Lehman brothers

- 1. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |1 QM-201103-01 20th March’2011 CONTENTS INTRODUCTION ------------------------------------------- PAGE 1 BRIEF DESCRIPTION --------------------------------------PAGES 2-4 1.SCOPE AND EXCLUSION ------------------------------PAGES 5-6 1.1.1 Purpose of Quality Management System 1.1.2 Scope & Exclusion 1.1.3 Policy 2.NORMATIVE REFERENCES -------------------------- PAGE 7 3.TERMS AND DEFINTIONS ---------------------------PAGE 7 4.QUALITY MANAGEMENT SYSTEMS ---------------PAGES 8-10 4.1 Documentation Structure 4.2 Control of Documents 4.3 Control of Records 5.MANAGEMENT RESPONSIBILITY ------------------ PAGES 11-25 5.1 Management Commitment 5.2 Customer Focus 5.3 Quality Policy 5.3.1 Policy Segmentation 5.3.2 Quality Policy Accounting 5.3.3 Implementation Procedures 5.3.4 Acceptable Lot Sizes 5.4Planning 5.4.1 The Quality Assurance Plan 5.4.2 The Quality Control Plan 5.4.3 Quality Control Plan Components 5.5 Responsibility, Authority & Communication 5.5.1 Responsibility and Authority 5.5.2 Management Representative 5.5.3 List of Processes 5.6 Management Review 5.6.1 General 5.6.2 Review Input 5.6.3 Review Output 6. Resource management……………………………………………..PAGES 26-27 6.1 Provision of resources 6.2 Human resources 6.3 Infrastructure 6.4 Work environment

- 2. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |2 QM-201103-01 20th March’2011 7. Product realization…………...............................................PAGES 27-28 7.1 Planning of product realization 7.2 Customer-related processes 7.3 Design and development 7.4 Purchasing 7.5 Production and service provision 7.6 Control of monitoring and measuring equipment 8. Measurement, analysis and improvement…………………….PAGES 28-41 8.1 General 8.2 Monitoring and measurement 8.3 Control of nonconforming product 8.4 Analysis of data 8.5 Improvement

- 3. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |3 QM-201103-01 20th March’2011 I. Introduction This document constitutes the highest level of quality documentation in the company. A supplementary compliance package may be attached to provide supporting detail for a site or laboratory. The information presented here takes precedence over any supporting documents. The company’s Standard Operating Procedures (SOPs) document additional details on how policies are implemented. Locally maintained work instructions provide further detail to support the SOPs. The scope and revision of each document is held in Lehman Brothers document control system. The quality manual defines Lehman Brothers policies regarding: 1. Description of the company 2. Scope and Exclusions, if any 3. Organisational Chart with Responsibilities 4. List of Processes 5. Process Maps 6. Other ISO requirements

- 4. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |4 QM-201103-01 20th March’2011 II. Description II.IHistory Lehman Brothers was an American company that operated in the investment services industry. Prior to their declaration of bankruptcy, the firm took part in investment banking, equity, fixed income sales, research and trading, investment management, private equity and private banking. Lehman was the fourth largest investment bank in the USA (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch). In 1844, Henry Lehman immigrated from Rimpar, Germany, to Montgomery, Alabama where he established a small shop selling groceries, dry goods, and utensils to the local cotton farmers. By 1850, his two brothers, Emanuel and Mayer, had joined him in the business, and they named it Lehman Brothers. After Henry Lehman's death in 1855 at the age of 33, the two younger brothers headed the firm for the next four decades. A New York office was opened in 1858, giving the firm a stronger presence in the commodities trading business as well as a foothold in the financial community. After facing the threat of the ‘civil war’ in 1870, they engaged themselves into the business of cotton as well as their previous commodities. The company also helped to establish the Coffee Exchange and the Petroleum Exchange. While the firm prospered over the following decades as the U.S. economy grew into an international powerhouse, Lehman had to contend with plenty of challenges over the years. Lehman survived them all – the railroad bankruptcies of the 1800s, the Great Depression of the 1930s, two world wars, a capital shortage when it was spun off by American Express in 1994, and the Long Term Capital Management collapse and Russian debt default of 1998. However, despite its ability to survive past disasters, the collapse of the U.S. housing market ultimately brought Lehman Brothers to its knees, as its headlong rush into the subprime mortgage market proved to be a disastrous step. II.II Bankruptcy On September 15, 2008, Lehman Brothers filed for bankruptcy. With $639 billion in assets and $619 billion in debt, Lehman's bankruptcy filing was the largest in history, as its assets far surpassed those of previous bankrupt giants such as WorldCom and Enron. Lehman was the fourth-largest U.S. investment bank at the time of its collapse, with 25,000 employees worldwide. Lehman's demise also made it the largest victim, of the U.S.

- 5. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |5 QM-201103-01 20th March’2011 subprime mortgage-induced financial crisis that swept through global financial markets in 2008. Lehman's collapse was a seminal event that greatly intensified the 2008 crisis and contributed to the erosion of close to $10 trillion in market capitalization from global equity markets in October 2008, the biggest monthly decline on record at the time. II.IIIProducts and Services In 1984, American Express acquired the investment banking and trading firm, Lehman Brothers Kuhn Loeb, and added it to the Shearson family, creating Shearson Lehman/American Express.Lehman Brothers Kuhn Loeb, which itself was the merger of Lehman Brothers and Kuhn Loeb in 1977 was led by Pete Peterson, a former United States Secretary of Commerce and future founder of the Blackstone Group. II.III.aBanking Services The primary operations of banks include: Keeping money safe while also allowing withdrawals when needed Issuance of checkbooks so that bills can be paid and other kinds of payments can be delivered by post Provide personal loans, commercial loans, and mortgage loans (typically loans to purchase a home, property or business) Issuance of credit cards and processing of credit card transactions and billing Issuance of debit cards for use as a substitute for checks Facilitation of standing orders and direct debits, so payments for bills can be made automatically Provide overdraft agreements for the temporary advancement of the Bank's own money to meet monthly spending commitments of a customer in their current account. Provide internet banking system to facilitate the customers to view and operate their respective accounts through internet.

- 6. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |6 QM-201103-01 20th March’2011 Provide Charge card advances of the Bank's own money for customers wishing to settle credit advances monthly. Provide a check guaranteed by the Bank itself and prepaid by the customer, such as a cashier's check or certified check. Notary service for financial and other documents II.III.bOther Types of Bank Services Private banking- thisbanking services exclusively to high net worth individuals. Capital market bank - underwrite debt and equity, assist company deals (advisory services, underwriting and advisory fees), and restructure debt into structured finance products. Bank cards - include both credit cards and debit cards. Credit card machine services and networks II.III.cForeign Exchange Services Foreign exchange services are provided by many banks around the world. Foreign exchange services include: Currency exchange - clients can purchase and sell foreign currency banknotes. Foreign Currency Banking - banking transactions are done in foreign currency. Wire transfer - clients can send funds to international banks abroad. II.III.dInvestment Services Asset management Hedge fund management Custody services - the safe-keeping and processing of the world's securities trades and servicing the associated portfolios. Assets under custody in the world are approximately $1.25 billion.

- 7. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |7 QM-201103-01 20th March’2011 1. Scope and Exclusion 1.1 Purpose of Quality Management System The purpose of this quality system is to assure that all products and services provided will meet or exceed the requirements specified by our customers, thereby contributing to the continued growth and prosperity of the company and its stake holders. A quality management system has two interrelated aspects: 1. The customer’s needs and expectations for the customer, there is a need for confidence in the ability of the organisation to deliver the desired quality as well as the consistent maintenance of that quality. 2. The organisation’s needs and interests. For the organisation, there is a business need to attain and to maintain the desired quality at an optimum cost; the fulfilment of this aspect is related to the planned and efficient utilization of the technological, human and material resources available to the organisation. 1.2 Scope & Exclusion The scope of the quality management system is to demonstrate the capability of Lehman Brothers Ltd. to provide financial services to personals as well as any company. Following the ISO 9001: 2008 standards does this, but with an exclusion for section 7.3 Design and Development. The policies specified are primarily aimed at achieving customersatisfaction. Confidence in financial and banking servicesconformance can be attained by adequate demonstration of ourcapabilities in investment, liquidity of money and faith of our stake holders. We are justifying an exemption from design because wemanufacture all products based on customer requirements: • Design is not required and the services requirements are stated by our market survey team and customer interaction team.

- 8. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |8 QM-201103-01 20th March’2011 1.3 Policy 1. Lehman Brothers Ltd. will establish, document, implement, and maintain a quality management system and continually improve its effectiveness in accordance with the requirements of ISO 9001:2008. 2. Lehman Brothers Ltd. will: 2.1 Identify the processes needed for the Quality Management System and their application throughout the organization; 2.2 Determine the sequence and interaction of these processes; 2.3 Determine criteria and methods needed to ensure that both the operation and control of these processes are effective; 2.4 Ensure the availability of resources and information necessary to support the operation and monitoring of these processes; 2.5 Monitor, measure, and analyze these processes, and; 2.6 Implement actions necessary to achieve planned results and continual improvement of these processes. 3. These processes will be managed by Lehman Brothers Ltd. in accordance with the requirements of ISO 9001:2008. 4. If Lehman Brothers Ltd. chooses to outsource any process that affects product conformity with requirements; Lehman Brothers Ltd. will ensure control over these processes. Control of these processes will be identified within the Quality Management System.

- 9. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : Page |9 QM-201103-01 20th March’2011 2. Normative references The following referenced documents are indispensable for the application of this document. For datedreferences, only the edition cited applies. For undated references, the latest edition of the referenced document (including any amendments) applies. 3. Terms and definitions The following terms and definitions are provided to assure a uniform understanding of selected terms as they are used in these requirements. Company Lehman Brothers Ltd. Fund provides financing to small and mid-sized companies. Supplier Targeted investments are used to finance buyouts, recapitalizations, strategic acquisitions, and later stage growth. Assists individuals, corporations and governments in raising Customer capital by underwriting and/or acting as the client's agent in the issuance of securities Product Foreign Exchange, Eommodities, and Equity Securities Services Investment banking,Sales and trading

- 10. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 10 QM-201103-01 20th March’2011 4. Quality management system Quality is how good a product is and it is synonymous with the high expectations of customers towards a product or a service (Garvin,1988). Also, quality is the plenitude of characteristics andattributes of service which satisfy given needs of customers (ANSI,1978). Moreover, quality is the ability of an enterprise to focus onthe existing and expected needs of its customers, to improve itslabour culture with the cooperation and development of its workers, tocreate relations of confidence with exterior collaborators andcustomers, to self-assess the systems of administration, tostrengthen learning and innovation and finally, to evaluate theresults of all the above (EFQM). 4.1 Documentation Structure Documentation is structured in two levels. The Lehman Brothers Ltd quality of the documentation is defined as Lehman Brothers Ltd Quality Manual, which provides all necessary and relevant information relating to Quality Management System, established and implemented in the organization. The second level of the documentation provides detailed procedures along with SOPs (Standard Operating Procedures) and work instructions. The documentation structure is diagrammatically represented as below: Lehman Brothers Ltd. Quality Manual Standard Operating Procedure,Work Instructions and Procedure for Implementation

- 11. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 11 QM-201103-01 20th March’2011 4.2 Control of Documents All of the QMS documents are controlled according to the Document Control Procedure (QP-1023-01). This procedure defines the process for: Approving documents for adequacy prior to issue Reviewing and updating as necessary and re-approving documents Ensuring that changes and current revision status of documents are identified Ensuring that relevant versions of applicable documents are available at points of use Ensuring that documents remain legible and readily identifiable Ensuring that documents of external origin are identified and their distribution controlled, Preventing the unintended use of obsolete documents and to apply suitable identification to them if they are retained for any purpose Departmental managers should always be responsible for promoting good document and record management practices in their area whilst supporting overall compliance to the document control procedure. Individuals and their line managers should be responsible for the documents and records that they create, as well as being responsible for their retention and disposal in line with legislative requirements and organizational procedures and practices. If you don’t want to control external documents, you must specifically state this in the procedure and on the documents themselves, which are ‘For Reference Only’ and are not updated.

- 12. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 12 QM-201103-01 20th March’2011 4.3 Control of Records Quality records are maintained to provide evidence of conformity to requirements and of the effective operation of the QMS. The records are maintained according to the Control of Quality Records Procedure (QP-1024-01). This procedure requires that quality records remain legible, readily identifiable and retrievable. The procedure defines the controls needed for identification, storage, protection, retrieval, retention time and disposition of quality records. This because records are an important organizational asset; they provide the primary route for evidence based verification and traceability since they demonstrate compliance with customer requirements. Records also prove the efficacy of the QMS. Records are used to prove compliance against requirements Develop and implement the control of records procedure Maintain the legibility and accessibility of QMS documents and records Implementing a document management system could mean keeping certain records that your organization might not be already keeping. Some of these records may seem a little confusing until you become more familiar with the quality standard. Of course, you are free to keep more records than those listed below, if you feel your organization needs them, but as we always preach; keep your system simple. The fewer documents and records you keep, the fewer things that will be audited, and the more time you will have to actually run your business. Keep in mind that you are free to combine some of these records where it makes sense, for example, you could combine the corrective and preventive action request log with a simple checkbox to note which one it is. You could also combine both corrective and preventive action requests onto one form, again with a simple check box to designate its purpose.

- 13. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 13 QM-201103-01 20th March’2011 5. Management Responsibility Top management must: Communicate to the organisation the importance of meeting customer requirements Communicate to the organisation the importance of meeting regulatory requirements Ensure that quality objectives are created Ensure that quality measurements are taken and recorded Ensure that quality measurements are compared against quality objectives Conduct periodic management reviews Review the quality system and make changes where necessary Provide evidence of management reviews

- 14. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 14 QM-201103-01 20th March’2011 5.1 Management Commitment Management Commitment is direct participation by the highest level executives in a specific and critically important aspect or program of an organization. In quality management it includes: 1. Setting up and serving on a quality committee 2. Formulating and establishing quality policies and objectives 3. Providing resources and training 4. Overseeing implementation at all levels of the organization 5. Evaluating and revising the policy in light of results achieved. 5.2 Customer Focus Every organization depends on its customers. Without satisfied customers, the organization cannot exist. Therefore, this requirement of ISO 9001:2000 is the core of the quality management system. There should be some method of establishing how customer requirements are determined. Methods could include: 1. Carrying out market / customer survey 2. Access to industry reports 3. Identification of niche marketing opportunities Benefits: Increased revenue and market share obtained through flexible and fast responses to market opportunities. Increased effectiveness in the use of the organization's resources to enhance customer satisfaction. Improved customer loyalty leading to repeat business.

- 15. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 15 QM-201103-01 20th March’2011 Application: Researching and understanding customer needs and expectations. Ensuring that the objectives of the organization are linked to customer needs and expectations. Communicating customer needs and expectations throughout the organization. Measuring customer satisfaction and acting on the results. Systematically managing customer relationships. Ensuring a balanced approach between satisfying customers and other interested parties 5.3 Quality Policy 5.3.1 Policy Segmentation 1. The relative amounts of Lehman Brothers Ltd.Quality Control Plan will be determined by Bank liquidity,respective market values, individual security "risk/return" profiles, and other factors such as theBank's tax position. 2. Quality Policy may only be changed inLehman Brothers Ltd.for permissible reasons: a. Less than 3 months to maturity or effective Policy Revise date. b. Less than 15% of purchase faces reported by customers. c. Deterioration of issues creditworthiness. d. Change in the tax laws (not tax rates). 5.3.2Quality Policy Accounting 1. Policiesin the Lehman Brothers Ltd.will be accounted for at amortized cost. 2. Policies in Lehman Brothers Ltd.will be accounted for at fair value with the net gain/loss (adjustedfor tax) reflected in the Bank's capital. 3. Any changes between policies will be accounted for at fair value.

- 16. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 16 QM-201103-01 20th March’2011 5.3.3Implementation Procedures 1. The purchase, sale and/or exchange shall be made by the SeniorInvestment Officer, as authorized by the Investment Committee according to Quality Policies that areapproved by the Board of Directors. 2. Orders for the purchase and/or sale of Federal Funds shall be made by the Senior InvestmentOfficer or his/her staff subject to policy determined by the Investment Committee 3. Acquisition of large Certificates of Deposit over $100,000 will be coordinated by the SeniorInvestment Officer and his/her staff with regard to amount, maturity and rates. 4. All public funds deposits requiring collateral will be coordinated through the Senior InvestmentOfficer to assure proper rate setting and pledging. 5.3.4Acceptable Lot Sizes 1. U.S. Treasury, Federal Agency, and other taxable issues are to be purchased in minimums of$100,000 2. Municipal securities are to be purchased in minimums of $100,000 when possible.

- 17. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 17 QM-201103-01 20th March’2011 5.4Planning 5.4.1 The Quality Assurance Plan 1. The QA Plan is a Government document used as a management tool. The components of a QA Plan are: • Government staffing requirements. • Functions of each QA team member. • Government training requirements. • Government pre-award activities. • Definable Features of Work (DFOW) list. • Government surveillance and testing activities. 2. The QA Plan ensures that all team members are following the same plan and achieves better coordination of the government’s QA activities. 5.4.2 The Quality Control Plan The QC Plan must be received, reviewed, and formally accepted by the Contracting Officer or their representatives before any construction work can begin. Resident Management System (RMS) is a Lehman Brothers Ltd. data management system that provides an easy mechanism for developing a QC Plan based on contractor input. 5.4.3 Quality Control Plan Components Table of Contents – A listing of the major sections identified with tabs in the order of the bulletined items following hereafter. QC Organization – The QC organization must be identified, including a chart showing the organizational structure and lines of authority. Names and Qualifications – The names, qualifications, and classification of each member of the contractor’s quality control team must be provided. Duties, Responsibilities and Authorities of QC Personnel – Provide a listing of assigned quality control activities for performance.

- 18. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 18 QM-201103-01 20th March’2011 5.5 Responsibility, Authority & Communication 5.5.1 Responsibility and Authority An organizational chart has been established to show the interrelation of personnel in the organization. Job descriptions define the responsibilities and authorities of each of the positions on the organizational chart. Job descriptions and the organizational chart are reviewed and approved by executive management for adequacy.

- 19. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 19 QM-201103-01 20th March’2011 Chairman & managing director: He is ultimately responsible for making balanced judgments, assessing the significance of variations in the processes and making decisions. ISO 9001-2008 Management representative: The ISO 9001-2008 management representative is responsible for ensuring that the requirements of model IS0 9001- 2008 are implemented and maintained. He is also responsible for the controlled internal distribution of the Quality manual and changes thereto. Director (operations & service): It is his job to co-ordinate and overlooks all operations/services undertaken daily in the organisation and to implement the quality standards assured by the firm according to ISO 9001-2008 regulations. Director (Human Resources) maintains the records of employee qualifications. He prepares job descriptions identifying the qualifications required for each position that affects conformity to product requirements. Director (Finance) All financial activities of the organisation are overlooked by him. It is also his job to see whether the organisation has been following ISO 9000 as well as financial laws imposed by the concerned Govt. while carrying out numerous financial activities. General Managers: The general managers are responsible for assuring that Quality Systems are followed in their area. 5.5.2 Management Representative A management representative has been appointed by the Chairman as Management Representative. As management representative, he has the following responsibilities and authority: Ensure that processes needed for the quality management system are established and implemented. Report to general management on the performance of the quality management system and note any needed improvements. Promote awareness of customer requirements throughout the organization.

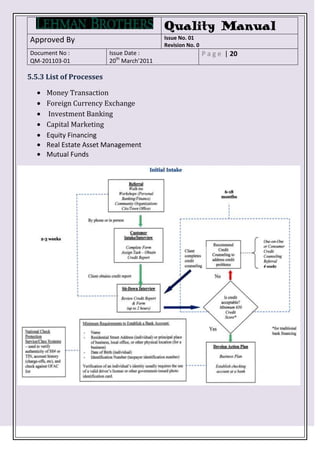

- 20. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 20 QM-201103-01 20th March’2011 5.5.3 List of Processes Money Transaction Foreign Currency Exchange Investment Banking Capital Marketing Equity Financing Real Estate Asset Management Mutual Funds

- 21. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 21 QM-201103-01 20th March’2011 PROCESS NAME DATE OF ISSUE: MONEY TRANSACTION APPROVED BY: (BANKING PROCESS) INPUT SPECIFICATION PROCESS OUTPUT SPECIFICATION SPECIFICATION 1.PURCHASE SPECIFICATION AND IBA REGULATIONS FOR TRANSACTION 1.LOAN SHOULD BE GIVEN BASED ON TECHNICAL SPECIFICATION TO BE ARE TO BE FOLLOWED PERSON'S CURRENT INCOME FOLLOWED RECORDS AND RETIREMENT PERIOD 2. DEPOSIT ENTRIES SHOULD BE CHECKED THOROUGHLY 2.RECORDS OF CASH DEPOSIT AND WITHDRAWAL TO BE ENTERED INPUTS RECIEVIN PROCESS DEFINITION FINA OUTPUT G THE PROCESS ESSENTIALLY L 1. PURCHASE CHECK COMPRISES OF THE FOLLOWING CHEC 2. PRECIOUS INPUT ITEMS 1. LOAN STEPS K METALS LIKE TO BE CHECK- 2. MONEY RECEIPT 1. CASH RECEIPT AND DEPOSIT CHECK TO GOLD (GOLD ED BY THE (IN FORM OF PASS 2. CASH TRANSACTION IN CASE OF BE MADE LOAN) FIELD BOOK ENTRY PURCHASE, LOAN OR MORTGAGE AND 3. DEPOSIT MANAGER OR WRITTEN 3. RECORDS TO BE MAINTAINED PROCESSE 4. MORTGAGE OF DOCUMENTS) TRANSACTION WHILE TRANSACTION OCCURS S TO BE 3. BANK INTEREST DEPT. THROUGH AUTH- DEBIT, ATM OR CREDIT CARDS ENTICATE 4. BANK INTERESTS RATE IS TO BE D BY THE MAN- REVISED TIME TO TIME AGER OF THE FINANCE DEPARTME NT DESCRIPTION OF RESOURCE PROCESS OWNER DEPUTY MANAGER FINANCE DEPT. SUPPLIERS PROCESS OPERATORCLERKS OF FINANCE CUSTOMERS DEPT. 1.GOVERNMENT LOCAL COMPANY 2.LOCAL AUTHORITIES A PERSON OR A GROUP OF PEOPLE EFFECTIVENESS 3. A PERSON OR GROUP OF PEOPLE INDICATOR THE COUNTING PROCESSES, MACHINES FOR EFFICIENCY COUNTING CASH ARE TO BE EXAMINED TIMELYINDICATOROF WORK AND QUALITY PERIODICALLY AND AS WELL AS THE WORK ARE TO BE CHECKED. MANUAL WORKING ARE SUBJECTED TO STRONG VIGILANCE VIGILANCE CAN BE MADE

- 22. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 22 QM-201103-01 20th March’2011 DATE OF ISSUE: APPROVED BY: PROCESS NAME FOREIGN CURRENCY EXCHANGE INPUT SPECIFICATION PROCESS SPECIFICATION OUTPUT SPECIFICATION CURRENCY OF ONE COUNTRY. EXCHANGE OF MONEY TO BE MADE CURRENCY OF THE DESIGNATED BETWEEN TWO CURRENCY SYSTEMS. COUNTRY. INPUTS RECIEVIG PROCESS DEFINITION FINAL OUTPUT CHECK THIS PROCESS COMPRISES OF THE CHECK MONEY IN FORM OF 1.TRAVELLERS FOLLOWING EXCHANGED CHEQUE. 1. AMOUNT 1. RECIPT OF MONEY CHECK CURRENCY. 2. FOREIGN OF MONEY 2. CHECKING OF THE CURRENT PERFORME CURRENCY CASH TO BE EXCHANGE RATE BETWEEN TWO D BY 3. FOREIGN EXCHANGED CURRENCIES GOVT. CURRENCY DRAFTS. 2. CURRENT 3. PROCESSING OF THE MONEY. FINANCE 4. CHEQUE DEPOSITES EXCHANGE 4. DELIVERY OF THE MONEY IN THE OFFICIALS. RATE OF DESIGNATED CURRENCY. CONVERSION BETWEEN TWO CURRENCIES. SUPPLIERS DESCRIPTION OF CUSTOMERS RESOURCE BOND HOLDERS LIKE CENTRAL BANKS 1. IMPORT/EXPORT DEALERS AND OR OTHER MONEYTORY AUTHORITIES BUSSINESSMAN OF A COUNTRY. 1. FOREIGN EXCHANGE RESERVES 2. PEOPLE IN GENERAL WHO MAKES 2. MAN POWER AT DIFFERENT LEVELS IN FREQUENT OVERSEAS TRIP. 3. FOREIGN NATIONALS WHO NEED THE FORM OF BANK EMPLOYEES TO MAKE OFFSHORE MONEY PROCESS OWNER LEHMAN BROTHERS TRANSFER. PROCESS OPERATOR EFFICIENCY INDICATOR EFFECTIVENESS 1. HOW FAST THE PROCESS IS BEING EXECUTED. INDICATOR 2. HOW SMOOTHLY THE MONEY 1. NETWORK OF THAT PARTICULER BANK. 2. SERVICE COST BEING CHARGED BY THE EXCHANGE TAKES PLACE WITHOUT ANY BANK. COMPLICATIONS

- 23. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 23 QM-201103-01 20th March’2011 DATE OF ISSUE: APPROVED BY: PROCESS NAME INVESTMENT BANKING INPUTSPECIFICATION PROCESSSPECIFICATION OUTPUT PROVIDING ASSISTANCE TO THE SPECIFICATION MAXIMIZED RETURN OF ENTITIES WHICH CAN BE CONSIDERED INVESTING PARTY IN RAISING CAPITAL INVESTMENT. ASSETS LIKE PENSION FUNDS, HEDGE BY UNDERWRITING OR BY ACTING AS FUNDS, MUTUAL FUNDS. CLIENTS AGENT. INPUTS RECIEVIN PROCESS DEFINITION FINALC OUTPUT G CHECK HECK ASSETS OR THE PROCESS IS ACCOMPLISHED BY ENTITIES RETURN OF SECUIRITY. WHICH CAN BE INVESTMENT IN CHECKING THE CONSIDERED TERMS OF SUSTAINABILIT ASSETS LIKE MONEY WITH Y PENSION INTEREST ISSUES FUNDS, HEDGE OR BONDS. BY RESEARCH FUNDS, AND MUTUAL ADVISORY FUNDS. AGENCIES. REGULARITY AUTHORITY IN U.S SUPPLIERS CUSTOMERS DESCRIPTION OF BROKERS RESOURCE INDIVIDUALS, CORPORATIONS INVESTIGATION AGENCIES OR GOVERNMENTS. PROCESS OWNER LEHMAN BROTHERS PROCESS OPERATOR EFFECTIVENESS EFFICIENCY INDICATOR WHETHER THE CLIENT IS GETTING INDICATOR MINIMIZATION OF RISK IN MAXIMUM RETURN OF HIS INVESTMENT. INVESTMENT.

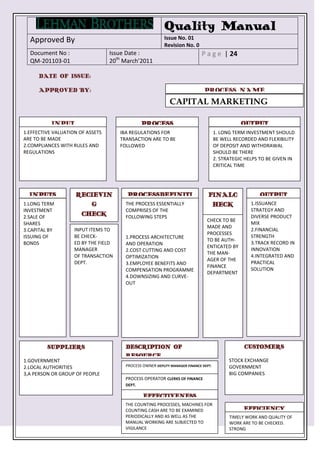

- 24. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 24 QM-201103-01 20th March’2011 DATE OF ISSUE: APPROVED BY: PROCESS NAME CAPITAL MARKETING PROCESS INPUT PROCESS OUTPUT SPECIFICATION 1.EFFECTIVE VALUATION OF ASSETS SPECIFICATION IBA REGULATIONS FOR SPECIFICATION 1. LONG TERM INVESTMENT SHOULD ARE TO BE MADE TRANSACTION ARE TO BE BE WELL RECORDED AND FLEXIBILITY 2.COMPLIANCES WITH RULES AND FOLLOWED OF DEPOSIT AND WITHDRAWAL REGULATIONS SHOULD BE THERE 2. STRATEGIC HELPS TO BE GIVEN IN CRITICAL TIME INPUTS RECIEVIN PROCESSDEFINITI FINALC OUTPUT 1.LONG TERM G THE PROCESSON ESSENTIALLY HECK 1.ISSUANCE INVESTMENT COMPRISES OF THE STRATEGY AND 2.SALE OF CHECK FOLLOWING STEPS DIVERSE PRODUCT CHECK TO BE SHARES MIX MADE AND 3.CAPITAL BY INPUT ITEMS TO 2.FINANCIAL PROCESSES ISSUING OF BE CHECK- 1.PROCESS ARCHITECTURE STRENGTH TO BE AUTH- BONDS ED BY THE FIELD AND OPERATION 3.TRACK RECORD IN ENTICATED BY MANAGER 2.COST CUTTING AND COST INNOVATION THE MAN- OF TRANSACTION OPTIMIZATION 4.INTEGRATED AND AGER OF THE DEPT. 3.EMPLOYEE BENEFITS AND PRACTICAL FINANCE COMPENSATION PROGRAMME SOLUTION DEPARTMENT 4.DOWNSIZING AND CURVE- OUT SUPPLIERS DESCRIPTION OF CUSTOMERS RESOURCE 1.GOVERNMENT STOCK EXCHANGE 2.LOCAL AUTHORITIES PROCESS OWNER DEPUTY MANAGER FINANCE DEPT. GOVERNMENT 3,A PERSON OR GROUP OF PEOPLE BIG COMPANIES PROCESS OPERATOR CLERKS OF FINANCE DEPT. EFFECTIVENESS INDICATOR THE COUNTING PROCESSES, MACHINES FOR COUNTING CASH ARE TO BE EXAMINED EFFICIENCY PERIODICALLY AND AS WELL AS THE INDICATOR TIMELY WORK AND QUALITY OF MANUAL WORKING ARE SUBJECTED TO WORK ARE TO BE CHECKED. VIGILANCE STRONG

- 25. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 25 QM-201103-01 20th March’2011 5.6 Management Review 5.6.1 General Board of Directors reviews the QMS annually at management review meetings. This review assesses the continuing QMS suitability, adequacy and effectiveness, identifying opportunities for improvement and needed changes. Records are maintained for each management review meeting. 5.6.2 Review Input Assessment of the QMS is based on a review of information inputs to management review. These inputs include the following: Results of audits Customer feedback Process performance and product conformity Status of corrective and preventive actions Follow-up actions from previous management reviews Planned changes that could affect the QMS and Recommendations for improvement 5.6.3 Review Output During these review meetings, management will identify appropriate actions to be taken regarding the following issues: Improvement of the QMS and its processes. Improvement of product related to customer requirements, and Resource needs Responsibilities for required actions are assigned to members of the management review group. Any decisions made during the meeting, assigned actions and their due dates are recorded in the minutes of management review. The records of these annual reviews are to be preserved, controlled and circulated throughout the organisation according to the Document Control Procedure.

- 26. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 26 QM-201103-01 20th March’2011 6. Resource Management 6.1 Provision of Resources Executive Management ensures that resources essential to the implementation; maintenance and improvement of the quality management system are identified and made available. 6.2 Human Resources 6.2.1 General To ensure the competence of personnel, job descriptions have been prepared identifying the qualifications required for each position that affects conformity to product requirements. Qualifications include requirements for education, skills and experience. Appropriate qualifications, along with required training, provide the competencies required for each position. 6.2.2 Competence, Training and Awareness Qualifications are reviewed upon hire, when an employee changes positions or the requirements for a position change. Human Resources maintain records of employee qualifications. If any differences between the employee’s qualification and the requirements for the job are found, training or other action is taken to provide the employee with the necessary competence for the job. The results are then evaluated to determine if they were effective. All employees are trained on the relevance and importance of their activities and how they contribute to the achievement of the quality objectives.

- 27. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 27 QM-201103-01 20th March’2011 6.3 Infrastructure Lehman Brothers Ltd Executive Management is committed to providing and maintaining suitable facilities that are necessary to implement the Quality Management System that will achieve conformity of product. The required infrastructure and resources are identified, as applicable this includes: building facilities, necessary work space, associated facilities, process equipment, information systems, communication media and transportation. An electronic maintenance program specifies the type and the frequency of needed maintenance, the methods for maintenance and the verification of its completion. Executive Management ensures the timely availability of identified and approved resources. 6.4 Work Environment Executive Management ensures that the appropriate human and physical factors of the work environment are considered and provided, including such factors as noise, temperature, lighting and etc. Lehman Brothers Ltd is committed to maintain its facilities in a safe and healthy manner establish and provide an infrastructure that is needed to comply with product requirements.

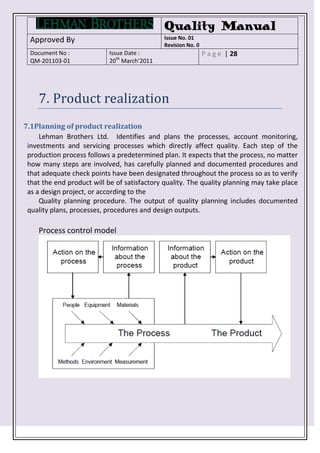

- 28. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 28 QM-201103-01 20th March’2011 7. Product realization 7.1Planning of product realization Lehman Brothers Ltd. Identifies and plans the processes, account monitoring, investments and servicing processes which directly affect quality. Each step of the production process follows a predetermined plan. It expects that the process, no matter how many steps are involved, has carefully planned and documented procedures and that adequate check points have been designated throughout the process so as to verify that the end product will be of satisfactory quality. The quality planning may take place as a design project, or according to the Quality planning procedure. The output of quality planning includes documented quality plans, processes, procedures and design outputs. Process control model

- 29. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 29 QM-201103-01 20th March’2011 7.2Customer-related processes 7.2.1 Determination of requirements related to the product Lehman Brothers Ltd has documented the procedures for the determination of Requirements which are stated by the customer Requirements which are not stated by the customer like the timely completion and efficient workings Statutory and regulatory requirements Other requirements Reviews of customer specifications are performed when received and any requirements documented for implementation as applicable. These may take the form of quality assurance instructions, standard comments for specific customer orders, instructions for design implementation or the use of industry standards for design, product fabrication, validation and/or verification processes. 7.2.2 Review of requirements related to the product Lehman Brothers Ltd has created a formal system ensure that each commitment to supply a product is formally reviewed and controlled. The review is conducted prior to the commitment to supply a product and ensures that: The requirements are adequately defined and documented. Where the customer provides no written statement of requirements, the order requirements are confirmed verbally before acceptance; That Lehman Brothers Ltd has the resources to meet the defined requirements, and that; Any differences between the contract and the tendered quotation are resolved to the mutualsatisfaction of the involved parties before formal acceptance of the contract. In the event of product/contract requirement amendments, appropriate notification is given toaffected departments within LEHMAN BROTHERS LTD and that relevant documentation is revised.Record requirements from these reviews are shown on the quote, e-mails, and/or the order acknowledgement.

- 30. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 30 QM-201103-01 20th March’2011 7.2.3 Customer communication LEHMAN BROTHERS LTD recognizes the necessity for customer communication and feedback as a major contributing element of customer satisfaction and has implemented an effective process for communicating with customers. LEHMAN BROTHERS LTD produces hard copy product and services catalogues and catalogues on CD’s for each of its three divisions LEHMAN BROTHERS LTD maintains a comprehensive website Customers can contact LEHMAN BROTHERS LTD via phone, e-mail, fax and mail Customer complaints are handled through the Sales Department Customer Satisfaction Surveys are used to monitor customer satisfaction 7.3Design and development 7.3.1 Design and development planning The company reviews and evaluates design requirements to ensure that the products it designs and/or develops meet or exceed customer specifications. In the course of addressing technical, logistical and financial concerns that impact the design process activities, LEHMAN BROTHERS LTD consistently exercises its organizational interfaces. Planning is maintained to its most current status, as appropriate, as design activities progress. 7.3.2 Design and development inputs LEHMAN BROTHERS LTD identifies design and development inputs and any applicable statutory or regulatory requirements during contract review and/or customer meetings. Ambiguous, conflicting, changing and unclear/incomplete requirements are clarified by reviews of the design at various stages of the designing process. Design requirements are amended to accurately capture all pertinent design input information. Design and development inputs, where applicable, are derived from previous similar designs and other requirements essential for design and development.

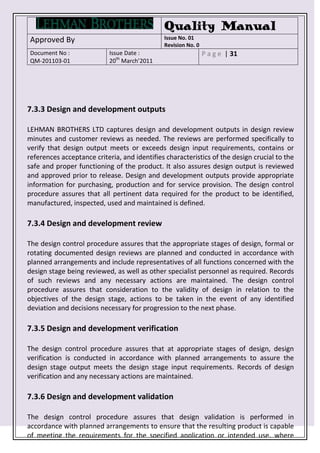

- 31. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 31 QM-201103-01 20th March’2011 7.3.3 Design and development outputs LEHMAN BROTHERS LTD captures design and development outputs in design review minutes and customer reviews as needed. The reviews are performed specifically to verify that design output meets or exceeds design input requirements, contains or references acceptance criteria, and identifies characteristics of the design crucial to the safe and proper functioning of the product. It also assures design output is reviewed and approved prior to release. Design and development outputs provide appropriate information for purchasing, production and for service provision. The design control procedure assures that all pertinent data required for the product to be identified, manufactured, inspected, used and maintained is defined. 7.3.4 Design and development review The design control procedure assures that the appropriate stages of design, formal or rotating documented design reviews are planned and conducted in accordance with planned arrangements and include representatives of all functions concerned with the design stage being reviewed, as well as other specialist personnel as required. Records of such reviews and any necessary actions are maintained. The design control procedure assures that consideration to the validity of design in relation to the objectives of the design stage, actions to be taken in the event of any identified deviation and decisions necessary for progression to the next phase. 7.3.5 Design and development verification The design control procedure assures that at appropriate stages of design, design verification is conducted in accordance with planned arrangements to assure the design stage output meets the design stage input requirements. Records of design verification and any necessary actions are maintained. 7.3.6 Design and development validation The design control procedure assures that design validation is performed in accordance with planned arrangements to ensure that the resulting product is capable of meeting the requirements for the specified application or intended use, where

- 32. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 32 QM-201103-01 20th March’2011 known. Wherever practicable, validation is completed prior to the delivery of implementation of the product. Records of the results of validation and any necessary actions are maintained. 7.3.7 Control of design and development changes The design control procedure assures that design validation is performed in accordance with planned arrangements to ensure that the resulting product is capable of meeting the requirements for the specified application or intended use, where known. Wherever practicable, validation is completed prior to the delivery of implementation of the product. Records of the results of validation and any necessary actions are maintained applicable verification and/or validation performed. 7.4Purchasing 7.4.1 Purchasing process Lehman Brothers Ltd shall ensure that purchased product conforms to specified purchase requirements. Lehman Brothers Ltd shall evaluate and select suppliers based on their ability to supply products in accordance with Lehman Brothers Ltd’s requirements. Records shall be maintained about the clients, investors or borrowers regarding - Evaluation and selection - control of accounts - selecting the degree of control 7.4.2 Purchasing information Purchasing information describes the product or the service to be purchased, including where appropriate: Requirements for approval of product, processes, procedures, services and equipment Requirements for qualification of personnel Quality management system requirements

- 33. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 33 QM-201103-01 20th March’2011 The purchasing documents are reviewed to ensure the adequacy of requirements before orders are placed with the supplier. 7.4.3 Verification of purchased product The Purchasing procedure describes the process used to verify that purchased product meets specified purchase requirements. If Lehman Brothers Ltd. or the customer will perform verification at the supplier’s premises; the verification arrangements and method of product release are documented in the purchasing information. 7.5Production and service provision 7.5.1 Control of production and service provision Lehman Brothers Ltd shall plan and carry out production and service provision under controlled conditions. Controlled conditions shall include, as applicable: • The availability of information that describes the characteristics of the product • The availability of work instructions, as necessary • The availability and use of monitoring and measuring devices • The implementation of monitoring and measurement • The implementation of release, delivery and post-delivery activities. Controlled conditions include too: - Documented procedures which should define: ∗The qualifications required for the person carrying out the procedure, if any special qualifications are required ∗The preparatory steps to be taken to prepare the product for processing ∗The preparatory steps to be taken to set up any equipment ∗The steps to be taken to process the product ∗The precautions to observe ∗The settings to record.

- 34. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 34 QM-201103-01 20th March’2011 - Suitable production, installation, and servicing equipment, and a suitable working environment. ∗ Documentation from the standards that are to be maintained ∗ providing training for staff ∗ providing procedures for maintaining the equipment to these standards ∗maintenance of records of the conditions as a means of demonstrating that the standards are being achieved. - Compliance with reference standards/codes, quality plans and/or documented procedures - Monitoring and control of process parameters and product characteristics - Approval of processes and equipment - Workmanship criteria, can comprise: ∗a list of the equipment upon which process capability depends ∗ defined maintenance requirements specifying maintenance tasks and their frequency 7.5.2 Validation of processes for production and service provision LEHMAN BROTHERS LTD validates any processes for production and service provision where the resulting output cannot be verified by subsequent monitoring or measurement. This includes any processes where deficiencies become apparent only after the product is in use or the service has been delivered. Validation demonstrates the ability of these processes to achieve planned results. 7.5.3 Identification and Traceability LEHMAN BROTHERS LTD identifies the product throughout the product realization, identifying the product status with respect to monitoring and measurement requirements. LEHMAN BROTHERS LTD controls and records the unique identification of the product where ever traceability is a specified requirement. 7.5.4 Customer Property LEHMAN BROTHERS LTD exercises care with customer property while it is under the company’s control or being used. The work instruction, outlines the identification, verification, protection and safeguarding of customer property provided for use. If any customer property is lost, damaged or otherwise found to be unsuitable for use, this is reported to the customer and records are maintained

- 35. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 35 QM-201103-01 20th March’2011 7.6 Control of Monitoring and Measuring Equipment The monitoring and measurement to be undertaken is identified and the monitoring and measuring equipment needed to provide evidence of conformity of product to specified requirements is determined. Measuring and monitoring equipment is used and controlled to ensure that measurement capability is consistent with monitoring and measurement requirements. In addition, Quality Control reviews and records the validity of the previous measuring results when the equipment is found not to conform to requirements. LEHMAN BROTHERS LTD takes appropriate action on the equipment and any product affected. Records of the results of calibration and verification are maintained. The capability of computer software to satisfy the intended application is established prior to initial use and reconfirmed as necessary, when used in the monitoring and measurement of specified requirements.

- 36. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 36 QM-201103-01 20th March’2011 8.MEASUREMENT, ANALYSIS AND IMPROVEMENT 8.1 GENERAL Lehman Brothers Ltd has plan and implemented the monitoring, measurement, analysis and improvement processes needed. This includes determination of applicable methods, including statistical techniques, and the extent of their use. Deviations become promptly detected by planned monitoring, measurement, analysis and improvement before, while and after the service contribution or the product creation and if necessary corrective actions are taken. The executed checks should be adapted at the sequence in the work areas; the later the check the more costly the rework. But type and scope of activities of the checks must be economically justifiable. The application of statistical methods is possible only in very limited measure for a ship model basin because performance essentially consists of scientific-technical performances and products in one-off production. 8.2 MONITORING AND MEASUREMENT 8.2.1 Customer Satisfaction Lehman Brothers Ltd monitors information relating to customer perception as to whether the organization has met customer requirements. The measurement and monitoring of the customer satisfaction are based on the evaluation of customer’s

- 37. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 37 QM-201103-01 20th March’2011 information, which can be collected actively or passively. The methods for obtaining and using this information shall be determined. 8.2.2 Internal Audit Lehman Brothers Ltd conducts internal audits at planned intervals to determine whether the quality management system: Conforms to the planned arrangements (see 7.1), to the requirements of this International Standard and to the quality management system requirements established by the organization Is effectively implemented and maintained. An audit program has been designed and implemented and identifies an audit schedule based on the importance of the areas to be audited, as well as the results of previous audits. The scope of each activity audit (per the audit schedule) is to verify compliance of that activity to the ISO 9001: 2000 elements shown on the activity matrix. The audit criteria, frequency, methods, responsibilities and requirements for planning and conducting audits, and for reporting and maintaining results, are defined and documented in the Internal Audit procedure 8.2.3 Monitoring and measurement of processes Lehman Brothers Ltd applies suitable methods for monitoring and measurement of the quality management processes. For the evaluation of the effectiveness of the quality management processes may be executed on the internal audit a self-assessment for selected areas of the organization by top management following the standard DIN EN ISO 9004

- 38. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 38 QM-201103-01 20th March’2011 Appendix A. The evaluation of the requirements and expectations of the interested parties are to be the center of attention like - Abilities of the organization - Response time to inquiries - Use of technologies - Input-output ratio. 8.2.4 Monitoring and Measurement of Product Lehman Brothers Ltd monitors and measures the characteristics of the product to verify that product requirements have been met. In agreement with the planned regulations in the quality management manual chapter 7.1 "Planning of Product Realization" in suitable phases of the product realization or service provision checks are executed. Recordings of these checks are created in accordance with quality management manual chapter 4.2.4 "Control of records". The product monitoring and measurement plans should: Identify the product to be inspected and tested Define the specification and acceptance criteria to be used and the issue status which applies Define the inspection aids and test equipment to be used; standard measuring equipment would not need to be specified as your inspectors and testers should be trained to select the right tools for the job; any special equipment should be identified Define the environment for the measurements to be made if critical to measurement accuracy

- 39. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 39 QM-201103-01 20th March’2011 Identify the organization which is to per-form the inspections and tests Make provision for the results of the inspections and test to be recorded. 8.3 CONTROL OF NONCONFORMING PRODUCT A nonconforming product is one that does not conform to the specified requirements. Specified requirements are either requirements prescribed by the customer and agreed by the organization in a contract for products or ser-vices, or are requirements prescribed by the organization which are perceived as satisfying a market need. Lehmann Brothers Ltd ensures their services which do not conform to customer requirements are identified and controlled to prevent their unintended use. The top management should empower people in the organization with the authority and responsibility to report nonconformities at any stage of a process in order to ensure timely detection and remedies for nonconformities. Authority for response to nonconformities should be defined to maintain achievement of process and customer requirements.. 8.4 ANALYSIS OF DATA Lehman Brothers Ltd determines, collects and analyses appropriate data to demonstrate the suitability and effectiveness of the quality management system and to evaluate. The basic data that are usually collected are increase in number of accounts opened, increase in investment etc. Thus this data gives the organization an idea about the Customer satisfaction (8.2.1)

- 40. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 40 QM-201103-01 20th March’2011 Conformity to service requirements (8.2.4) Characteristics and trends of processes and products, including opportunities for preventive action (8.2.3 and 8.2.4) Market analysis 8.5 IMPROVEMENT 8.5.1 Continual Improvement Identification of continual improvement needs are determined by analyzing customer satisfaction information, product and process conformance data, supplier performance data, internal audit results and other data and information relevant to quality performance. Management review considers all relevant information and defines priorities for improving the quality system. The corrective action and/or auditing processes are used to formally identify, respond to, verify acceptability of actions and track the corrective action request or internal audit findings.

- 41. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 41 QM-201103-01 20th March’2011 8.5.2 Corrective Action Lehman Brothers Ltd shall take action to eliminate the cause of nonconformities in order to prevent recurrence. The defined corrective actions are focused on eliminating causes of nonconformities in order to avoid recurrence. Examples of sources of information for corrective action consideration include: - Customer complaints - Nonconformity reports - Internal audit reports - Outputs from management review - Outputs from data analysis - Outputs from satisfaction measurements.

- 42. Quality Manual Approved By Issue No. 01 Revision No. 0 Document No : Issue Date : P a g e | 42 QM-201103-01 20th March’2011 - Relevant quality management system records - The organization’s people - Process measurements - Results of self-assessment. 8.5.3 Preventive Action Lehmann Brothers Ltd shall determine actions to eliminate the causes of potential nonconformities in order to prevent their occurrence. Results of the evaluation of the effectiveness and efficiency of the preventive action should be an output from management review, and should be used as an input for the modification of plans and as an input to the improvement processes.