India’s most prolific angel investors

- 1. India’s most prolific Angel Investors May 2013

- 2. Angel investors are a key part of the startup ecosystem India’s most prolific Angel Investors

- 3. They provide funds and advice to support early stage companies... India’s most prolific Angel Investors

- 4. ...that lets these companies build their initial products and assemble an early team India’s most prolific Angel Investors

- 5. Angel investors help startups get into shape for a larger round of funding India’s most prolific Angel Investors

- 6. Angel investors bear high risk as they often work with unproven ideas/products India’s most prolific Angel Investors

- 7. Angel investing is just picking up in India... India’s most prolific Angel Investors

- 8. Having said that, there are a few angels who’ve been generous when it comes to number of investments… India’s most prolific Angel Investors

- 9. We got the list for you... India’s most prolific Angel Investors

- 10. Along with the compilation of all the companies they’ve invested in… India’s most prolific Angel Investors

- 11. Read on. But remember that this is not a ranking list. It’s a compilation India’s most prolific Angel Investors

- 12. India’s most prolific Angel Investors

- 13. India’s most prolific Angel Investors Rajan Anandan is a Sri Lankan who is currently the Head of Google India. He was earlier the Managing Director of Microsoft's Sales Marketing and Services business in India before which he was the MD at Dell India. He’s probably the most prolific angel investor in India at the moment. He Invests only in tech companies (in India) with above par tech founders. He appreciates focus on ideas that meet a real need of consumers or businesses Detailed interview here 1) Rajan Anandan

- 14. India’s most prolific Angel Investors Investments: Capillary Technologies: Cloud-Based Loyalty, Mobile and Social CRM Solutions Druva: Integrated platform for endpoint backup, secure file sharing, data loss prevention and real-time analytics Webengage: SaaS based toolkit for online businesses which allows them to run on-site marketing campaigns, get customer insights and collect feedback. Reach Accountant: A software which connects the accountant and the small businesses Sapience: Software solution that delivers significant work output gains from existing teams at companies. eTechies.in: Remote dependable technical support and quality repair service providers wiziq.com: Making online teaching and learning easier Mobilewalla: Big data venture that collects all publicly available information regarding mobile apps, computes analytics and provides intelligence Peel-Works: Helps organizations increase the efficiency of their sales team StepOut: A social network which helps people meet up in the real world

- 15. India’s most prolific Angel Investors Investments: Instamojo: Simplifying online commerce by making the payment checkout process super simple Emo2: Builds hardware and software to bring inanimate surfaces to life (e.g. restaurant tables) HashCube: Makes social games on Facebook Ayojak: A 360 solution to organize an event, managing online-offline event ticket sales, payment processing, event marketing, and event logistics. MyShaadi.in: Niche services to the new-age generation to-be married couples Taxspanner: Online preparation and filing of individual Income Tax Returns (ITR) SkoolShop: eCommerce portal for school and education products Digilogues: Digital communications service provider Cherishmaternity: One stop shop for all pregnancy, maternity and infant needs abreakplease: Helps discover and book weekend getaways 24/7 Techies: Tech Support for SMBs iDubba: Improving the TV viewing experience Missmalini.com: Online portal for Bollywood, Fashion & Lifestyle.

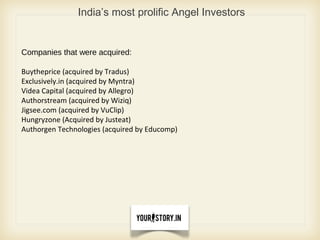

- 16. India’s most prolific Angel Investors Companies that were acquired: Buytheprice (acquired by Tradus) Exclusively.in (acquired by Myntra) Videa Capital (acquired by Allegro) Authorstream (acquired by Wiziq) Jigsee.com (acquired by VuClip) Hungryzone (Acquired by Justeat) Authorgen Technologies (acquired by Educomp)

- 17. 2) Sharad Sharma Sharad Sharma is an executive council member at NASSCOM. He has previously served as the CEO of Yahoo! India R&D and was responsible for emerging markets engineering and several key global products. He is an evangelist for developing technology product businesses in India. Sharad is sector agnostic when it comes to investing and his investment thesis keeps evolving. Has made investments in enterprise, consumer, hardware and more. Detailed interview here . India’s most prolific Angel Investors

- 18. India’s most prolific Angel Investors Investments: - Lead investor or Board Member: Druva : Data protection and backup OrangeScape : A visual platform as a service provider partners Google in Cloud platform Partner Program. Unbxd : A virtual salesperson on a e-commerce site AurusNet : Brings the high-definition video communication products and also offers the first completely cloud based HD video conferencing solution Peel-works : A company which helps keep organization an eye on their sales staff Stayzilla : Revolutionizing hotel accommodation and booking in India

- 19. India’s most prolific Angel Investors Hashcube : About 2 million users use this social gaming website TechFetch : Creating effortless job search along with instant recruitments. MobileWalla : Offers the intersection of Big Data powered Analytics & Mobility BrandSigma : Analytics for Brand Management combining marketing science with large data sets. Vayavya Labs : Electronic System Level (ESL) Design ro enhance the productivity of Embedded system designers and programmers. - Active investor: i7 Networks, TaxSpanner, Kwench, BirdsEye, Consure - Through IIF: Surewaves, Iken, Mitra biotech, Sedemac - Adviser – Eventifier, others

- 20. 3) Ravi Gururaj Ravi Gururaj is the Vice president of Cloud platform at Citrix and the co-founder of Harvard Business school alumni angels. He likes to invest in simple defendable ideas in which he believes he can add value beyond simply writing a check. He prefers seed rounds where both the product and idea are malleable. He generally stays away from offline, capex heavy and horizontal e commerce opportunities. More from Ravi Gururaj in these interviews: Here, here and here. India’s most prolific Angel Investors

- 21. India’s most prolific Angel Investors Investments: Aurus Networks Pretty Secrets : An online brand which offers lingerie, nightwear, swimwear, shape wear & accessories. Ayojak: A 360 solution to organize an event, managing online-offline event ticket sales, payment processing, event marketing, and event logistics. Tuebora* : It provides comprehensive cloud based Identity and Access Governance solutions satisfying the needs of a wide range of Organizations. GrexIT* : It helps Google Apps users to create an online repository of knowledge out of their day to day email communication. SyncUsUp : It is cross-platform mobile & web apps for iOS & Android that will truly transform and simplify Social Contact & Address Book Management. Pretty Secrets: An eCommerce portal specializing in a niche- lingerie. TookiTaki : It does semantic search on social media for any product and finds out people who are interested in it. Moojic : It gives you the power to choose the tunes that play in your favourite hangout. In the pipeline: Gridsense, Systematics, SocialNewsStand *Citrix Startup Accelerator Investments

- 22. 4) Vishal Gondal Vishal Gondal is a partner at Sweat and blood venture group. He is also the founder and CEO of Indiagames, a company he founded right out of college. He is the poster boy of the Indian games industry. He primarily invests in online companies, but is completely sector agnostic in his choices, investing in a range of sectors like travel, healthcare and product management. Read our interview with him and his blog: godinchief India’s most prolific Angel Investors

- 23. Investments: Skift: Travel Industry focused content site Babuki: Allows users to chat with Facebook, MSN, AIM, Yahoo and Gtalk friends from the web or the desktop Gama Entertainment: A developer and manufacturer of entertainment hardware & software products for the retail industry Docsuggest: Simplifying healthcare Meracareerguide: Helping students make informed career decisions Examify: A product to help students prepare for exams OnContract: Online marketplace to find people and services on contract. Indix: A product management software Instablogs: Conversational platform built around the collaborative news model India’s most prolific Angel Investors

- 24. 5) Rajesh Sawhney Rajesh Sawhney is the founder of Global Superangels Forum (GSF) and has previously worked as the president of Reliance Entertainment. He likes to invest in startups that have clearly differentiated ideas and are targeting a big market. He invests behind founders and teams that want to change the world and dream big. He has invested in healthcare, e commerce and analytics related companies. Read more about Rajesh and GSF here India’s most prolific Angel Investors

- 25. India’s most prolific Angel Investors Investments: Viki: A global TV site Mobstac: Helps create mobile websites Biosense: Healthcare startup into devices and taking technology advances in healthcare to the masses. Chhotu: eCommerce delivery solutions Autowale: 24*7 Dial-A-RickShaw Service Brandidea: Consulting and SW Applications for Business Analytics for Mass Market Brand Owners & Managers in India. Speakwell: An English training company Playcez: A location based app that recommends events and activities in the vicinity to users. Serial Innovations (exited): Serial Innovations designs, builds and deploys systems for defense and homeland security applications. DEXL: A learning solution. Rajesh is also the founder of GSF Accelerator wherein he has stakes in companies.

- 26. 6) Seeders- Abhishek Rungta and Pallav Nadhani Abhishek Rungta is the CEO and founder of Indus Net Technologies while Pallav Nadhani is the CEO and Founder of Fusion charts. Together, the duo founded Seeders which invests in early stage companies. They prefer to invest in entrepreneurs who are resilient, bootstrapped and are sharply focused. They mainly invest in tech startups. Read more on our interviews with Pallav, here and here. Find Abhishek’s blog here and an interview here. India’s most prolific Angel Investors

- 27. India’s most prolific Angel Investors Investments: Plivo: Provides scalable and feature-rich voice and messaging platform wrapped with flexible APIs iimjobs: A jobs portal iDubba: Builds products to make the TV viewing experience better Eduora: A startup in the field of education Shopo.in: An online marketplace for everything with an Indian touch Azoi: Azoi is a start-up that works on integrating natural interaction and ubiquitous computing into consumer technology products. Cropex: Produces eco-friendly, result oriented agrochemicals. CapriconGifting: A corporate gifts and promotional products companyCarSingh: An automotive classified website for the auto market in India NeoBVM: Digital marketing company iPlus Training: Training for English and government jobs

- 28. 7) Anand Ladsariya Anand Ladsariya is the CEO and promoter director of Everest Flavours Ltd., a privately owned manufacturing and exports company. Anand has made more than 40 investments in the Indian startup space. This list includes companies like: Vellvette: subscription based eCommerce company dealing with beauty products Traffline: Offers real time traffic conditions for Mumbai, Delhi and Bangalore Tookitaki: Social audience discovery and retargeting platform FrameBench: Online collaboration and communication for creative teams *Other companies haven’t been included on request. India’s most prolific Angel Investors

- 29. 8) Sunil Kalra India’s most prolific Angel Investors Sunil Karla is a member of the Indian Angel network. He is also on the Board of Governors of the University of Petroleum and Energy Studies. He invests in a wide range of startups. He prefers online startups in the service sector although he also has significant investments in the microfinance and analytics space.

- 30. India’s most prolific Angel Investors Investments: Aurality: Personal mobile radio for the textual web.Closed down. Instamojo: Simplifying online commerce by making the payment checkout process easy Jigsee: Free mobile video streaming application Hashcube:Makes social games on facebook Mobilewalla: Big data venture that collects all publicly available information regarding mobile apps, computes analytics and provides intelligence MyShaadi.in: Niche services to the new-age generation to-be married couples Unbxd : A virtual salesperson on a e-commerce site Taxspanner.com: Online income tax filing portal Kwench: Builds social intranet platforms for companies Vayavyalabs: Electronics system level designer OrangeScape : A visual platform as a service provider partners Google in Cloud platform Partner Program. Cherishmaternity: One stop shop for all pregnancy, maternity and infant needs

- 31. India’s most prolific Angel Investors Peel-Works: Helps organizations increase the efficiency of their sales team Sensibol: Builds interactive audio applications for edutainment Goonj: Channelizes unsued materials from urban households to rural areas Skoolshop: Online portal for school accessories Druva: Data protection and backup Utkarsh: Microfinance firm Consure: Healthcare startup that deals with fecal incontinence Innovise tech: Develop mobile websites and apps Acquired companies: Innoveda: Engages in the development, marketing, and provision of technical support (acquired by Mentor Graphics Corp) Buytheprice: Ecommerce portal (aquired by Tradus)

- 32. 9) Rehan Yar Khan Rehan Yar Khan is a partner in Orios Venture partners. Taking a leap into entrepreneurship in early 90’s, RYK started Flora2000.com in 2004 from the US. In 2008, he came full circle as an entrepreneur and started investing in early stage companies in India. He is also a board member on the Indian Angels network and the Harvard Angels. He has led investments in more than 15 early stage companies. Interview on investment philosophy here India’s most prolific Angel Investors

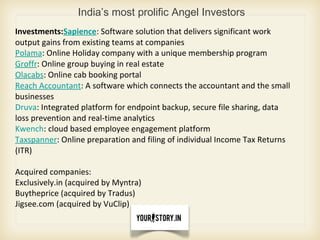

- 33. Investments:Sapience: Software solution that delivers significant work output gains from existing teams at companies Polama: Online Holiday company with a unique membership program Groffr: Online group buying in real estate Olacabs: Online cab booking portal Reach Accountant: A software which connects the accountant and the small businesses Druva: Integrated platform for endpoint backup, secure file sharing, data loss prevention and real-time analytics Kwench: cloud based employee engagement platform Taxspanner: Online preparation and filing of individual Income Tax Returns (ITR) Acquired companies: Exclusively.in (acquired by Myntra) Buytheprice (acquired by Tradus) Jigsee.com (acquired by VuClip) India’s most prolific Angel Investors

- 34. 10) Krishnan and Meena Ganesh Krishnan and Meena Ganesh are both entrepreneurs with decades of experience. After completing 100 % sale of TutorVista to Pearson in February 2013 for $ 213 mm valuation, they are promoting entrepreneurship through their platform growthstory.in . They look for passionate entrepreneurs who are consumed by their idea to create something new. In terms of space, they are looking at blue-ocean spaces, disruptive business models that can change the status quo without having to compete with existing players. They like entrepreneurs who want to solve big problems. The bigger the problem, the more value can be created. Interviews here and here. More on their blog: GrowthStory India’s most prolific Angel Investors

- 35. India’s most prolific Angel Investors Investments: Bluestone: An online jewellery shopping store BigBasket: Online grocery store MustSeeIndia: A portal about complete travel information for India Delyver: Enabling home delivery of restaurant food BookAdda: An online book store

- 36. 11) Sashi Reddi Sashi Reddi is a serial entrepreneur. His latest company, AppLabs, was a leader in software testing and was acquired by Computer Sciences Corporation (NYSE: CSC) in September 2011. He looks for companies with a strong, committed founding team where he has the ability to contribute positively using his experience and network to give a significant advantage to the company. Sashi’s comfort zone is technology, ideally straddling the India-US corridor but is open to investing in non-software companies focused on India or the US. The founding team must have a realistic horizon for building out the company, impeccable integrity, and passion for their business. He prefer firms playing into large global trends but focused on dominating a small niche within that overall market. Read our interview here and more on his site: Sri Capital. India’s most prolific Angel Investors

- 37. India’s most prolific Angel Investors Investments: Oximity: Revolutionizing the way that news is generated and consumed Healthify: Intends to provide a fun and effective way to manage your health Invntn: Has developed some cool technology that will revolutionize augmented reality. Glassbeam: Provides analytical solutions based on machine log data for some of the world’s leading technology companies. KonciergeMD: Revolutionizing the way that patients interact with their doctors. Identropy: A cloud-based identity-as-a-service company. Edutor: Designs, develops and markets innovative, technology-based educational products Thinci: Chip design company in stealth mode

- 38. India’s most prolific Angel Investors GIBSS: multi-channeled business that offers compelling operational, maintenance and energy solutions to help buildings reduce costs, reduce carbon emissions and raise productivity. Shopo: online marketplace for Indian handmade, handcrafted, and designer goods. Silicon India: largest network of Indian professionals worldwide. Sashi invests via other funds as well, more details here

- 39. Notes: This list has been compiled without any intention of ranking. And the list is not exhaustive. There are many more angel investors in the Indian startup space. In this list, the focus has been on individual angel investors. Apart from these, there are a lot of angel networks (IAN, Mumbai Angels, HBS Angels, etc.) and funds (Seedfund, Blume Ventures, India Quotient, etc.) that invest in early stage companies. A comprehensive list of investors in India can be found on our product- YS Pages. List of investors

- 40. Thank You! Read YourStory.in to stay updated with the startup space in India. Subscribe to our newsletter and find startup research reports on YS Research. Cheers!