Hra

- 1. HUMAN RESOURCE ACCOUNTING

- 2. • Human resource accounting is the process of identifying and measuring data about human resources and communicating this information to interested parties. - by AAA’s commitee....

- 3. Outputs Services provided by individual and groups.

- 4. OBJECTIVES • To overcome one of the major drawbacks of traditional financial accounting system • Helpful in making management decisions. • Helps to management to monitor efficiency. • Effective management of human resources. • Greater accountability for human resources. • Better human resource planning.

- 5. ADVANTAGES • HRA will give the cost of developing human resource s in the business. • The investment on development of human resource can be compared with the benefits and results derived. • Helps management in planning and executing personnel policies. • Helps in improving the efficiency of employees.

- 6. PROBLEMS ENCOUNTERED IN ACCOUNTING FOR HR • HOW TO FIND VALUE OF HUMAN RESOURCES? • METHODOLOGY FOR RECORDING?

- 7. Models for accounting for human resources HUMAN RESOURCE ACCOUNTING H.R. COST H.R. VALUE ACCOUNTING ACCOUNTING 1. Hermanson’s 1. Historical cost model method 2. Lev-schwartz’s 2. Replacement cost model method 3. Flamholtz’s model 3. Opportunity cost 4. Ogan’s model method 5. Jaggi and lau’s model

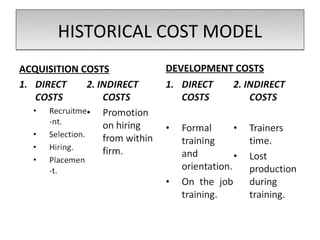

- 8. HISTORICAL COST METHOD • This approach was developed by BRUMMET, FLAMHOLTZ and PYLE. • The cost incurred on ACQUIRING and DEVELOPING the human resources of an enterprise are CAPITALISED and written off over the expected useful life of human resources. • ACQUISITION COST of human resources include recruitment and selection cost incurred on human resources. • DEVELOPMENT COST of human resource include cost of orientation, expenses incurred for off the job training and expenses incurred for on the job training, any amount spent for increase in efficiency of human resource.

- 9. HISTORICAL COST MODEL ACQUISITION COSTS DEVELOPMENT COSTS

- 10. Merits • Simple to understand and easy to develop • Can provide a basis for evaluation of companies ROI in human resources. • This method also helps in control of personnel costs

- 11. Demerits • It takes into account only acquisition and development costs but ignore the value of their potential services • It is very difficult to determine the number of years over which capital expenditure on human resource is to be amortised • It is also difficult to determine the rate of amortisation • It has been found that economic value of human resource increases with passage of time.

- 12. Replacement cost model • It is based on the replacement cost of human resource which is defined as the sacrifice would have to be incurred today to replace human resources presently employed. • Flamholtz emphasised on positional replacement cost, which refers to the sacrifice that has to be incurred to replace a person with substitute of same calibre, capable of providing same set of services.

- 13. Positional replacement costs ACQUISITION DEVELOPMENT SEPARATION COSTS COSTS COSTS DIRECT INDIRECT DIRECT INDIRECT DIRECT INDIRECT COSTS COSTS COSTS COSTS COSTS COSTS • •COST OF •ON THE VACANT COST OF JOB POSITION RECRUITM PROMOTI- TRAINING DURING -ENT , ON COST OF SEPARAT •FORMAL SEARCH SELECTION OR TRAINER I-ON TRAINING •LOSS OF PLACING TRANSFER TIME PAY AND EFFICIENCY HIRING FROM ORIENTATI- PRIOR TO WITHIN ON SEPARATIO N

- 14. Merits • Replacement cost model is the best value measure. • It is present oriented than future oriented. • This model is a form of economic value of individual’s services reflected by amount that organisation would have to pay to replace.

- 15. Demerits • Replacement cost is irrelevant in some situations. • This model is based on estimates only. • This method does not reflect loyalties and calibres of individuals.

- 16. Opportunity cost model • This model was developed by HEKIMIAN and JONES. • This model is based on the fact that every human asset has value only when it is scarce. • The investment manager will bid for the scarce employees, they need to recruit. • The investment centre with the highest bid would win the human resource and include the price in its investment base. This model is also known as competitive bidding.

- 17. Merits • Suitable for scarce employees only • All managers will be encouraged to bid • Concept of opportunity cost is applied by establishing an internal labour market within an organisation through the process of competitive bidding.

- 18. Demerits • This model is subjective. • It does not show the true cost of human resource. • The inclusion of scarce employees in the asset base may be interpreted as discriminatory by other employees. • It may lower down the morale of employees. • Quantification of future economic benefit is difficult.

- 19. HUMAN RESORCE VALUE ACCOUNTING • Human resource value is present worth of human’s expected future services. • Human resource value accounting is accounting for valuation of human resources. • This concept is derived from the economic concept of value which has two dimensions 1.Utility, value in use. 2.Purchasing power i.e, exchange value

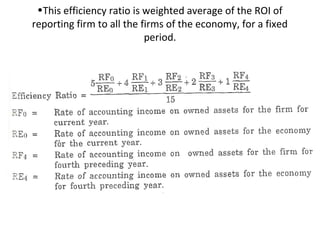

- 20. HERMANSON’S MODEL • This model is given by ROGER H HERMANSONS. • This model is based on assumption that a relationship can be established between employees salary and his value to the organisation. • In this the present value of discounted wages of future is calculated for each year for coming 5 years. • The present value is further adjusted by efficiency ratio.

- 21. •This efficiency ratio is weighted average of the ROI of reporting firm to all the firms of the economy, for a fixed period.

- 22. Steps involved in the process of valuation. 1. Estimation is to be done about annual salaries and wages for the next 5 years. 2. Discount factor is to be applied to the annual wages. 3. Present value of wages and salaries is calculated by multiplying wages with discount factor. 4. Calculate efficiency ratio with the formula. 5. Present value of wages and salaries are multiplied with efficiency ratio.

- 23. • The estimated annual wages and salaries for next five years of nippon chemical company are Rs. 3, 4, 5, 6, 7 lacs. The ARR of the company for the current and proceeding 4years is 20, 15, 12, 12, and 10.and ARR of all the firms in the chemical industry for the corresponding period is 15, 10, 8, 6 and 5 resp. Assume the discount rate is 10%.

- 25. UNPURCHASED GOODWILL MODEL • According to hermansons, the unpurchased goodwill notion is based on the premise that “ The best available evident of the present existence of unowned resources is the fact that a given firm earned higher than normal rate of income for the most recent year”

- 26. MERITS • Uses information from published financial statements. • Based on a logical indication of the presence of human resources in an organisation. • Easy to understand and easy to make.

- 27. DEMERITS • It ignores human resource base that is required to carry out normal operations of organisation. • It uses the actual earnings of most recent year as the basis for calculating human assets which puts restriction on the scope of making very much discounts the reliability of forecasts of future earning that could be more relevant for managerial decisions.

- 28. • The average rate of return on tangible asset in a particular industry over past five years has been 12% and the firm has enjoyed 16% return on its tangible assets of Rs. 30,00,000. then calculate value of human resources of that company.

- 29. Tangible assets=30,00,000 Profit of company= 16% Profit= 30,00,000 x 16 / 100 = 4,80,000 Rate of return in industry = 12% capital base = 4,80,000 / 12% =40,00,000 Valuation of unowned assets= 40,00,000-30,00,000 Human resources=10,00,000

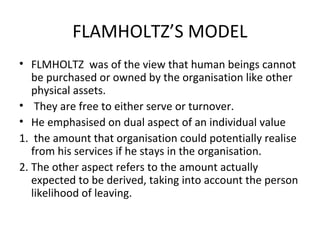

- 30. FLAMHOLTZ’S MODEL • FLMHOLTZ was of the view that human beings cannot be purchased or owned by the organisation like other physical assets. • They are free to either serve or turnover. • He emphasised on dual aspect of an individual value 1. the amount that organisation could potentially realise from his services if he stays in the organisation. 2. The other aspect refers to the amount actually expected to be derived, taking into account the person likelihood of leaving.

- 32. FORMULA

- 33. COMPENSATION MODEL • This model was developed by BARUCH LEV and SCHWARTZ . • schwartz model also known as compensation model, which determines present value of future earnings of a person in an organisation. • It recognises human resource as wealth providing source of income and relies on measurement of such wealth as present value of future earnings.

- 34. Formula

- 35. There is a group of 200 skilled workers in sant valve ltd. In the age group of 20-29 . It is estimated that every employee will earn as per earning profile as under Calculate value of 200 employees by using schwartz model by assuming discount rate 10% and age 20.

- 36. • Each employee will earn as under as per earning profile: Rs. 8,000 per year for 1st 10 years. Rs. 10,000 per year for 2nd 10 years. Rs. 12,000 per year for 3rd 10 years. Rs. 16,000 per year for 4th 10 years. Calculate the present value: 8000 x 6.145(1-10)=49,160 10000 x 2.369(11-20)=23,690 12000 x .913(21-30)=10,956 16000 x .352(31-40)=5,632

- 37. • Value of each employee=89,438 • Value of 200 employees= 200 x 89,438 =1,78,87,600

- 38. Limitations • It ignores the possibility and probability of an individual leaving an organisation for reasons other than retirement and death. • The assumptions of schwartz that human beings will not make role changes during thier tenure in the organisation seems unrealistic. • it fails to accurately evaluate the group and the team work involved. • It ignores security, bargaining capacity, skill and experience which may affect the payment of more or low salaries.

- 39. • Subjectivity is likely to be there while determining future level of salaries even about determination of discount rate. • A value of human being to the organisation is not determined entirely by person inheritent qualities, traits and skills, but also by organisation role in which individual is placed

- 40. OGANS MODEL • Ogan was of the view that there are seven major determinants which can helpful in valuation of human resources.

- 42. MERITS • This model is suitable for service organisation. • It generates data that is amenable for use in an on going manner like performance evaluation system.

- 43. DEMERITS • Total value of individual is not considered. • Model is limited for use in professional service organisation. • The model does not concern itself with the value of complement of standard work index.

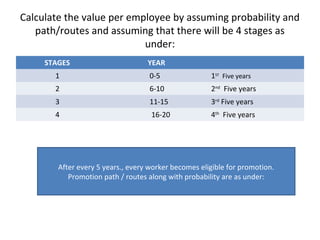

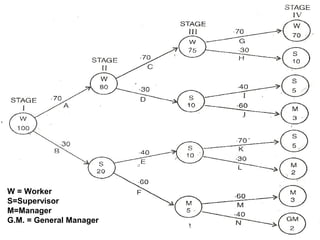

- 44. JAGGI AND LAU’S MODEL • JAGGI and LAU have proposed the model which is based on groups rather than individuals. • It is based on homogeneous groups • A markov chain representation is used. • Duration of employment is taken into consideration. • Promotion paths are taken into consideration. • Multiple probabilities of further changes are taken in to consideration.

- 45. Duration of service of a group is=20 years (250 days, @ 8 hours per day)working hours 40,000 hours/worker/a year chargeable rate per hour) For worker Rs. 10 per hour For supervisor Rs. 15 per hour For manager Rs.25 per hour For general manager Rs. 30 per hour after 20 years, current position of the group is predicted as follows: RANKS NUMBERS Workers 70 Supervisors 20 Managers 8 General managers 2

- 46. Calculate the value per employee by assuming probability and path/routes and assuming that there will be 4 stages as under: STAGES YEAR 1 0-5 1ST Five years 2 6-10 2nd Five years 3 11-15 3rd Five years 4 16-20 4th Five years After every 5 years., every worker becomes eligible for promotion. Promotion path / routes along with probability are as under:

- 47. W = Worker S=Supervisor M=Manager G.M. = General Manager

- 50. MERITS • Time saving and economical model • Model motivates the total group as a whole. • Less chances of feeling of jealously among employees. • Easily acceptable by the trade unions. • Valuation of all employees is done. • In this model only multiple probability are taken in to account for valuation purposes.

- 51. DEMERITS • Difficult to understand by illiterate working class. • All workers are given equal attention. • Predicting further is difficult task. • Subjectivity is likely to be there. • Lack of reliable data.

- 52. REASONS OF SLOW PROGRESS OF HRA IN INDIA AT MACRO LEVEL • No legal binding and backing. • Lack of initiative in private sector. • India is trend follower and not trend setter • Lack of initiation from professional institutes. • No contribution from universities • Family denominations in private sector.

- 53. AT MICRO LEVEL TO ENTREPRENEURS • Lack of computer technology. • Costs are more than the benefits. • Fear of bargaining by trade unions. TO INVESTORS • Lack of awareness among investors. • No standard model. • Difficulty in comparison.

- 54. TO WORKERS • Workers are liabilities not assets. • High labour turnover. • Illiteracy among the working class.

- 55. THANKYOU