IPE-2 - Estimate of Insurance Premium Tax

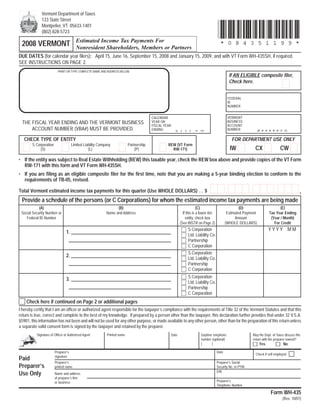

- 1. Vermont Department of Taxes 133 State Street *084351199* Montpelier, VT 05633-1401 (802) 828-5723 Estimated Income Tax Payments For 2008 VERMONT *084351199* Nonresident Shareholders, Members or Partners DUE DATES (for calendar year filers): April 15, June 16, September 15, 2008 and January 15, 2009, and with VT Form WH-435SH, if required. SEE INSTRUCTIONS ON PAGE 2. PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW If AN ELIGIBLE composite filer, Check here. FEDERAL ID NUMBER VERMONT CALENDAR BUSINESS YEAR OR THE FISCAL YEAR ENDING AND THE VERMONT BUSINESS ACCOUNT FISCAL YEAR ACCOUNT NUMBER (VBA#) MUST BE PROVIDED. NUMBER ENDING (y y y y m m) (# # # # # # X X) CHECK TYPE OF ENTITY FOR DEPARTMENT USE ONLY S Corporation Limited Liability Company Partnership REW (VT Form IW CX CW (S) (L) (P) RW-171) • If the entity was subject to Real Estate Withholding (REW) this taxable year, check the REW box above and provide copies of the VT Form RW-171 with this form and VT Form WH-435SH. • If you are filing as an eligible composite filer for the first time, note that you are making a 5-year binding election to conform to the requirements of TB-05, revised. , , , . Total Vermont estimated income tax payments for this quarter (Use WHOLE DOLLARS) . . $ Provide a schedule of the persons (or C Corporations) for whom the estimated income tax payments are being made (A) (B) (C) (D) (E) Social Security Number or Name and Address If this is a lower-tier Estimated Payment Tax Year Ending Federal ID Number entity, check box Amount (Year / Month) (See INSTR on Page 2) (WHOLE DOLLARS) For Credit YYYY MM S Corporation 1. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 2. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 3. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation Check here if continued on Page 2 or additional pages I hereby certify that I am an officer or authorized agent responsible for the taxpayer’s compliance with the requirements of Title 32 of the Vermont Statutes and that this return is true, correct and complete to the best of my knowledge. If prepared by a person other than the taxpayer, this declaration further provides that under 32 V.S.A. §5901, this information has not been and will not be used for any other purpose, or made available to any other person, other than for the preparation of this return unless a separate valid consent form is signed by the taxpayer and retained by the preparer. Signature of Officer or Authorized Agent Printed name Date Daytime telephone May the Dept. of Taxes discuss this number (optional) return with the preparer named? ( ) Yes No Date Preparer’s Check if self-employed signature Paid Preparer’s Preparer’s Social Preparer’s printed name Security No. or PTIN EIN Use Only Name and address of preparer’s firm Preparer’s or business Telephone Number Form WH-435 (Rev. 10/07)

- 2. INSTRUCTIONS • NEW: There is now an opportunity for an entity to voluntarily opt to file a composite return and to also notify the Department that the entity was subject to Real Estate Withholding (REW). See the check boxes on side one and also note the binding election associated with composite filing. • A Subchapter S Corporation, Limited Liability Company or Partnership is required to make estimated income tax payments on behalf of its non- Vermont shareholders, members or partners. If any are lower-tier entities, the minimum annual tax is $250 for each one. • For column (C), check if the payment is for a lower-tier entity. If a Subchapter S Corporation, Limited Liability Company, or Partnership, provide a separate Form WH-435 for the individuals (or C Corporations) that are ultimately to receive the credit on an individual (or corporate) income tax return. • The estimated payments are due quarterly and are calculated by multiplying the estimated payment rate (7.2% for 2007) by the income distributed or allocable to the shareholder, member or partner (taxable income reported on Federal Schedule K-1). For additional information see VT Technical Bulletin 5 (TB-05) (revised), VT Technical Bulletin 6 (TB-06), and Form WH-435SH (Safe Harbor Worksheet) at our website www.state.vt.us/tax under the headings of “Legal Interpretations” and “Forms”, respectively. • Technical Bulletin 5 (TB-05) now provides for an “administrative safe harbor” and a “catch-up payment” for estimated payments due on or after April 15, 2005. This “catch-up payment”, if required, must be paid on or before the original due date of the Vermont business income tax return for the taxable year. The “catch-up payment” is determined using VT Form WH-435SH (Safe Harbor Worksheet) and should accompany a completed VT Form WH-435 and the payment. • Certain Subchapter S Corporations, Partnerships, and Limited Liability Companies may file and remit the estimated tax payments on behalf of nonresident shareholders, partners and members annually, on January 15th, instead of quarterly. To qualify, the entity must have a single (nonresident) shareholder, partner or member and a tax liability of $250 or less in the prior year; or 2 or more shareholders, partners or members and a tax liability of $500 or less in the prior year. • Complete the information for the entity and enter the total amount of estimated payments being remitted for all Vermont nonresidents. • THIS FORM MUST STATE THE FISCAL YEAR ENDING AND THE ASSIGNED VERMONT BUSINESS ACCOUNT NUMBER (VBA#). • Use blue or black ink to fill in the form and clearly print or type the entries. Round amounts to the nearest whole dollars. Call (802) 828-5723 if you need assistance. Provide a schedule of the persons (or C Corporations) for whom the estimated income tax payments are being made (A) (B) (C) (D) (E) Social Security Number or Name and Address If this is a lower-tier Estimated Payment Tax Year Ending Federal ID Number entity, check box Amount (Year / Month) (See INSTR above) (WHOLE DOLLARS) For Credit YYYY MM S Corporation 4. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 5. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 6. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 7. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 8. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 9. __________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ S Corporation 10. _________________________________________ Ltd. Liability Co. ___________________________________________ Partnership C Corporation ___________________________________________ Check here if continued on additional pages. Attach additional pages in the same format as necessary. Form WH-435 (Rev. 10/07)