kellogg kellogg Q1 2008 Earnings Release

- 1. 1

- 2. Forward-Looking Statements This presentation contains, or incorporates by reference, “forward-looking statements” with projections concerning, among other things, the Company’s strategy, and the Company’s sales, earnings, margin, operating profit, costs and expenditures, interest expense, tax rate, capital expenditure, dividends, cash flow, debt reduction, share repurchases, costs, brand building, ROIC, working capital, growth, new products, innovation, cost reduction projects, and competitive pressures. Forward-looking statements include predictions of future results or activities and may contain the words “expects,” “believes,” “should,” “will,” “will deliver,” “anticipates,” “projects,” or words or phrases of similar meaning. The Company’s actual results or activities may differ materially from these predictions. The Company’s future results could also be affected by a variety of other factors, including competitive conditions and their impact; the effectiveness of pricing, advertising, and promotional spending programs; the success of productivity improvements and business transitions; the success of innovation and new product introductions; the recoverability of carrying amounts of goodwill and other intangibles; the availability of and interest rates on short-term financing; changes in consumer behavior and preferences; commodity and energy prices and labor costs; actual market performance of benefit plan trust investments; the levels of spending on systems initiatives, properties, business opportunities, integration of acquired businesses, and other general and administrative costs; U.S. and foreign economic conditions including interest rates, taxes and tariffs, and currency rate translations or unavailability; legal and regulatory factors; the underlying price and volatility of the Company’s common stock and the impact of equity-based employee awards; business disruption or other losses from terrorist acts or political unrest; and other items. Forward-looking statements speak only as of the date they were made, and the Company undertakes no obligation to publicly update them. 2

- 3. First Quarter 2008: Continued Momentum • Strong Revenue Growth • Affirming Full-Year Guidance • Returning Cash to Shareholders 3

- 4. Summary of Financial Results Millions, except EPS First Quarter Growth 2008 2007 Reported Internal Net Sales 1 $ 3,258 $ 2,963 10% 5% Operating Profit 1 $ 545 $ 499 9% 6% Earnings Per Share $ 0.81 $ 0.80 1% 2 Cash Flow $ 181 $ 289 -37% 1) Internal sales and operating profit growth exclude the impact of foreign currency translation and if applicable, acquisitions, dispositions, and shipping day differences. 2) Cash Flow, defined as cash from operating activities less capital expenditures, is reconciled to the comparable GAAP measure at the end of this presentation. 4

- 5. Q1 2008: Net Sales Growth Components Year-Over-Year % Change +5.4% 10.0% 4.4% 3.2% 1.4% 1.0% Net Sales Tonnage Price/Mix Currency Acq./ Divest 5

- 6. Reinvestment for the Future: Growth in Advertising % Change, Net Sales and Advertising Net Sales Advertising +10% +DD +9% + MSD Q1 2007 Building Q1 2008 Building Net Sales Brand Net Sales Brand 6

- 7. Gross Profit and Margin* $ Millions - Acquisitions + Operating leverage - Energy and fuel + Productivity savings - Commodities + Price/Mix $1,364 $1,264 8% Growth Q1 2007 Q1 2008 Gross Margin* 42.7% 41.9% * Gross profit as a % of net sales 7

- 8. First Quarter 2008: Internal Operating Profit Growth by Area Year-Over-Year % Change, Internal Growth (1) 9.8% 6.4% 3.9% -0.6% -6.8% Total North Latin Europe Asia America Pacific (2) Company America 1. Internal operating profit growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions, and shipping day differences. 2. Includes Australia, Asia, and South Africa. 8

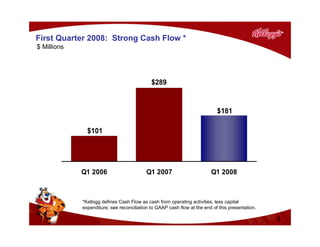

- 9. First Quarter 2008: Strong Cash Flow * $ Millions $289 $181 $101 Q1 2006 Q1 2007 Q1 2008 *Kellogg defines Cash Flow as cash from operating activities, less capital expenditure; see reconciliation to GAAP cash flow at the end of this presentation. 9

- 10. 2008 Outlook: Another Year of Growth Full-Year 2008 Internal Net Sales* +Mid SD - Greater than our long-term target Internal Operating Profit* +Mid SD - Significant investment in innovation - Strong advertising - Incremental commodity, energy, fuel, benefits expense of approximately 80 cents - Continued up-front cost investment Earnings Per Share Guidance Range of $2.92 to $2.97 - Higher tax rate of approximately 31%. * Internal sales and operating profit growth exclude the impact of foreign currency translation and if applicable, acquisitions, dispositions, and differences in the number of shipping days. 10

- 11. First Quarter 2008 Broad-Based Sales Growth 6% 5% Kellogg North America Kellogg International 11

- 12. First Quarter 2008: Broad-Based Growth in North America Year-Over-Year %, Internal Net Sales Growth (1) 10% 5% 4% 4% (2) (3) Total North America Retail Cereal Retail Snacks Frozen and (4) Specialty Channels 1) Internal sales growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions, and differences in the number of shipping days. 2) Includes U.S. and Canada retail cereal. 3) Includes biscuits, wholesome snacks, Pop-Tarts, and fruit snacks. 4) Includes frozen foods, Food Away From Home, and custom manufacturing. 12

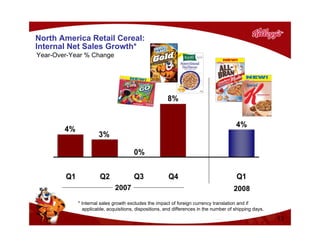

- 13. North America Retail Cereal: Internal Net Sales Growth* Year-Over-Year % Change 8% 4% 4% 3% 0% Q1 Q2 Q3 Q4 Q1 2007 2008 * Internal sales growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions, and differences in the number of shipping days. 13

- 14. North America Retail Snacks: Internal Net Sales Growth* Year-Over-Year % Change 11% 9% 5% 4% 2% Q1 Q2 Q3 Q4 Q1 2007 2008 * Internal sales growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions, and differences in the number of shipping days. 14

- 15. First Quarter 2008: North America Retail Snacks Year-Over-Year Change, Net Sales Sales Toaster Pastries Crackers Cookies Wholesome Snacks Portfolio +4% 15

- 16. North America Frozen & Specialty Channels(1): Internal Net Sales Growth (2) Year-Over-Year % Change 10% 8% 6% 6% 5% Q1 Q2 Q3 Q4 Q1 2007 2008 1) Includes Frozen Foods, Food Away From Home, and custom manufacturing. 2) Internal sales growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions and differences in the number of shipping days. 16

- 17. Kellogg International: Internal Net Sales Growth* Year-Over-Year % Change 6% 6% 5% 5% 4% Q1 Q2 Q3 Q4 Q1 2007 2008 * Internal sales growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions, and differences in the number of shipping days. 17

- 18. First Quarter 2008: International Growth Year-Over-Year % Change, Internal Sales Growth (1) 7% 6% 5% 5% Latin Asia (2) Total Europe America Pacific International 1) Internal sales growth excludes the impact of foreign currency translation and if applicable, acquisitions, dispositions, and differences in the number of shipping days. 2) Includes Australia, Asia, and South Africa. 18

- 19. First Quarter 2008: Continued Momentum • Strong Q1 Execution • Strong Innovation & Investment • Sustainable and Dependable 19

- 20. 20

- 21. Appendix 1 Reconciliation of Kellogg-Defined* Cash Flow to GAAP Cash Flow Year-to-date period ended March 29, March 31, 2008 2007 (unaudited) Operating activities Net earnings $315 $321 Adjustments to reconcile net earnings to operating cash flows: Depreciation and amortization 94 87 Deferred income taxes (11) (33) Other 70 28 Postretirement benefit plan contributions (41) (30) Changes in operating assets and liabilities (179) (18) Net cash provided by operating activities 248 355 Less: Additions to properties (67) (66) Cash flow $181 $289 *We use this non-GAAP measure of cash flow to focus management and investors on the amount of cash available for share repurchases, dividend distributions, acquisition opportunities, and debt reduction. 21