IRS Form 1099-MISC

- 1. IRS Form 1099-MISC The 1099-MISC is used to report those payments that have been made towards jobs or to workers or independent contractors for the jobs undertaken by them.

- 2. Who Needs To File A 1099-MISC? Broker and/or royalties expenditures with respect to dividends/tax-exempt interests in excess of $10 Attorney expenses paid Sales of minimum $5,000 of FMCGs to a buyer for resale anywhere but a retail concern Every contractor paid minimum $600 during the tax year is to be reported individually.

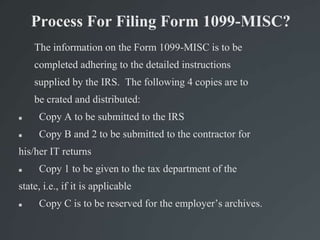

- 3. Process For Filing Form 1099-MISC? The information on the Form 1099-MISC is to be completed adhering to the detailed instructions supplied by the IRS. The following 4 copies are to be crated and distributed: Copy A to be submitted to the IRS Copy B and 2 to be submitted to the contractor for his/her IT returns Copy 1 to be given to the tax department of the state, i.e., if it is applicable Copy C is to be reserved for the employer’s archives.

- 4. Who Are Out Of Form 1099-MISC? If you are employed by a firm or a registered corporation, then you are not supposed to file the Form 1099-MISC. Entities or individuals paying for scholarship/fellowship support (student should file return).

- 5. When is Form 1099-MISC To Be Filed? January 31st– 1099-MISC Form must be sent to the recipient February 28th – The Form 1099-MISC is to be filed with the IRS physically via paper April 1st – The Form 1099-MISC is to be filed electronically with the IRS.

- 6. Process For E-Filing Form 1099-MISC? The e-filing of the 1099-MISC can be done online on the IRS website or the individual can download the e-Smart Form of the 1099-MISC on his computer and upload the data and information on the IRS website. Additionally, the process of e-filing does away with the copy A of 1099-MISC. However, the additional still need to be given and distributed to the contractors. Also, e-filing does away with the necessity to file Form 1096 with the IRS.

- 7. How To Select Correct E-Service Provider For Filing Form 1099-MISC? Should be approved by the IRS (will have the IRS logo on their website) Must be secure and safe to trust with important info(check the site’s security certificate) Have ample client assistance service – phone, email, etc. Should be affordable, reasonable and cost effective.

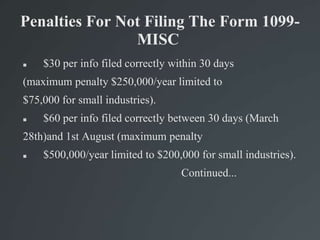

- 8. Penalties For Not Filing The Form 1099- MISC $30 per info filed correctly within 30 days (maximum penalty $250,000/year limited to $75,000 for small industries). $60 per info filed correctly between 30 days (March 28th)and 1st August (maximum penalty $500,000/year limited to $200,000 for small industries). Continued...

- 9. Penalties For Not Filing The Form 1099- MISC $100 per info filed correctly after 1st August (maximum penalty of $1,500,000/year limited to $500,000 for small industries). $250 penalty for deliberate failure to file.

- 10. About Us 1099Fire focuses solely on the information reporting industry. We develop and maintain software for year-end information compliance of 1042-S, 1097, 1098, 1099 software, 3921, 3922, 5498, 8027, 8955- SSA, W-2G, and W-2/W-3 (with corrections).

- 11. Thanks For Watching Our Presentation Over Form 1099-MISC. Feel Free To Contact Us Anytime. We Would Feel Extremely Happy To Help You! Visit us at http://www.1099fire.com