IBM Payments Gateway

- 2. MORE PAYMENT OPTIONS MEAN MORE COMPLETED SALES.MORE COMPLETED SALES. IBM PAYMENTS. 2

- 3. Digitally empowered customers are changing the way commerce is done and while elusive they are extremely valuable to merchants and billers Evolving customer behaviors and preferences create new consumer payments challenges and opportunities 4/5 20% 56% 17% customers dislike the checkout process because it is inefficient or inaccurate.1 of millennials would shop with a digital wallet via mobile device, even while making in-store purchases.1 of customers abandoned their shopping cart due to concerns over payments security.3 of online shoppers want to see a variety of payment options at checkout.2 1 Cognizant, Getting personal with shoppers, The Cognizant UK Shopper Study, 2013, http://www.cognizant.com/InsightsWhitepapers/Cognizant-UK-Shopper-Study-2013.pdf 2 Milo Local Shopping, NO CART LEFT BEHIND: WHY SHOPPERS AREN’T FOLLOWING THROUGH ON ONLINE PURCHASES, 2013, http://www.columnfivemedia.com/work-items/infographic-no-cart-left-behind-why-shoppers-arent-following-through-on- online-purchases 3 Statista, “Why do online shoppers leave without paying?” 2012, http://www.statista.com/statistics/232285/reasons-for-online-shopping-cart-abandonment/3

- 4. The vast majority of merchants agree that accepting a larger variety of payment types would lead to more completed sales 56% 66% 53% 57% Fewer barriers to buying for customers Reduced cart abandonment Expansion to new geographies / regions 71% 5% more 1% more 2%514% 86% 45% Slightly agree 41% Significantly agree 8% Neither agree or disagree Advantages of More Payment Options for Consumers 51% 44% geographies / regions Greater sales in existing geographies / regions 47% IT Decision Maker Business Decision Maker 2% more -3% less Other / unknown -1% less 1% 2% 4 514% more think variety leads to more sales 86% 2% Slightly disagree 1% Unknown 3% Significantly disagree Merchants Who Believe More Payment Options Leads to More Completed Sales 2016 IBM Payments Merchant Study

- 5. Keeping up with security mandates and managing multiple payment solutions impacts payment options and increases cost The Average Number of Acceptance Solutions Merchants Must Manage is 4. 45% Slightly agree 41% Significantly agree 86% 12% 18% 1%1% One 5 Merchants Who Feel Maintaining Security Compliance Prevents Them from Offering More Payment Types 2016 IBM Payments Merchant Study 2% Unknown 18% Do not agree 86% 17% 26% 86% managing 3 or more payment solutions 24% Four Two Three Five Between Six and Ten More than Ten

- 6. Most merchants indicate that the additional financial overhead prevents them from adding more payment options for customers The Average Number of Employees Managing Reconciliation and Settlement for Merchants is 21. 71% 49% Slightly 22% Significantly 21%26 – 30 employees 26%16 – 20 employees 6 Merchants Who Feel Additional Financial Overhead Prevents Them from Offering More Payment Types 2016 IBM Payments Merchant Study 71% 5% Unknown 24% Not Affected 14% 9% 8% 2% 16%6 – 10 employees 11 – 15 employees 21 – 25 employees 1 – 5 employees > 30 employees Unknown 3%

- 7. Eliminate Data Exposure and Privacy Concerns CISO VP of Fraud Prevention Director of Network Security ________________________ Reduced Reconciliation Complexity and Cost CFO Executive Director of Payments ________________________ Deployment, Growth and Certification Abstraction CTO VP of Payment Transactions Director of B2B ________________________ Superior Customer Payment Experiences CMO VP of e-Commerce Director of Channel Sales ______________________ __ IBM Payments Gateway was designed increase opportunities for sales growth and decrease resource and development costs. Increase transaction rate leverage by enabling processing through multiple banks while reducing cost through complex payments reconciliation insight and chargeback dispute analysis. Assist counter-fraud activities with complex multi-bank reconciliation and dispute insights while eliminating concerns of data at rest, regulation compliance and system exposure. ConcernsCost Leverage the SaaS cloud architecture to alleviate time-to-market, scalability and security concerns by offloading the burden of PCI-compliance, data security and regulation maintenance to IBM. Abstraction Experiences Offer customers frictionless and secure payment options across devices and channels, reducing checkout abandonment and improving the entire shopping experience with over 170 payment methods in over 70 countries to help your business grow globally. Better payments. Better experiences. 7

- 8. STREAMLINED RECONCILIATION AND LEAST-COST-ROUTINGAND LEAST-COST-ROUTING MEANS BETTER MARGINS. IBM PAYMENTS. 8

- 9. A complete solution for online consumer payment acceptance More payment options means less cart abandonment and increased sales. More pre-integrated connections means faster time to market. Accept Connect Stronger security and deeper fraud analysis means more trusted relationships. Streamlined reconciliation and least-cost-routing means better margins. ManageSecure 9

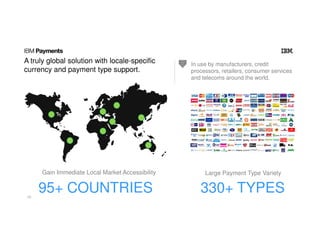

- 10. A truly global solution with locale-specific currency and payment type support. In use by manufacturers, credit processors, retailers, consumer services and telecoms around the world. 10 330+ TYPES Large Payment Type VarietyGain Immediate Local Market Accessibility 95+ COUNTRIES

- 11. Tested and benchmarked to provide exceptional performance when our clients need it most. Deployed on one of the world’s top 3 cloud platforms according to analysts and researchers.1 BENCHMARKED BEYOND 6,000 99.9992% 11 BEYOND 6,000 PAYMENTS PER SECOND 1 Synergy, IBM, Amazon and Salesforce Lead in Cloud Infrastructure, 2014, https://www.srgresearch.com/articles/amazon-salesforce-and-ibm-lead-cloud-infrastructure-service-segments 99.9992% UPTIME Past 24 months

- 12. A consumer payment acceptance solution for retailers, merchants, and billers Pre-integrated to hundreds of banks and processors, IBM automates payment routing and secures Payer (Consumer) Transaction Acquirer Payee (Merchant) Issuer Processor Instrument Issuer Network Acquirer Processor routing and secures credentials across digital channels. 12 Acceptance Technologies: Payments Management: Integrate through APIs to pre-integrated payment methods, banks and processors around the globe. A cloud-based payment management solution with one view of payments and reconciliation across channels.

- 13. Acquirers/Issuers Processors and Third Party Providers IBM Payments Gateway Integration APIs / HPP PCI Data Vault Tokenizer in-app online in-store Customer Channels Merchant web sites mobile sites call centers IVR mobile apps agent cash ops point of sale order mgmt { JSON } javascriptobjectnotation Digital Wallet E-Cash Virtual Terminal / Admin 330+ traditional and alternative payment types Customer Choice IBM Payments Gateway solution capabilities overview funds settlement billing logistics credit mgmt loyalty ledger AR treasury iOS android Automated Payment Reconcliation Payment Switch Counter Fraud funds withdrawal fulfillment 255+ pre-integrated banks and processors Instant Access 13

- 14. IBM Payments Gateway provides additional advanced integration capabilities Multiple Web, API and App Integration Options • APIs – Provide full control of payment GUI and user experience, a RESTFul (JSON) HATEOAS interface. Ready for web 2.0 and HTML5 with PCI-DSS insulation and a full suite of transactions, for all payment methods. Can be extended with full Android and iOS source code libraries. • Hosted Payment Page - Embeds “payment page” into merchants { JSON } XML 14 • Hosted Payment Page - Embeds “payment page” into merchants commerce site to receive and store payment info (e.g. credit card #) within a PCI compliant vault requiring no additional development. Comprehensive Payments Insight and Control • Technical Issues • Entry point: 2nd Level Support Desk • Escalation: Support Desk Manager / Duty Manager • Business Related Issues • Entry point: IPG Account Manager • Escalation: IPG Operations Team Lead / PS Operations Manager { JSON }javascript object notation iOS android

- 15. Highly secure data vault in the cloud and tokenized communication means no longer having to manage customer credit data and security headaches in house PCI Data Vault with Tokenization IBM Payments Gateway stores all payment information in a PCI vault where the information is encrypted, protected by strict access controls, and purged when no longer needed. The vault includes a tokenization mechanism that works in all interface modules, tools, feeds and reports. This enables centralization and outsourcing the storage of all payment information to the 15 and outsourcing the storage of all payment information to the data vault. Counter Fraud Prevention • Address Verification Service (AVS) check • Card Verification Code (CVC) check • Card issuer and country check • 3D secure cardholder authentication • Dynamic security checks

- 16. IBM Payments Gateway provides complete reconciliation and insight into all payments activity Straight-Through Processing Data feeds designed to lower manual workload and achieve straight-through processing of payments. • Automated closing and (re-)opening of accounts receivable (A/R) records • Automated posting of bank and processor fees 16 • Automated posting of bank and processor fees • Automated cash application and deposit forecasting Lower Settlement Costs Automated reconciliation of funds settlement combined with a managed service, which handles exceptions and ensures proper settlement on every transaction. • Controls over lost settlements, fees and downgrades, settlement timeliness, and foreign exchange • Managed service to reduce operating costs

- 17. THE COMFORT OF EXPERIENCE AND PROVEN RESULTS.AND PROVEN RESULTS. IBM PAYMENTS. 17

- 18. 600k IBM Payments Gateway A multi-national toy and board game company located in North America was deploying a new online storefront solution for B2B Better retailing made with IBM expected purchase transactions per year direct to the consumer via the online channel subsidiary companies leveraging the same cloud-based payment system at checkout America was deploying a new online storefront solution for B2B and B2C sales. The company selected IBM Payments Gateway to accept multiple credit/debit card, ACH and digital wallet payment types along with a card-on-file solution to streamline subsequent customer checkout experiences. 12 18

- 19. 35 IBM Payments Gateway A large North American telecom provider was facing a cost- prohibitive upgrade to its payments system to meet new Better telecommunications made with IBM internal systems aggregated to provide omni- channel support for payments level of PCI compliance enabled via the cloud without any capital costs and delays in time to market prohibitive upgrade to its payments system to meet new regulatory requirements. They also wanted to reduce customer friction when making payments. The cloud-based IPG provided a PCI compliant solution and card-on-file services to meet all mandates and increase customer satisfaction. 1 19

- 20. 250k IBM Payments Gateway A European transportation agency needed an easier and simpler way to let their residents pay for peak traffic driving and express Better cities made with IBM vehicles/owners in use that have accounts and need payments management movements are tracked daily and corresponding payments must be processed when peak charges are assessed way to let their residents pay for peak traffic driving and express lane surcharges which must be paid within 24 hrs of occurance. The IPG solution expanded payment options to auto billing, credit/debit card, IVR and SMS. The solution also simplified and reduced fee collection costs as well. 450k 20

- 21. 430 IBM Payments Gateway A large European payments processor needed to develop a strategy to compete in the digital wallet space against Better financial services made with IBM million debit, credit pre-paid and commercial cards issued in processors’ regional footprint. banks and member cooperatives that now have access to deliver a digital wallet solution to their customers through the new service strategy to compete in the digital wallet space against competition like PayPal and Google Wallet for online, mobile and NFC sales. The IPG solution was deployed to cardholders and provides wallet services, payments gateway, merchant on- boarding and hosted payment/checkout pages. 3700+ 21

- 22. IBM is dedicated to your success, in your industry Unparalleled Industry Expertise Extensive Industry Support Community Significant Technical Investment • Accelerate solution design and thorough business process expertise • Reduce project risk with reusable implementation patterns and support for industry standards • Extensive support, research and domain leadership across more than 40 industries and sectors • IBM partners with the top retailers, merchants and billers in the world to invest in innovative design, functionality, and integration • Dedicated resources within Global Business Services with an average of more than 10 years of experience • Services organization closely aligned with software products to effectively translate technology into business outcomes • Over $3 billion invested in the last 3 years in Commerce to create a truly smarter approach to commerce • Integrated products for easier implementation and increased speed to value • Synchronized product roadmaps across software portfolio 22