Investor Presentation Aug-Sept 2012

- 1. Path to Production Aug-Sept 2012

- 2. Forward Looking Statements Statements made in this presentation, other than those concerning historical information, should be considered forward-looking statements which are subject to various risks and uncertainties. Such forward-looking statements are made based on management’s belief as well as assumptions made by, and information currently available to, management. The Company’s actual results may differ materially from the results anticipated in such forward-looking statements as a result of a variety of factors. Additional information concerning factors that could cause actual results to materially differ from those in such forward-looking statements is contained in the Company’s filings with the securities and regulatory authorities. Note: All currencies are in Canadian dollars unless otherwise noted 1

- 3. CORPORATE VISION Sage Gold’s short term plans are to develop production on their existing resource to generate cash flow to fund further exploration and potentially develop a leading gold mining company in a world class mining camp. CORPORATE STRUCTURE • Shares O/S: 83.3 million • Shares F/D: 116.6 million • Current price: $0.055 • 52 week high/low: $0.21/$0.045 • Market Cap: C$ 5 million • Average Strike Price of Warrants/Options: $0.34 • Proceeds from Warrants/Options: $10.5 million Exchange Symbol: TSX.V – SGX OTC – SGGDF (USA) 2

- 4. Sage Gold Advantage 1. Near Term Production – Clavos Deposit. • Sage Gold has access to SAS’s mill in the area and is able to move into production quickly and cost effectively - will generate strong cash flow for the company 2. Blue Sky Potential – Clavos Deposit Open at depth and on multiple directions along strike Management will focus on continuing to increase resources 3. Strong Strategic Partnerships Clavos Property - Sage and St Andrew Goldfields JV partners (60%-40%) Providing low cost access to mine and mill Established infrastructure with $46 million spent on underground development 4. Experienced Management Team 5. New NI43-101 Resource Estimate and PEA in Q4 2012 3

- 5. Clavos Deposit - Highlights Located in the prolific Timmins Mining camp and close geographically (20kms) to Goldcorp’s (TSX-G) high grade Hoyle Pond mine which has produced more than 2.4 M ozs since 1985 and is still in operation. Existing infrastructure in place including underground ramp access to the 300m level, underground levels developed every 25m, power to site, surface ventilation system, water management system. Prior gold resource for Clavos reported by SAS in October 2006. The resource was calculated by Roscoe Postle & Associates (RPA) and comprises 37,000 gold ozs, 143,000 tons @ 8.07 g/t Au in M&I and 110,300 gold ozs.; 529,000 tons @ 6.5 g/t Au in Inferred ( assays cut to 60g/t) Suite of Permits in place Clavos is also located 10kms from the Brigus Gold mill in Stock Township. 4

- 6. Near Term Production Plans CLAVOS DEPOSIT Timmins, Ontario Q4- 2012 New Resource Study by RPA Scoping study (PEA) Revision to Closure Plan Q1-2 2013 Dewater and Rehab. Mine Underground and Surface Drilling Project Financing Start of initial production 2014 - Commercial Production 5

- 7. CLAVOS DEPOSIT Existing Timmins Gold Projects Timmins, Ontario Clavos Property - In Good Company Advanced Projects • Lakeshore Gold → Timmins Mine now in production → Current resources of 1.87M oz Au • Goldcorp → Hollinger Open Pit Scheduled for production by 3Q’12 → Current resources 900,000 oz Au Near-Term Production Potential • Sage Gold (Clavos) • Lakeshore Gold (Bell Creek, Vogel) • St. Andrew Goldfields (Taylor) • SGX Resources (Tully) • Lexam - VG Gold - (Paymaster West) 6

- 8. CLAVOS DEPOSIT Timmins, Ontario Existing Clavos OPEN OPEN 960 Zone Sediment OPEN Zone 4.5 KM strike length 7

- 9. CLAVOS DEPOSIT Timmins, Ontario Underground Drill Core Photos A-B: Photos from hole CL252-13, 63.1- A 64.3m, illustrating stylolitic white quartz veining with visible gold from a stylolitic quartz vein system with chlorite-carbonate-pyrite altered wallrock slivers that is consistent in style with the en echelon vein arrays. Photos A and B are close-ups of stylolitic ribboned chlorite-rich bands in the system partially zone shown in B, containing multiple B grains and blebs of native gold. Note aggregates of pale grey Fe-carbonate in lower left portion of photo B. The vein system occurs adjacent to a narrow grey porphyry dyke. 594.88 gpt Au (17.35 opt) over 1.2m (uncut) 8

- 10. CLAVOS DEPOSIT Timmins Gold Camps Timmins, Ontario Clavos Mine 9

- 11. CLAVOS DEPOSIT Blue Sky Potential Timmins, Ontario Highlights : Data compilation complete consisting of 150,000m of historical surface drilling and 40,000m of historical U/G drilling - 9000m+ (SGX) drilled in 2011-2012 – 960 zone plus existing Clavos deposit 3D Geological model of all mineralized zones Internal capital expenditure estimates Open at depth and along strike Exploration upside - new alteration zone north of the 960 zone - Clavos and 960 zones untested at depth - potential to more than triple the resource 10

- 12. CLAVOS DEPOSIT Strategic Partnerships Timmins, Ontario Joint Venture Partnership completed August 2012 with St Andrew Goldfields (SAS) for the Clavos Deposit in Timmins Sage fully vested with 60% ownership in Clavos Existing infrastructure in place SAS $46 million spent for underground development Underground ramp access to the 300 metre level Existing buildings and settling ponds Revision to Closure plan New Resource estimate underway by RPA 11

- 13. CLAVOS DEPOSIT Strategic Partnerships Timmins, Ontario 2006 Resource – Mine Only Category Tonnes Uncut Grade Cut Grade Total Ounces Total M&I 143,000 10.27 8.07 (60g/t) 37,100 (cut) 47,200 (uncut) __________________________________________________________________________ Total Inferred 529,000 6.70 6.49 (60g/t) 110,300 (cut) 114,000 (uncut) __________________________________________________________________________ Note: The 2006 resources are estimated at a cut-off grade of 4 g/t Au, high gold assays are cut to 60g/t Au, minimal horizontal thickness of 1.5 metres and an average long-term gold price of US$500 per ounce was used. 12

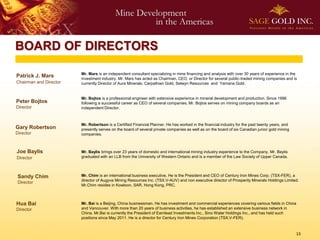

- 14. BOARD OF DIRECTORS Mr. Mars is an independent consultant specializing in mine financing and analysis with over 30 years of experience in the Patrick J. Mars investment industry. Mr. Mars has acted as Chairman, CEO, or Director for several public-traded mining companies and is Chairman and Director currently Director of Aura Minerals, Carpathian Gold, Selwyn Resources and Yamana Gold. Mr. Bojtos is a professional engineer with extensive experience in mineral development and production. Since 1996 Peter Bojtos following a successful career as CEO of several companies, Mr. Bojtos serves on mining company boards as an Director independent Director. Mr. Robertson is a Certified Financial Planner. He has worked in the financial industry for the past twenty years, and Gary Robertson presently serves on the board of several private companies as well as on the board of six Canadian junior gold mining Director companies. Joe Baylis Mr. Baylis brings over 23 years of domestic and international mining industry experience to the Company. Mr. Baylis Director graduated with an LLB from the University of Western Ontario and is a member of the Law Society of Upper Canada. Sandy Chim Mr. Chim is an international business executive. He is the President and CEO of Century Iron Mines Corp. (TSX-FER), a director of Augyva Mining Resources Inc. (TSX.V-AUV) and non executive director of Prosperity Minerals Holdings Limited. Director Mr.Chim resides in Kowloon, SAR, Hong Kong, PRC. Hua Bai Mr. Bai is a Beijing, China businessman. He has investment and commercial experiences covering various fields in China Director and Vancouver. With more than 20 years of business activities, he has established an extensive business network in China. Mr.Bai is currently the President of Earnlead Investments Inc., Sino Water Holdings Inc., and has held such positions since May 2011. He is a director for Century Iron Mines Corporation (TSX.V-FER). 13

- 15. MANAGEMENT and CONSULTANTS Management Mr. Lees is a founder and past director of TVX Gold Inc., a significant gold producer in North and South America, C. Nigel Lees which merged into Kinross Gold, listed on the TSX and the New York Stock Exchange. Mr. Lees has over 30 years President, CEO and Director experience in the Canadian investment industry and is currently a Director of several publicly traded mining companies including Yamana Gold. Mr. Love is a geologist who has been involved in mineral exploration in Canada and was part of the world class Hemlo William D. Love discovery team. He was also an institutional equity salesperson in London, England, for a Canadian brokerage firm. VP and Business Development Mr. Love has spent the last fifteen years as a venture capitalist and a corporate finance specialist in a variety of resource and technology companies. Ron Reed Mr. Reed is a CGA with an MBA ( Finance) from the NY Institute of Technology. He has more than 20 years of senior Chief Financial Officer experience in implementing financial business strategies and has been involved in more than 15 acquisition and divesture transactions. Since 2009 he has been providing CFO services in the mining sector. Michael Skutezky Secretary and Legal Counsel Mr.Skutezky was Assistant General Counsel of Royal Bank for 25 years focused on International Project financing based in Montreal and Toronto, in addition to working in Eastern Europe with Canadian Law Firms. He has recently formed his own professional corporation for the practice of law and is the principal of Rhodes Capital Corporation. Consultants Peter Hubacheck Mr. Peter Hubacheck is a consulting geologist and President of W. A. Hubacheck Consultants Ltd. He has over 35 years of experience as a project geologist, exploration manager and Qualified Person for the purposes of NI 43-101, P.Geo, QP with experience in the exploration for gold, silver, base metals, uranium and diamonds in Canada and the USA. He holds a Mining Technologist (1974) diploma from the Haileybury School of Mines and Technology, Haileybury, Ontario and a B.A.Sc. (Geol. Eng. 1977) degree from the South Dakota School of Mines and Technology, Rapid City, South Dakota. Bob Ritchie Mr. Ritchie is a Professional Engineer with over 40 years of experience in mine management and development, feasibility studies and mine construction. He has worked with several mining companies including Goldcorp, Noranda Mining Engineer Mines and St. Andrew Goldfields. He was responsible for the construction of the Stock (now Brigus Gold) Mill which is 10 kms from the Clavos mine. Mr. Ritchie is a graduate of the Michigan Technological University with a Bachelor of Science in Geology Engineering. He is also a Qualified Person (QP) as defined by NI43-101. Peter de la Plante Avrom Howard Abitibi 70 M.Sc, FGA, P.Geo 14

- 16. Why Invest in Sage Gold Compliant Resources - Established resource to fast track production Near Term Production - Milling Contract in process with the St. Andrews Mill to deliver ore Low Capex / Fast Payback Strong potential to increase tonnage through further in-fill and exploration drilling Strategic acquisitions being evaluated to augment the company's resources and production potential Ideal Market Timing - Low market capitalization 15

- 17. Sage Exploration Properties Beardmore Geraldton Gold Camp Joint Venture Potential • Properties - Onaman - Lynx Deposit, NI43-101 compliant resource Paint Lake (adjacent to Brookbank Gold Deposit) Jacobus (Cu/Ni), Clist Lake (Au) • Infrastructure in place - Road, Rail, Power • Underexplored; Potential for large gold deposits - i.e. Red Lake • Option agreement - MetalCorp (70% interest) in Solomon’s Pillars • Ongoing negotiations with potential joint venture partners. 16

- 18. Onaman LYNX DEPOSIT Beardmore, Ontario Lynx NI43-101 Open Pit Resource 485,000 tonnes 2.1 % Cu, 45.3 g Ag/T, 0.70 g Au/T at 1% Cu cut off Lynx NI43-101 Resource 1.936 million tonnes, 1.44% Cu 39.6 g Ag/T, 0.58 g Au/T Yellow = .5% Cu x 3 metres – Cut Off Red = 1% Cu x 3 metres 17

- 19. Contact Information Sage Gold Inc. Investor Cubed Inc. 365 Bay Street, Suite 500 67 Yonge St., Suite 1000 Toronto, ON M5H 2V1 Toronto, ON M5E 2J8 Tel.: 416 204-3170 Tel.: 1-888-258-3323 Fax: 416 260-2243 Fax: 416 363-7977 info@sagegoldinc.com info@investor3.ca Mike O’Brien – Neil Simon Communications Manager; Investor Relations 18