Huge Opportunities: The CFO is Undergoing a Strategic Transformation with Inovia Capital Phoebe Kitchen, Vice President, Growth Equity @ Inovia Capital

- 1. Huge Opportunities: The CFO is Undergoing a Strategic Transformation with Inovia Capital Phoebe Kitchen Vice President Inovia Capital

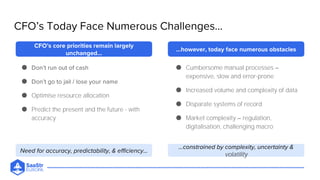

- 2. Increased operational complexity and a challenging macro environment has catalyzed How can emerging SaaS players tackle their mission-critical needs?

- 3. Optimise resource allocation Predict the present and the future - with accuracy Cumbersome manual processes expensive, slow and error-prone Increased volume and complexity of data Disparate systems of record Market complexity regulation, digitalisation, challenging macro volatility

- 4. Strategic CFOs are key organisation change- -driven rigour throughout the organisation key Strategic Partner FP&A as a key strategic asset: maximising growth opportunities, whilst maintaining cash discipline Multi-dimensional role, collaborating with stakeholders across strategy and operations, building best practices at scale Navigating Board-level priorities (resource allocation, fundraising) Control and synthesis of mission-critical data Responsibility to drive key insights and deliverables, from budgeting to establishing quantifiable objectives (North Star KPIs) Ability to unlock inefficiencies within the business today Implementing data-driven processes to maximise growth objectives (e.g. pathway to IPO)

- 5. Current tools are failing our CFOs from large MNCs New software is required to liberate strategic CFOs, demonstrating: Mission-critical need Clear ROI across the organisation Ability to increase agility and minimise complexity Strong integration into existing systems

- 6. #2 Tooling Up The Mid-Market Cash Flow = Upgrading legacy systems Treasury = Increasing access to enterprise functionality Adapting to emerging business models = Procurement, Tax, Billings #1 Liberating SMBs From Manual Processes FP&A = Excel, be gone! AR/AP = Cash is king Accounting = Digitising mission-critical functions

- 7. Key Takeaways CFOs today are constrained by numerous obstacles = increased complexity, uncertainty and volatility = driving data-driven processes and levelling up the finance function across the organisation Requiring a new generation of SaaS tools to support their needs = across both finance verticals and business size

- 8. CFOs role as an operator where are the most mission-critical painpoints today which are being neglected? Emerging areas of innovation which sub- sectors do you expect most disruption to occur (e.g. accounting, FP&A, AR/AP, treasury)? ○ What is the role of AI applications in this future? ○ What are the likely obstacles you expect these players will face?

- 9. -generation tools across all finance verticals. Will you be the one to build it?

- 10. Thank You!