India now the largest mobile advertising market in Asia Pacific

- 1. A GLOBAL VIEW OF MOBILE ADVERTISING: OCTOBER 2010 REPORT - INDIA MARKET SECOND RELEASE: INMOBI NETWORK DATA Release Date: 6 January, 2011 The World’s Largest Independent Mobile Ad Network To download the full report, visit us at www.InMobi.com/research www.inmobi.com research@inmobi.com

- 2. NET WORK DATA Network Data: Specifications and Representation Specifications Data in this report are sourced from our global mobile advertising network which served 24.1 billion impressions in October 2010. With 102 countries receiving over 10 million impressions in October 2010, we are able to claim one of the broadest and most representative networks in the world. Exact specifications are as follows: • Global Available Impressions in July 2010: 20.3 Billion • Global Available Impressions in October 2010: 24.1 Billion • Regions Represented: Africa, Asia Pacific, Europe, Middle East, North America, and South America • Countries Represented: 102 countries with over 10 million impressions in October 2010 • Base Measure: Available Impressions • Reports: Market Summary, Manufacturer Share, OS Share, and Top Handsets & Connected Devices • Time Periods: October 2010 with change versus July 2010 Representation InMobi is committed to an independent and transparent leadership position in mobile advertising. With that in mind, the following issues are present in this data. Mobile Advertising Market Definition: This report covers mobile display advertising only including both WAP and APP. SMS/Text and Search are NOT included in this synopsis. Scale and Time In Market: Representation within the network is a function of the both scale and time in market. Readers can expect more fluctation and variance in younger, smaller markets for the company. Publisher Mix: As with any ad network, market representation is a function of the publisher mix. We have over 5,000 publishers of all sizes and content types, but changes to the publisher mix in a given market could impact the data. Advertiser Mix: Similar to publisher mix, the advertiser mix could impact the numbers in our network, although to a much lesser extent than publishers. www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, October 2010

- 4. INDIA India OS Share: October 2010 Regional Global Operating System Available Impressions % Share Pt Chg Development Development Available Impressions Index Index Nokia OS 2,221,208,125 38.1% +0.3 156 200 Symbian OS 1,552,571,804 26.6% +0.2 158 166 Android 12,245,888 0.2% +0.2 12 4 Nokia OS iPhone OS 10,338,277 0.2% +0.1 3 2 Windows Mobile OS 10,087,354 0.2% -0.2 42 32 34.7% Symbian OS 38.1% Others 2,020,438,377 34.7% -0.7 n/a n/a Android iPhone OS Windows Mobile OS .2% .2% Others .2% 26.6% OS shares stayed relatively consistent in the market over the past 90 days. Growth of Android and iPhone has yet to occur, as it does in other Asia markets. Nokia OS remains the top OS with 38.1% of impressions. iPhone OS and Android combine for 22.6 million monthly impressions, about 0.4% share. www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, October 2010

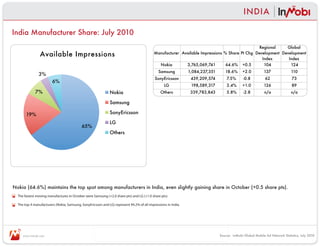

- 5. INDIA India Manufacturer Share: July 2010 Regional Global Available Impressions Manufacturer Available Impressions % Share Pt Chg Development Development Index Index Nokia 3,765,069,741 64.6% +0.5 104 124 Samsung 1,084,237,351 18.6% +2.0 137 110 3% SonyEricsson 439,209,574 7.5% -0.8 62 73 6% LG 198,589,317 3.4% +1.0 126 89 7% Nokia Others 339,783,843 5.8% -2.8 n/a n/a Samsung 19% SonyEricsson LG 65% Others Nokia (64.6%) maintains the top spot among manufacturers in India, even slightly gaining share in October (+0.5 share pts). The fastest moving manufactures in October were Samsung (+2.0 share pts) and LG (+1.0 share pts). The top 4 manufacturers (Nokia, Samsung, SonyEricsson and LG) represent 94.2% of all impressions in India. www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, July 2010

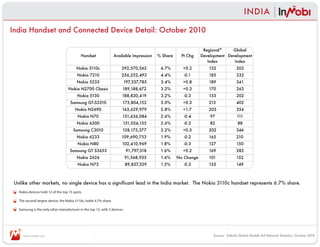

- 6. INDIA India Handset and Connected Device Detail: October 2010 Regional* Global Handset Available Impression % Share Pt Chg Development Development Index Index Nokia 3110c 392,570,562 6.7% +0.2 132 202 Nokia 7210 256,252,493 4.4% -0.1 185 332 Nokia 5233 197,337,785 3.4% +0.8 189 341 Nokia N2700 Classic 189,188,672 3.2% +0.3 170 263 Nokia 5130 188,830,419 3.2% -0.3 153 202 Samsung GT-S3310 173,804,152 3.0% +0.3 213 402 Nokia N2690 163,629,979 2.8% +1.7 203 356 Nokia N70 151,636,084 2.6% -0.4 97 111 Nokia 6300 151,026,155 2.6% -0.2 82 88 Samsung C3010 128,175,377 2.2% +0.5 202 346 Nokia 6233 109,690,753 1.9% -0.2 165 210 Nokia N80 102,410,969 1.8% -0.3 127 150 Samsung GT S3653 91,797,318 1.6% +0.2 169 282 Nokia 2626 91,568,935 1.6% No Change 101 152 Nokia N73 89,837,329 1.5% -0.3 135 149 Unlike other markets, no single device has a significant lead in the India market. The Nokia 3110c handset represents 6.7% share. Nokia devices hold 12 of the top 15 spots. The second largest device, the Nokia 3110c, holds 4.7% share. Samsung is the only other manufacturer in the top 15, with 3 devices. www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, October 2010

- 7. INDIA India Market Summary: October 2010 Available Impression Volume & Composition Top 3 OS Systems: % Share Available Impressions Regional Global Regional Global Type July October % Chg Development Development July October Pt. Chg Development Development Index Index Index Index Total 4,780,660,996 5,826,889,826 22% n/a n/a Nokia OS 37.8% 38.1% +0.3 156 200 Smartphone 715,797,059 721,542,695 1% 69 45 Symbian OS 26.4% 26.6% +0.2 158 166 Advanced 4,064,863,937 5,105,347,131 26% 107 120 Android 0.0% 0.2% +0.2 12 4 Top 4 Manufacturers: % Share Available Impressions Top 10 Handsets: % Share Available Impressions Regional Global Regional Global July October Pt. Chg Development Development July October Pt. Chg Development Development Index Index Index Index Nokia 64.1% 64.6% +0.5 104 124 Nokia 3110c 6.5% 6.7% +0.2 132 202 Samsung 16.6% 18.6% +2.0 137 110 Nokia 7210 4.5% 4.4% -0.1 185 332 SonyEricsson 8.3% 7.5% -0.8 62 73 Nokia 5233 2.6% 3.4% +0.8 189 341 LG 2.4% 3.4% +1.0 126 89 Nokia N2700 Classic 2.9% 3.2% +0.3 170 263 Others 8.6% 5.8% -2.8 n/a n/a Nokia 5130 3.5% 3.2% -0.3 153 202 Samsung GT-S3310 2.7% 3.0% +0.3 213 402 Nokia N2690 1.1% 2.8% +1.7 203 356 Nokia N70 3.0% 2.6% -0.4 97 111 Nokia 6300 2.8% 2.6% -0.2 82 88 Samsung C3010 1.7% 2.2% +0.5 202 346 Available impressions increased 22%, just over 1 billion impressions in the past 90 days. Nokia still commands the majority of impressions in India with nearly 2 out of every 3 impressions (64.6%). Android and iPhone OS have yet to gain signi cant ground in India. Device availability and pricing will hinder signi cant growth in the near term. OS shares stayed consistent in the region over the past 90 days, with advanced phones dominating the market. www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, October 2010

- 8. NEXT STEPS These data are the second of a series of network reports that are released quarterly. Additional regions and markets will be released throughout the quarter. Release Schedule Network data will be released at least once per quarter with the potential to increase frequency. The next planned release is January 2011 data around February 28th, 2011. Open Source Research: Getting Involved Objective industry analysts and thought-leaders are encouraged to comment, question, and participate. We will be sure to consider and update the research based on feedback and questions to improve the quality for all end users. To participate, contact us at Research@inMobi.com. To download the full reports, visit us at www.InMobi.com/research www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, October 2010

- 9. MEASURES AND TERM DEFINITIONS InMobi Global Research: Measures and Term Definitions Measures: Available Impressions: The total number of ad requests made to the InMobi network. Note this is the base measure for all analysis in this report given its representation of mobile advertising activity. % Share (of Available Impressions): The % of total available impressions in the specified region allocated to the inventory type, device, manufacturer, or OS under analysis. Global Development Index: An index of the % share of the inventory type, device, manufacturer, or OS under analysis in the specified region or country relative to that same inventory type, device, manufacturer, or OS share globally. (For example, iPhone OS Share in Europe is 22.9% while globally its 8.2%. Indexing 22.9% to 8.2% gives us our EU Global Development Index of 279.) Regional Development Index: An index of the % share of the inventory type, device, manufacturer, or OS under analysis in the specified country relative to that same inventory type, device, manufacturer, or OS share in the relevant region. % Chg: The percentage change in absolute value between two different time periods. Pt Chg: The difference between two share percentages for an inventory type, device, manufacturer, or OS under analysis in different time periods. Definitions: Smartphone: Any phone with an iPhone OS, Android OS, RIM OS, webOS, Windows Mobile OS, Linux Smartphone OS, Palm OS, Nokia N & E Series Phones, or Samsung Bada. Advanced: Any phone with an OS or handset NOT included in the smart phone definition above. Note that feature phones are not capable of receiving mobile display ads and WAP (Wireless Application Protocol): Any impression served using Wireless Application Protocol (WAP) which is an open international standard for application-layer network communications in a wireless-communication environment. App (Application): Any impressions served to a Mobile application resident on the consumer mobile device. OS (Operating System): The system software (programs and data) running on the mobile devices that manages the hardware and provides common services for execution of various application software receiving the impression. Handsets and Connected Device: The make and model of the mobile device receiving the impression. Manufacturer: The manufacturer of the mobile device receiving the impression. Other: An aggregation of any remaining impressions not specifically detailed previously. InMobi Regional Definitions: InMobi defines all regions per Wikipedia with the following modifications: “Asia Pacific” excludes China and Japan and includes all remaining Asian countries plus the 15 Oceania countries as listed in Wikipedia. Contact Information: Readers are encouraged to contact us and/or follow us on www.Twitter.com/InMobi, Facebook by searching “InMobi” and looking for our logo, or follow our company blog at www.inMobi.com/blog. You can also hear from us directly by contacting us at Research@InMobi.com. www.inmobi.com Source: InMobi Global Mobile Ad Network Statistics, October 2010