cola helps you get off to a great start. Order 2 Mc Combo Meals with Coca- Cola and get $15 off using our coupon. Order and enjoy. Key Account Special negotiations addressed in the annual plan

- 52. Such a combo meal like this, is perfect for satisfying the hunger on a Friday night. But in order to be perfect, it needs a very cold Coca- Cola, right? Combo Negotiation with Key Account that mitigates consumer barriers to order Coca-Cola

- 53. Right assortment and special price list to delivery customers Tool to facilitates assembling images to small restaurants Dashboard measuring 100 thousand delivery restaurants

- 54. Rappi PUSH NOTIFICATION BANNER AD CHECK OUT Leveraging the user journey in the app increased Coca-Cola products relevance and sales

- 55. Global Award 2019 "The Battle of Yakisoba” gamification between the largest Chinese restaurant chain, Coca-Cola and iFood.

- 56. Key Account Food aggregator How to win “Golden Rules” playbook

- 59. Acquisition/ CRM/Loyalty Strategy BlueprintStrategic Value Segmentation Customer Decision Journeys Acquisition, CRM or Loyalty Program Idea Customer Personalization Data plan Tactical Ideas Programme Management Plan Realtime Measurement Dashboard & Reporting Test Plan & Measurement Plan Customer Experience Journey CREATE REALISETHINK 1:GROUP 1:MANY 1:ONE Dynamic Design System Engagement Segmentation Growing in incidence while building relevance through CX

- 60. Personas who are adept to delivery services

- 63. + AGGREGATORS KA’S + Powered by

- 64. key learnings

- 65. Marketplaces are highly competitive environment with a great opportunity to grow in scale but your brand must do the right thing in order to stand out You must concentrate your efforts and join marketplaces that matter - your brand does not need to be in all marketplaces. In case of delivery platforms, build long-term partnerships where there are 3-way value exchange: brand, key-account & platform In LATAM there is room to negotiate and join marketplaces strategically. Choose the right partner to support you on that. And grow your business increasing opportunities to deliver brand experience that delights consumers

- 66. How to win - Expanding presence The importance of localisation

- 67. 67 2.5%As of now, online makes up of total retail sales in MENA $9bnMarket expected to reach by 2022 30%With a CAGR of almost $8.3bneCommerce market is worth eCommerce in MENA is witnessing a major transformation in consumer behavior on account of the pandemic. More than 90 percent of consumers in the UAE and Saudi Arabia have shifted their purchases online. Retail outlets are under pressure to expand their online presence — and eCommerce players need to step up their game. What is happening in MENA?

- 68. 68 • Arabic is the fourth most commonly used language on the Internet • 237 million Arabic speaking internet users • There are over 30 Arabic dialects/variants and spoken & written vary too, & there is ono single Arabic culture • 60% of Arabic speakers prefer browsing content in Arabic (this number jumps to 97% when you look at Saudi Arabia and Egypt alone • When delivering an experience specifically for Arab users, you need to apply UX and usability considerations that are specific to users in the region Localization is the process of adapting an existing solution to local language and culture in the target market. It involves much more than the simple translation of text. The objective is to seem "natural" to its viewers despite any differences between the creators and the audience. What do we mean by Localization?

- 69. MENA – A 0.5 Billion Market The first strategic mistake companies fall into while entering the MENA market is treating the 500 million Arabic-speaking population in the same way. Having a strong awareness of the unique cultural characteristics of Arab nations is a vital first step for eCommerce businesses targeting expansion in the MENA region.

- 70. Beyond Translation Just like designing for a Western Audience, keeping the user at the center of what we deliver is key to ensuring we get the experience right. Consulting with end users at different parts of the project is key and delivers better results as opposed to designers assuming they know what users want and how they behave. Whereas the Internet and many digital solutions originated in the Western world and users became accustomed to how they can engage with them, that does not mean that these ‘standards’ apply fully to an Arabic audience and hence being mindful of the mental models for Arabic users is very important and helps deliver a more accurate experience. The culture of one country or region has an impact on how a website is designed and the type of content it communicates. The culture from one Arab country to another (and in some cases within the same country) can vary massively. Language is key to your website success. More often direct translations don’t work or don’t lend themselves to the channel the content is being used on. For example the translation of a ‘shopping cart’ may differ for a supermarket than for an online retailer. In addition, the spoken Arabic language varies from one country to another (and within a single countries’ regions in some cases). Which is the right version of Arabic to use for the market(s) you are targeting? Or should classical Arabic be used? Whereas, it is commonly understood by all Arabic speakers it is often considered a formal way of communication and may not lend itself to your brand identity and character. User-Centricity Being Mindful Understanding the Culture Language It’s not about flipping every template and every image. Certain elements may not require this based on how users interact with them. For example logos, icons, buttons, may need consideration before jumping into flipping them. Right-to-left Layout Images need to be culturally appropriate and fit for purposes. For example, not all imagery would work in Saudi. Using Arab looking models may create a better connection with customers, etc. And going back to culture, Arabs don’t all look the same. Imagery Along with the issues with translation and localization, there’s also a visual element to consider when it comes to using Arabic for your interfaces in the form of Arabic typography. Arabic characters tend to be shorter and wider than Latin characters. This means that they take up more space horizontally. Font & Text Size

- 71. Analysis Content THINK CREATE REALIZE Established Process with Multiple Outputs Brand Audit Website Audit Customer Personas Best-practice Audit Cultural Mapping Information Architecture Localization Framework Content Audit Imagery Video UX/UI RTL Layout Typography Colors Imagery Prototyping User Testing Measurement & Optimisation plan Scale & Roll-out Channel Rollout Moving Image Go-To-Market Strategy Dashboard & Reporting Optimize & Repeat Measure and Optimize v Localization Definition

- 72. Not Always Done Right

- 73. Not Always Done Right

- 74. Not Always Done Right

- 75. Examples

- 76. Examples Digits (like phone numbers with international dialing codes). These are still displayed on RTL websites as they would be on LTR websites. Daisy by Marc Jacobs KSA Campaign International Campaign

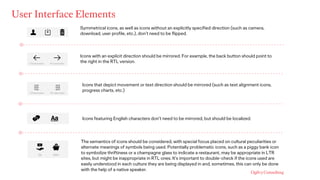

- 77. User Interface Elements Symmetrical icons, as well as icons without an explicitly specified direction (such as camera, download, user profile, etc.), don’t need to be flipped. Icons with an explicit direction should be mirrored. For example, the back button should point to the right in the RTL version. Icons that depict movement or text direction should be mirrored (such as text alignment icons, progress charts, etc.) Icons featuring English characters don’t need to be mirrored, but should be localized. The semantics of icons should be considered, with special focus placed on cultural peculiarities or alternate meanings of symbols being used. Potentially problematic icons, such as a piggy bank icon to symbolize thriftiness or a champagne glass to indicate a restaurant, may be appropriate in LTR sites, but might be inappropriate in RTL ones. It’s important to double-check if the icons used are easily understood in each culture they are being displayed in and, sometimes, this can only be done with the help of a native speaker.

- 78. Proof Points Top apparel retailers in the UK see 70% of traffic from outside the UK UK online retailers see about $28bn of sales from outside the UK Karen Millen increased conversion by 25% by changing the word ‘autumn’ to ‘fall’ On average, brands witness a 20% increase in conversion when campaigns and landing pages are localized And 70% increase in conversion when when a website is fully localized

- 79. key learnings

- 80. Localisation doesn’t just mean translations. Consider the entire interface Think locally and be mindful of the mental models for Arabic users One language doesn’t fit all. Arabic differs from country to country. The big players are not necessarily the benchmarks

- 81. How to win - Ways of Working & Performance (U.S. & EMEA) Creating the right operating model to launch a brand on Amazon

- 82. 82 $16.2%By 2023 online will make up & 57%Online sales accounted for of all gains in the retail market in 2019 $3.7tMarketplaces accounted for $6.5tBy 2023, online sales will reach in U.S. & Driven by changing consumer behaviour, and hastened by the outbreak of Covid-19, the eCommerce landscape in is transforming at speed $5.9t Europe $13.8%in U.S. & of sales in the U.S and $363bin Europe Europe respectively What is happening in the U.S. and Europe?

- 83. 83 Although Amazon is the dominant player with €32b in sales, there are several local prominent platforms across the continent due to the varying levels of digital maturity between countries, inconsistent logistical infrastructure, different languages and currencies. The European landscape is diverse and complex

- 84. 84 Although there are several marketplaces in the U.S., 3 retailers account for the lion share of sales. Amazon accounts for 38.7% of sales, which dwarfs its competitors Walmart 5.3%. eBay 4.7% and Target 1.2%. The U.S. landscape is dominated by few players

- 85. 85 Despite a varied marketplace landscape, to perform and maximise sales and grow your brand, the principles are the same Be Available 24/7 Be Discoverable Be Customer Focused

- 86. 86 Optimisation Sales Activation Content Operations Strategy Integrated Reporting Shopping Behaviours Content Optimisation Performance Media Social Commerce Product Assets Ratings & Reviews Brand & Product Pages Retail Basics Channel Control Logistics & Supply Chain Business Case & Forecasting Go-To-Market Strategy Portfolio Strategy *WPP ACE Marketplace Framework Think Create Realise To this end, we developed a cross-platform customer-centric marketplace framework to maximise success

- 87. 87 eCommerce Performance Team OperationsOptimisation Strategy Sales Activation Content Key Ogilvy Expertise WPP ACE expertise Ogilvy & Ogilvy Social Lab expertise And an agile growth focused operating model that leverages resources across the Ogilvy and WPP network to bring it to life

- 88. How we helped a FMCG brand launch on Amazon in the U.K

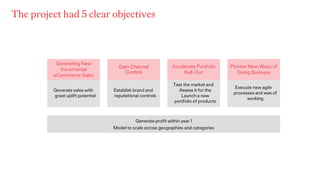

- 89. Generating New Incremental eCommerce Sales Generate sales with great uplift potential Gain Channel Control Establish brand and reputational controls Accelerate Portfolio Roll-Out Test the market and Assess it for the Launch a new portfolio of products Pioneer New Ways of Doing Business Execute new agile processes and was of working Generate profit within year 1 Model to scale across geographies and categories The project had 5 clear objectives

- 90. Logistics, Supply Chain Business Case & Forecasting Product Portfolio Strategy Product Assets & Brand Pages Realtime Measurement Dashboard & Reporting Test Plan & Measurement Plan CREATE REALISETHINK Go-To-Market & Communication Strategy Which we mapped against our marketplace framework and defined the key deliverables Channel Control Shopping Behaviour & Content Optimisation Operating Model

- 91. 91 eCommerce “War Room” OperationsOptimisation Strategy Sales Activation Content Key Ogilvy expertise Client expertise Social Lab & GroupM expertise We implemented a cross-functional team to maximise performance and drive efficiencies

- 92. +1,200% sales increase in 6 months +135% MoM from launch 3x higher performance than eRetailers 250% ROAS The results were unequivocal and confirmed that not selling on Amazon is not an option This pilot was subsequently launched on the Lazada platform to test its viability in the Asia market.

- 93. key learnings

- 94. Understanding the Amazon environment and gaining control of the channel is critical Analyse customer and sales data to optimise your product offering Have a small, committed and empowered team to act fast Have a simple and phased Go-To-Market strategy. Start small and scale Do not underestimate your competitors no matter how small. Amazon allows everyone to perform even on small budgets Sales do not just happen because you are on Amazon. Paid media is critical in and out of the platform

- 95. How Ogilvy Can Help

- 97. Our Commerce Offering Ed Kim Global Managing Partner Ogilvy Consulting Pierre Kremer Consulting Director Ogilvy Consulting Global & U.S. UK & EMEA LATAM ASIA MENA Hazem El Zayat Chief Digital Officer, Ogilvy MENA Alessandra Dal Bianco Managing Director, Brazil Ogilvy Consulting Sheilen Rathod President, CE&C Ogilvy Asia

- 98. Questions?

- 99. Thank you.