JP Morgan Energy Conference

- 1. NYSE: DVN devonenergy.com J.P.Morgan Energy Equity Conference June 26, 2017

- 2. Investor Contacts & Notices 2 Investor Relations Contacts Scott Coody, Vice President, Investor Relations (405) 552-4735 / scott.coody@dvn.com Chris Carr, Supervisor, Investor Relations (405) 228-2496 / chris.carr@dvn.com Forward-Looking Statements This presentation includes "forward-looking statements" as defined by the Securities and Exchange Commission (the “SEC”). Such statements are subject to a variety of risks and uncertainties that could cause actual results or developments to differ materially from those projected in the forward-looking statements. Please refer to the slide entitled “Forward-Looking Statements” included in this presentation for other important information regarding such statements. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Devon’s most recent earnings release at www.devonenergy.com. Cautionary Note to Investors The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC's definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. This presentation may contain certain terms, such as resource potential, risked or unrisked resource, potential locations, risked or unrisked locations, exploration target size and other similar terms. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosure in our Form 10-K, available at www.devonenergy.com. You can also obtain this form from the SEC by calling 1-800-SEC- 0330 or from the SEC’s website at www.sec.gov.

- 3. 3 Delivering top-tier execution Significant financial strength Premier asset portfolio Multi-decade growth platform Devon Energy A Leading North American E&P

- 4. Premier Asset Portfolio 4 STACK & DELAWARE 90% OTHER ASSETS 10% U.S. Rig Activity >1 MM net effective acres >20,000 potential locations 625,000 net acres by formation >10,000 potential locations Delaware Basin STACK For additional information see our Q1 operations report. STACK & Delaware focused Visible growth trajectory Organically funded growth Significant resource upside

- 5. 30,000> STACK And Delaware Basin 5 Massive Resource Opportunity DRILLING INVENTORY Multi-Decade Growth Platform POTENTIAL LOCATIONS (1/3 CURRENTLY DE-RISKED) Best emerging development plays in N.A. Industry-leading acreage positions Sustainable, long-term growth platform Appraisal work to further expand resource

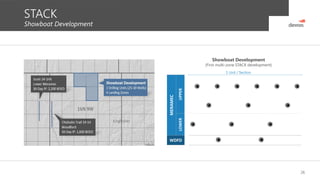

- 6. STACK Franchise Growth Asset 6 Transitioning to full-field development Peak rates at Hobson Row in Q2 Multi-zone Showboat project Q3 spud Jacobs Row Q4 spud with long laterals (1) Represents Meramec and Woodford net acreage by formation. STACK RESOURCE OVERVIEW Blaine Custer Dewey NET ACRES(1) k625RISKED LOCATIONS 5,400 Canadian Kingfisher Showboat Project 25-30 wells 2 drilling units Jacobs Row Up to 7 drilling units Hobson Row 39 wells (5-sections) IPs: 25% oil mix >10,000 UNRISKED LOCATIONS Meramec Core Woodford Core

- 7. STACK Multi-Decade Growth Platform 7 Future Drilling Unit 400 drilling units Majority operated 70% long laterals Up to 4 intervals per unit Showboat Project Canadian Kingfisher Blaine Caddo Hobson Row Jacobs Row

- 8. Delaware Basin 8 Lea New Mexico TexasRattlesnake Thistle/GauchoCotton Draw Todd Potato Basin Loving Eddy Acreage concentrated in core of play Transitioning to full-field development Accelerating Wolfcamp & Leonard activity 1st multi-zone project underway at Thistle Core Development Emerging Leonard Multi-Zone 10 wells (3 intervals) Franchise Growth Asset Wolfcamp Multi-Zone 10 wells (4 intervals) Q4 spud Fighting Okra 71H 30-Day IP: 3,000 BOED

- 9. Delaware Basin Multi-Decade Growth Platform 9Note: Graphic for illustrative purposes only and not necessarily representative across Devon’s entire acreage position. Basin Slope DELAWARE SANDS Madera Lower Brushy LEONARD A B C BONESPRING 1st 2nd (Upper & Lower) 3rd WOLFCAMP X/Y A, B, C & D Risked Location Unrisked Location 1 Section 1 Section >4,000’ OFPAY >5,800 >1 MM RISKED LOCATIONS NET EFFECTIVE ACRES

- 10. 0 10 20 30 10 Capital allocation focused on returns Ramping to ~20 operated rigs by year-end Further accelerate investment in 2018 Multi-year capital programs self-funding 2017e Billion$2.0-2.3 Rig Activity – U.S. Resource Plays Operated Rigs 12/31/16 3/31/17 12/31/17e AT MARCH 31, 2017 RIGS BY YEAR-END 2017 RIGS 15 20 AT YEAR-END 2016 RIGS10 Accelerating Capital Investment E & P C A P I T A L ~

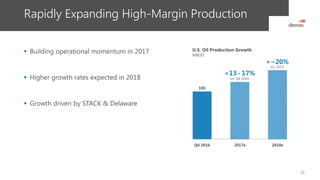

- 11. Rapidly Expanding High-Margin Production 11 Building operational momentum in 2017 Higher growth rates expected in 2018 Growth driven by STACK & Delaware U.S. Oil Production Growth MBOD Q4 2016 2017e 2018e 105 (vs. Q4 2016) +13 - 17% (vs. 2017) +~20%

- 12. Peer-Leading Cash Flow Expansion 12 Shifting to higher-value production Cost savings boost margins Delivering peer-leading cash flow expansion 42% 52% 61% 61% ~65% 2013 2014 2015 2016 Q4 2017e $4.1 $3.7 $2.8 ~$2.7 2014 2015 2016 2017e 2016 2017e $ Billions INCREASE 175% Upstream Cash Flow EnLink Distributions (1) Assumes $50 WTI and $3 Henry Hub in 2017; excludes EnLink operating cash flow. (2) 2016 excludes $150 million of cash flow associated with divestiture assets and includes $265 million of cash associated with debt repayments. $0.9(2) ~$2.5(1) Liquids % of Total Product Mix Operating Costs and G&A ($ Billions)

- 13. Financial Capacity To Execute 13 Investment-grade credit ratings No significant debt maturities until 2021 Disciplined hedging program Significant investment in EnLink Midstream INVESTMENT- GRADE credit ratings Excellent Liquidity (Cash: $2.1 billon) EnLink Investment (Market value: ~$3.5 billion) Disciplined Hedging PROTECTING OUR ABILITY TO EXECUTE

- 14. Active Portfolio Management 14 TARGETED DIVESTITURES BILLION1.0$ For additional information see our Q1 operations report. $1 billion divestiture program ― Targeting select U.S. assets ― Timing: 12-18 months Driven by depth of U.S. resource Potential for additional sales

- 15. Operating Strategy For Success 15 Maximize base production — Minimize controllable downtime — Enhance well productivity — Leverage midstream operations — Control operating costs Optimize capital program — Disciplined project execution — Perform premier technical work — Focus on development drilling — Increase capital efficiency Capture FULL VALUE Improve RETURNS

- 16. Best-In-Class Well Productivity 16 Avg. 90-Day Wellhead IPs BOED, 20:1 200 400 600 800 1,000 Top 30 U.S. Producers Source: IHS/Devon. Top operators with more than 40 wells over the trailing 12-months. DEVON WELL ACTIVITY (Since 2012) >450%I M P R O V E M E N T

- 17. Efficiencies Offsetting Industry Inflation Completely offset industry inflation YTD Significant efficiency gains in STACK & Delaware Innovative supply-chain initiatives — Unbundling historical, high-margin services — Utilizing diversified vendor universe Initial results: 10% savings at Hobson Row 17 SAVINGS AT WOODFORD HOBSON ROW 10%

- 18. Multi-Zone Manufacturing 18 Shifting to development in STACK & Delaware Benefits of multi-zone manufacturing — LOE and capital efficiencies — Simultaneous operations — Increase recoveries — Optimize surface facilities — Maintain short cycle times Technology to further enhance performance Multi-Zone Development – Full Section The Next Frontier Of Efficiency Gains

- 19. Devon’s Technology Leadership 19 Technology revolution provides massive upside Optimizing base production — 2% uplift achieved = $100 million annually Enhancing drilling & completion operations — Delivering best-in-class well productivity Cutting-edge petrophysical models — Rapidly expanding STACK & Delaware resource Targeting hundreds of millions in value creation annually

- 20. Devon Energy 20 Premier asset portfolio Multi-decade growth platform Delivering top-tier execution Significant financial strength A Leading North American E&P

- 21. Thank you. Thank you. For additional information see our Q1 Operations Report

- 22. Forward-Looking Statements 22 This presentation includes "forward-looking statements" as defined by the SEC. Such statements include those concerning strategic plans, expectations and objectives for future operations, and are often identified by use of the words “expects,” “believes,” “will,” “would,” “could,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the company expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the company. Statements regarding our business and operations are subject to all of the risks and uncertainties normally incident to the exploration for and development and production of oil and gas. These risks include, but are not limited to: the volatility of oil, gas and NGL prices; uncertainties inherent in estimating oil, gas and NGL reserves; the extent to which we are successful in acquiring and discovering additional reserves; the uncertainties, costs and risks involved in exploration and development activities; risks related to our hedging activities; counterparty credit risks; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; risks relating to our indebtedness; our ability to successfully complete mergers, acquisitions and divestitures; the extent to which insurance covers any losses we may experience; our limited control over third parties who operate our oil and gas properties; midstream capacity constraints and potential interruptions in production; competition for leases, materials, people and capital; cyberattacks targeting our systems and infrastructure; and any of the other risks and uncertainties identified in our Form 10-K and our other filings with the SEC. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. The forward-looking statements in this presentation are made as of the date of this presentation, even if subsequently made available by Devon on its website or otherwise. Devon does not undertake any obligation to update the forward-looking statements as a result of new information, future events or otherwise.

- 24. Cash-Flow Generating Assets 24 2017e >$2.0 Billion of Cash Flow Q1 production: 158 MBOED Net acres: 610,000 Q1 production: 141 MBOED BARNETT HEAVY OIL Q1 production: 83 MBOED Net acres: 65,000 EAGLE FORD ENLINK 12% EAGLE FORD 30% OTHER 3% BARNETT 20% HEAVY OIL 35%

- 25. Rockies Oil 25 Johnson Campbell Converse Weston Niobrara Natrona Premier Powder River Basin position — 470,000 net surface acres — Q1 net production: 17 MBOED (79% oil) Prolific Q1 Parkman wells 2017 drilling activity: ~20 wells Parkman Turner Teapot Powder River Focus Areas Q1 Parkman Results 4 extended-reach wells Avg. 30-Day IP: >1,800 BOED

- 26. STACK 26 Showboat Development (First multi-zone STACK development) MERAMEC UPPERLOWER WDFD Showboat Development 1 Unit / Section

- 27. STACK Window Net Acres Gross Risked Locations Meramec Oil 10,000 100 Over-Pressured Oil 120,000 1,600 Liquids-Rich >120,000 TBD Woodford Oil 25,000 200 Liquids-Rich 180,000 2,200 Dry Gas 100,000 1,300 Exploration 70,000 TBD Total 625,000 5,400 27 Resource Table

- 28. Delaware Basin 28 Leonard multi-zone development — Testing up to 19 wells per section — Initial production: 2H 2017 Wolfcamp multi-zone development — Testing up to 18 wells per section — Expected to spud in late 2017 Multi-Zone Developments

- 29. Delaware Basin 29 Formation Net Effective Acres Risked Gross Locations Unrisked Gross Locations Delaware Sands 170,000 700 2,000 Leonard Shale 160,000 950 3,100 Bone Spring 565,000 3,500 5,700 Wolfcamp 475,000 500 >9,000 Other (Yeso & Strawn) 190,000 200 200 Total >1,000,000 5,850 >20,000 Resource Table

- 30. Barnett Shale 30 Massive position in core of the Barnett — Net acres: 610,000 — Q1 net production: 158 MBOED (28% liquids) Evaluating strategic options for Johnson County area — 20% of Devon’s Barnett position Wise Parker Hood Tarrant Ft. Worth Denton Denton Johnson County Divestiture Package Johnson Evaluating Strategic Options