Hyperion 101 fast track your financial close

- 1. Hyperion EPM 101: Fast Track Your Financial Close Presented by: Timothy J. Simkiss, CPA October 18, 2013

- 2. Agenda BIZTECH SUMMARY ? THE TYPICAL FINANCIAL CLOSE CYCLE BEST PRACTICES OF WORLD CLASS FINANCE DEPARTMENTS ORACLE HYPERION EPM TOOLS 1 2 3 4 Q & A SESSION5

- 4. PROFESSIONAL SERVICES FIRM – Professional Services firm focused on Oracle applications and technology – Oracle Platinum Partner – Highest Level of Certification – Over 400 successful Oracle implementations over the past 15 years ORACLE SOLUTIONS • Oracle Applications • Oracle Technology • Business Intelligence • Hyperion EPM • Managed Services INDUSTRIES • Financial • Professional • Business Services • Communications • Manufacturing • Distribution • Public Sector • Government • Healthcare • Life Sciences About BizTech www.biztech.com

- 5. SIMKISS – Former Corporate Controller of a Multi-million Dollar Organization – Director of Accounting/FP&A at Several Companies – 15 years of Financial & Operational Accounting Experience timsimkiss@biztech.com 267-454-3784 TIMOTHY Hyperion Practice Lead, CPA

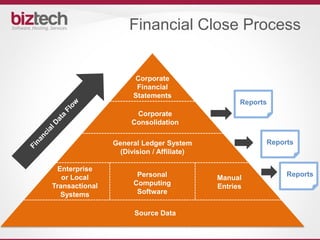

- 7. Financial Close Process Corporate Financial Statements Corporate Consolidation General Ledger System (Division / Affiliate) Manual Entries Personal Computing Software Enterprise or Local Transactional Systems Source Data Reports Reports Reports

- 8. Typical Budgeting Model Excel Templates Are Prepped Templates Instructions Are Mailed Templates Submitted to FPA Data is Consolidated, Reviewed & Audited FPA team Department Heads Department Heads FPA team Budget is submitted, reviewed & process begins again.

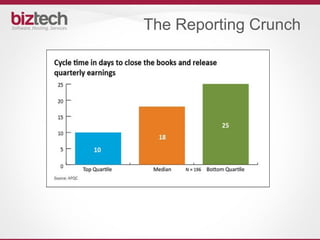

- 9. 9 1. Complicated Consolidations • Reviewing, matching, reconciling and accounting for multi-entity, multi- currency intercompany transactions 2. Stringent Regulations • GAAP (Generally Accepted Accounting Standards) • IFRS (International Financial Accounting Standards) 3. Heightened Reporting Crunch • Shrinking Deadlines • XBRL Requirements 4. Unreliable Spreadsheets • Error Prone • Labor Intensive 5. Disconnected Departments TOP FINANCIAL CLOSE ISSUES

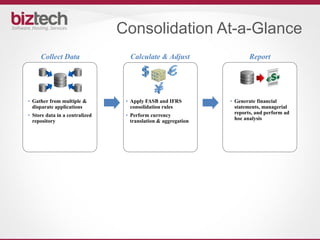

- 10. Consolidation At-a-Glance Collect Data Calculate & Adjust Report • Gather from multiple & disparate applications • Store data in a centralized repository • Generate financial statements, managerial reports, and perform ad hoc analysis • Apply FASB and IFRS consolidation rules • Perform currency translation & aggregation

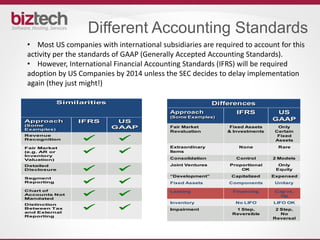

- 11. Different Accounting Standards • Most US companies with international subsidiaries are required to account for this activity per the standards of GAAP (Generally Accepted Accounting Standards). • However, International Financial Accounting Standards (IFRS) will be required adoption by US Companies by 2014 unless the SEC decides to delay implementation again (they just might!) Similarities Approach (Some Examples) IFRS US GAAP Revenue Recognition Fair Market (e.g. AR or Inventory Valuation) Detailed Disclosure Segment Reporting Chart of Accounts Not Mandated Distinction Between Tax and External Reporting Differences Approach (Some Examples) IFRS US GAAP Fair Market Revaluation Fixed Assets & Investments Only Certain Fixed Assets Extraordinary Items None Rare Consolidation Control 2 Models Joint Ventures Proportional OK Only Equity “Development” Capitalized Expensed Fixed Assets Components Unitary Leasing Financing Cap vs. Op Inventory No LIFO LIFO OK Impairment 1 Step, Reversible 2 Step, No Reversal

- 13. UNRELIABLE SPREADSHEETS z 80% STILL USE SPREADSHEETS • Error Prone • Non-Collaborative • Maintenance Intensive • Fragile, Easy to Break • Little Centralized Control • Poor Data Integrity (Audit trails) • Unmanageable consolidation • Lack of Security Issues that Arise:

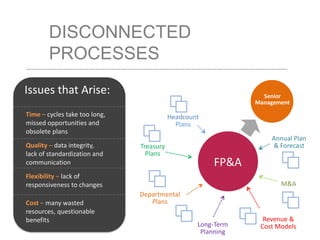

- 14. DISCONNECTED PROCESSES Time – cycles take too long, missed opportunities and obsolete plans Quality – data integrity, lack of standardization and communication Flexibility – lack of responsiveness to changes Cost – many wasted resources, questionable benefits FP&A Senior Management Annual Plan & Forecast Revenue & Cost Models M&A Departmental Plans Headcount Plans Treasury Plans Long-Term Planning Issues that Arise:

- 15. Common Financial Dept vs. World Class Depts. Processes focused on analysis & value addition Planning is a communication Company plan is owned used by all operating mgmt Continuous planning is responsive to market Mgmt is empowered & performs optimally Strategic initiatives funded separately for day-to-day business expenses World Class Depts.Common Depts. Time consumed by planning Future plans, unclear goals and mission are not aligned “Finance” owns the plan Process and cycle not linked to the business Spreadsheets and data stores are fragmented Metrics are not reflective of strategies Managers mange around plans No funding in resource plan for strategic initiatives

- 16. BEST PRACTICES OF WORLD CLASS FINANCE DEPARTMENTS

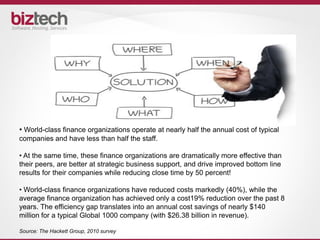

- 17. • World-class finance organizations operate at nearly half the annual cost of typical companies and have less than half the staff. • At the same time, these finance organizations are dramatically more effective than their peers, are better at strategic business support, and drive improved bottom line results for their companies while reducing close time by 50 percent! • World-class finance organizations have reduced costs markedly (40%), while the average finance organization has achieved only a cost19% reduction over the past 8 years. The efficiency gap translates into an annual cost savings of nearly $140 million for a typical Global 1000 company (with $26.38 billion in revenue). Source: The Hackett Group, 2010 survey

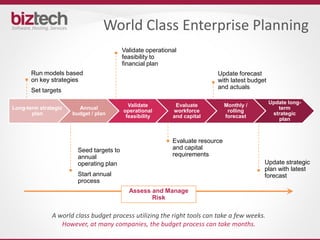

- 18. Run models based on key strategies Set targets Seed targets to annual operating plan Start annual process Update strategic plan with latest forecast Evaluate resource and capital requirements Long-term strategic plan Annual budget / plan Validate operational feasibility Evaluate workforce and capital Monthly / rolling forecast Update long- term strategic plan World Class Enterprise Planning Assess and Manage Risk Validate operational feasibility to financial plan Update forecast with latest budget and actuals A world class budget process utilizing the right tools can take a few weeks. However, at many companies, the budget process can take months.

- 19. 1. Make full use of automation and utilize key metrics to gauge performance 2. Establish deadlines and use on-line checklists 3. Delegate responsibilities where possible 4. Prepare results and ensure visibility management 5. Eliminate redundancies and paper chasing (outsourcing, shared services, third party providers) 6. Close sub-ledgers on day one (i.e. a soft close on payables, receivables and fixed assets) 7. Post recurring journal entries prior to month end (day -1) 8. Reforecast monthly and provide realistic updates 9. Encourage suggestions and improvements to existing processes 10.Document policies and procedures TOP 10 BEST PRACTICES OF WORLD CLASS FINANCE DEPARTMENTS

- 20. Sample KPI’s

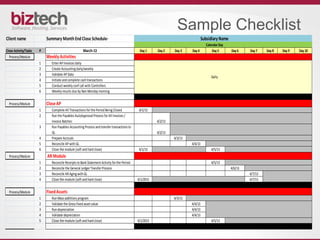

- 21. Sample Checklist Client name Summary MonthEndClose Schedule- Close Activity/Tasks # March-13 Day1 Day2 Day3 Day4 Day5 Day6 Day7 Day8 Day9 Day10 Process/Module Weekly Activities 1 EnterAP Invoices daily 2 Create Accountingdaily/weekly 3 Validate AP Data 4 Initiate and complete cash transactions 5 Conductweekly conf call with Controllers 6 Weekly results due by 9amMonday morning Process/Module Close AP 1 Complete All Transactions forthe Period BeingClosed 4/1/13 2 Run the Payables AutoApproval Process forAll Invoices / Invoice Batches 4/2/13 3 Run Payables AccountingProcess and transfertransactions to GL 4/2/13 4 Prepare Accruals 4/3/13 5 Reconcile AP with GL 4/4/13 6 Close the module (softand hard close) 4/1/13 4/5/13 Process/Module AR Module 1 Reconcile Receipts to Bank StatementActivity forthe Period 4/5/13 2 Reconcile the General LedgerTransferProcess 4/6/13 3 Reconcile ARAgingwith GL 4/7/13 4 Close the module (softand hard close) 4/1/2013 4/7/13 Process/Module FixedAssets 1 Run Mass additions program 4/3/13 2 Validate the Gross fixed assetvalue 4/4/13 3 Run depreciation 4/4/13 4 Validate depreciation 4/4/13 5 Close the module (softand hard close) 4/1/2013 4/5/13 Subsidiary Name Daily CalendarDay

- 22. Sample Workflow and Status Workflow approval process Key Metrics and Dashboards

- 23. Sample Policy

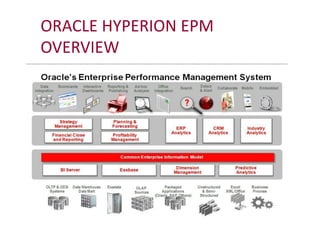

- 24. HYPERION EPM TOOLS WORLD CLASS FINANCE DEPARTMENTS & THEIR TOOLS

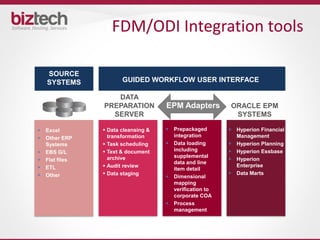

- 26. FDM/ODI Integration tools SOURCE SYSTEMS DATA PREPARATION SERVER ORACLE EPM SYSTEMS Excel Other ERP Systems EBS G/L Flat files ETL Other Data cleansing & transformation Task scheduling Text & document archive Audit review Data staging Prepackaged integration Data loading including supplemental data and line item detail Dimensional mapping verification to corporate COA Process management Hyperion Financial Management Hyperion Planning Hyperion Essbase Hyperion Enterprise Data Marts GUIDED WORKFLOW USER INTERFACE EPM Adapters

- 27. Hyperion Planning FEATURES • Strategic Planning • Forecasting and Modeling & Simulation • What-if Analysis • Excel Integration and full Enterprise Collaboration • Currency conversion feature for multi-currency applications • Streamlines and improves the Budget process • Ensures Speed & accuracy • Finance owned tool • Align finance and operations • Accountability • Visibility to past, current and future business performance BENEFITS WORLD CLASS Planning & Budgeting Applications in the World #1

- 28. Hyperion Essbase FEATURES • Essbase or "Extended Spread Sheet dataBASE“, is a 3-D Spreadsheet • Addresses scalability issues and allows deep dives into data in real time. • Defines the “by’s” and “where’s” of the company • Powers the Planning Application as well as its standing alone capabilities • One Version of the Truth • Speed-of-thought analysis for thousands of concurrent users • Scalable to enterprise-level user base • Premium Performance & Optimized Storage BENEFITS

- 29. Hyperion Financial ManagementFEATURES • Multi-Currency Capability • Multi-Dimensionality Features • Automates Intercompany Accounting • Integrates Data from most GL Systems. • Excel Integration adapts for user comfort with spreadsheets • Web interface, allowing for real time consolidation • Speed & accuracy • Finance owned tool • Align entities and divisions • Increased Visibility and Accountability • Out of the box features improve implementation time and ROI BENEFITS WORLD CLASS Financial Reporting Consolidation & Analysis Tool #1

- 30. Financial Close ManagementFEATURES • Workflow solution manage the entire close process • Easily illustrates the current status of the close • Automates checklists and Account Reconciliation process • Highlights which tasks are at risk or behind schedule Finance owned Central dashboard enables: Process monitoring Immediate action on errors Encourages continuous improvement to the close process BENEFITS

- 31. Financial Disclosure ManagementFEATURES • Automates and manages the SEC and other regulatory reporting process • Ensures data accuracy via embedded regulatory validation rules • Offers a variety of publishing formats including XBRL, iXBRL, EDGAR HTML and PDF • Allows multiple users to work together on different report sections Easy regulatory reporting with data quality assurance Deep integration with Oracle Hyperion Financial Management, Oracle Hyperion Planning, and Oracle Essbase Best in class document management BENEFITS