Investors' meeting 2 q08 results

- 1. 2Q08 Results August 12th , 2008 A t

- 2. Forward Looking Statement This presentation contains certain statements that are neither reported financial results or other historical information. They are forward-looking statements. Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the y y p p y statements. Many of these risks and uncertainties relate to factors that are beyond CCR’s ability to control or estimate precisely, such as future market conditions, currency fluctuations the behavior of other market participants the actions of fluctuations, participants, governmental regulators, the Company's ability to continue to obtain sufficient financing to meet its liquidity needs; and changes in the political, social and regulatory framework in which the Company operates or in economic or technological trends or conditions, inflation and consumer confidence, on a global, regional or national basis. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. CCR does not undertake any obligation to publicly release any revisions to these forward looking statements to reflect events or circumstances after the date of this presentation. 2

- 3. Agenda Highlights g g Results Outlook Social and Cultural Responsibility Policy 3

- 4. Highlights Operating • Traffic grew by 9.4% in the 2Q08, and 8.4% in the 1H08. • Net revenue reached R$ 635.3 million (+14.3%) in the second quarter, and R$ 1,255.7 million (+14.0%) in the 1H08. • Net Income totaled R$ 138.0 million in the 2Q08 (+13.3%) up on the same period last year, and R$ 305.2 million (+13.6%) in the 1H08. • 28.7% increase in AVI users in the year, compared to Jun/07, totaling 1,039,000. 1 039 000 4

- 5. Highlights Corporate • On June 02nd , 2008, Consórcio Integração Oeste signed the concession agreement and began operating the Mário Covas Ring Road – West Segment as of this date date. • On June 03rd , 2008 the Company informed its shareholders and the market 2008, that it has conclude the phases foreseen in the Investment Agreement entered into on January 29th 2008 and now hold 40% of common and p preferred shares of Renovias Concessionária S/A. • On August 11, 2008, CCR prepaymetn of dividends for the fiscal year 2008 proposed by the management approved the, in the amount of R$ 1.00 per share, totaling R$ 403.1 million, to be paid on September 30, 2008. 5

- 6. Results The results reflect a combination of factors... R$ Million Financial Highligths 2Q07 2Q08 Chg % 1H07 1H08 Chg % Net Revenue 555.7 635.3 +14.3% 1,101.6 1,255.7 +14.0% Total Cost (1) ( (313.9) ) ( (347.6) ) 10.7% ( (599.2) ) ( (654.2) ) 9.2% EBIT 241.8 287.7 +19.0% 502.4 601.5 +19.7% EBIT Margin 43.5% 45.3% +1.8 p.p. 45.6% 47.9% +2.3 p.p. Depreciation and Amortization (2) 84.3 86.7 2.9% 164.6 174.2 5.8% EBITDA 326.1 374.5 +14.9% 666.9 775.7 +16.3% EBITDA Margin 58.7% 58.9% +0.2 p.p. 60.5% 61.8% +1.3 p.p. Net Financial Result (45.1) (71.7) 59.2% (88.3) (125.2) 41.8% Income and Social Contribution Taxes (73.0) (77.0) 5.5% (139.0) (167.8) 20.7% Net Income 121.8 138.0 +13.3% 268.6 305.2 +13.6% (1) Total Costs + Administrative Expenses (2) Includes prepaid expenses ...higher traffic and reduction of operating costs. 6

- 7. Net Financial Result ido id Net Financial Result (R$ MM) 2Q07 2Q08 Chg % 1H07 1H08 Chg % Net Financial Result (45.1) (71.7) 59.2% (88.3) (125.2) 41.8% Financial Expenses: (61.0) (104.3) 70.9% (127.9) (200.5) 56.8% Exchange Rate Variation 2.5 (0.0) n.m. 4.1 (12.9) n.m. Results f R lt from H d i T Hedging Transactions ti (3.1) (3 1) (15.2) (15 2) n.m. (5.5) (5 5) (24.0) (24 0) n.m. Monetary Variation (1.5) (34.2) n.m. (6.5) (53.6) n.m. Interest on Short-term and Long-term Debt (46.4) (48.6) 4.7% (96.3) (96.8) 0.5% Other Financial Expenses (12.5) (12 5) (6.2) (6 2) -50 7% 50.7% (23.8) (23 8) (13.3) (13 3) -44 2% 44.2% Financial Income 16.0 32.5 104.0% 39.6 75.3 90.4% Results from Hedging Transactions 0.0 0.0 n.m. 0,0 13.7 n.m. Other Financial Income 16.0 32.5 104.0% 39.6 61.6 55.6% 7

- 8. Business Dynamics EBITDA (R$ million) x EBITDA Margin 411 401 377 374 341 322 323 326 310 309 299 259 263 216 218 224 67% 6 % 151 65% 62% 60% 59% 59% 59% 58% 59% 56% 57% 55% 55% 54% 55% 51% 44% 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 8

- 9. Revenues Toll Payment Method 65% 53% 50% 47% Electronic Cash 53% 50% 47% 35% 1Q05 1Q06 1Q07 1Q08 Concession Breakdown Revenues Breakdown – 2Q08 Renovias STP 1.8% Other 1.6% 3%* Outras ViaOeste 2%* 16% AutoBan ViaLagos 37% 1% Ponte 4% 96.6% Rodonorte 96,2% 11% Toll NovaDutra 9 26% * Pro-forma 2Q08

- 10. Traffic (Vehicle Equivalents - million) Quarterly Evolution 146 133 126 126 2Q05 2Q06 2Q07 2Q08 2Q07 x 2Q08 – Concession Breakdown 9.9% 9.5% 8.4% 7.6% 5.1% 2.4% AutoBAn NovaDutra Rodonorte Ponte Via Lagos ViaOeste 10

- 11. Net Revenue & Total Costs We are still delivering... 635 556 513 471 338 347 Net Revenue 314 14% 288 14% Other 12% 17% R$ (milhões) ) 14% 18% 22% 22% Payroll 17% 15% 20% 14% 15% Concession Fee 22% 28% 26% % % 61% 66% % 55% % 56% 23% 25% Third-Party Third Party 22% 28% 24% D&A 25% 25% 26% 2Q05 2Q06 2Q07 2Q08 Other: insurance, rent, marketing, travel, electronic payment and conservation and material for conservation and maintenance. Third-Party Services: auditing, consulting, shared services and routine maintenance. ... operating efficiency . 11

- 12. Indebtdness Balance sheet is ready for... Gross Debt Net Debt 2,248 1,770 1,622 98% 1,484 1,347 100% 1,123 1,160 1,103 100% ion) R$ (million) 1.12 R$ (milli 1.22 0.84 77% 0.98 2Q05 2Q06 2Q07 2Q08 2Q05 2Q06 2Q07 2Q08 Short Term Long Term In R$ Net Debt Net Debt / EBITDA ...the currrent oppotunities scenario 12

- 13. Indebtdness We are still pursuing a more... Distribution Long Term Debt Amortization BNDES 500 513 Foreign TJLP + (4.5% - 5.0%) Other 442 Currency 10% 104.5% - 107.3% CDI 2% 6% 21% 265 39% 184 37% 31% 44% 136 41% 36% 113 94 Debentures 103.3% - 105% CDI Debentures 2H08 2009 2010 2011 2012 2013 2014 2015 IGP-M 7 6% 11% IGP M + 7.6% -11% ...efficient capital structure 13

- 14. Capital Expenditures Schedule 2008 - 2009 CAPEX (R$ MM) % CCR 1Q08 2Q08 2008(E) 2009 (E) AutoBAn 100 34.3 61.3 199.1 149.8 NovaDutra 100 29.4 29 4 37.6 37 6 88.9 88 9 56.0 56 0 ViaOeste 100 13.6 9.6 103.2 4.2 Rodonorte 86 8.2 14.9 90.7 74.8 Ponte 100 3.0 3.2 4.4 3.5 Via Lagos 100 0.1 0.2 0.3 0.5 ViaQuatro 58 12.9 0.0 185.6 252.7 Renovias 40 96.8 80.2 Rodoanel 95 2.2 49.0 36.1 Other1 100 1.8 (1.7) 10.9 8.7 Consolidated 103.2 127.4 828.7 666.4 1 – Includes CCR, CCR Mexico, CCR USA, Actua, Engelog, Parques and STP. The values esteem for 2008 and 2009 in the concessionaires Rodonorte, ViaQuatro, Renovias e Rodoanel means a 100% of the projetc. 14

- 15. New Businessess • State of São Paulo Concessions • Federal Concessions • Secondary Market • PPP’s • Logistics • Mexico and USA Brazil is still the main growth driver. 15

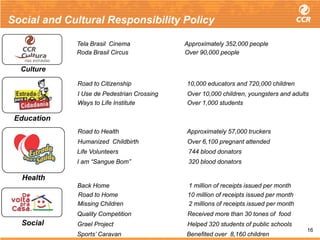

- 16. Social and Cultural Responsibility Policy Tela Brasil Cinema Approximately 352,000 people Roda Brasil Circus Over 90,000 people Culture Road to Citizenship 10,000 educators and 720,000 children I Use de Pedestrian Crossing Over 10,000 children, youngsters and adults Ways to Life Institute Over 1,000 students Education Road to Health Approximately 57,000 truckers Humanized Childbirth Over 6,100 pregnant attended Life Volunteers Lif V l t 744 bl d d blood donators t I am “Sangue Bom” 320 blood donators Health Back Home 1 million of receipts issued per month Road to Home 10 million of receipts issued per month Missing Children 2 millions of receipts issued per month Quality Competition Received more than 30 tones of food Social Grael Project Helped 320 students of public schools 16 Sports’ Caravan Benefited over 8,160 children

- 17. Investor Relations invest@grupoccr.com.br Tel: 55 (11) 3048-5955/6353