Inflation Watch: February 2012

- 1. February 2012 Inflation Watch An Eye on Prices February 28, 2012 Next Release: March 19, 2012

- 2. Inflation Watch Inflation (price-level growth) is important for REALTORS® because it can lead to shifts in interest rate policy by the Federal Open Market Committee (FOMC). Generally, the FOMC lowers interest rates to stimulate the economy. However, rates that are too low may lead to inflation. To combat inflation, the central bank increases interest rates but this policy may dampen economic growth. For example, the FOMC has extended its commitment to keeping rates low through late 2014 to help shore up economic activity, but this commitment comes with its own set of risks.

- 3. Inflation Watch During the recent financial crisis, fears of deflation (price-level decline) were rampant. (Deflation caused a downward spiral of prices that destroyed the economy in the Great Depression.) With financial markets somewhat stable, some fear that inflation is around the corner. Stagflation, another unpleasant economic condition characterized by high unemployment and high inflation, is also a possibility. In stagflation, it is difficult for the central bank to raise interest rates to combat inflation due fear of further job market deterioration if demand is hurt by the increased interest rates.

- 4. February 2012 Highlights January price growth accelerated for many items. This caused the headline measure of consumer prices to be up 0.2 percent while producer prices were up 0.1 percent in the month. Despite weakness in recent months, prices are noticeably higher than a year ago—by 2.9 percent for consumers and 4.1 percent for producers. Core consumer prices (those excluding food and energy) are just outside the bound of the target range of 1 to 2 percent. December’s relaxation in price growth gave the Fed the ability to continue the low-rate policy to which it was committed and even extend the commitment from mid-2013 to late 2014 as noted in the January statement. Some consumer prices are advancing at a considerable rate. Necessities such as meats, food at home, transportation, and hospital services are areas of concern. The following tables summarize key figures while the graphs show increasing and decreasing prices for a few items.

- 7. PCUSLFE CPI-U: All Items Less Food and Energy % Change - Year to Year SA, 1982-84=100 CPI-U: All Items % Change - Year to Year SA, 1982-84=100 PCUSLFE.EMF (USECON) PCUSLFE / PCU 10603-11102

- 8. PCUHSHO CPI-U: Owners' Equivalent Rent/Primary Residence % Change - Year to Year SA, Dec-82=100 PCUHSHO.EMF (USECON) PCUHSHO 10103-11102

- 9. SP3000 PPI: Finished Goods % Change - Year to Year SA, 1982=100 PPI: Finished Goods less Food and Energy % Change - Year to Year SA, 1982=100 SP3000.EMF (USECON) SP3000 / SP3500 10603-11102

- 10. PZGOL Cash Price: Gold Bullion, London Commodity Price, PM Fix US$/troy Oz PZGOL.EMF (USECON) PZGOL 10603-11102

- 11. PZTEX Domestic Spot Oil Price: West Texas Intermediate % Change - Year to Year $/Barrel PZTEX.EMF (USECON) PZTEX 10103-11102

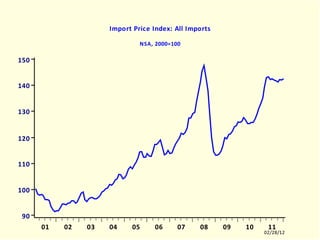

- 12. PMEA Import Price Index: All Imports NSA, 2000=100 PMEA.EMF (USECON) PMEA 10004-11103

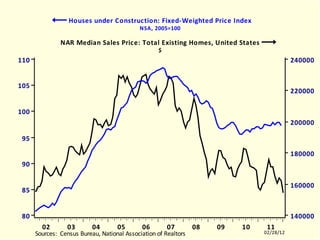

- 13. CCIHF Houses under Construction: Fixed-Weighted Price Index NSA, 2005=100 NAR Median Sales Price: Total Existing Homes, United States $ CCIHF.EMF (USECON) CCIHF / USMNBDP 10102-11101